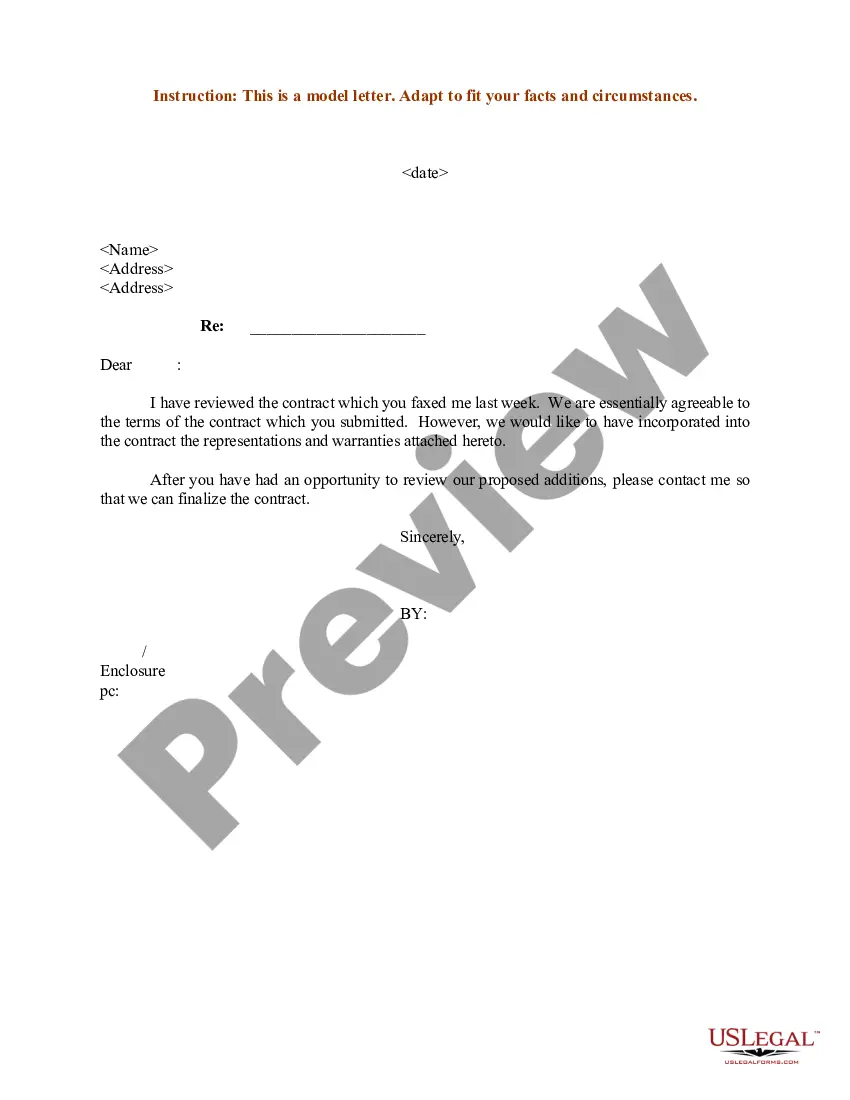

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account

Description

How to fill out Settlement Offer Letter From A Business Regarding A Disputed Account?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal templates that you can download or create.

Using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest types of forms, such as the New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account in just seconds.

If you already have a subscription, Log In and download the New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account from the US Legal Forms library. The Download button will appear on every template you view. You have access to all previously acquired forms from the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account. Each template you add to your account has no expiration date and is yours permanently. So, if you need to download or create another copy, simply go to the My documents section and click on the form you require. Access the New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- Make sure you have selected the correct form for your area/region.

- Click the Review button to examine the form's content.

- Check the form description to ensure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Download now button.

- Then, select the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

In your negotiation letter, begin by expressing your intention to resolve the debt amicably. Clearly state your proposed settlement amount and provide reasons for your offer, such as financial hardship or other circumstances. The use of a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account can help establish your seriousness and commitment to resolving the issue. Always maintain a polite tone and invite further discussion.

Begin the negotiation by explaining your current financial difficulties clearly and honestly. State your proposed settlement amount and why you believe it is fair, referencing any relevant financial documents. By using a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account, you can ensure that your communication is clear and professional. Always remain calm and open to discussion to find a mutually agreeable solution.

When considering a settlement offer, aim to propose between 30% to 50% of the total debt amount. This range often encourages creditors to see your offer as reasonable while still giving you room to negotiate. Remember, using a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account can strengthen your proposal by formalizing your terms. Additionally, be prepared to justify your offer with your financial situation.

Making a final settlement offer requires complete clarity about your terms and the rationale behind your decision. Begin by restating the context of the dispute and your preferred resolution, and underline that this is your best and final offer. If you’re sending a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account, convey sincerity and openness to resolution while being firm in your proposal.

Filing a small claim in New Hampshire involves gathering necessary documents, filling out a complaint form, and submitting it to the appropriate court. Ensure you adhere to the financial threshold for small claims. If you are dealing with a disputed account, consider drafting a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account as a preliminary step before litigation.

To write a settlement offer letter, start by summarizing the background of the dispute clearly and concisely. Detail your offer, outlining how much you are willing to settle for and why this offer is fair. Crafting a compelling New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account can significantly influence how the recipient perceives your commitment to resolving the issue.

Rule 9 in the New Hampshire Superior Court pertains to the requirements for pleading special matters. This includes how parties should handle affirmative defenses and claims, which can dramatically affect dispute resolutions. Familiarizing yourself with Rule 9 is vital when preparing a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account.

Writing a settlement letter involves clearly stating the disputed account details and your proposed resolution. Begin with a polite introduction, outline the issues, and specify the terms of your offer. If you are drafting a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account, ensure you provide necessary documentation that supports your claim.

Rule 7 in the New Hampshire Superior Court addresses the requirements for motions in civil cases. This rule clarifies how to file and respond to motions, ensuring a fair process in managing disputes. Understanding this rule is essential if you want to effectively manage issues related to a New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account.

A claim settlement letter outlines the terms and conditions under which a disagreement will be resolved. For instance, if you are addressing a disputed account, the New Hampshire Settlement Offer Letter from a Business Regarding a Disputed Account would specify how much you are offering to settle the claim. It should clearly state the reason for the settlement and the benefits of accepting the offer.