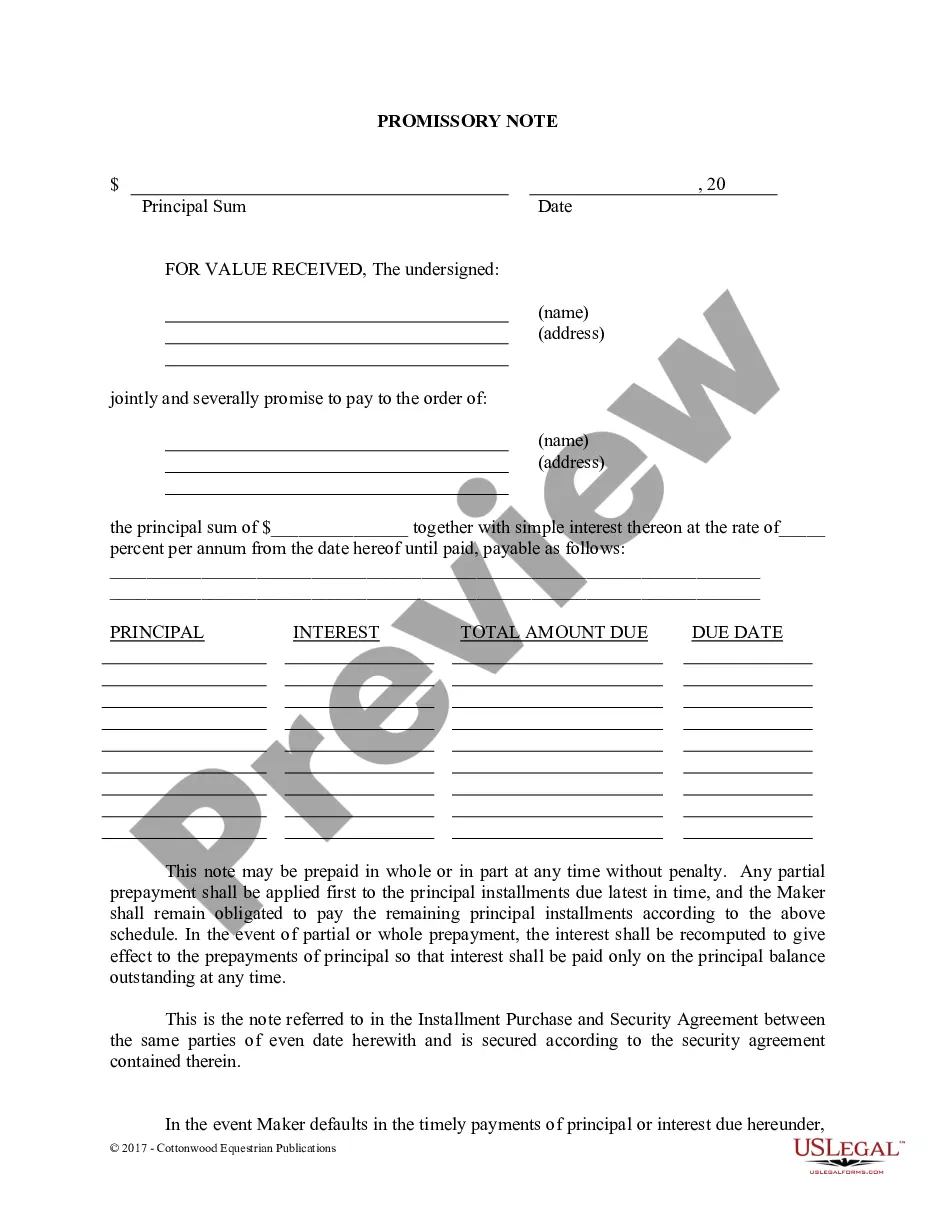

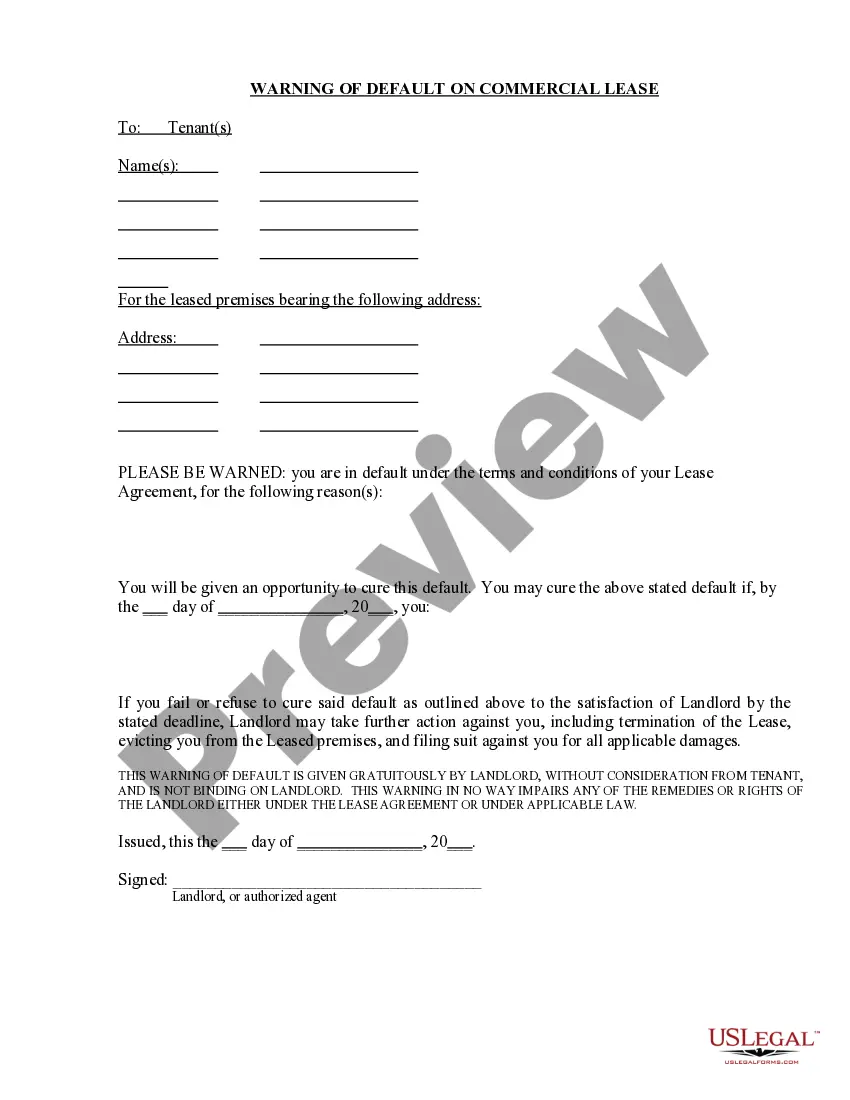

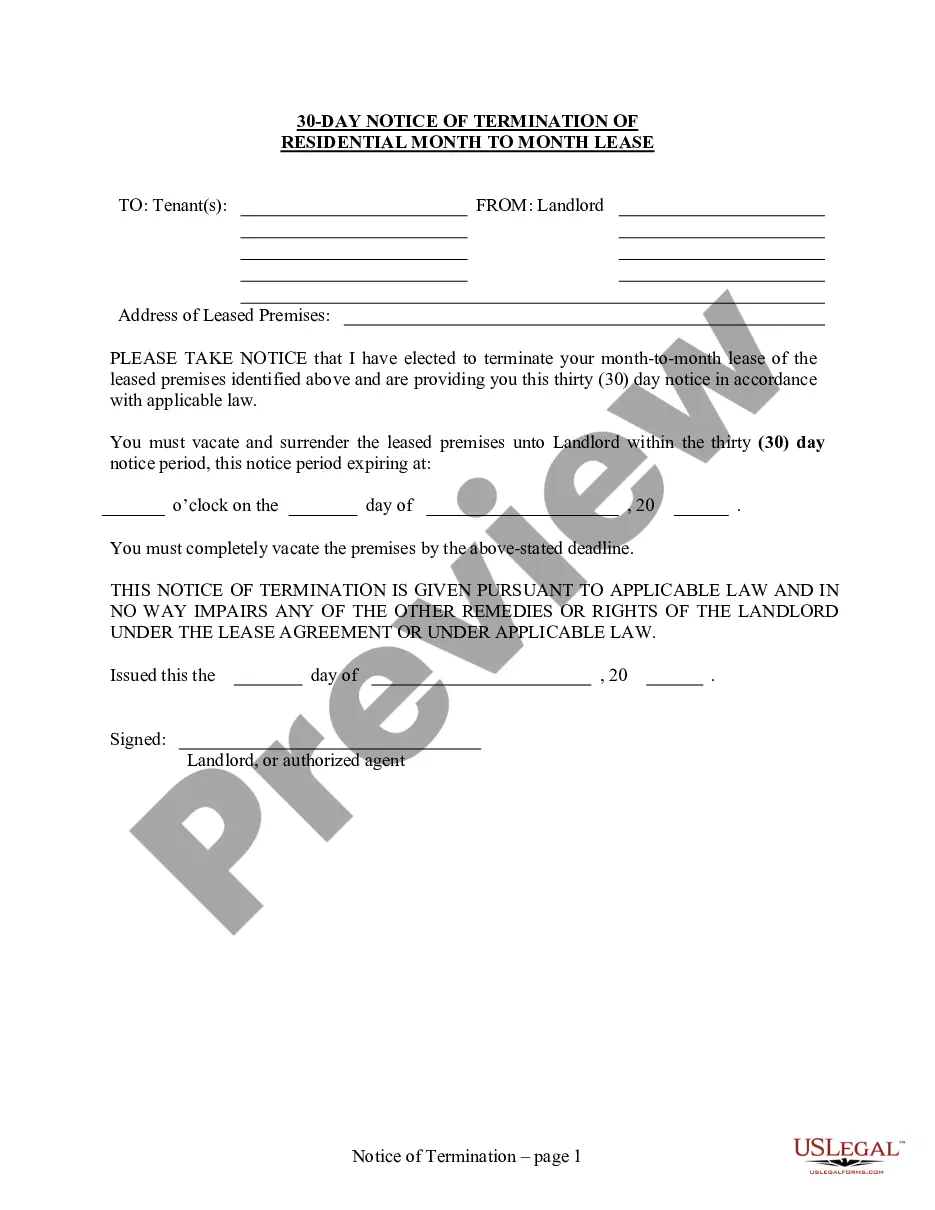

In New Hampshire, when a partner passes away, it becomes necessary to transfer their interest in a partnership to the surviving partner. To legally accomplish this, a Purchase Agreement and Bill of Sale can be used as essential documents to formalize the transaction. This ensures the smooth transition of ownership and protects the rights and interests of both parties involved. The Purchase Agreement outlines the terms and conditions related to the sale of the deceased partner's interest and serves as a binding contract between the surviving partner and the estate of the deceased partner. It covers various aspects, including the purchase price, payment terms, and any other specific provisions agreed upon by both parties. Additionally, the agreement may address issues such as the valuation of the deceased partner's interest and the allocation of profits and losses. The Bill of Sale, another crucial document, serves as evidence of the transfer of the deceased partner's interest from the estate to the surviving partner. It contains detailed information about the transferred interest, including its description, the purchase price, names of parties involved, and the date of transfer. The Bill of Sale also aims to document the parties' agreement that the surviving partner now holds full ownership of the deceased partner's interest in the partnership. When considering the different types of New Hampshire Sale of Deceased Partner's Interest to Surviving Partner, there are no specific variations in terms of the Purchase Agreement and Bill of Sale. However, the specifics of the agreement may differ depending on the circumstances and the preferences of the parties involved. For instance, the agreement might detail whether the surviving partner will assume any liabilities associated with the partnership, how the deceased partner's interest will be valued, or any specific provisions related to the partnership's dissolution or continuation. In conclusion, the New Hampshire Sale of Deceased Partner's Interest to Surviving Partner entails the usage of a Purchase Agreement and Bill of Sale to legally transfer ownership. These documents provide a clear and comprehensive understanding of the agreed-upon terms and confirm the transfer of the deceased partner's interest. It is important to consult with legal professionals experienced in partnership law to ensure all necessary requirements and provisions are properly addressed in the Purchase Agreement and Bill of Sale.

New Hampshire Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

US Legal Forms - one of the largest libraries of legitimate forms in America - gives a wide array of legitimate papers web templates you can acquire or printing. Using the site, you can find thousands of forms for business and person uses, sorted by categories, claims, or keywords.You can get the most recent versions of forms much like the New Hampshire Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale in seconds.

If you already have a monthly subscription, log in and acquire New Hampshire Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale in the US Legal Forms library. The Acquire option will appear on each and every type you perspective. You gain access to all formerly delivered electronically forms inside the My Forms tab of your own profile.

If you would like use US Legal Forms the first time, listed here are simple guidelines to obtain started:

- Be sure to have selected the correct type to your city/area. Go through the Review option to analyze the form`s content. Browse the type explanation to actually have selected the correct type.

- In case the type doesn`t suit your requirements, utilize the Research area at the top of the display to find the one which does.

- In case you are satisfied with the shape, affirm your decision by simply clicking the Purchase now option. Then, select the pricing program you favor and supply your qualifications to sign up on an profile.

- Approach the purchase. Use your Visa or Mastercard or PayPal profile to accomplish the purchase.

- Choose the formatting and acquire the shape on your own gadget.

- Make modifications. Fill out, modify and printing and indication the delivered electronically New Hampshire Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale.

Each template you added to your account does not have an expiry particular date and is also your own property eternally. So, in order to acquire or printing yet another backup, just proceed to the My Forms portion and click on around the type you require.

Obtain access to the New Hampshire Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale with US Legal Forms, the most substantial library of legitimate papers web templates. Use thousands of professional and state-certain web templates that meet up with your small business or person needs and requirements.

Form popularity

FAQ

Essentially, partners share in the profits and the debts of the daily workings of the business. Because of that, when one partner wants to sell, they cannot sell the entire business. They can only sell their assets ? i.e., their share of the partnership.

The sale of a partnership interest is generally treated as the sale of a capital asset. As a result, the sale of a partnership interest will generally generate capital gain or loss for the difference between the amount realized on the sale and the partner's adjusted basis in the partnership interest.

Updated November 2, 2020: A sales partner agreement is a contract that exists between multiple business partners and is used to define what the responsibilities of the company are.

Partnership Interest means a partner's share of the profits and losses of a limited partnership and the right to receive distributions of partnership assets.

Partnership Sale means a bona fide arm's-length transaction or series of related transactions involving a Transfer, directly or indirectly, of all or any portion of the Interests in the Partnership, or a Transfer of all or any portion of the assets of the Partnership.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction.