New Hampshire Revocable Trust for Estate Planning

Description

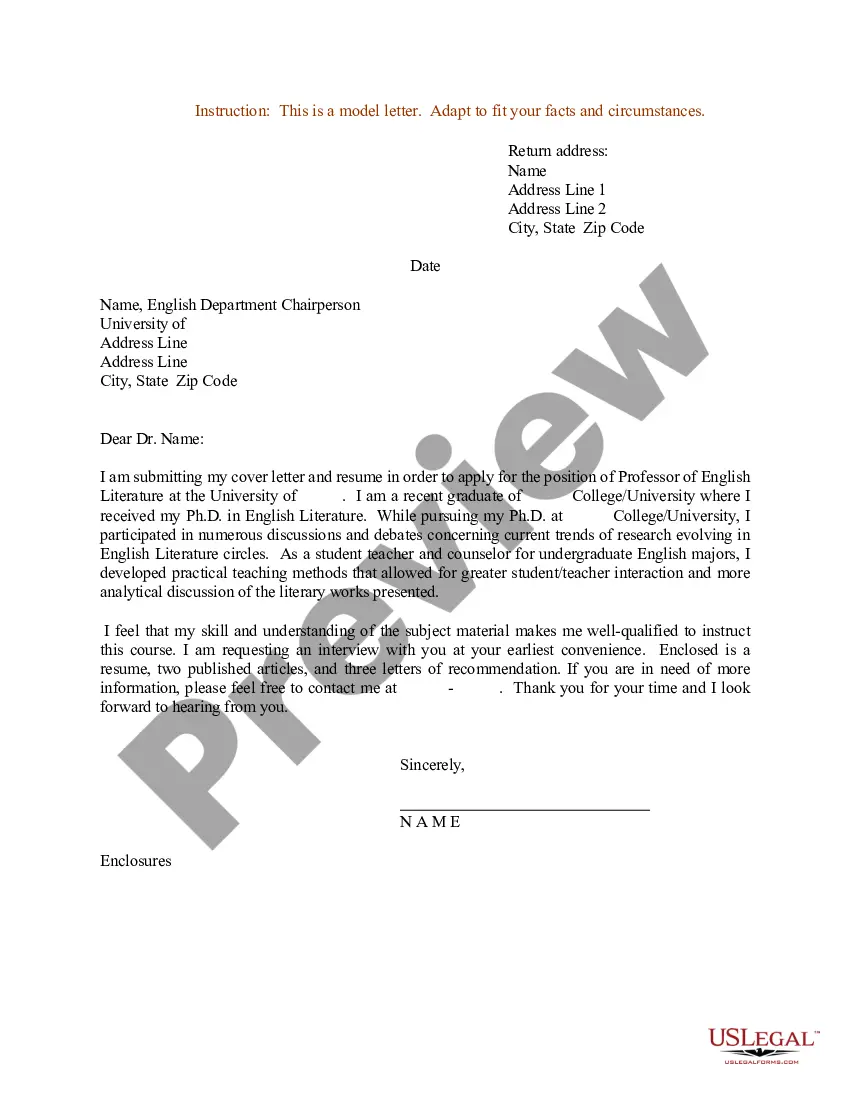

How to fill out Revocable Trust For Estate Planning?

It is feasible to allocate time online seeking the valid document format that complies with the state and federal requirements you desire.

US Legal Forms offers a vast array of legal documents that can be reviewed by experts.

You can easily obtain or print the New Hampshire Revocable Trust for Estate Planning from this service.

If available, utilize the Review feature to examine the format as well. If you want to find another version of the document, use the Search field to locate the format that conforms to your needs and specifications.

- If you possess a US Legal Forms account, you can sign in and select the Download button.

- Afterward, you can complete, modify, print, or sign the New Hampshire Revocable Trust for Estate Planning.

- Each legal document you acquire is yours permanently.

- To request another copy of a purchased form, navigate to the My documents section and select the corresponding option.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct format for the county/region you choose.

- Review the form details to confirm you have picked the right document.

Form popularity

FAQ

A New Hampshire Revocable Trust for Estate Planning offers a good level of privacy and security for your assets while you are alive. However, since you maintain control over the assets, it does not provide the same protections as an irrevocable trust in terms of creditor claims. Despite this, the trust can still safeguard your estate from the lengthy probate process, ensuring a smoother transition for your beneficiaries. For those seeking more information, USLegalForms can help you create a trust tailored to your needs.

Yes, a New Hampshire Revocable Trust for Estate Planning becomes irrevocable upon your death. This change occurs because you can no longer modify or revoke the trust after you pass away. The assets within the trust will then be distributed according to your wishes outlined in the trust document. It effectively allows for a seamless transition of assets to your beneficiaries without the need for probate.

One key disadvantage of a New Hampshire Revocable Trust for Estate Planning is that it does not provide asset protection from creditors. If you face legal judgments or debts while alive, creditors can still access your assets held in a revocable trust. Additionally, because you maintain control over the trust during your lifetime, it may come under scrutiny during legal proceedings. It's essential to weigh these factors when considering your estate planning options.

In New Hampshire, a New Hampshire Revocable Trust for Estate Planning generally does not incur state income tax on the trust itself. Instead, the income is typically reported on the tax return of the individual who created the trust. However, if the trust becomes irrevocable, it may face different tax rules. To fully understand the tax implications, consider consulting a tax advisor or using services like USLegalForms to guide you through the complexities.

Creating a New Hampshire Revocable Trust for Estate Planning starts with drafting the trust document. You will need to outline the terms of the trust, including the assets to be included and your chosen trustee. Once the document is prepared, you must sign it in front of a notary to ensure its validity. It is advisable to consult with an estate planning attorney or use a platform like USLegalForms to simplify the process and ensure that all legal requirements are met.

The greatest advantage of an irrevocable trust is its ability to protect your assets from creditors and legal claims. By transferring your assets into an irrevocable trust, you effectively remove them from your ownership, which can provide peace of mind. However, if you prefer flexibility, a New Hampshire Revocable Trust for Estate Planning may better suit your needs.

The main downside of an irrevocable trust is the loss of control over the assets once they are transferred. Unlike a New Hampshire Revocable Trust for Estate Planning, which allows you to modify or revoke it, an irrevocable trust remains unchanged. This can create challenges if your circumstances or intentions shift in the future.

Irrevocable trusts typically cannot hold assets that benefit you directly, such as personal residences or funds in a bank account that you access regularly. However, a New Hampshire Revocable Trust for Estate Planning allows you to retain control over your assets during your lifetime. This flexibility makes it a popular choice for many individuals looking to manage their estate.

A New Hampshire Revocable Trust for Estate Planning is often considered the best option for placing your house. This trust allows you to maintain control over your property while bypassing probate after your passing. Additionally, it provides a flexible way to manage your assets during your lifetime and ensures a smooth transition for your heirs.

In New Hampshire, a trust does not need to be recorded with the state, which is a significant advantage of using a New Hampshire Revocable Trust for Estate Planning. The trust exists as a private agreement, and only the trustee and beneficiaries need to be aware of its existence and terms. This privacy can protect your estate plan from unnecessary scrutiny. However, it's still important to keep records of the trust and its assets for your personal reference.