In this form, the beneficiary consents to the revocation of the trust of which he/she is a beneficiary and consents to the delivery to the trustor by the trustee of any and all monies or property of every kind, whether principal or income, in trustee's possession by virtue of the Trust Agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Consent to Revocation of Trust by Beneficiary

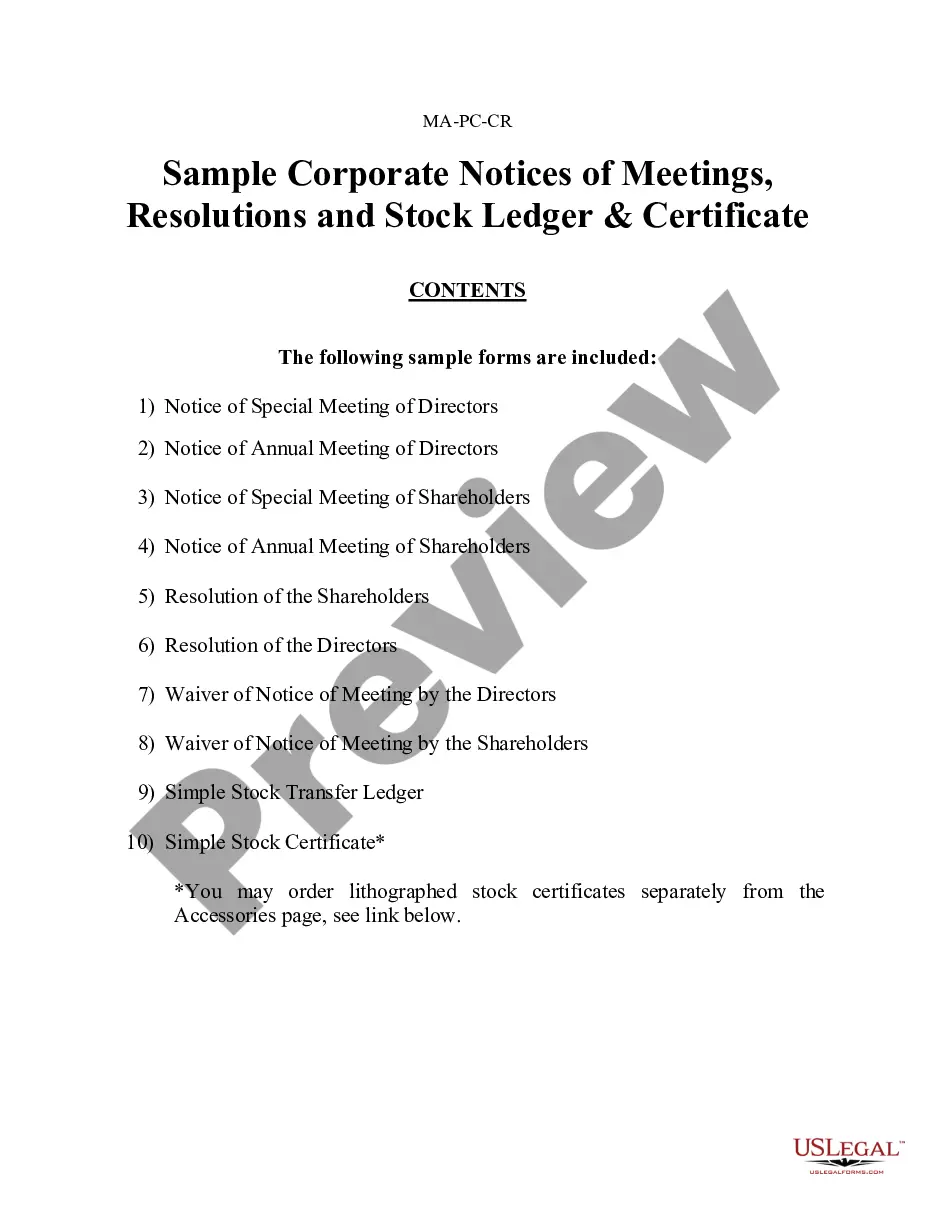

Description

How to fill out Consent To Revocation Of Trust By Beneficiary?

Are you currently in a situation where you need documents for either business or personal purposes on a daily basis.

There are numerous legal document templates available online, but finding reliable ones is not straightforward.

US Legal Forms offers thousands of form templates, such as the New Hampshire Consent to Revocation of Trust by Beneficiary, designed to comply with state and federal regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you need, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the New Hampshire Consent to Revocation of Trust by Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

- Use the Preview button to review the form.

- Check the description to ensure you have chosen the correct form.

- If the form isn’t what you are looking for, utilize the Search area to locate the form that suits your needs.

Form popularity

FAQ

To invalidate a trust in New Hampshire, you must demonstrate adequate grounds such as lack of capacity, undue influence, or improper execution. The New Hampshire Consent to Revocation of Trust by Beneficiary allows beneficiaries to formally revoke a trust, which is a crucial step in this process. Legal documentation is essential; you may find it helpful to use platforms like US Legal Forms to access templates that guide you through this method. Seeking professional legal advice can also clarify specific paths tailored for your situation.

Removing a beneficiary from an irrevocable trust is generally challenging and often requires the consent of all parties involved. The New Hampshire Consent to Revocation of Trust by Beneficiary can aid in formalizing changes but may still necessitate legal intervention. If you find yourself in this situation, it's vital to understand the trust's terms and seek legal guidance to explore your options. Proper handling of this issue ensures the trust meets its intended purpose.

The 5-year rule in an irrevocable trust refers to the waiting period that affects tax implications and Medicaid eligibility. If you transfer assets into an irrevocable trust and wish to qualify for Medicaid, you typically must wait five years before those assets are considered out of your ownership. Engaging with the provisions of the New Hampshire Consent to Revocation of Trust by Beneficiary can help clarify your options within this timeframe and ensure compliance with regulations.

Beneficiaries can withdraw from an irrevocable trust only under conditions stipulated in the trust agreement. Typically, they must wait until a specific event occurs, such as the trust's termination or changes outlined in the New Hampshire Consent to Revocation of Trust by Beneficiary. Additionally, some trusts may allow for distributions at certain times or milestones, while others restrict access until another triggering event happens. Always review the trust document for these details.

Revoking a trust can be complex, especially if it is an irrevocable trust. It usually requires the agreement of all beneficiaries, making the New Hampshire Consent to Revocation of Trust by Beneficiary an important document. While some trusts may have built-in flexibility for amendments or revocations, many require strict adherence to legal stipulations. Consulting with an attorney can help simplify this process and ensure compliance.

To revoke an irrevocable beneficiary, you generally need to obtain consent from all parties involved. This can be done through the New Hampshire Consent to Revocation of Trust by Beneficiary form. It’s essential to follow the legal procedures outlined in your trust document to avoid complications and ensure the revocation is valid. Consulting with a legal professional is advisable to navigate this process effectively.

A trust can be terminated in several ways, including by the completion of its purpose, mutual consent of all parties, or through a court order. A beneficial approach is understanding each method's implications, especially regarding the New Hampshire Consent to Revocation of Trust by Beneficiary. It is crucial that the termination is conducted per state laws to avoid potential disputes or unintended consequences. Resources from uslegalforms can provide necessary templates and guidance for fulfilling these legal requirements securely.

To remove yourself as a beneficiary from a trust, you typically need to submit a written notice of revocation to the trustee. This notice should explicitly state your desire to relinquish your beneficiary rights and comply with any state-specific guidelines, particularly in New Hampshire. Engaging in the New Hampshire Consent to Revocation of Trust by Beneficiary procedure interacts with this action, ensuring that the release is legally sound. Always consider consulting with a legal professional to ensure the process unfolds smoothly.

One significant mistake parents often make when setting up a trust fund is failing to communicate their intentions clearly with their beneficiaries. This oversight can lead to confusion and potential disputes down the line. When establishing a trust, it is worthwhile to ensure that all parties understand their roles and the terms behind the trust. Utilizing the New Hampshire Consent to Revocation of Trust by Beneficiary can also help address and clarify consent issues regarding modifications in the future.

An example of revocation is when a trust beneficiary formally decides to withdraw their consent to the trust terms. This process might involve submitting a signed document to the trustee that outlines their intent to revoke their beneficiary status. Understanding the steps involved in revocation is key to navigating the New Hampshire Consent to Revocation of Trust by Beneficiary efficiently. Utilizing legal forms can simplify this process and ensure compliance.