If a person acting, or purporting to act, as a representative signs an instrument by signing either the name of the represented person or the name of the signer, the represented person is bound by the signature to the same extent the represented person would be bound if the signature were on a simple contract. If the represented person is bound, the signature of the representative is the authorized signature of the represented person, and the represented person is liable on the instrument, whether or not identified in the instrument.

New Hampshire Signature Authorization - Card Authorizing Attorney to Sign Signature of Depositor

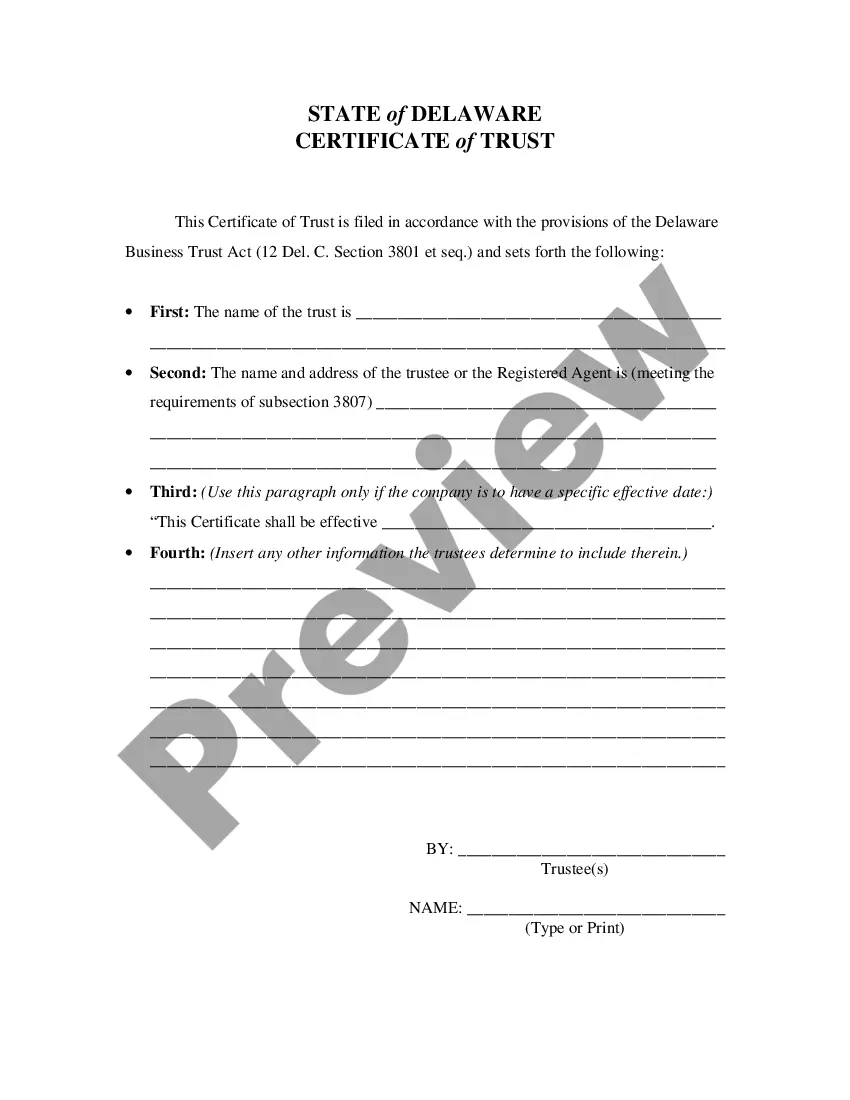

Description

How to fill out Signature Authorization - Card Authorizing Attorney To Sign Signature Of Depositor?

US Legal Forms - one of the most notable collections of legal documents in the country - offers an extensive array of legal form templates that you can download or generate.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the New Hampshire Signature Authorization - Card Authorizing Attorney to Sign Signature of Depositor in just seconds.

If you already have a membership, Log In and download the New Hampshire Signature Authorization - Card Authorizing Attorney to Sign Signature of Depositor from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously saved forms in the My documents tab of your account.

Select the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the saved New Hampshire Signature Authorization - Card Authorizing Attorney to Sign Signature of Depositor. Each template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Hampshire Signature Authorization - Card Authorizing Attorney to Sign Signature of Depositor with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your city/state. Click the Preview option to review the content of the form.

- Examine the form details to ensure you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select your preferred payment method and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finish the transaction.

Form popularity

FAQ

Conflicts of Interest. (2) there is a significant risk that the representation of one or more clients will be materially limited by the lawyer's responsibilities to another client , a former client or a third person or by a personal interest of the lawyer.

Safekeeping Property. (a) A lawyer shall hold property of clients or third persons that is in a lawyer's possession in connection with a representation separate from the lawyer's own property, in ance with the provisions of the New Hampshire Supreme Court Rules.

Confidentiality of Information. (a) A lawyer shall not reveal information relating to the representation of a client unless the client gives informed consent, the disclosure is impliedly authorized in order to carry out the representation, or the disclosure is permitted by paragraph (b).

Depositions. (a) A party may take as many depositions as necessary to adequately prepare a case for trial so long as the combined total of deposition hours does not exceed 20 unless otherwise stipulated by counsel or ordered by the court for good cause shown.

Parties to a matter may communicate directly with each other, and a lawyer is not prohibited from advising a client concerning a communication that the client is legally entitled to make.

When a lawyer has been directly involved in a specific transaction, subsequent representation of other clients with materially adverse interests in that transaction clearly is prohibited.