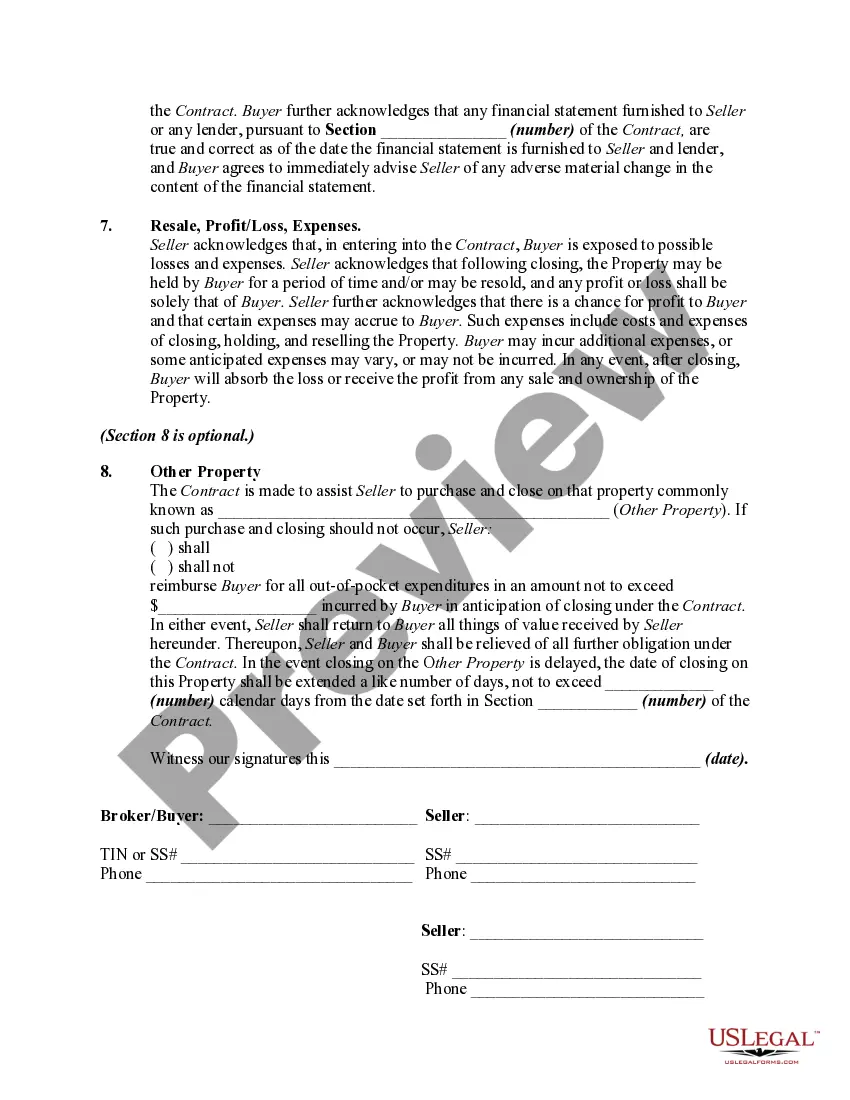

Some state real estate commissions require the use of a buyout addendum when a real estate broker enters into a contract to purchase a property: i) concurrent with the listing of such property; ii) as an inducement or to facilitate the property owner's purchase of another property; or iii) continues to market that property on behalf of the owner under an existing listing contract.

It is generally recommended that a real estate broker use such an addendum when he/she continues to market the property and is only agreeing to buy it to make the deal. If a licensee actually wants to own the property, using the addendum does not solve the conflict of interest.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Real Estate Broker Buyout and Price Addendum to Contract to Buy and Sell Real Estate: In the state of New Hampshire, a Real Estate Broker Buyout and Price Addendum to Contract to Buy and Sell Real Estate is an important document that can be utilized in property transactions. This addendum acts as an agreement between the parties involved, typically the buyer, seller, and real estate broker, to outline specific terms and conditions related to the purchase price and any broker involvement. This addendum is designed to clarify the role of the real estate broker in the transaction and address any potential concerns regarding their commission or involvement in the purchase. It ensures transparency and prevents misunderstandings by clearly outlining the agreed-upon terms regarding the broker's compensation and potential buyout options. The New Hampshire Real Estate Broker Buyout and Price Addendum may have different variations, depending on the specific circumstances or negotiations involved. Some notable types of addendums include: 1. Standard Broker Buyout Addendum: This addendum typically includes provisions regarding the broker's right to purchase the property in the event the initial purchase agreement falls through. It outlines the agreed-upon price, terms, and conditions for the broker's buyout, ensuring a smooth transition in case the buyer backs out. 2. Commission Adjustment Addendum: This type of addendum is focused on adjusting the commission payable to the broker based on changes in the final purchase price. It addresses scenarios where the purchase price fluctuates due to negotiations, property appraisal, or other factors, ensuring that the broker's commission aligns with the adjusted value. 3. Dual Agency Addendum: In situations where the real estate broker represents both the buyer and the seller, a dual agency addendum may be necessary. This addendum clarifies the broker's fiduciary duties and obligations to each party, ensuring fair representation and disclosure throughout the transaction. 4. Broker Release Addendum: This addendum aims to address scenarios where the buyer or seller wishes to terminate the brokerage relationship before completing the transaction. It outlines the conditions and terms for releasing the broker from their obligations without any further liabilities or obligations. It is crucial for all parties involved in a New Hampshire real estate transaction to carefully review, understand, and negotiate the terms of the Real Estate Broker Buyout and Price Addendum. Consulting with a qualified real estate attorney or broker can provide valuable insights and guidance in drafting or reviewing this essential document to ensure a smooth and legally binding property transaction.New Hampshire Real Estate Broker Buyout and Price Addendum to Contract to Buy and Sell Real Estate: In the state of New Hampshire, a Real Estate Broker Buyout and Price Addendum to Contract to Buy and Sell Real Estate is an important document that can be utilized in property transactions. This addendum acts as an agreement between the parties involved, typically the buyer, seller, and real estate broker, to outline specific terms and conditions related to the purchase price and any broker involvement. This addendum is designed to clarify the role of the real estate broker in the transaction and address any potential concerns regarding their commission or involvement in the purchase. It ensures transparency and prevents misunderstandings by clearly outlining the agreed-upon terms regarding the broker's compensation and potential buyout options. The New Hampshire Real Estate Broker Buyout and Price Addendum may have different variations, depending on the specific circumstances or negotiations involved. Some notable types of addendums include: 1. Standard Broker Buyout Addendum: This addendum typically includes provisions regarding the broker's right to purchase the property in the event the initial purchase agreement falls through. It outlines the agreed-upon price, terms, and conditions for the broker's buyout, ensuring a smooth transition in case the buyer backs out. 2. Commission Adjustment Addendum: This type of addendum is focused on adjusting the commission payable to the broker based on changes in the final purchase price. It addresses scenarios where the purchase price fluctuates due to negotiations, property appraisal, or other factors, ensuring that the broker's commission aligns with the adjusted value. 3. Dual Agency Addendum: In situations where the real estate broker represents both the buyer and the seller, a dual agency addendum may be necessary. This addendum clarifies the broker's fiduciary duties and obligations to each party, ensuring fair representation and disclosure throughout the transaction. 4. Broker Release Addendum: This addendum aims to address scenarios where the buyer or seller wishes to terminate the brokerage relationship before completing the transaction. It outlines the conditions and terms for releasing the broker from their obligations without any further liabilities or obligations. It is crucial for all parties involved in a New Hampshire real estate transaction to carefully review, understand, and negotiate the terms of the Real Estate Broker Buyout and Price Addendum. Consulting with a qualified real estate attorney or broker can provide valuable insights and guidance in drafting or reviewing this essential document to ensure a smooth and legally binding property transaction.