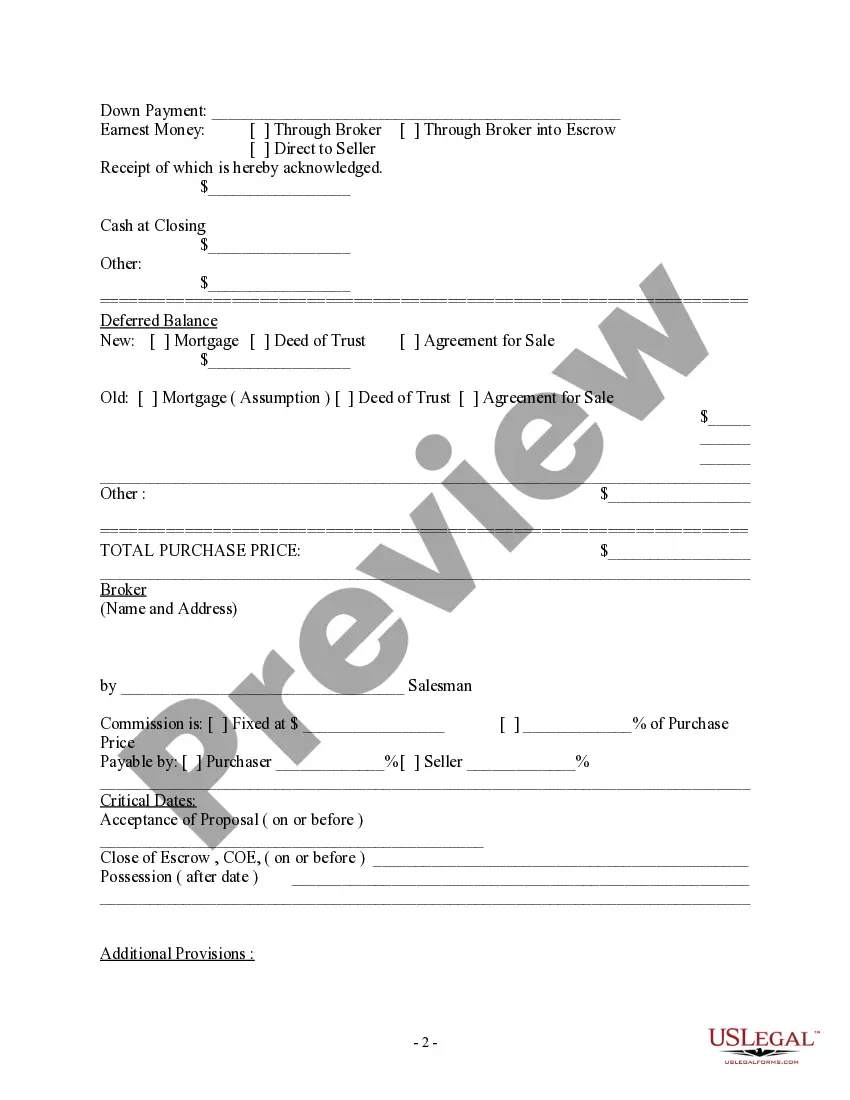

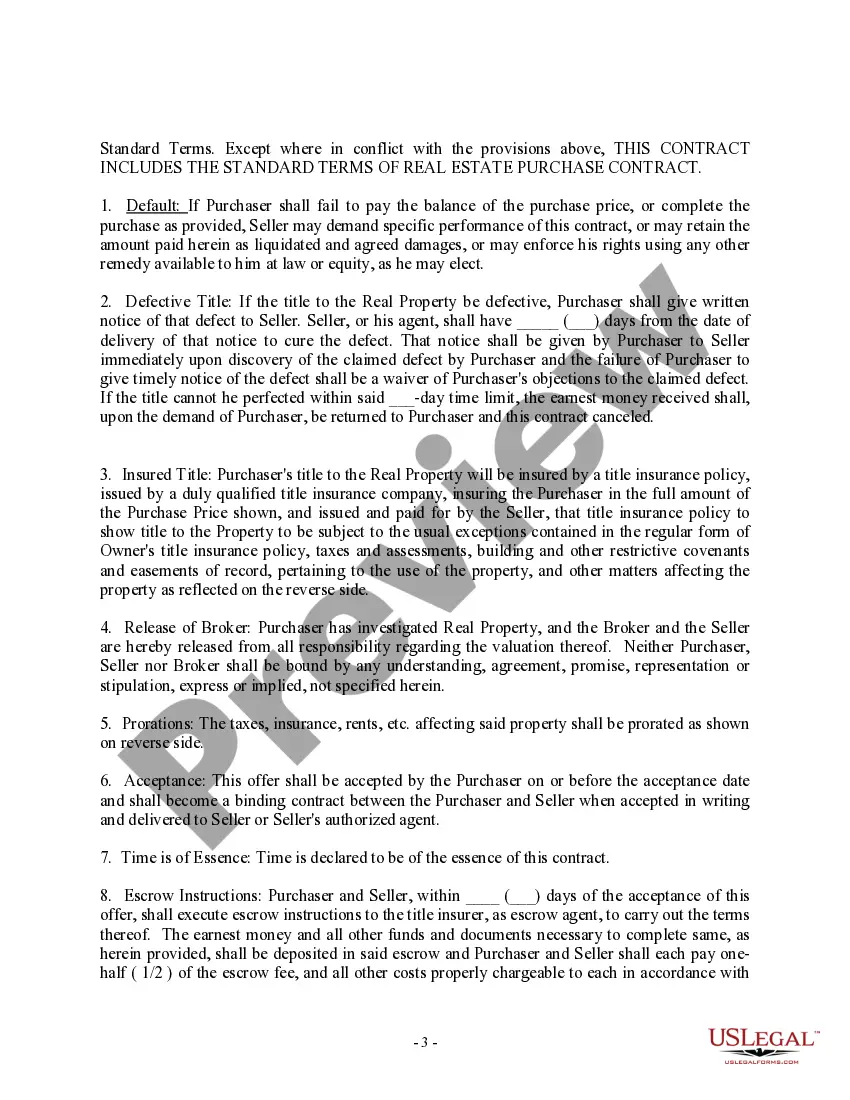

The New Hampshire Purchase Contract and Receipt — Residential is a crucial legal document used in real estate transactions within the state of New Hampshire. This contract outlines the terms and conditions agreed upon by the buyer and seller involved in a residential property sale. It serves as concrete evidence of their agreement and protects the interests of both parties involved. The document ensures transparency, legality, and a smooth transfer of ownership. The New Hampshire Purchase Contract and Receipt — Residential typically covers various essential aspects related to the property sale, including the purchase price, financing arrangements, property details, contingency clauses, and closing terms. It provides a comprehensive framework that outlines the responsibilities of both the buyer and the seller throughout the transaction process. The agreement begins with the identification of the parties involved, highlighting their legal names, addresses, and contact information. It also stipulates the effective date of the contract and the property's complete description, including its address, legal description, and parcel identification number. This clarity helps avoid any confusion or disputes regarding the intended property. Within the contract, the purchase price agreed upon by the buyer and seller is clearly stated, along with the payment terms and any contingencies related to financing or appraisal. Contingency clauses protect the buyer's interests by allowing them to withdraw from the purchase contract if specified conditions, such as a failed inspection or failure to secure financing, are not met. Additionally, the contract outlines the closing terms, including the anticipated closing date, the allocation of closing costs, and any other specific conditions agreed upon by the buyer and seller. It also provides a space for the buyer to acknowledge receipt of any earnest money or deposit, acting as a receipt for the initial payment made toward the purchase. This section highlights the financial commitment of the buyer and helps establish the seriousness of their offer. Although there may not be different types of New Hampshire Purchase Contract and Receipt — Residential based on the document's core structure, there may be variations depending on specific terms or clauses negotiated between the parties involved. These variations are commonly found in the additional clauses or addendums that may be included to address unique aspects related to the property or transaction. In conclusion, the New Hampshire Purchase Contract and Receipt — Residential is a vital legal document that protects the rights and interests of both the buyer and seller involved in a residential property sale. It serves as a binding agreement that outlines the terms and conditions of the transaction, ensuring a smooth transfer of ownership. By clearly documenting the purchase price, property details, financing arrangements, and other relevant terms, this contract provides a solid framework that governs the entire transaction process.

New Hampshire Purchase Contract and Receipt - Residential

Description

How to fill out New Hampshire Purchase Contract And Receipt - Residential?

You are able to commit several hours online attempting to find the legal record web template that meets the state and federal demands you need. US Legal Forms gives a huge number of legal forms which can be reviewed by specialists. You can easily acquire or print out the New Hampshire Purchase Contract and Receipt - Residential from your support.

If you already have a US Legal Forms accounts, you are able to log in and click the Download switch. Following that, you are able to full, modify, print out, or indicator the New Hampshire Purchase Contract and Receipt - Residential. Each and every legal record web template you buy is yours eternally. To get one more duplicate of the bought kind, proceed to the My Forms tab and click the related switch.

If you work with the US Legal Forms web site the first time, follow the basic directions listed below:

- Initially, make certain you have selected the correct record web template to the state/city of your choosing. See the kind information to ensure you have picked the right kind. If available, make use of the Preview switch to check through the record web template also.

- If you want to find one more version of your kind, make use of the Research industry to get the web template that meets your needs and demands.

- When you have found the web template you desire, simply click Acquire now to carry on.

- Pick the prices strategy you desire, type your credentials, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your credit card or PayPal accounts to purchase the legal kind.

- Pick the structure of your record and acquire it for your device.

- Make modifications for your record if required. You are able to full, modify and indicator and print out New Hampshire Purchase Contract and Receipt - Residential.

Download and print out a huge number of record web templates using the US Legal Forms site, which offers the biggest collection of legal forms. Use skilled and status-specific web templates to deal with your small business or individual needs.