New Hampshire Letter Notifying Social Security Administration of Identity Theft

Description

How to fill out Letter Notifying Social Security Administration Of Identity Theft?

Are you currently inside a position that you need paperwork for either organization or specific reasons nearly every time? There are tons of authorized record themes accessible on the Internet, but getting versions you can rely isn`t easy. US Legal Forms offers thousands of kind themes, such as the New Hampshire Letter Notifying Social Security Administration of Identity Theft, which are composed in order to meet federal and state needs.

Should you be presently knowledgeable about US Legal Forms web site and have a free account, merely log in. Next, it is possible to down load the New Hampshire Letter Notifying Social Security Administration of Identity Theft web template.

Unless you offer an profile and need to begin to use US Legal Forms, follow these steps:

- Get the kind you require and ensure it is for that correct town/region.

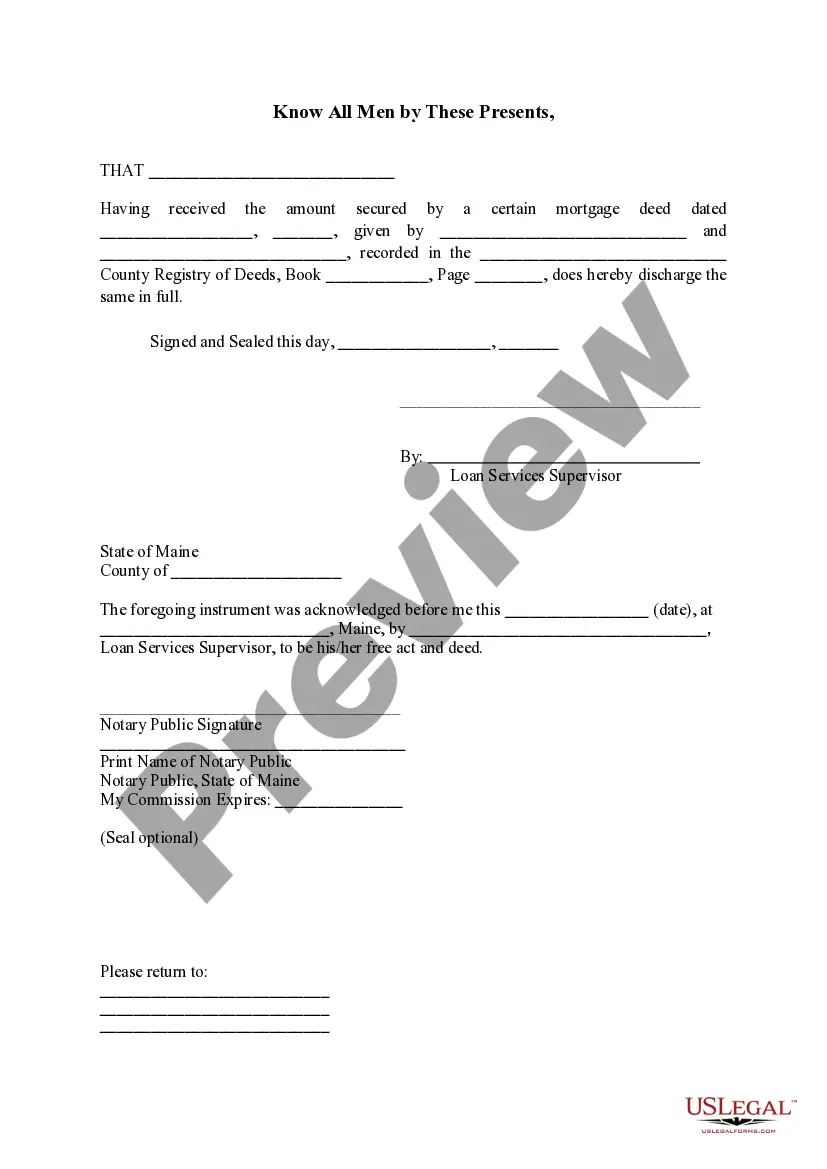

- Make use of the Review button to review the shape.

- Browse the information to actually have chosen the right kind.

- When the kind isn`t what you are trying to find, make use of the Research discipline to get the kind that suits you and needs.

- When you get the correct kind, just click Get now.

- Pick the rates program you need, submit the necessary information to generate your bank account, and pay money for the order using your PayPal or credit card.

- Select a convenient data file file format and down load your duplicate.

Discover all of the record themes you possess bought in the My Forms menus. You can obtain a more duplicate of New Hampshire Letter Notifying Social Security Administration of Identity Theft any time, if necessary. Just click the needed kind to down load or produce the record web template.

Use US Legal Forms, the most substantial collection of authorized varieties, to save efforts and avoid errors. The support offers expertly created authorized record themes which you can use for an array of reasons. Create a free account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

Consumers can report identity theft at IdentityTheft.gov, the federal government's one-stop resource to help people report and recover from identity theft. The site provides step-by-step advice and helpful resources like easy-to-print checklists and sample letters.

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Warning signs of identity theft Debt collection calls for accounts you did not open. Information on your credit report for accounts you did not open. Denials of loan applications. Mail stops coming to, or is missing from, your mailbox.

You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report. An FTC Identity Theft Report subjects the person filing the report to criminal penalties if the information is false, and businesses can treat it as they would a police report.

You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov. Our investigations are most successful when you provide as much information as possible about the alleged suspect(s) and victim(s) involved.

If you have been a victim of identity theft, the Identity Theft Statement helps you notify financial institutions, credit card issuers and other companies that the identity theft occurred, tell them that you did not create the debt or charges, and give them information they need to begin an investigation.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Look out for notifications that a tax return has been filed under your name. Additionally, if you receive a W-2, 1099, or any other tax form from a company you've never worked for, it might mean that someone obtained your Social Security number and is using it for employment purposes.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.