New Hampshire Revocable Trust for Child

Description

How to fill out Revocable Trust For Child?

If you need to finish, acquire, or generate legal document formats, utilize US Legal Forms, the primary selection of legal documents, accessible online.

Leverage the website's straightforward and user-friendly search feature to locate the forms you require. Various templates for commercial and personal purposes are categorized by types and categories, or keywords.

Employ US Legal Forms to access the New Hampshire Revocable Trust for Child within just a few clicks.

Each legal document template you acquire is yours indefinitely. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Complete, retrieve, and print the New Hampshire Revocable Trust for Child using US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and select the Download option to retrieve the New Hampshire Revocable Trust for Child.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the directions outlined below.

- Step 1. Confirm you have chosen the form for your specific city/state.

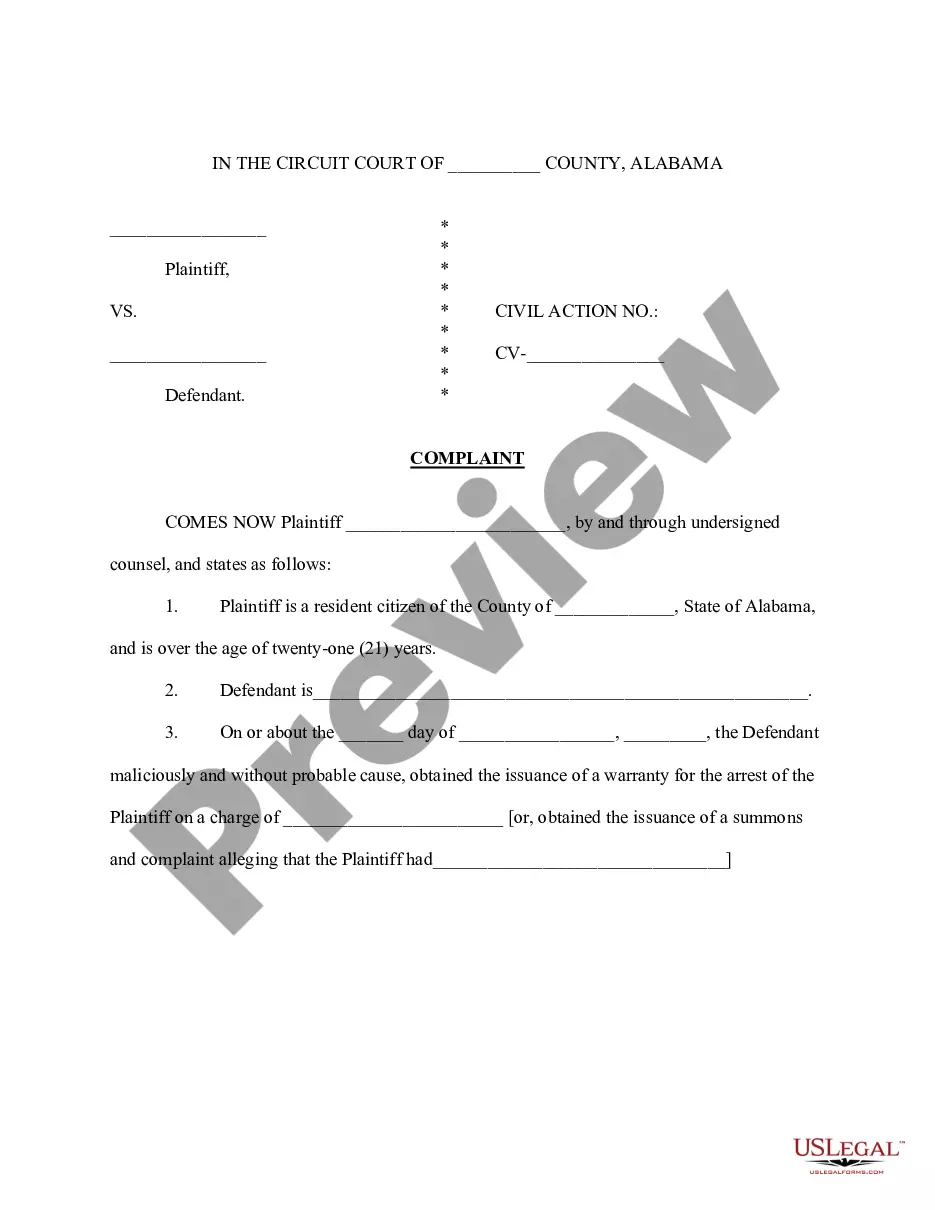

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to discover other variations of the legal document template.

- Step 4. Once you have found the required form, select the Get now option. Choose the payment plan you prefer and provide your credentials to register for an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Retrieve the format of the legal document and download it onto your device.

- Step 7. Complete, modify and print or sign the New Hampshire Revocable Trust for Child.

Form popularity

FAQ

A New Hampshire Revocable Trust for Child allows you to maintain control over the assets during your lifetime, meaning you can modify or revoke the trust as your circumstances change. In contrast, an irrevocable trust locks assets in and cannot be easily altered or undone. This key difference impacts how assets are managed and distributed. If you want flexibility and the ability to adapt your estate plan, a revocable trust may be the better choice.

A New Hampshire Revocable Trust for Child is often considered the best option for leaving assets to children. This type of trust allows you to maintain control over the assets while specifying how and when your child inherits them. Such trusts provide flexibility, enabling you to adjust terms as needed during your lifetime. Ultimately, consulting with a legal advisor can help tailor the trust according to your family's unique needs.

Creating a trust in New Hampshire involves drafting a trust document that outlines the terms and conditions of the trust, including your intention to use a New Hampshire Revocable Trust for Child. You should appoint a trustee, who will manage the assets on behalf of your child. It is highly advisable to work with a legal expert to ensure that all aspects comply with state laws. Additionally, platforms like uslegalforms offer templates and guidance to simplify this process.

New Hampshire does not impose an income tax on revocable trusts, including the New Hampshire Revocable Trust for Child. However, once the trust becomes irrevocable, it may be subject to federal taxes depending on its income. It is important to consult with a tax professional to understand the tax implications fully. Overall, using a trust can provide a tax-efficient means of transferring assets to your child.

In New Hampshire, a New Hampshire Revocable Trust for Child does not need to be recorded to be valid. However, it is essential to keep the trust document in a safe place and provide copies to relevant parties, like your attorney or financial planner. This ensures that the terms of the trust can be easily accessed when needed.

A family trust, including a New Hampshire Revocable Trust for Child, can have disadvantages such as potential loss of control over assets once they are transferred. Additionally, if not managed correctly, a trust could lead to family disputes. Balancing your desire to protect your assets with the need to give your children financial independence is crucial.

Many parents overlook the importance of clearly communicating their intentions when setting up a trust fund. A New Hampshire Revocable Trust for Child should reflect your values and wishes, but failing to discuss this with your children can create misunderstandings. Regular communication helps ensure everyone is on the same page.

A common mistake parents make when setting up a trust fund, whether in the UK or elsewhere, includes failing to review and update the trust regularly. Changes in family dynamics or financial situations can significantly affect how a New Hampshire Revocable Trust for Child should be structured. Not engaging a professional for guidance can also lead to oversight of important legal considerations.

A New Hampshire Revocable Trust for Child can be an excellent option for you. This type of trust allows for flexibility and control, enabling you to manage assets until your child is ready to inherit. You can also specify conditions that protect the child from mismanaging their inheritance.

Common pitfalls of a New Hampshire Revocable Trust for Child include inadequate funding and unclear terms outlined in the trust document. If the trust is not fully funded with your assets, it may not achieve your goals. Furthermore, not detailing your wishes clearly can lead to confusion and disputes among beneficiaries.