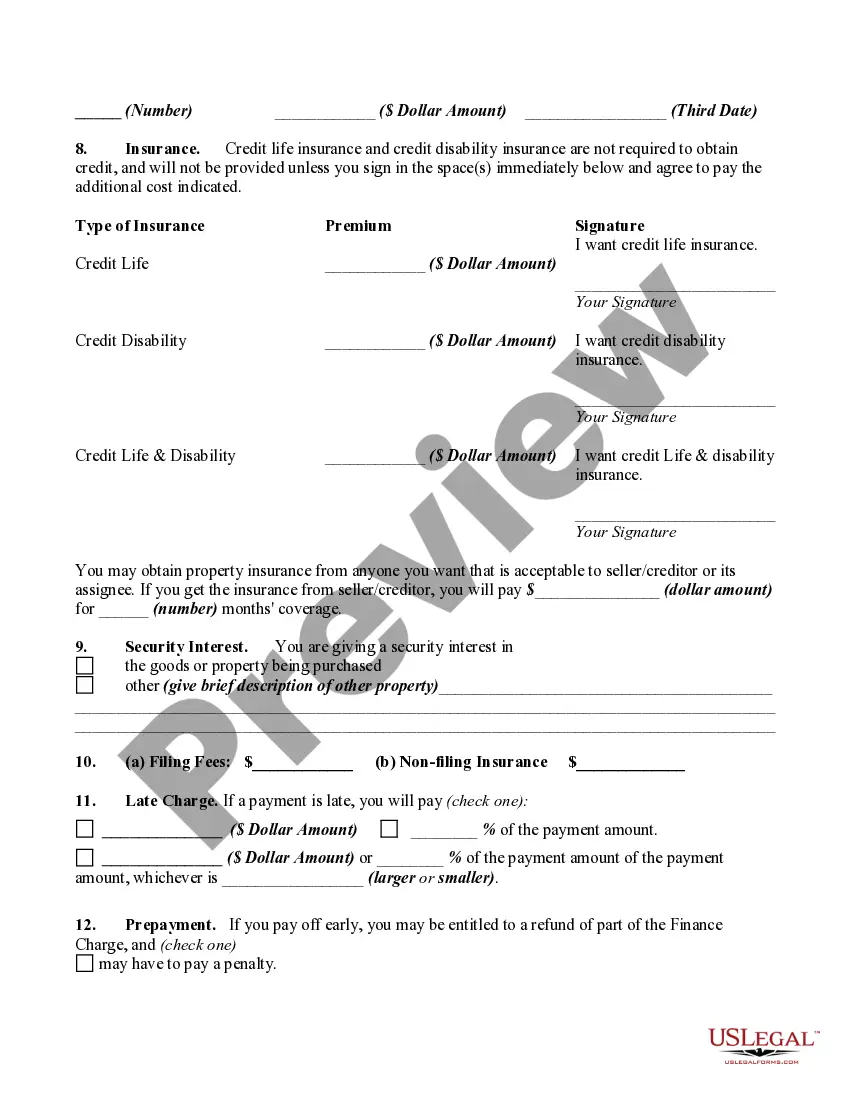

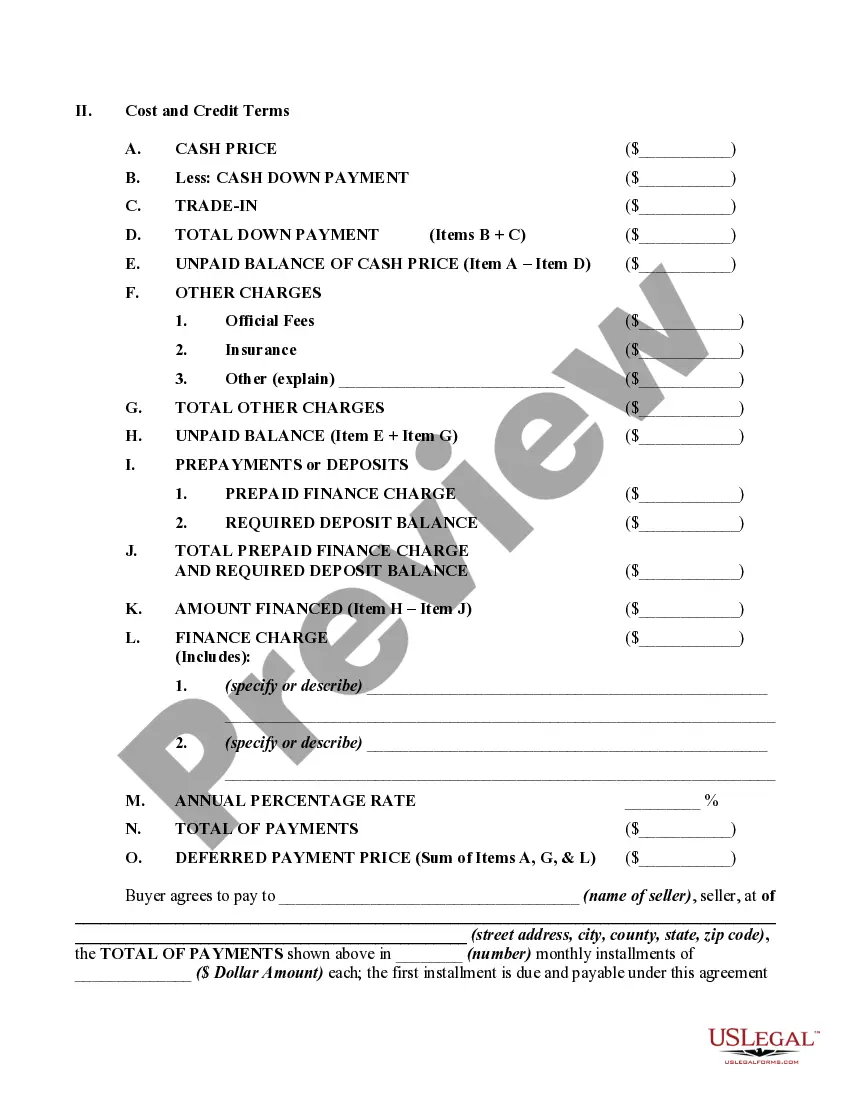

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and must be worded as shown if the form.

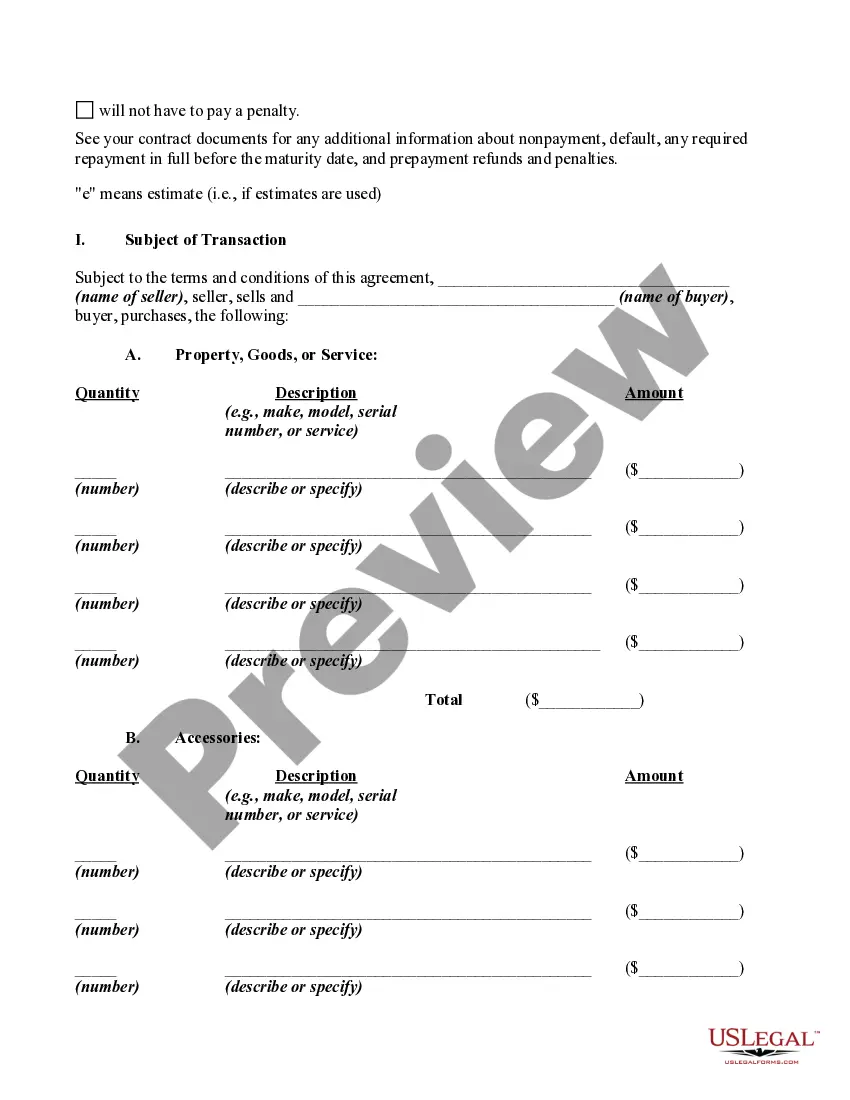

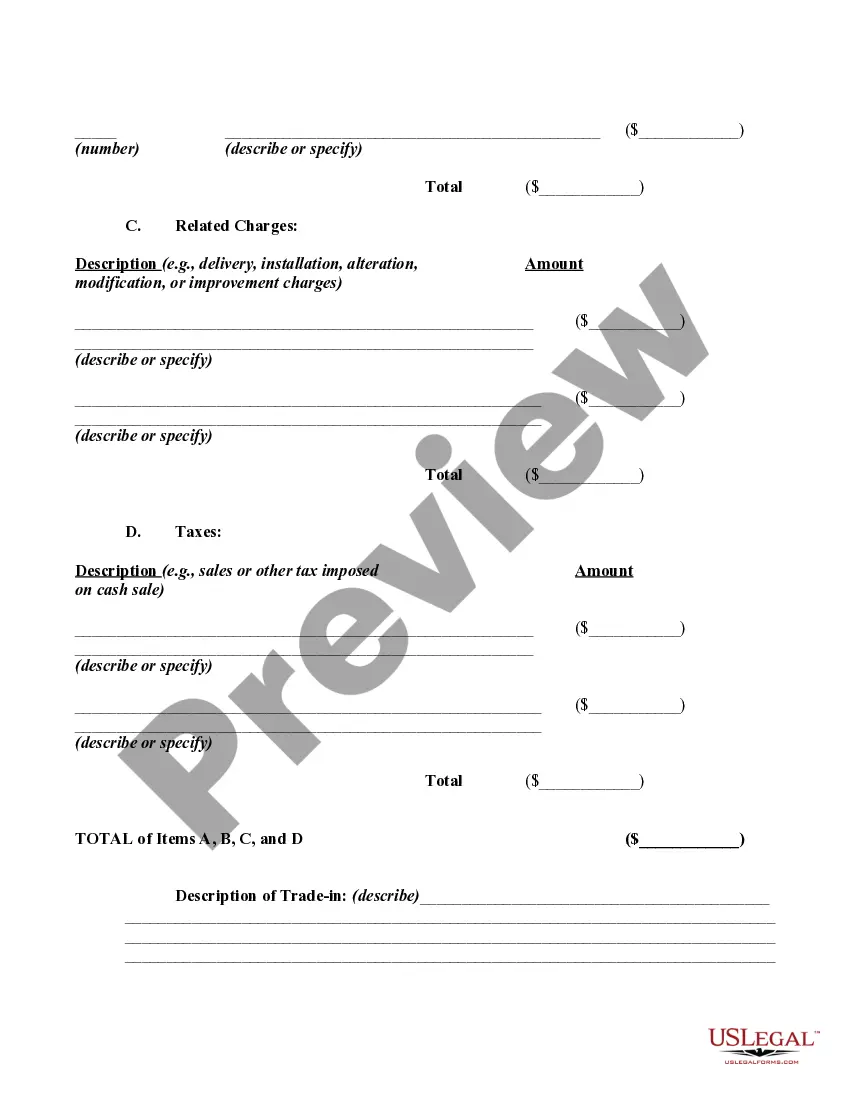

Title: Understanding the New Hampshire Retail Installment Contract and Security Agreement Introduction: The New Hampshire Retail Installment Contract and Security Agreement is an essential legal document that governs the sale of goods or services in New Hampshire and the financing arrangements associated with such transactions. This agreement outlines the terms and conditions for both the seller and the buyer, protecting the interests of both parties involved. This article will provide a detailed description of the New Hampshire Retail Installment Contract and Security Agreement, highlighting its key elements and potential variations. Key Elements: 1. Financing Arrangements: The agreement sets forth the terms of the financing plan, including the total amount financed, the number and frequency of payments, the interest rate, any late fees or penalties, and the total amount to be repaid. 2. Description of Goods or Services: It includes a comprehensive description of the goods or services being sold, such as automobiles, furniture, electronics, or home appliances, ensuring clarity regarding the specific items covered under the agreement. 3. Security Interest: The agreement establishes a security interest in the purchased goods, which serves as collateral to secure the buyer's payment obligations. This allows the seller to repossess the goods in the event of default. 4. Buyer's Representations and Warranties: The buyer is required to provide accurate information regarding their financial situation to the seller. This may include disclosing their income, employment status, and other relevant details to assess creditworthiness. 5. Delivery and Acceptance: The agreement specifies the terms surrounding the delivery and acceptance of goods or completion of services. It clearly outlines the conditions under which the buyer will take possession and become responsible for the items. Different Types of New Hampshire Retail Installment Contract and Security Agreement: 1. Automobile Purchase Agreement: This type of agreement specifically applies to the purchase of vehicles. It encompasses the unique aspects of vehicle financing, including motor vehicle registration, insurance requirements, and warranties offered. 2. Home Appliance Retail Installment Contract: This agreement focuses on the sale and financing of home appliances like refrigerators, washers, dryers, etc. It accommodates specific considerations related to installation, usage, and warranties associated with household appliances. 3. Furniture or Electronics Retail Installment Contract: This agreement caters to the financing of furniture or electronic goods, delineating the terms and conditions specific to these products. 4. Services Retail Installment Contract: This type applies to contracts involving service-based purchases, such as home repairs, renovations, or any other contracted services. It outlines the financing terms for services rendered, ensuring the buyer's obligations for timely payment. Conclusion: The New Hampshire Retail Installment Contract and Security Agreement is crucial in protecting the rights and obligations of both sellers and buyers in the state. Whether for automotive, home appliances, furniture, electronics, or services, these agreements ensure transparency and legal compliance during the purchase and financing process. Understanding these agreements is crucial for consumers to make informed decisions and protect their interests within the retail marketplace.Title: Understanding the New Hampshire Retail Installment Contract and Security Agreement Introduction: The New Hampshire Retail Installment Contract and Security Agreement is an essential legal document that governs the sale of goods or services in New Hampshire and the financing arrangements associated with such transactions. This agreement outlines the terms and conditions for both the seller and the buyer, protecting the interests of both parties involved. This article will provide a detailed description of the New Hampshire Retail Installment Contract and Security Agreement, highlighting its key elements and potential variations. Key Elements: 1. Financing Arrangements: The agreement sets forth the terms of the financing plan, including the total amount financed, the number and frequency of payments, the interest rate, any late fees or penalties, and the total amount to be repaid. 2. Description of Goods or Services: It includes a comprehensive description of the goods or services being sold, such as automobiles, furniture, electronics, or home appliances, ensuring clarity regarding the specific items covered under the agreement. 3. Security Interest: The agreement establishes a security interest in the purchased goods, which serves as collateral to secure the buyer's payment obligations. This allows the seller to repossess the goods in the event of default. 4. Buyer's Representations and Warranties: The buyer is required to provide accurate information regarding their financial situation to the seller. This may include disclosing their income, employment status, and other relevant details to assess creditworthiness. 5. Delivery and Acceptance: The agreement specifies the terms surrounding the delivery and acceptance of goods or completion of services. It clearly outlines the conditions under which the buyer will take possession and become responsible for the items. Different Types of New Hampshire Retail Installment Contract and Security Agreement: 1. Automobile Purchase Agreement: This type of agreement specifically applies to the purchase of vehicles. It encompasses the unique aspects of vehicle financing, including motor vehicle registration, insurance requirements, and warranties offered. 2. Home Appliance Retail Installment Contract: This agreement focuses on the sale and financing of home appliances like refrigerators, washers, dryers, etc. It accommodates specific considerations related to installation, usage, and warranties associated with household appliances. 3. Furniture or Electronics Retail Installment Contract: This agreement caters to the financing of furniture or electronic goods, delineating the terms and conditions specific to these products. 4. Services Retail Installment Contract: This type applies to contracts involving service-based purchases, such as home repairs, renovations, or any other contracted services. It outlines the financing terms for services rendered, ensuring the buyer's obligations for timely payment. Conclusion: The New Hampshire Retail Installment Contract and Security Agreement is crucial in protecting the rights and obligations of both sellers and buyers in the state. Whether for automotive, home appliances, furniture, electronics, or services, these agreements ensure transparency and legal compliance during the purchase and financing process. Understanding these agreements is crucial for consumers to make informed decisions and protect their interests within the retail marketplace.