New Hampshire UCC-1 for Real Estate

Description

How to fill out UCC-1 For Real Estate?

You can spend hours online trying to locate the legal document template that matches the state and federal regulations you require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

It is easy to download or print the New Hampshire UCC-1 for Real Estate from our service.

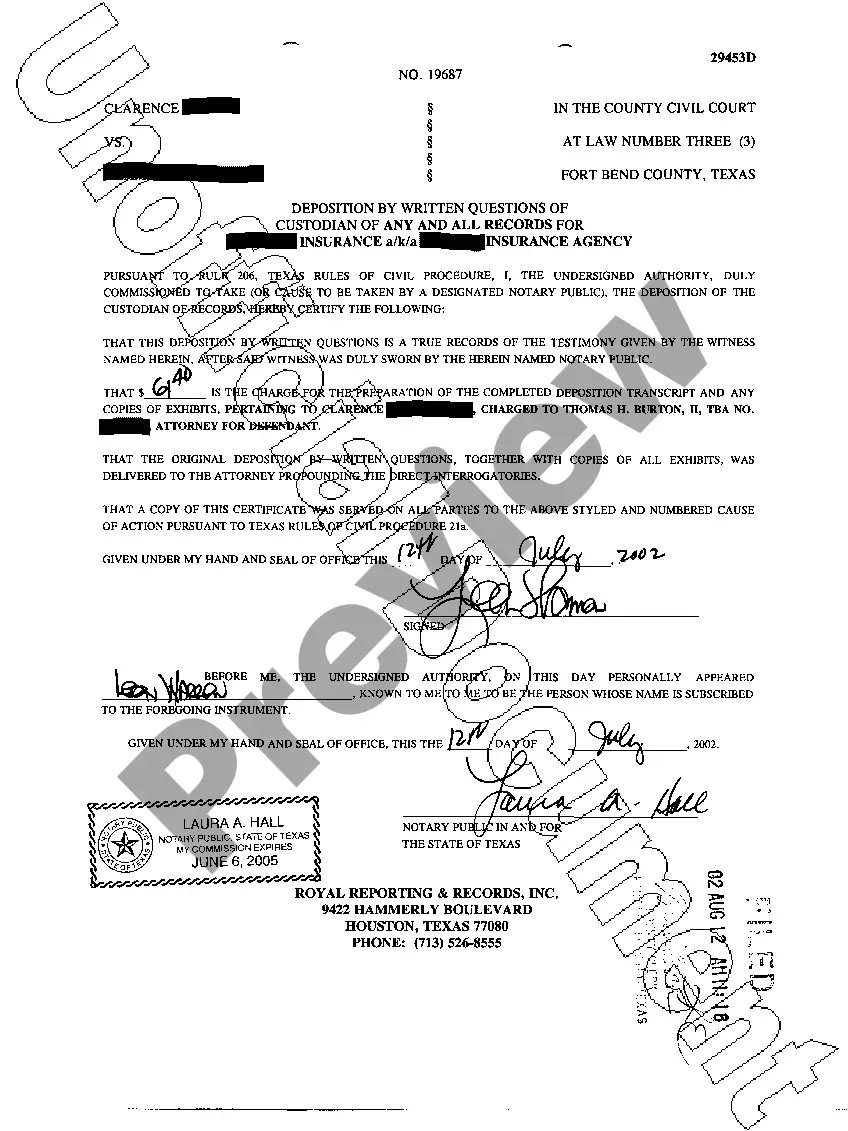

If available, utilize the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the New Hampshire UCC-1 for Real Estate.

- Every legal document template you acquire is yours permanently.

- To receive another copy of a downloaded form, go to the My documents section and select the appropriate option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Check the form description to make sure you have chosen the correct form.

Form popularity

FAQ

Any creditor or secured party can file a UCC statement, including individuals or businesses seeking to protect their interest in a property. By submitting a New Hampshire UCC-1 for Real Estate, you can publicly declare your security interest. This filing is essential for establishing your rights against the property. You may also benefit from using platforms like US Legal Forms, which simplify the filing process.

UCC primarily focuses on personal property rather than real estate transactions. However, the New Hampshire UCC-1 for Real Estate allows for the creation of security interests in certain situations. This means creditors can protect their rights against default by ensuring they have a claim on the property. Understanding this connection is important for anyone dealing with real estate financing.

An UCC filing in real estate refers to the document filed to secure an interest in personal property tied to real property. This means that by completing a New Hampshire UCC-1 for Real Estate, you can create a public record that your interest in the property is protected. This filing is crucial for lenders or businesses seeking to secure debts against a property. It serves as a way to establish priority over other creditors.

Yes, you can place a UCC lien on a house in certain situations by filing a New Hampshire UCC-1 for Real Estate. This filing secures your interest in the property and provides notice to other potential creditors. It is important to clarify that this lien appears on personal property interests associated with the real estate, not the real estate itself. Consulting with a legal professional can provide guidance on this process.

UCC Article 9 primarily governs personal property rather than real property. However, the New Hampshire UCC-1 for Real Estate does facilitate securing interests in real estate by allowing creditors to file liens. This filing helps to establish a claim against the collateral tied to real estate, which can protect a lender’s investment. Always consult with a legal expert to understand the nuances of UCC Article 9 as it relates to real property.

Any creditor or secured party can file a UCC-1. This includes individuals and organizations that have a secured interest in a debtor's collateral. In New Hampshire, you should familiarize yourself with the filing process to ensure compliance. Platforms like uslegalforms simplify the UCC-1 filing, making it accessible for anyone looking to secure their interests effectively.

Filing a UCC-1 on real estate is possible under certain conditions. While a UCC-1 primarily deals with personal property, it can attach to real estate by including a description of the property. In New Hampshire, this process often complements your real estate transactions, providing additional security interests. Use a reliable source like uslegalforms to ensure everything is handled according to the state's regulations.

Yes, a UCC-1 can be assigned to another party. This assignment allows the new party to take over the rights associated with the UCC-1 filing. When assigning a New Hampshire UCC-1 for Real Estate, ensure that all necessary documentation is completed accurately. This ensures a smooth transition and maintains the legal integrity of the filing.

To properly fill out a UCC-1 form, begin with the debtor's accurate legal name and their address, as these details are crucial. Include the secured party's name and address to make the filing complete. Describe the collateral in clear terms, covering all real estate involved, and check for any mistakes before submission. Using a platform like uslegalforms can streamline this process, ensuring compliance with New Hampshire UCC-1 for Real Estate standards.

To fill out a UCC-1 form, begin by providing the debtor's name and address, ensuring accuracy to avoid future complications. Next, include the secured party's name and address, followed by a description of the collateral, which can be specific real estate details. Finally, review the completed UCC-1 carefully before submitting it to the appropriate state office in accordance with New Hampshire UCC-1 for Real Estate regulations.