New Hampshire Agreement to Incorporate Close Corporation

Description

How to fill out Agreement To Incorporate Close Corporation?

Choosing the right legal file template can be quite a have a problem. Needless to say, there are tons of themes available on the net, but how can you find the legal form you want? Take advantage of the US Legal Forms web site. The service gives thousands of themes, like the New Hampshire Agreement to Incorporate Close Corporation, which you can use for company and personal requirements. Every one of the types are inspected by specialists and meet state and federal specifications.

When you are already registered, log in for your accounts and then click the Acquire key to obtain the New Hampshire Agreement to Incorporate Close Corporation. Utilize your accounts to check with the legal types you possess ordered formerly. Check out the My Forms tab of the accounts and obtain another version in the file you want.

When you are a fresh user of US Legal Forms, listed below are basic recommendations that you can adhere to:

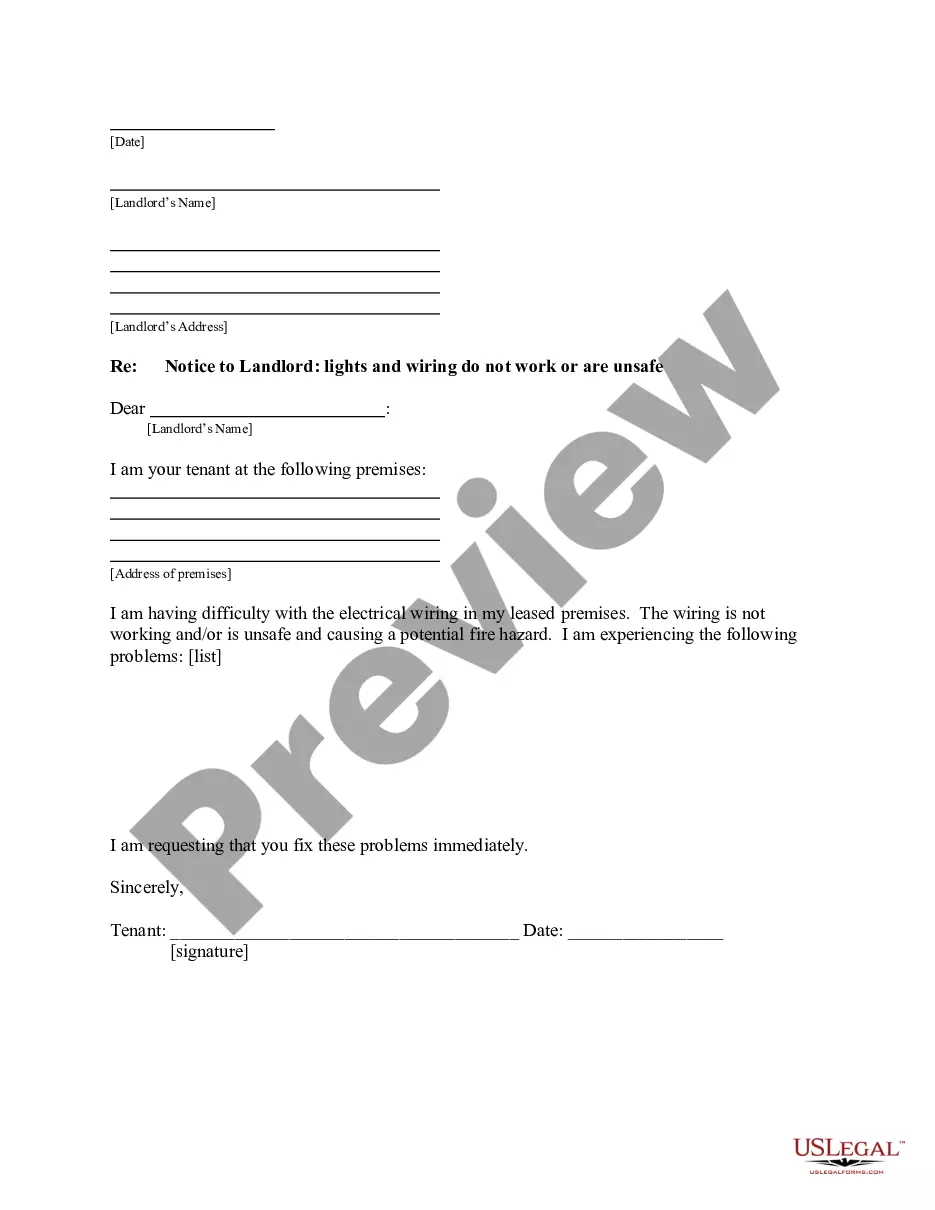

- Very first, be sure you have selected the right form for the area/county. It is possible to look over the shape while using Preview key and browse the shape description to make certain this is the right one for you.

- In the event the form fails to meet your expectations, make use of the Seach industry to get the correct form.

- When you are sure that the shape is acceptable, click on the Acquire now key to obtain the form.

- Opt for the costs program you would like and type in the essential details. Design your accounts and buy the order utilizing your PayPal accounts or bank card.

- Opt for the submit structure and acquire the legal file template for your gadget.

- Comprehensive, edit and print and indication the acquired New Hampshire Agreement to Incorporate Close Corporation.

US Legal Forms will be the greatest library of legal types in which you will find a variety of file themes. Take advantage of the company to acquire expertly-produced paperwork that adhere to condition specifications.

Form popularity

FAQ

New Hampshire domestication is a statutory procedure that officially transfers an existing LLC to a different state. An out-of-state LLC can domesticate into New Hampshire, or a New Hampshire LLC can domesticate into another state (if the other state also allows LLC domestications).

New Hampshire LLC Formation Filing Fee: $100 Filing your Certificate of Formation has a fee of $100. You can submit the certificate through the mail or in person, or you can do it online through NH QuickStart, though you'll need to add $2 for online filings.

Register Your New Hampshire LLC There is a $100 fee to complete the form ($102 for online filing), and you will receive a file-stamped copy of your certificate within 30 days. Checks should be made payable to the ?State of New Hampshire.?

To dissolve a New Hampshire corporation, you need to file Articles of Dissolution. To dissolve a New Hampshire LLC, you need to request a Certificate of Dissolution from the Department of Revenue Administration. This certificate will state that the LLC has paid all its taxes due.

Benefits of starting a New Hampshire LLC: Easily file your taxes and discover potential advantages for tax treatment. Protect your personal assets from your business liability and debts. Low filing fee ($100)

Initial New Hampshire LLC Fees State FeeState Filing TimeExpedited Filing Time$102*4 Weeks11 Business DaysState Fee$102*State Filing Time4 WeeksExpedited Filing Time11 Business Days

How to Incorporate in New Hampshire. To start a corporation in New Hampshire, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Corporation Division. You can file this document online or by mail. The articles cost $100 to file.