A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

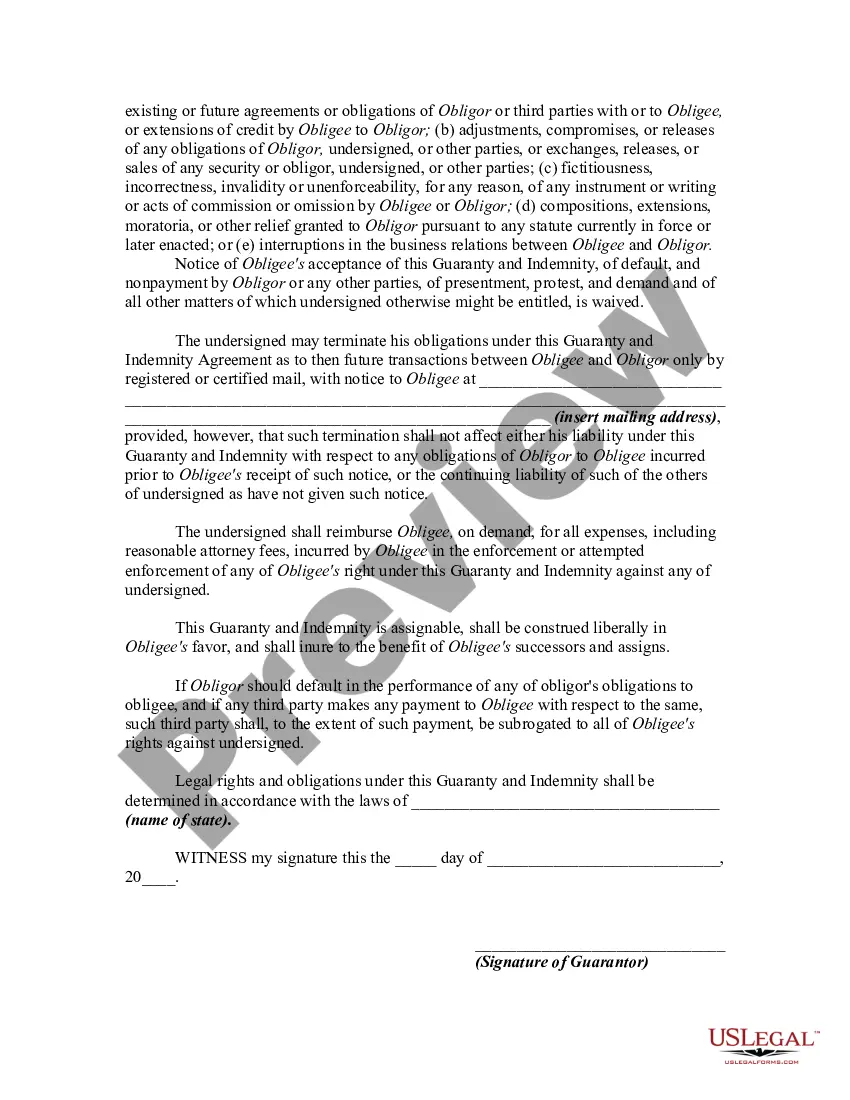

New Hampshire Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal document that outlines the guarantee provided by a party (the guarantor) to ensure the repayment of business debt by another party (the borrower). This agreement is commonly used in commercial transactions, loans, or credit arrangements. Keywords: New Hampshire, Continuing and Unconditional Guaranty, Business Indebtedness, Indemnity Agreement, legal document, guarantee, repayment, borrower, commercial transactions, loans, credit arrangements. There are different types or variations of the New Hampshire Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement, which can be tailored to suit specific needs or requirements. Some of these types include: 1. Limited Guaranty: This type of guaranty limits the liability of the guarantor to a specific amount or time period. It provides a partial guarantee, often capping the maximum liability of the guarantor. 2. Corporate Guaranty: In this type, the guarantor is a corporate entity rather than an individual. The obligations and responsibilities are assumed by the corporation, typically with the consent of its board of directors. 3. Joint and Several guaranties: This form of guaranty makes multiple individuals or entities jointly and severally liable for the indebtedness. This means that each guarantor is individually responsible for the full amount of the debt if the borrower defaults. 4. Guaranty with Collateral: This variation involves the pledge of specific assets or collateral to secure the guarantee. In case of default, the creditor can utilize these assets to recover the outstanding debt. 5. Unlimited Guaranty: Also known as an absolute guaranty, this type holds the guarantor fully responsible for the entire debt amount without any limitations on liability or timeframe. It is important to seek legal advice when drafting or entering into a New Hampshire Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement to ensure compliance with the state's laws and regulations.New Hampshire Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal document that outlines the guarantee provided by a party (the guarantor) to ensure the repayment of business debt by another party (the borrower). This agreement is commonly used in commercial transactions, loans, or credit arrangements. Keywords: New Hampshire, Continuing and Unconditional Guaranty, Business Indebtedness, Indemnity Agreement, legal document, guarantee, repayment, borrower, commercial transactions, loans, credit arrangements. There are different types or variations of the New Hampshire Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement, which can be tailored to suit specific needs or requirements. Some of these types include: 1. Limited Guaranty: This type of guaranty limits the liability of the guarantor to a specific amount or time period. It provides a partial guarantee, often capping the maximum liability of the guarantor. 2. Corporate Guaranty: In this type, the guarantor is a corporate entity rather than an individual. The obligations and responsibilities are assumed by the corporation, typically with the consent of its board of directors. 3. Joint and Several guaranties: This form of guaranty makes multiple individuals or entities jointly and severally liable for the indebtedness. This means that each guarantor is individually responsible for the full amount of the debt if the borrower defaults. 4. Guaranty with Collateral: This variation involves the pledge of specific assets or collateral to secure the guarantee. In case of default, the creditor can utilize these assets to recover the outstanding debt. 5. Unlimited Guaranty: Also known as an absolute guaranty, this type holds the guarantor fully responsible for the entire debt amount without any limitations on liability or timeframe. It is important to seek legal advice when drafting or entering into a New Hampshire Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement to ensure compliance with the state's laws and regulations.