A deed in lieu of foreclosure is a method sometimes used by a lienholder on property to avoid a lengthy and expensive foreclosure process, with a deed in lieu of foreclosure a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor basically deeds the property to the bank instead of them paying for foreclosure proceedings. Therefore, if a debtor fails to make mortgage payments and the bank is about to foreclose on the property, the deed in lieu of foreclosure is an option that chooses to give the bank ownership of the property rather than having the bank use the legal process of foreclosure.

New Hampshire Offer by Borrower of Deed in Lieu of Foreclosure

Description

How to fill out Offer By Borrower Of Deed In Lieu Of Foreclosure?

If you have to full, down load, or produce legal file templates, use US Legal Forms, the greatest assortment of legal varieties, that can be found online. Utilize the site`s simple and easy handy lookup to discover the paperwork you will need. A variety of templates for company and personal purposes are categorized by categories and claims, or keywords. Use US Legal Forms to discover the New Hampshire Offer by Borrower of Deed in Lieu of Foreclosure with a few clicks.

Should you be previously a US Legal Forms consumer, log in to the bank account and click the Obtain key to find the New Hampshire Offer by Borrower of Deed in Lieu of Foreclosure. You may also access varieties you in the past delivered electronically inside the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for that appropriate town/region.

- Step 2. Use the Review solution to look through the form`s information. Never overlook to read through the outline.

- Step 3. Should you be unsatisfied together with the kind, utilize the Look for field at the top of the screen to find other variations of your legal kind template.

- Step 4. When you have located the form you will need, click on the Get now key. Choose the prices prepare you prefer and include your credentials to sign up for an bank account.

- Step 5. Approach the deal. You should use your charge card or PayPal bank account to complete the deal.

- Step 6. Select the formatting of your legal kind and down load it on your system.

- Step 7. Full, modify and produce or indication the New Hampshire Offer by Borrower of Deed in Lieu of Foreclosure.

Each legal file template you buy is yours permanently. You have acces to every kind you delivered electronically within your acccount. Go through the My Forms section and pick a kind to produce or down load once again.

Be competitive and down load, and produce the New Hampshire Offer by Borrower of Deed in Lieu of Foreclosure with US Legal Forms. There are thousands of specialist and condition-specific varieties you can use to your company or personal requires.

Form popularity

FAQ

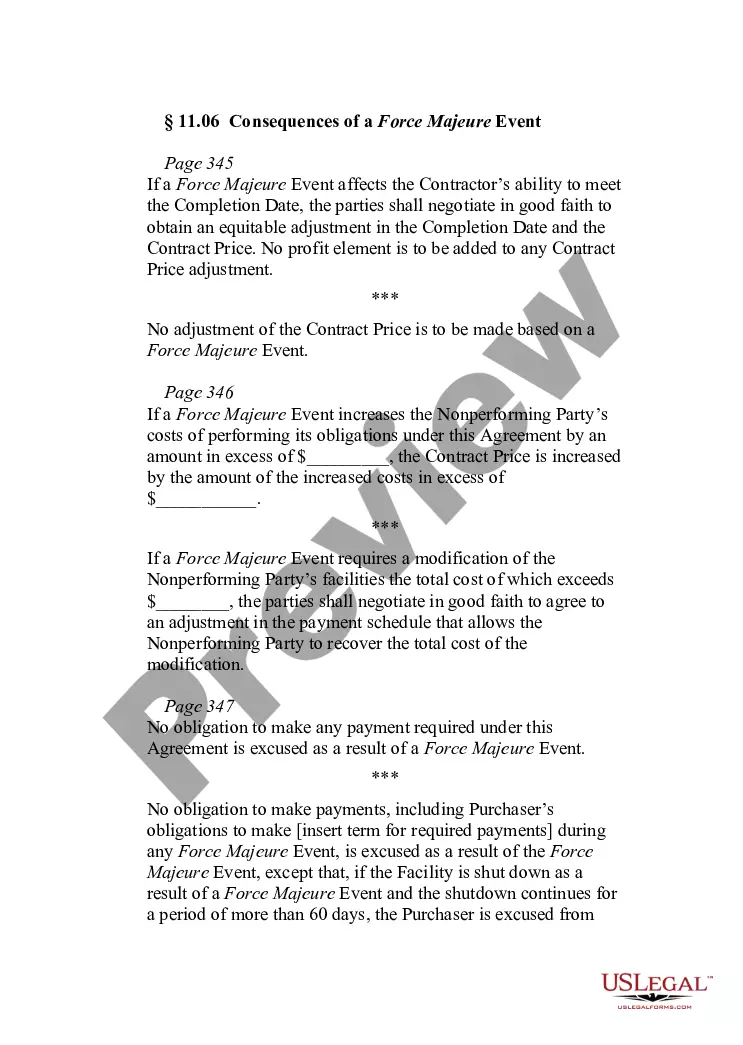

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

Loss in Ownership, Title, and Equity: The most obvious drawback of a deed in lieu is the loss of ownership, title, and equity in the property. A borrower will also lose any improvements that were done on the property, rental income, and other profits related to the property.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy. As noted above, the burden of selling your home shifts to someone else, so it may be more appealing than a short sale.

Advantages to a borrower in offering a lieu deed include, first, the release of the borrower and all other persons who may owe payment or the performance of other obligations secured by the mortgage. However, such persons remain liable if they agree to do so contemporaneously with the lieu deed transaction.

Advantages of a Deed in Lieu of Foreclosure Another advantage to you is the ability to avoid the expense, publicity, and time involved in the necessary legal proceedings to enforce your mortgage loan and related obligations. The lender may agree to pay a portion, or even all, of the expenses related to the transfer.

By accepting a deed in lieu of foreclosure, lenders may take possession of the property sooner and keep it in better condition. The lender may be more likely to approve a request for a deed in lieu on a home in good condition so they can sell the property quickly and at a fair market rate.