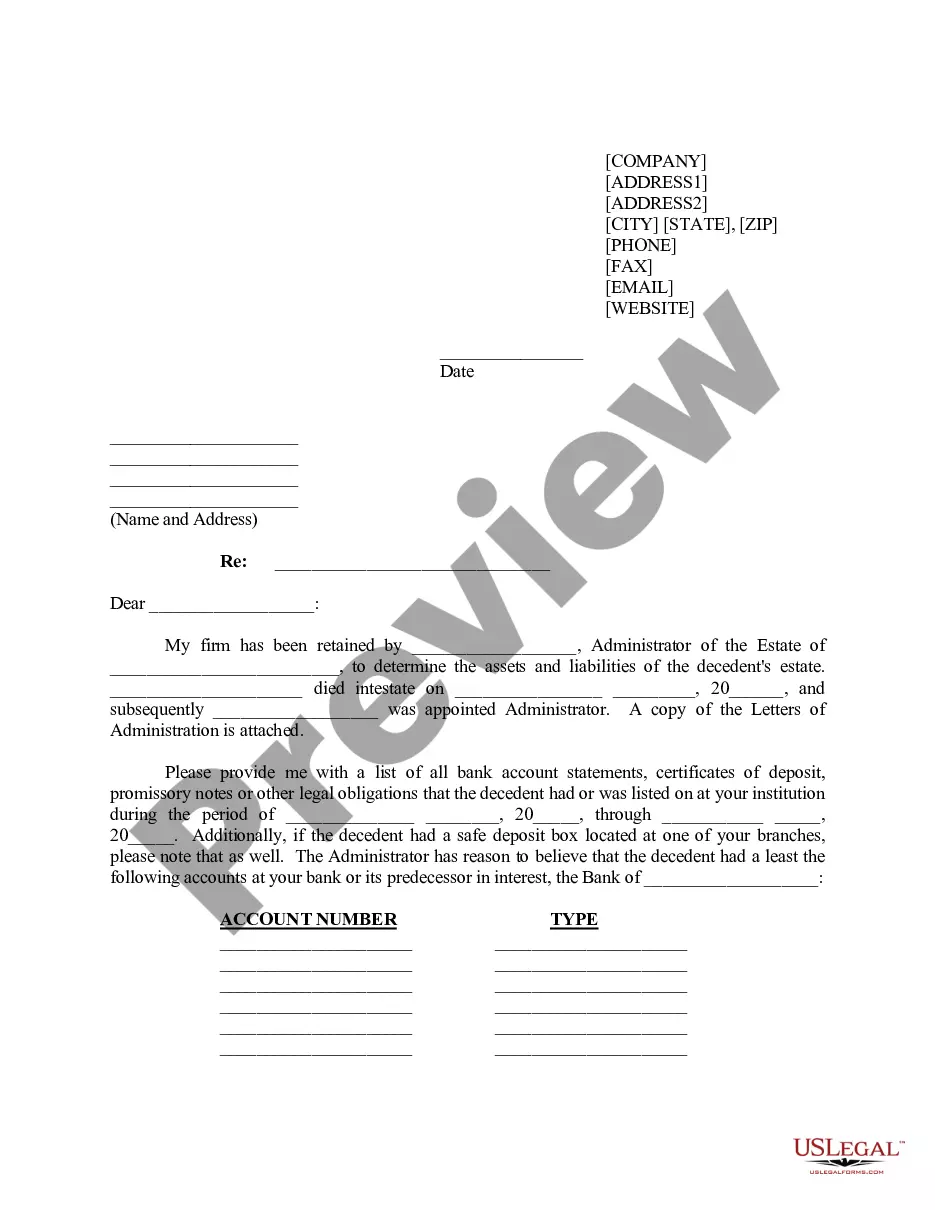

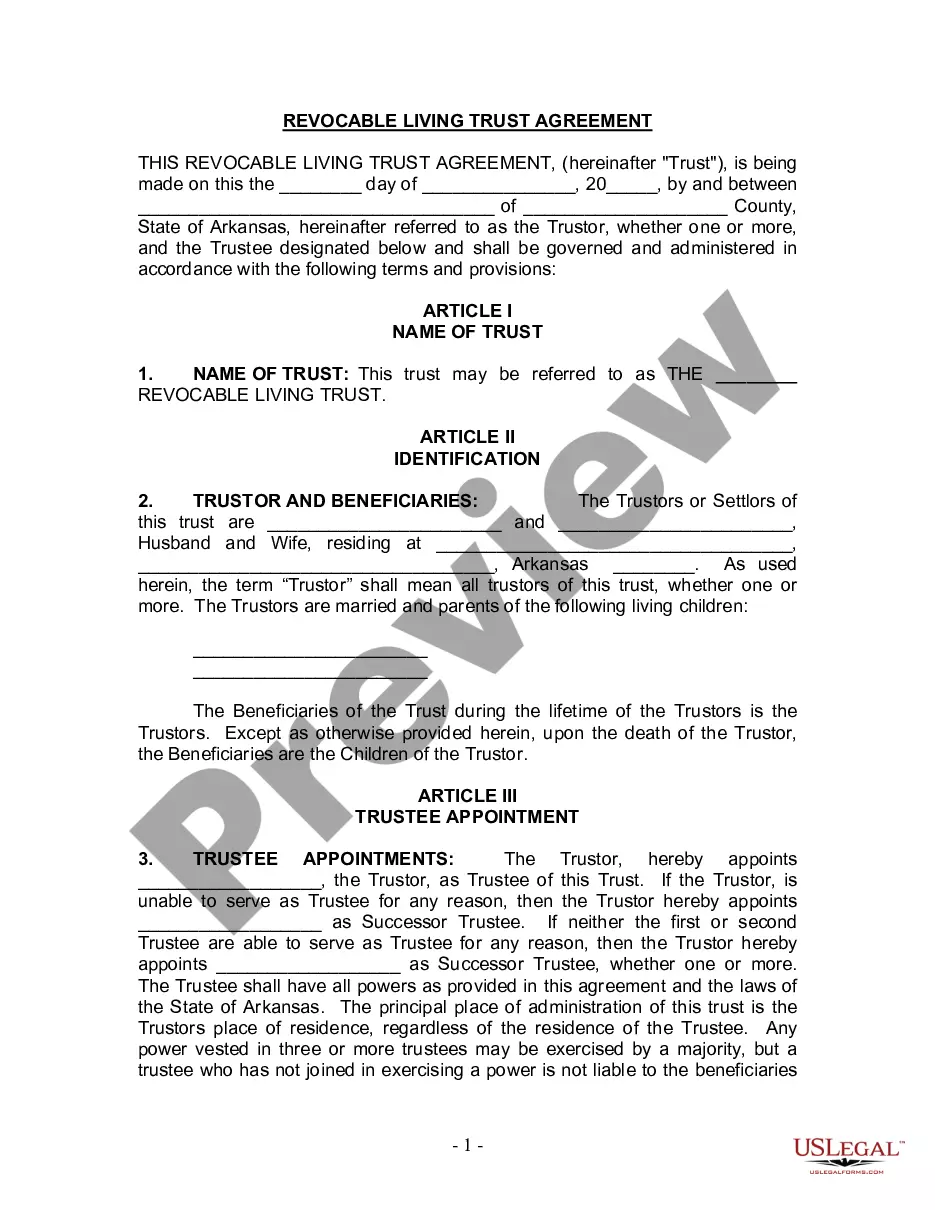

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

Locating the appropriate legal document template can be a challenge.

It goes without saying that there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service provides a vast array of templates, such as the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, which can be used for both business and personal purposes.

You can view the form using the Preview button and read the form description to confirm it is the right one for your needs.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click on the Obtain button to access the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

- Use your account to view the legal documents you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should take.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

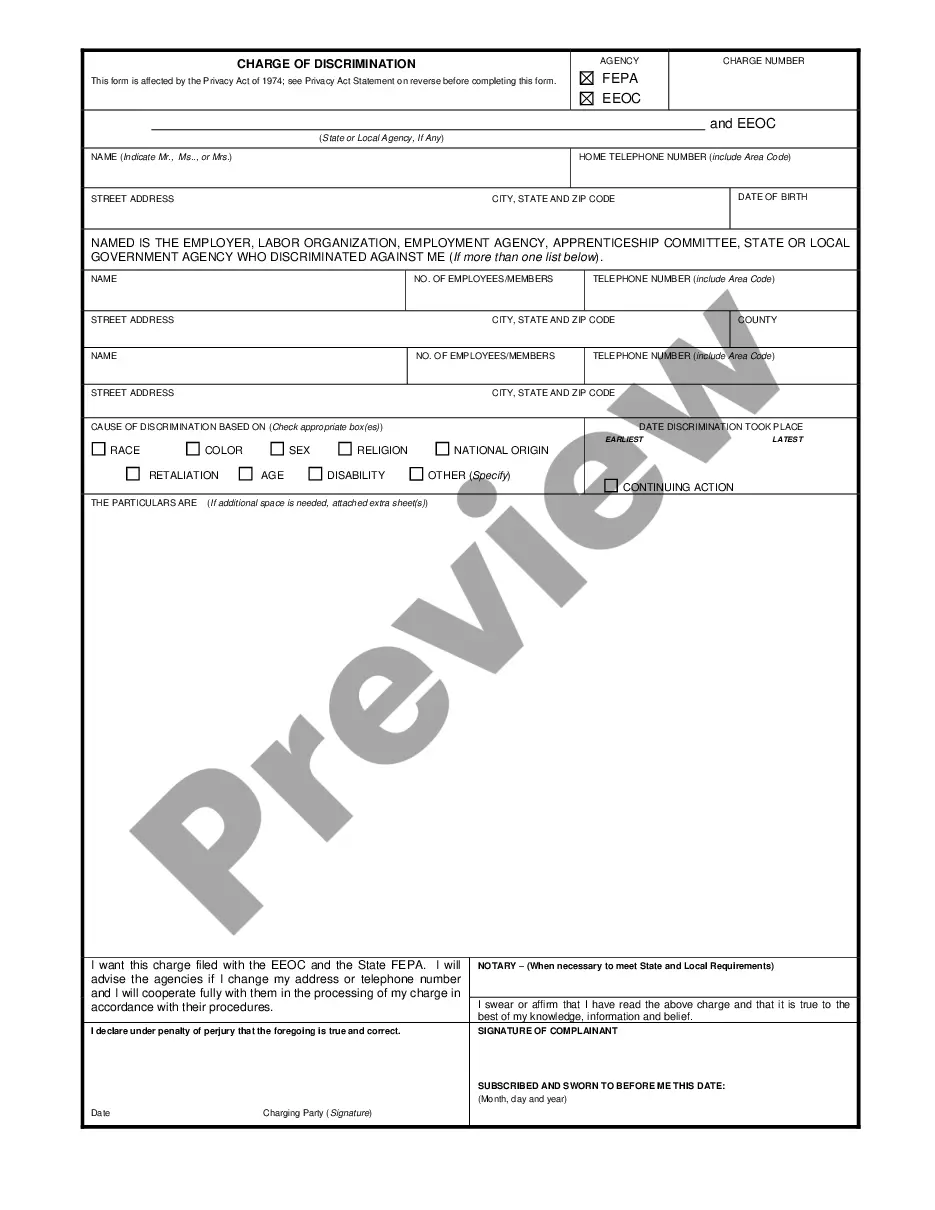

The final letter to beneficiaries from the executor summarizes the estate settlement process and details distributions made to each beneficiary. This communication reassures beneficiaries that the executor has fulfilled their obligations efficiently. Including information about the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can also clarify how assets were managed throughout the process.

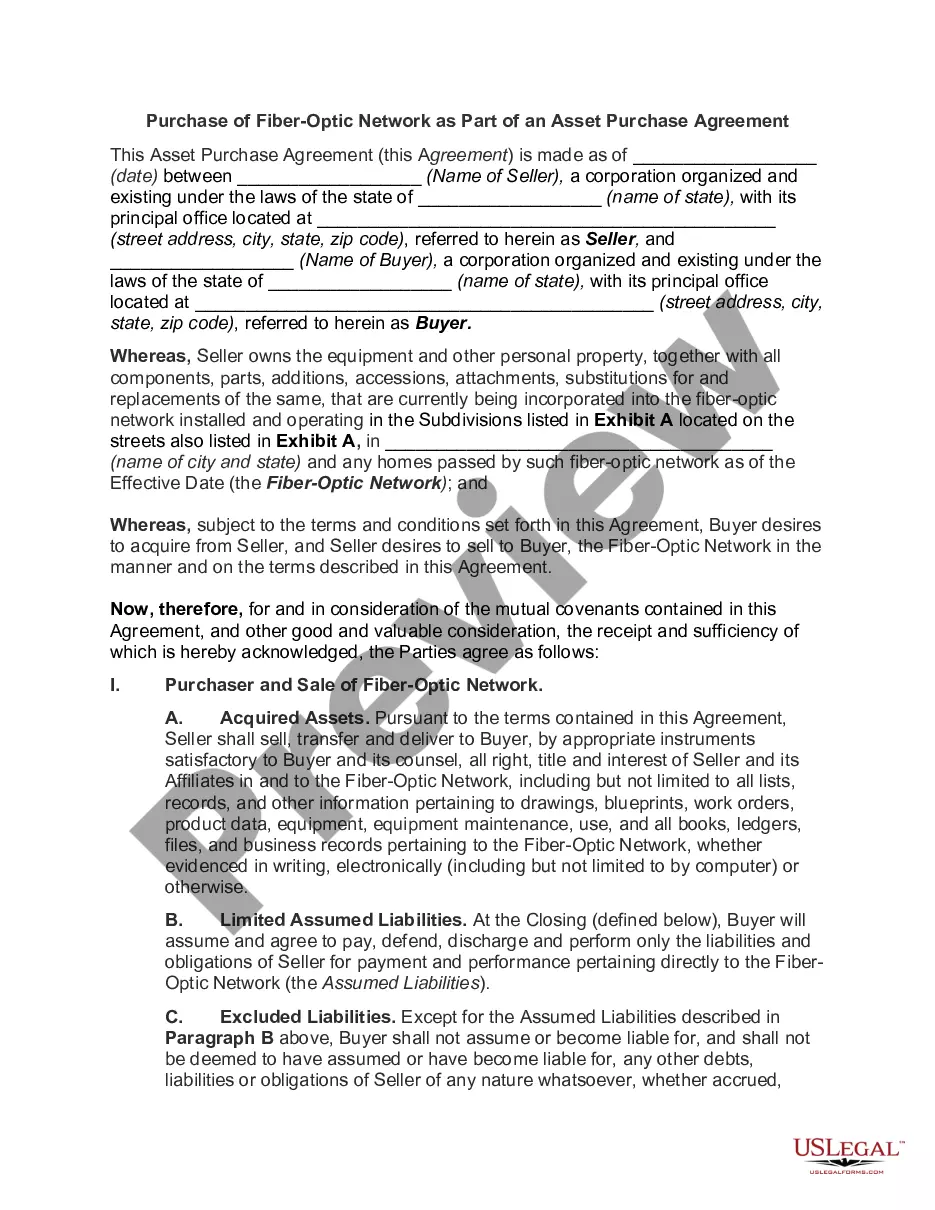

The executor statement of account is a detailed report that outlines all financial transactions made during the administration of an estate. This document provides transparency and accountability, as it lists assets acquired, liabilities settled, and distributions made to beneficiaries. Understanding this statement is crucial, especially in cases involving the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

When writing a letter to an executor, start by clearly stating your identity and relationship to the deceased. Detail your wishes regarding asset distribution and address any specific responsibilities. For instances involving a New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, make sure to provide relevant account details and instructions.

A letter to the executor of an estate serves as formal communication, laying out instructions and pertinent information for the executor. This letter often outlines your intentions regarding asset distribution and management. In the context of the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, it may specify how to handle financial accounts.

A letter of wishes to the executor provides personal guidance on how you would like your estate to be managed and distributed. Although not legally binding, it offers valuable insight into your preferences. This letter can help direct the executor's actions, particularly regarding the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

A letter of instruction does not require a signature to be effective, as it is not a legally binding document. However, signing this document can lend it a greater sense of authority and clarity. When drafting a New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, consider adding a signature or date to help establish its validity. Using platforms like uslegalforms can guide you in creating a comprehensive letter with all necessary details.

A letter of instruction for death is a comprehensive guide for loved ones left behind. It typically outlines key information needed to settle the decedent's affairs, including funeral arrangements, location of important documents, and specific requests related to asset distribution. Within the framework of the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, this letter ensures that the executor has all the necessary information to facilitate a smooth transition of assets in line with the decedent's wishes.

A letter of instruction is a non-legal document that outlines the decedent's wishes regarding their assets and personal affairs. In the context of the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, this document may include details about account management, specific asset allocations, and guidance for the executor. While it is not legally binding, it serves as a valuable tool for executors and trustees to understand and act in accordance with the decedent's intent.

The primary purpose of a letter of instruction is to guide the executor or trustee in managing and distributing the decedent's estate. Specifically, when dealing with the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, it helps clarify the decedent's wishes. This document ensures that the transfer of assets occurs smoothly and according to the desires of the deceased, ultimately providing peace of mind to the beneficiaries.

The 3-year rule for a deceased estate refers to the period in which the Internal Revenue Service can audit estate tax returns. Executors need to maintain records and documentation for at least three years after filing. This is crucial when managing assets and being prepared for any inquiries, ensuring adherence to the regulations set out in the New Hampshire Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.