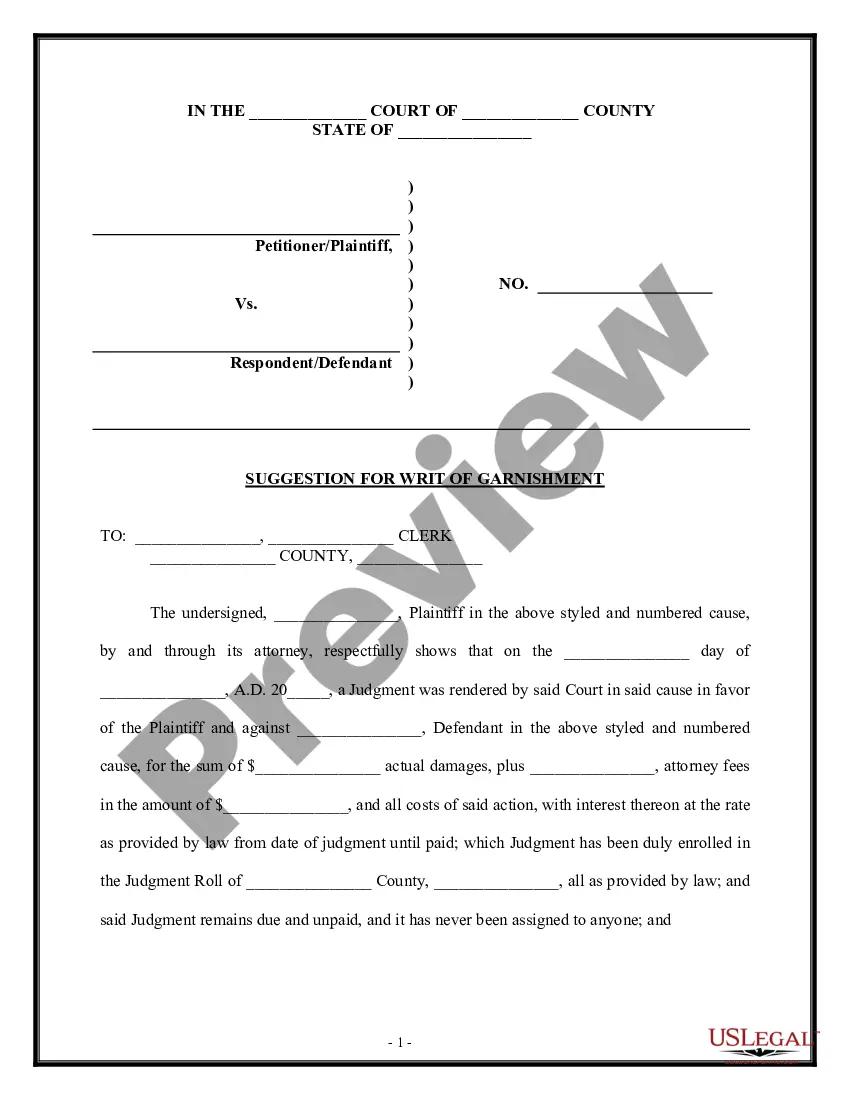

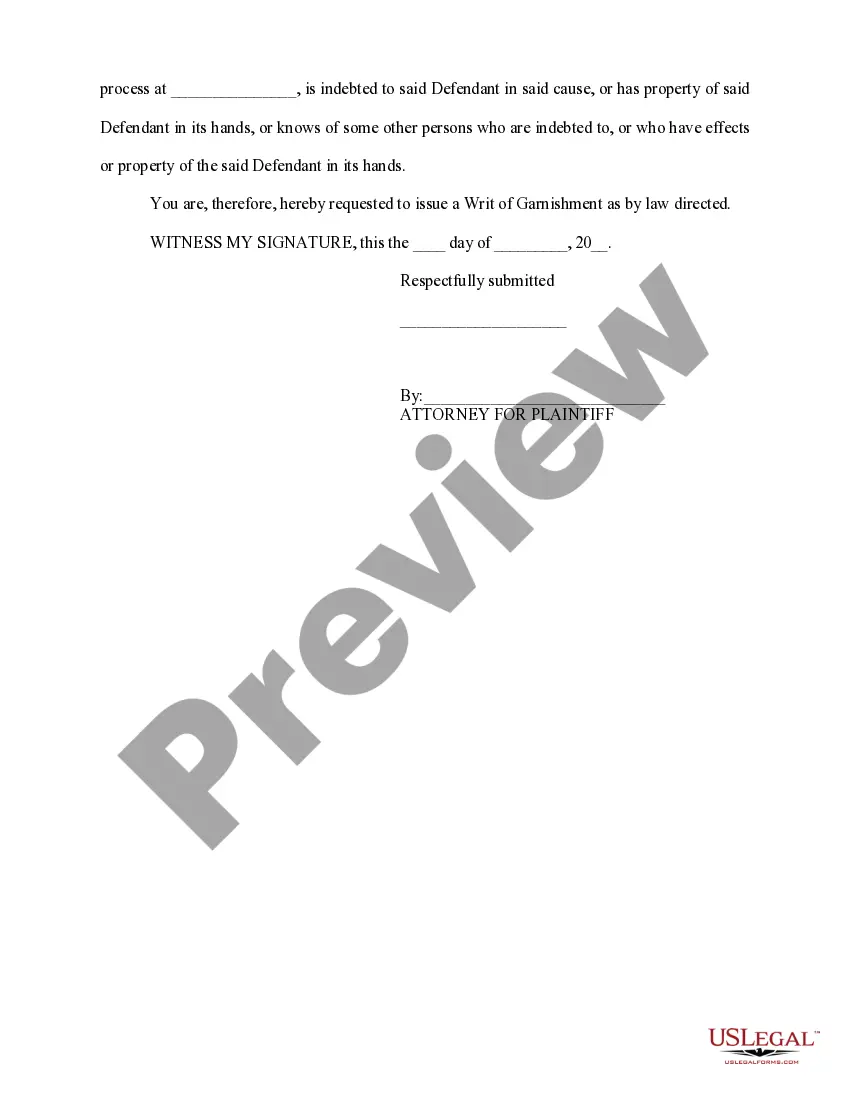

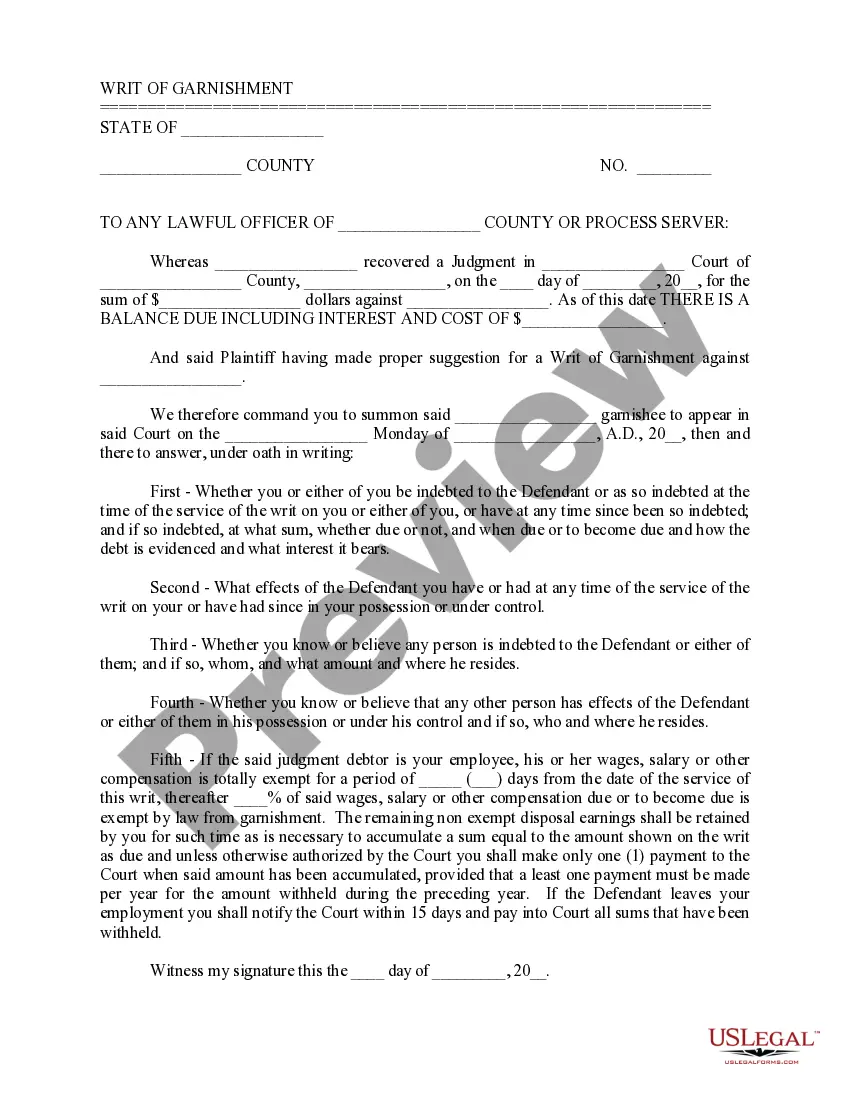

Title: Understanding New Hampshire's Suggestion for Writ of Garnishment: Types, Process, and Key Considerations Introduction: In the state of New Hampshire, a Suggestion for Writ of Garnishment is a legal tool used by judgment creditors to collect outstanding debts from a judgment debtor's wages or bank accounts. This comprehensive guide provides an in-depth understanding of the different types of garnishment, how the process works, and important factors to consider when pursuing such legal action in New Hampshire. Types of New Hampshire Suggestion for Writ of Garnishment: 1. Wages Garnishment: — This type of garnishment allows creditors to collect a portion of the debtor's wages or salary to satisfy their outstanding debt. — The maximum allowable garnishment amount is typically calculated as a percentage of the debtor's disposable income. 2. Bank Account Garnishment: — Creditors can use this type of garnishment to seize funds directly from the debtor's bank accounts. — Certain exempt funds, such as Social Security benefits or child support payments, may be protected from garnishment. 3. Third-Party Garnishment: — In cases where the debtor owes money to a third party, this type of garnishment allows judgment creditors to collect the debt directly from that third party. — Common examples include garnishing funds held by a tenant's landlord or a business client who owes money to the debtor. Process for Obtaining a Suggestion for Writ of Garnishment in New Hampshire: 1. Obtain a Money Judgment: — Before pursuing garnishment, the judgment creditor must first obtain a legal judgment against the debtor in a court of law. 2. Prepare and File Relevant Documents: — The creditor must file a written suggestion with the court, providing details of the debtor, the outstanding debt, and the reasons for pursuing garnishment. — Additionally, the suggested writ of garnishment must be filed, which authorizes the garnishment action. 3. Serve Notice to the Debtor: — Once the court approves the issuance of the writ of garnishment, a copy of the court order along with the writ must be served to the debtor, informing them of the impending garnishment. 4. Compliance by Garnishee: — A garnishee is the party who holds the debtor's assets, such as the employer or the bank. — The garnishee is then legally obligated to withhold the appropriate funds from the debtor's wages or accounts, as specified in the writ of garnishment. Key Considerations for New Hampshire Suggestion for Writ of Garnishment: 1. Exemptions and Limits: — Certain funds and incomes may be exempt from garnishment under state and federal laws, such as federal benefits and a portion of the debtor's wages. — Understanding the limits and exemptions is crucial to avoid violating debtor rights. 2. Promptness and Accuracy: — Strict compliance with deadlines and accuracy in filing the necessary documents is vital to ensure a smooth garnishment process. — Attention to detail will reduce delays and potential legal complications. 3. Seek Legal Advice: — Given the complexities and potential pitfalls involved in the garnishment process, seeking guidance from a qualified legal professional is highly recommended. — An attorney can provide precise advice, help navigate legal requirements, and increase the chances of a successful garnishment. In conclusion, a Suggestion for Writ of Garnishment in New Hampshire is a legal mechanism allowing creditors to collect outstanding debts from debtors' wages or bank accounts. Understanding the various types of garnishment, the process involved, and important considerations will enable creditors to pursue these actions effectively while adhering to relevant legal requirements in the state of New Hampshire.

New Hampshire Suggestion for Writ of Garnishment

Description

How to fill out Suggestion For Writ Of Garnishment?

You can commit time on the web attempting to find the authorized record format that meets the federal and state needs you will need. US Legal Forms gives thousands of authorized forms that are evaluated by pros. It is simple to acquire or print the New Hampshire Suggestion for Writ of Garnishment from my support.

If you already have a US Legal Forms account, it is possible to log in and click the Down load key. After that, it is possible to complete, change, print, or sign the New Hampshire Suggestion for Writ of Garnishment. Each authorized record format you get is the one you have eternally. To acquire an additional copy of any bought form, proceed to the My Forms tab and click the corresponding key.

If you use the US Legal Forms site the very first time, adhere to the straightforward recommendations under:

- Initial, be sure that you have selected the correct record format for the county/city that you pick. Browse the form explanation to make sure you have picked the appropriate form. If offered, utilize the Preview key to appear through the record format at the same time.

- In order to locate an additional edition of the form, utilize the Research industry to discover the format that meets your needs and needs.

- After you have found the format you would like, click on Get now to move forward.

- Select the prices plan you would like, enter your qualifications, and register for a merchant account on US Legal Forms.

- Full the deal. You may use your charge card or PayPal account to fund the authorized form.

- Select the format of the record and acquire it for your product.

- Make adjustments for your record if required. You can complete, change and sign and print New Hampshire Suggestion for Writ of Garnishment.

Down load and print thousands of record layouts utilizing the US Legal Forms site, that provides the greatest selection of authorized forms. Use skilled and status-certain layouts to tackle your company or specific demands.

Form popularity

FAQ

In New Hampshire, creditors can garnish the lesser of: 25% of your weekly disposable income, or. The amount that your weekly earnings exceed 30 times the federal minimum wage. This is currently $7.25/hour, and 30 times that is $217.50.

In New Hampshire, the statute of limitations period for most types of debt is three years. That said, the statute of limitations period in New Hampshire for auto loan debt is four years, for credit card debt is three years, for medical debt is six years, and for mortgage debt is twenty years.

NEW HAMPSHIRE Actions of debt upon judgments must be brought within 20 years. N.H. Rev. Stat.

You may be able to stop wage garnishment by negotiating with the creditor. If this is not possible and you feel the judgement was incorrect you may be able to object to or challenge the garnishment.

Have you been threatened with one or the other? If so, you know how frustrating it can be. Wage garnishments are a frequent tool both the IRS and the State of Maryland use to collect back taxes or tax liabilities. But these levies and liens can cause real pain for those who are subject to them.

A garnishment proceeding determines whether the debtor has any assets that can be used to pay a judgment. Once a judgment has been entered, the creditor can collect what is owed. Judgments are enforceable in Maryland for 12 years and they can be renewed.

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).

There are four ways to open a bank account that no creditor can touch: (1) use an exempt bank account, (2) establish a bank account in a state that prohibits garnishments, (3) open an offshore bank account, or (4) maintain a wage or government benefits account.