New Hampshire Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

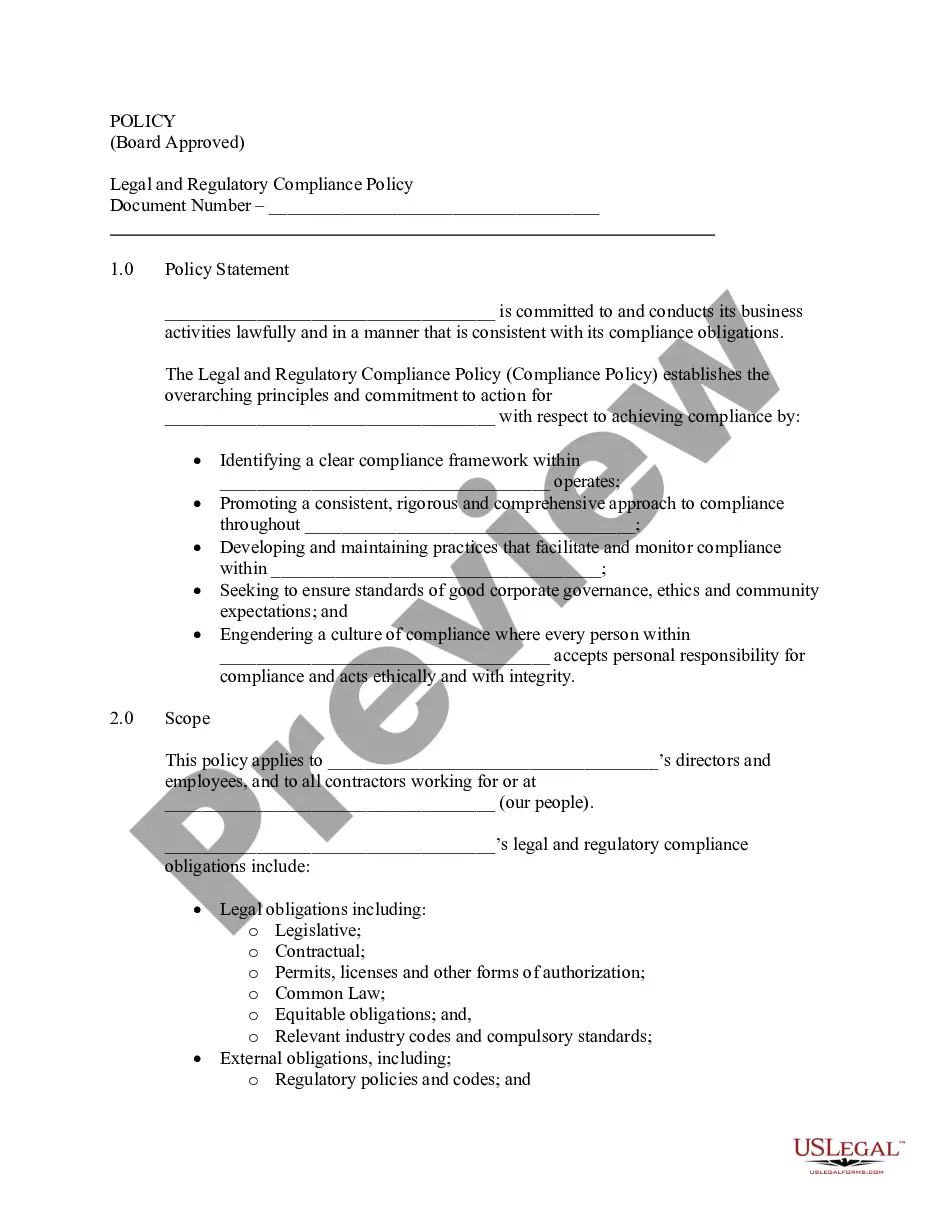

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Choosing the best authorized papers design can be a battle. Needless to say, there are tons of web templates accessible on the Internet, but how can you find the authorized form you will need? Utilize the US Legal Forms site. The support delivers a large number of web templates, including the New Hampshire Sample Letter to City Clerk regarding Ad Valorem Tax Exemption, which you can use for company and personal requires. Each of the varieties are checked out by pros and fulfill state and federal demands.

In case you are previously signed up, log in to your profile and click the Down load switch to get the New Hampshire Sample Letter to City Clerk regarding Ad Valorem Tax Exemption. Use your profile to check with the authorized varieties you possess purchased earlier. Proceed to the My Forms tab of your respective profile and get an additional copy in the papers you will need.

In case you are a whole new customer of US Legal Forms, here are straightforward recommendations that you can follow:

- First, make sure you have selected the appropriate form for your town/county. You can look through the form making use of the Review switch and study the form information to make certain this is the right one for you.

- In case the form does not fulfill your needs, use the Seach area to find the appropriate form.

- Once you are sure that the form is suitable, click on the Buy now switch to get the form.

- Pick the rates strategy you want and enter the essential info. Make your profile and buy the transaction with your PayPal profile or bank card.

- Select the submit format and acquire the authorized papers design to your product.

- Complete, modify and produce and indicator the received New Hampshire Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

US Legal Forms is the most significant collection of authorized varieties where you can see various papers web templates. Utilize the service to acquire professionally-made papers that follow condition demands.

Form popularity

FAQ

Brief Overview of New Hampshire Homestead Protection Laws The state of New Hampshire provides up to $100,000 worth of property (based on equity) to be declared a homestead in the event of a bankruptcy. This amount may be doubled for married couples.

New Hampshire State Tax: Overview New Hampshire has no income tax and no sales tax. New Hampshire also has fairly high property taxes when compared to other states. Earned income is untaxed in New Hampshire, but the state taxes dividends and interest at 5%. Social Security benefits are not taxed by the state.

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

Requirements: Must be a New Hampshire resident for 3 consecutive years. Must be 65 on or before April 1st (or spouse) The property for which the exemption is applied must be the legal residence of applicant(s) Property Transfers: the property cannot be transferred within the last 5 years from a blood relative or marriage.

Is New Hampshire tax-friendly for retirees? New Hampshire has no personal income tax, which means Social Security retirement benefits are tax-free at the state level. Income from pensions and retirement accounts also go untaxed in New Hampshire. On top of that, there is no sales tax, estate tax or inheritance tax here.

New Hampshire's homestead exemption allows you to protect up to $120,000 of equity in your home, and twice that amount if you are a married couple filing jointly. In bankruptcy, a homestead exemption protects equity in your home. Here, you'll find specific information about the homestead exemption in New Hampshire.

Which NH towns have the lowest property taxes? Windsor ($3.39) New Castle ($4.48) Moultonborough ($4.78) Bartlett ($4.97) Tuftonboro ($6.44)