Generally, a debtor may demand a receipt for payment of an obligation. No particular form is necessary for a valid receipt. However, a receipt should recite all facts necessary to substantiate the tender and acceptance of payment.

New Hampshire Receipt for Payment of Salary or Wages

Description

How to fill out Receipt For Payment Of Salary Or Wages?

It is feasible to spend time online attempting to locate the legal document template that meets the state and federal requirements you need.

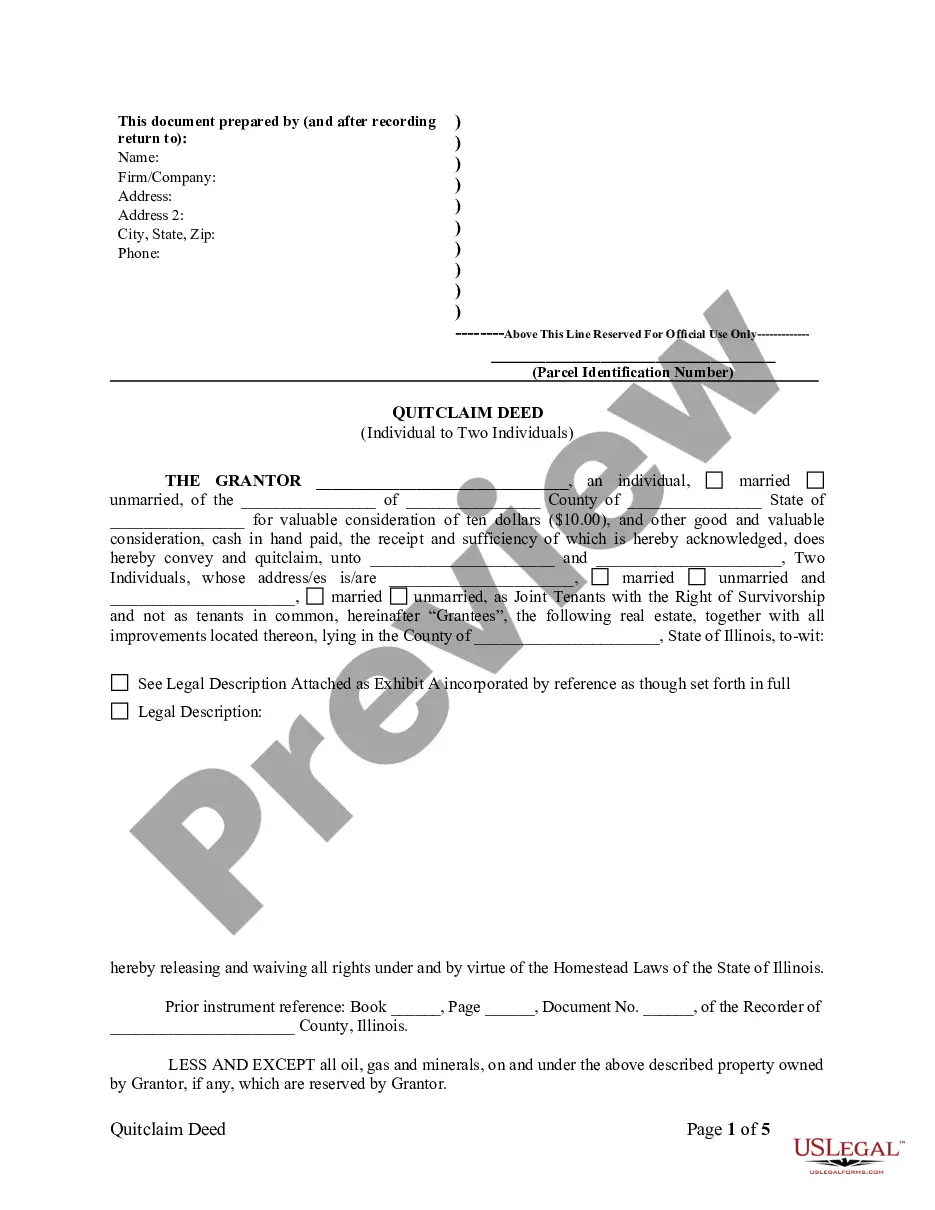

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

It is easy to obtain or print the New Hampshire Receipt for Payment of Salary or Wages from our service.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can complete, modify, print, or sign the New Hampshire Receipt for Payment of Salary or Wages.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for your area/city of choice.

- Check the form description to confirm you have picked the right form.

Form popularity

FAQ

In New Hampshire, employees typically do not see state income taxes withheld from their paychecks. However, they may have federal taxes, Social Security, and Medicare deductions applied. It's important to clearly understand your paycheck, and the New Hampshire Receipt for Payment of Salary or Wages can help track your earnings and any applicable deductions effectively.

New Hampshire is recognized as one of the states without a payroll tax, providing significant relief for employees and employers alike. This status allows residents to enjoy more of their earned income compared to states with payroll taxes. Having a New Hampshire Receipt for Payment of Salary or Wages showcases this benefit prominently in the payroll process.

The law states that an employer in New Hampshire must provide the final paycheck to a terminated employee within 72 hours of termination. This ensures that employees receive any earned wages without undue delay. To document the payment clearly, the New Hampshire Receipt for Payment of Salary or Wages can serve as a helpful reference.

New Hampshire does not impose a state withholding tax on wages. This policy allows employees to keep more of their earnings in hand, simplifying payroll procedures for employers as well. However, it is crucial to stay informed about other applicable taxes. The New Hampshire Receipt for Payment of Salary or Wages can clarify the breakdown of payments received.

Employers in New Hampshire must adhere to specific payroll requirements, such as maintaining accurate records of hours worked and payments made. Employers should also inform employees of their wage rates and have a timely payroll schedule. Using the New Hampshire Receipt for Payment of Salary or Wages can help confirm that payroll processes meet state regulations seamlessly.

In New Hampshire, there is no state income tax on wages, which results in no payroll tax for most employees. However, the state does impose other types of taxes, including taxes on dividends and interest. Therefore, workers benefit from the lack of a direct payroll tax, making the New Hampshire Receipt for Payment of Salary or Wages advantageous for residents.

There is no inheritance tax in New Hampshire, which can be appealing for individuals looking to transfer their assets. However, it is important to be aware of other taxes that may apply. If you are dealing with estate planning or need guidance around the New Hampshire Receipt for Payment of Salary or Wages, consulting with legal platforms like US Legal Forms can provide you with the necessary information.

The DP 10 form in New Hampshire is vital for employers who need to reconcile their payroll information annually. This form aids in reporting total wages and any state taxes withheld, ensuring accurate state tax compliance. To simplify your understanding of these processes, explore US Legal Forms, which offers resources relevant to the New Hampshire Receipt for Payment of Salary or Wages.

A DP10 refers to the New Hampshire Department of Revenue's 'Employer's Annual Reconciliation of Wages and Withholding'. This form is important for summarizing employee earnings and taxes withheld over the year. By completing a DP10, employers can ensure they are in compliance with state tax laws and accurately report wages connected to the New Hampshire Receipt for Payment of Salary or Wages.

You can obtain New Hampshire tax forms from the New Hampshire Department of Revenue Administration's website. Their official site contains a comprehensive collection of all necessary forms, including those related to the New Hampshire Receipt for Payment of Salary or Wages. You may also find useful resources on platforms like US Legal Forms, which can streamline your access to various legal documents.