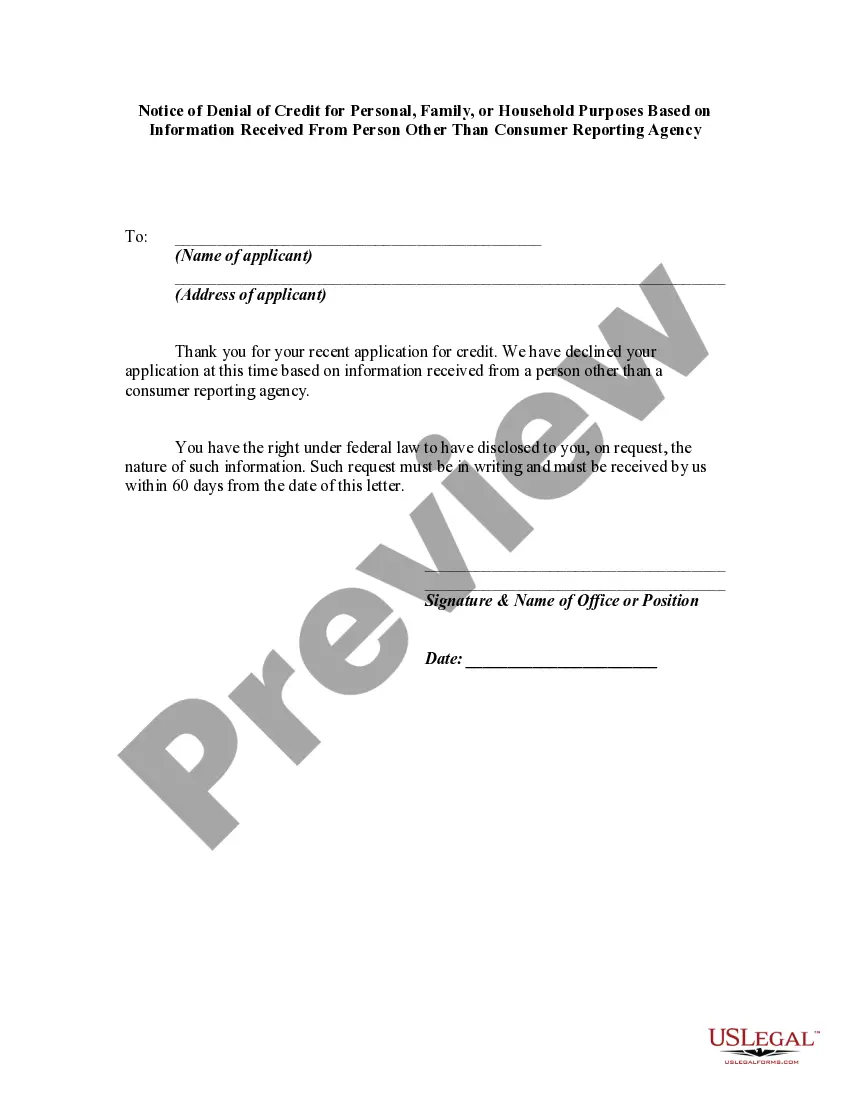

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

New Hampshire Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a legal document that informs an individual about the denial of credit for personal, family, or household purposes. This denial is based on information received from a person or entity other than a consumer reporting agency. It is essential to understand the details and different types of this notice to protect one's rights and take appropriate action. The New Hampshire Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency serves as a crucial notification, explaining the reasons behind the denial and the source of the information used during the credit evaluation process. This notice aims to provide transparency to the consumer and ensure they are informed of the factors that influenced the decision. When dealing with this type of notice, it is important to be aware of the different variations that may exist. These could include, but are not limited to: 1. Standard Notice of Denial: This is the most common type of notice received by consumers when their application for credit has been denied. It typically highlights the reasons for denial and specifies the information that led to this decision. 2. Adverse Action Notice: This is a broader term that encompasses various types of adverse actions taken by creditors. While denial of credit is one form of adverse action, others can include increasing interest rates, reducing credit limits, or altering the terms and conditions of existing credit agreements. 3. Specific Source Notice: In certain cases, the notice may specifically mention the person or entity from whom the information was obtained. This type of notice provides additional information to the consumer, enabling them to understand who provided the negative information and potentially rectify any inaccuracies. 4. Time-sensitive Notice: This notice may have a specific timeframe within which the consumer must initiate a dispute or request additional information. It is important to be aware of any time limitations to ensure one can exercise their rights promptly and take appropriate action if necessary. Overall, the New Hampshire Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency is a vital document that protects consumers' rights and ensures transparency in the credit evaluation process. It is crucial for individuals to be knowledgeable about the different types of notice and understand how to respond effectively to protect their financial interests.