A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

New Hampshire Conditional Guaranty of Payment of Obligation

Description

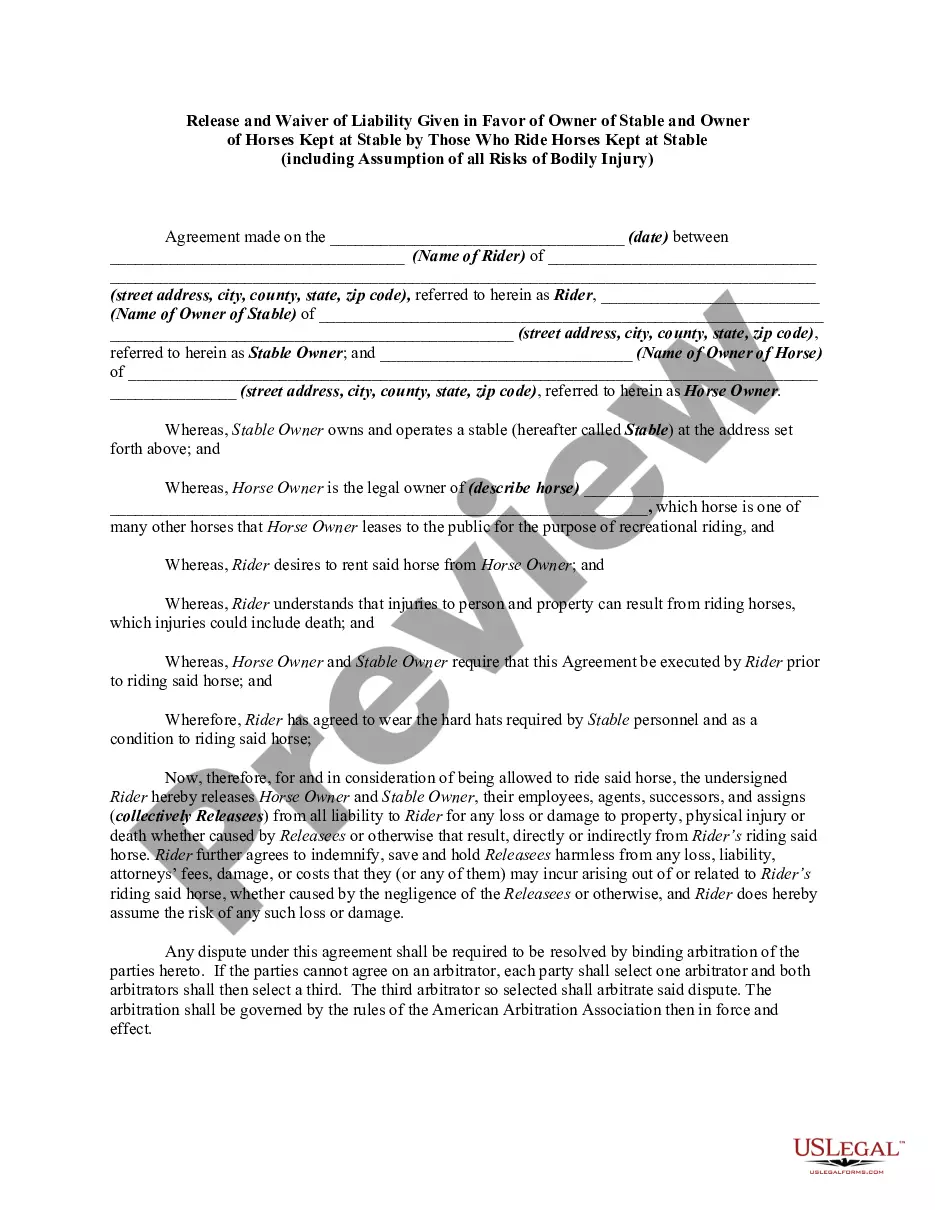

How to fill out Conditional Guaranty Of Payment Of Obligation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal template options that you can download or print.

By using the website, you can access thousands of forms for personal and business needs, organized by categories, states, or keywords. You can find the most recent editions of forms like the New Hampshire Conditional Guaranty of Payment of Obligation in moments.

If you have an active subscription, Log In and download the New Hampshire Conditional Guaranty of Payment of Obligation from the US Legal Forms library. The Download button will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded New Hampshire Conditional Guaranty of Payment of Obligation. Every template you save in your account has no expiration date and is yours permanently. Thus, if you wish to download or print another copy, just visit the My documents section and click on the form you require. Access the New Hampshire Conditional Guaranty of Payment of Obligation with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize numerous professional and state-specific templates that fulfill your personal and business needs.

- If you are using US Legal Forms for the first time, here are straightforward steps to get you started.

- Ensure you have selected the correct form for your locality/region.

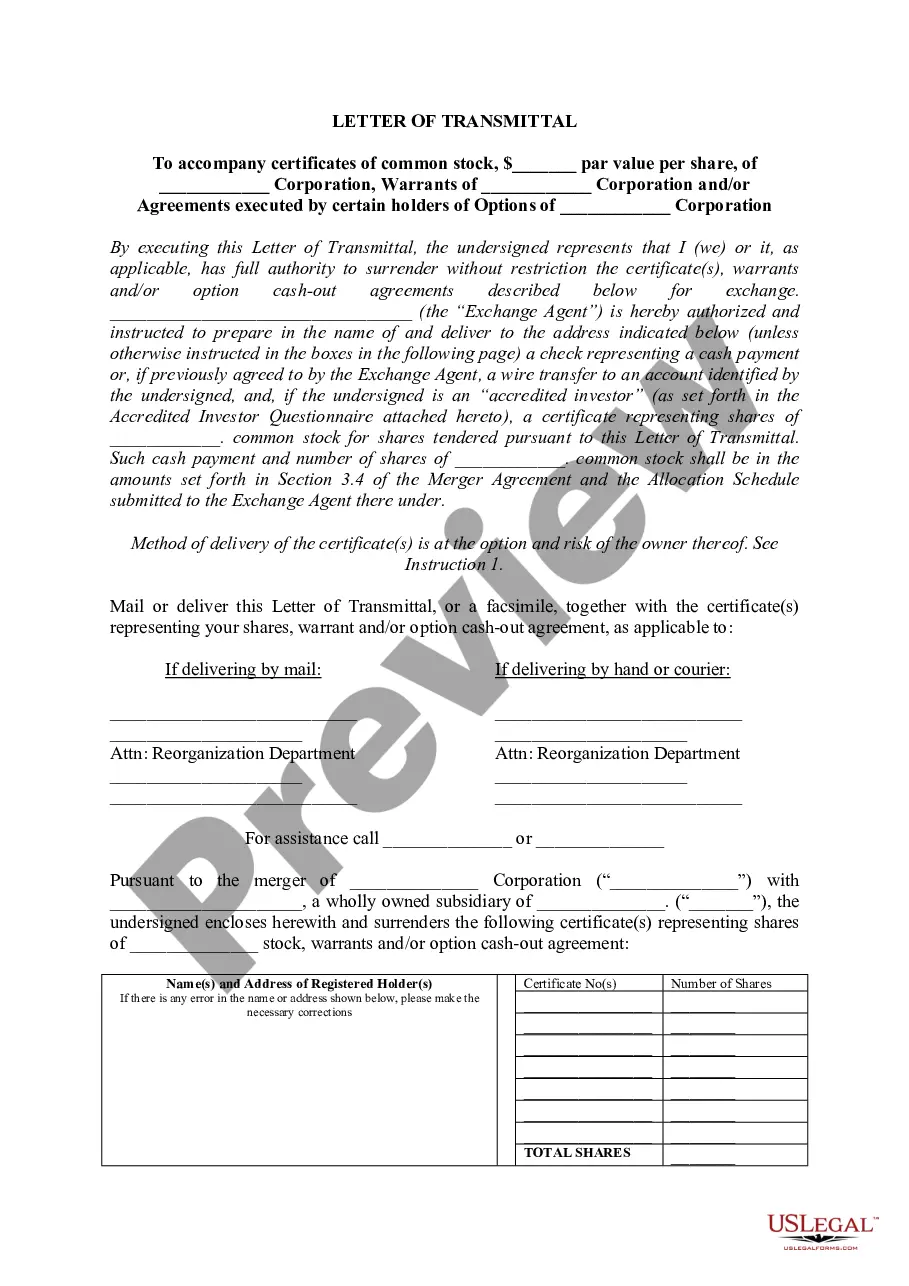

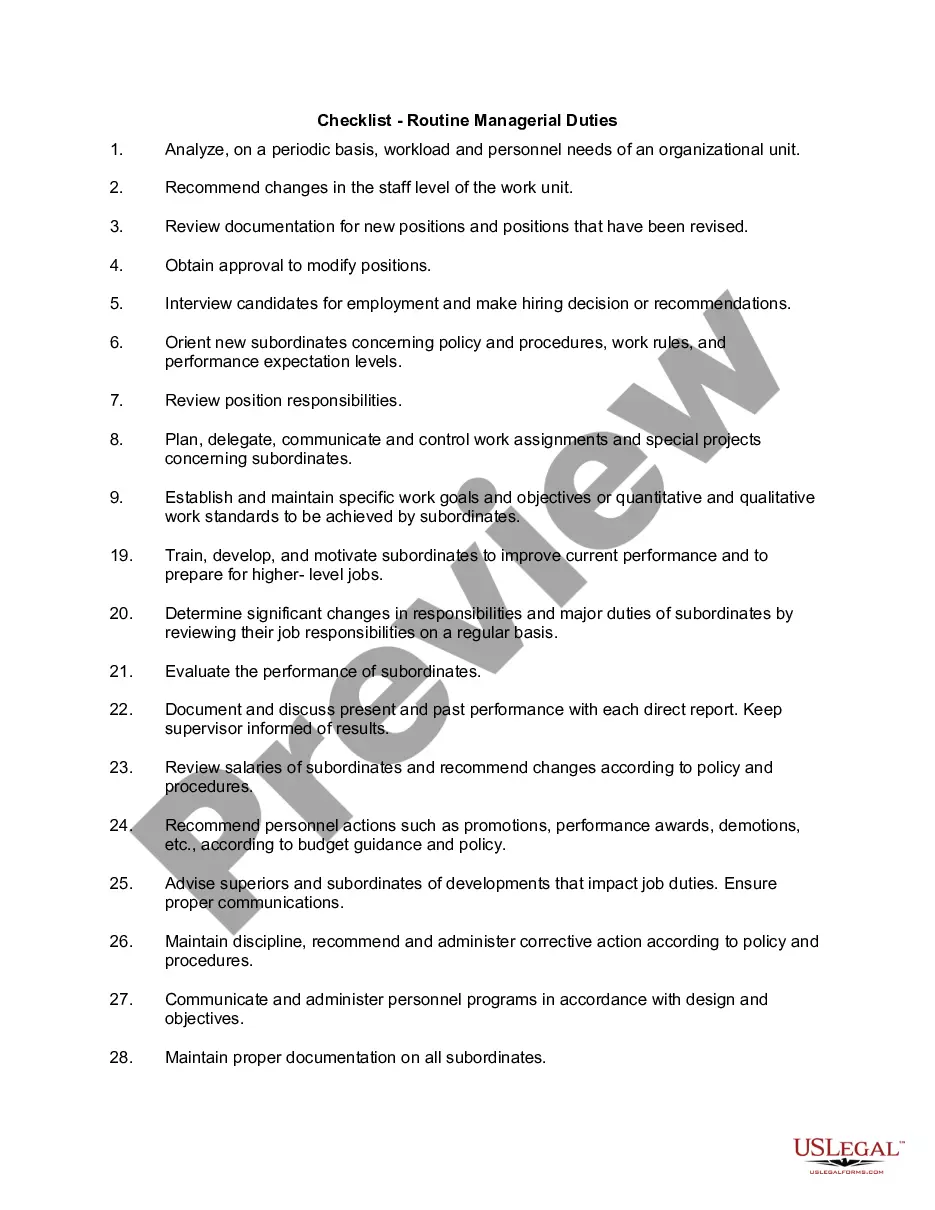

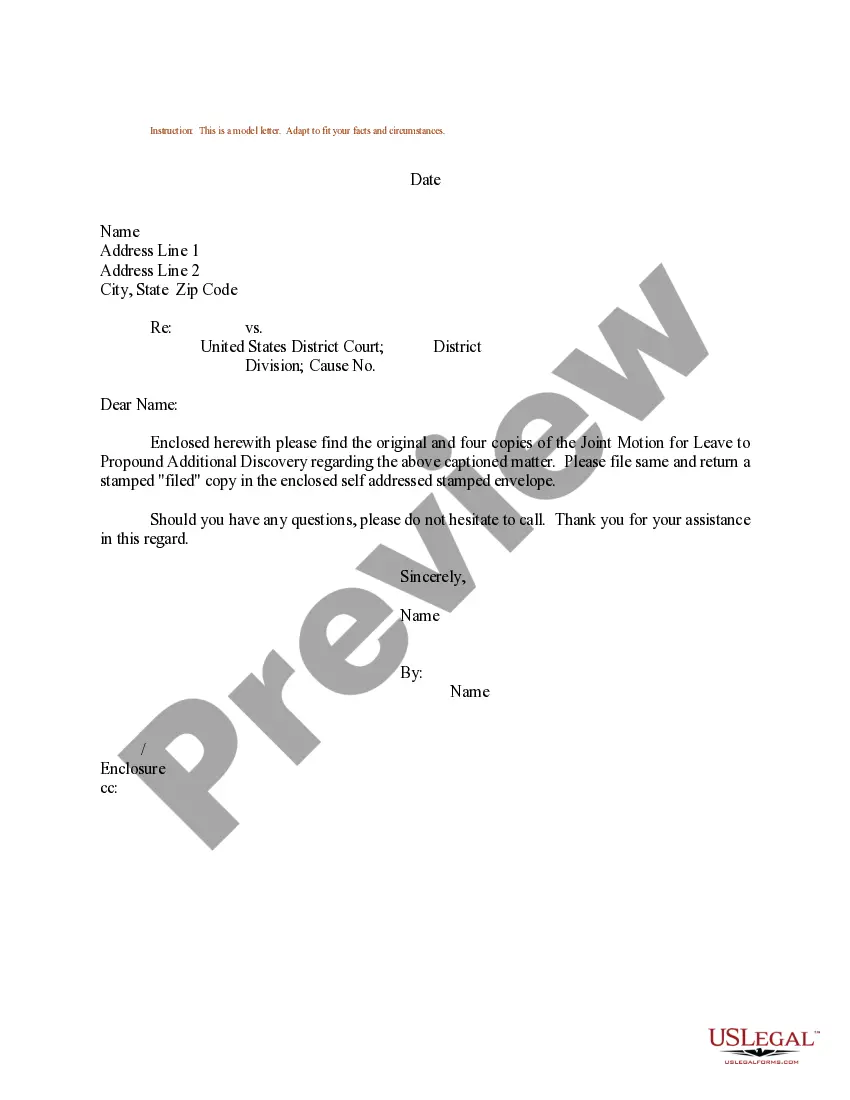

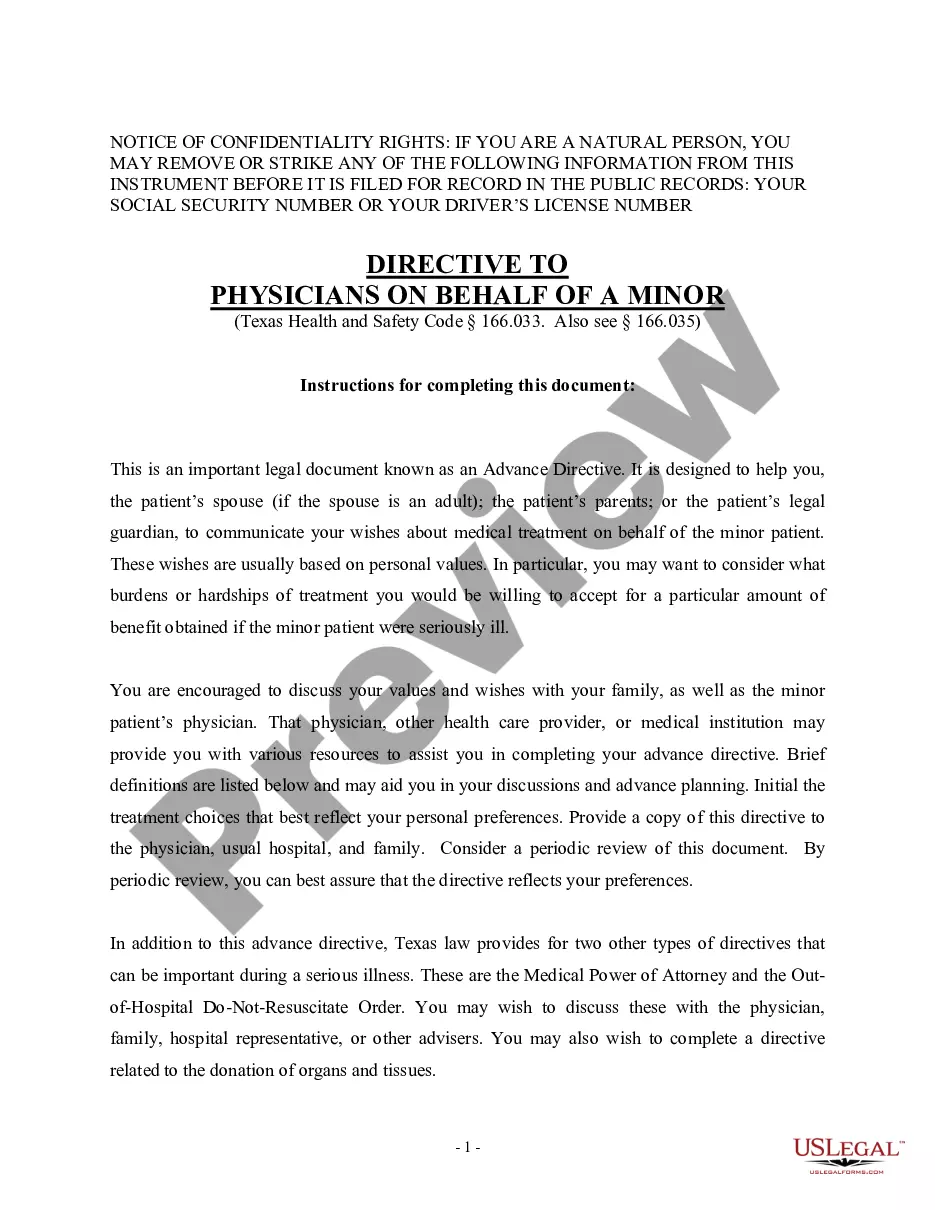

- Click the Preview button to view the form's content.

- Check the form details to confirm you have chosen the right document.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

An example of a payment clause might be one that states, 'In the event of default, the guarantor shall be responsible for all unpaid amounts within 30 days of notification.' Such clauses protect lenders by ensuring they have a clear path to recovery if the borrower defaults. Reviewing similar clauses can enhance your understanding of the New Hampshire Conditional Guaranty of Payment of Obligation.

To exit a guaranty, you typically need the consent of the creditor or an agreement that releases you from your obligations. It's crucial to review the specific terms of the New Hampshire Conditional Guaranty of Payment of Obligation to understand your rights and responsibilities. Consulting with a legal expert or utilizing resources on the US Legal Forms platform can help clarify your options.

A form of payment guarantee is an assurance that a specified method of payment will be honored by the guarantor. This form provides security in transactions where financial commitments are involved. The New Hampshire Conditional Guaranty of Payment of Obligation exemplifies this assurance, creating a trustworthy framework for financial interactions.

A bank guarantee is issued by a bank on behalf of a party and promises payment to a third party if the bank's client defaults. Conversely, a payment guarantee may involve a broader range of commitments and can be issued by various parties, not just banks. Understanding the specific terms of a New Hampshire Conditional Guaranty of Payment of Obligation helps clarify the responsibilities and protections involved in your agreement.

A form of guarantee is a legal document that commits a guarantor to fulfill a payment or obligation if the primary party fails to do so. This instrument protects the interests of the party expecting payment. The New Hampshire Conditional Guaranty of Payment of Obligation is a specific example of such a document, ensuring that contractual promises are honored.

To obtain a payment guarantee, you typically need to approach a financial institution specializing in such services. They will evaluate your financial credibility and the obligations you want to secure. Utilizing a New Hampshire Conditional Guaranty of Payment of Obligation ensures that you have a formal agreement backing your payment commitments, providing peace of mind in your transactions.

The guarantee of payment clause is a contractual provision that outlines the terms under which a guarantor agrees to assume responsibility for payment. This clause can define either conditional or unconditional terms, depending on the agreement. When examining a New Hampshire Conditional Guaranty of Payment of Obligation, it is important to review this clause to ensure it aligns with your financial goals and expectations.

An unconditional and irrevocable guarantee provides an assurance that cannot be rescinded or modified once made. This means the guarantor cannot back out under any circumstances, ensuring that the promise of payment remains intact. For those involved with a New Hampshire Conditional Guaranty of Payment of Obligation, this type of guarantee builds solid financial relationships and reduces the risk for lenders.