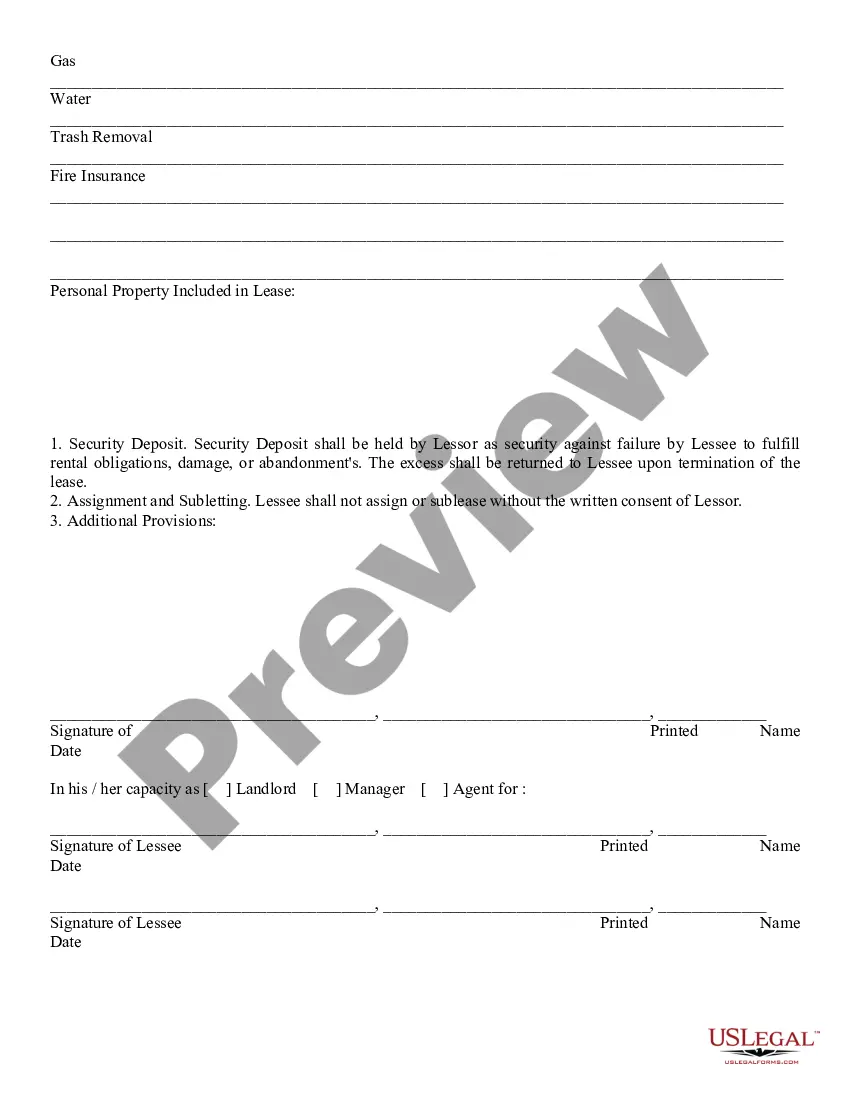

A New Hampshire Nonresidential Simple Lease refers to a legal agreement between a landlord and a tenant for the rental of a nonresidential property in the state of New Hampshire. This lease is specifically designed for commercial properties such as office spaces, retail stores, warehouses, industrial units, and other nonresidential buildings. The New Hampshire Nonresidential Simple Lease clearly outlines the terms and conditions of the lease, ensuring that both parties understand their rights and obligations. It covers various aspects such as the duration of the lease, rental payment details, security deposits, maintenance responsibilities, insurance requirements, and termination procedures. The lease agreement typically includes the following key elements: 1. Parties: The lease identifies the landlord (property owner) and the tenant (occupant or business entity). 2. Property Description: It provides a detailed description of the nonresidential property being leased, including its address, size, and any specific amenities or features. 3. Lease Term: This section specifies the duration of the lease, whether it's monthly, yearly, or for a fixed term. It may also include provisions for renewal or termination of the lease. 4. Rent and Payments: The lease clearly outlines the rent amount, how it should be paid (e.g., monthly, quarterly, or annually), and the due date. It may also mention any penalties for late payments or bounced checks. 5. Maintenance and Repairs: This section defines the responsibilities of the landlord and tenant regarding property upkeep, repairs, and maintenance. It outlines who is responsible for specific aspects such as utilities, landscaping, and common area maintenance. 6. Security Deposits: The lease agreement specifies the amount of the security deposit, the conditions for its refund or utilization, and any limitations imposed by New Hampshire state laws. 7. Insurance and Liability: This section discusses the insurance requirements for the property, both for the landlord and tenant. It may include general liability insurance, property insurance, and provisions related to indemnification. 8. Use of Property: The lease outlines the permitted use of the nonresidential property, any restrictions, and whether subleasing is allowed. 9. Default and Termination: It states the circumstances under which either party can terminate the lease early and the consequences of defaulting on the lease terms. Different types of New Hampshire Nonresidential Simple Leases may exist, each catering to specific types of commercial properties or industries. Examples include: 1. Office Space Lease: Designed for leasing commercial office spaces, often within business centers or office buildings. 2. Retail Store Lease: Tailored for leasing spaces intended for retail businesses, such as malls, shopping centers, or standalone storefronts. 3. Warehouse or Industrial Lease: Specifically created for leasing nonresidential properties used for manufacturing, storage, distribution, or industrial purposes. In summary, a New Hampshire Nonresidential Simple Lease is a legal document that governs the rental of commercial properties in the state. It ensures the landlord and tenant have a clear understanding of their rights, responsibilities, and the terms of occupancy, leading to a mutually beneficial leasing arrangement.

New Hampshire Nonresidential Simple Lease

Description

How to fill out New Hampshire Nonresidential Simple Lease?

If you need to comprehensive, down load, or printing lawful document themes, use US Legal Forms, the greatest variety of lawful varieties, that can be found on-line. Use the site`s simple and practical search to get the papers you want. A variety of themes for enterprise and specific uses are categorized by groups and claims, or key phrases. Use US Legal Forms to get the New Hampshire Nonresidential Simple Lease in a few mouse clicks.

In case you are already a US Legal Forms buyer, log in for your account and click the Obtain key to obtain the New Hampshire Nonresidential Simple Lease. You can also gain access to varieties you previously saved within the My Forms tab of the account.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have selected the form for your appropriate metropolis/country.

- Step 2. Use the Preview choice to examine the form`s information. Never neglect to learn the outline.

- Step 3. In case you are unsatisfied together with the kind, take advantage of the Research industry on top of the display screen to discover other versions of the lawful kind web template.

- Step 4. Once you have found the form you want, click on the Acquire now key. Choose the prices plan you choose and add your accreditations to register for an account.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal account to complete the financial transaction.

- Step 6. Find the structure of the lawful kind and down load it in your system.

- Step 7. Comprehensive, change and printing or signal the New Hampshire Nonresidential Simple Lease.

Every lawful document web template you acquire is yours eternally. You possess acces to every single kind you saved in your acccount. Select the My Forms area and choose a kind to printing or down load yet again.

Contend and down load, and printing the New Hampshire Nonresidential Simple Lease with US Legal Forms. There are many expert and express-distinct varieties you can use to your enterprise or specific demands.