In the sale of a business through a stock transfer, care should be taken to determine the actual ownership of the stock to be sold. Everyone having an interest in it should be made a party to the agreement. A buyer acquiring a business through a stock acquisition takes the business subject to both the known and unknown liabilities of the seller. Accordingly, the buyer should seek protection through the inclusion of detailed seller's warranties as to the corporation's financial condition.

New Hampshire Right of First Refusal to Purchase All Shares of Corporation from Sole Shareholder

Description

How to fill out Right Of First Refusal To Purchase All Shares Of Corporation From Sole Shareholder?

Have you found yourself in a circumstance where you require documentation for either professional or personal motives nearly all the time.

There is an assortment of legal document templates accessible online, but locating versions you can rely on can be challenging.

US Legal Forms offers thousands of templates, such as the New Hampshire Right of First Refusal to Purchase All Shares of Corporation from Sole Shareholder, which are designed to meet federal and state regulations.

Once you find the appropriate document, simply click Acquire now.

Choose the pricing plan you desire, enter the required information for payment, and complete the transaction using your PayPal or credit card. Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Hampshire Right of First Refusal to Purchase All Shares of Corporation from Sole Shareholder template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for the correct city/area.

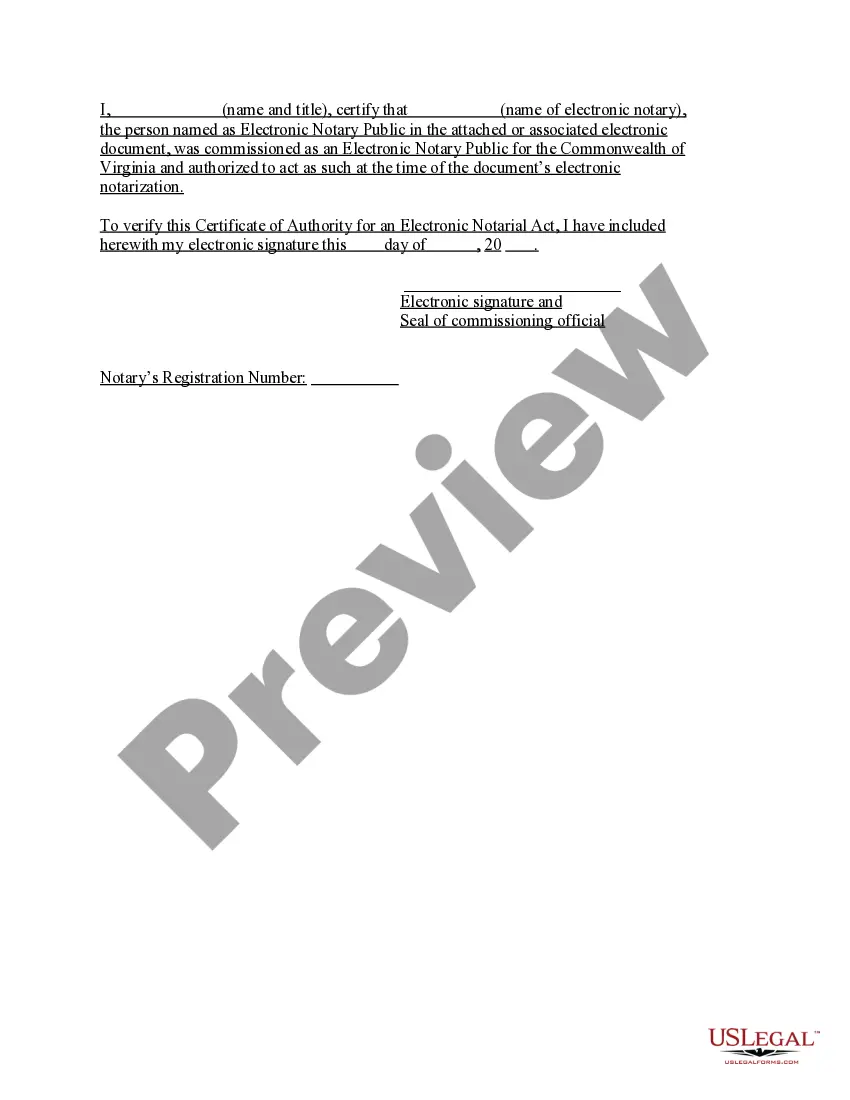

- Utilize the Review function to examine the document.

- Check the description to confirm that you have chosen the right document.

- If the document is not what you’re searching for, use the Search field to find the template that suits your needs.

Form popularity

FAQ

In most circumstances, the shareholders' agreement should take priority, because the agreement is specifically designed to control the shareholders' relationship. Once a conflict is disclosed between the bylaws and shareholders' agreement, the bylaws should be amended to remove the conflict.

Classes of shares If there is only one class of shares, those shares must, as a minimum, have: the right to vote. the right to receive dividends (if the board of directors has declared any) the right to receive the remaining property of the corporation after it is dissolved.

Shareholders without the control of a business can typically be removed by the controlling shareholders for any violation of the company's bylaws or the shareholders' agreement.

Stockholders are entitled to dividends pro rata based on the total number of shares that they own. Accordingly, stockholders are entitled to proprietary rights such as right to receive dividend, right of appraisal, right to inspect corporate books, and right to vote.

When some of the shareholders wish to sell their share, a clause in the shareholder's agreement should state that the shareholders who wish to sell their shares have to show the right to match an offer received from a third party. This is known as the right of first refusal.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, dividends, the right to inspect corporate documents, and the right to sue for wrongful acts.

The basic rights of each stockholder (unless otherwise restricted) are to share proportionately: (1) in profits, (2) in management (the right to vote for directors), (3) in corporate assets upon liquidation, and (4) in any new issues of stock of the same class (preemptive right). 2.

Shareholders who do not have control of the business can usually be fired by the controlling owners. The same process is followed even if the shareholder is on the board of directors. A vote may be required to remove someone from the board of directors.

The basic rights of shareholders is an important thing to consider when forming a new business.Voting Rights.Voting Rights.Right to Appoint a Proxy.Other Shareholder Rights.Justification.

Removal may be as simple as the member submitting a letter of resignation, depending on the relevant provisions. However, if the member is not willing to voluntarily resign, the provisions might provide, for example, a voting procedure allowing the other members to vote for the removal of the recalcitrant member.