The New Hampshire Sale of Deceased Partner's Interest refers to the legal process by which the deceased partner's share in a partnership or business is sold and transferred to a third party in the state of New Hampshire. This procedure is enacted upon the death of a partner to ensure the smooth continuation of the business and the fair distribution of assets. When a partner passes away, their ownership interest in the partnership becomes part of their estate. The deceased partner's interest typically needs to be assessed and valued before any sale can take place. Appropriate professionals such as accountants or appraisers may be involved in determining the value of the interest. There are a few different types of New Hampshire Sale of Deceased Partner's Interest, which include: 1. Outright Sale: In this type, the deceased partner's interest is sold to an individual or entity outside the partnership. The partner's estate receives the agreed-upon amount for their share, and the buyer becomes a new partner in the business. 2. Purchase by Existing Partners: In some instances, the remaining partners may decide to buy the deceased partner's interest. This type of sale can occur when the partnership agreement includes a provision allowing for the purchase of a partner's share upon their death. 3. Redemption: Here, the partnership itself buys back the deceased partner's interest. The partnership would use its own funds or secure financing to pay the estate for the value of the share. The remaining partners would then divide the interest among themselves or admit a new partner. The New Hampshire Sale of Deceased Partner's Interest is governed by state laws and the partnership agreement, if one exists. It is imperative for all parties involved to consult an attorney to ensure compliance with legal requirements. The process also involves various legal documents, such as purchase agreements or redemption agreements, which outline the terms of the sale. These agreements detail the valuation of the interest, payment terms, and any additional provisions agreed upon by the parties involved. Overall, the New Hampshire Sale of Deceased Partner's Interest is a crucial step to protect the rights of the deceased partner's estate, maintain business continuity, and ensure the fair distribution of assets among the surviving partners or new owners.

New Hampshire Sale of Deceased Partner's Interest

Description

How to fill out New Hampshire Sale Of Deceased Partner's Interest?

Have you been in a place that you need to have documents for either enterprise or individual reasons almost every day time? There are tons of legitimate file layouts available on the Internet, but finding types you can depend on is not straightforward. US Legal Forms delivers 1000s of develop layouts, like the New Hampshire Sale of Deceased Partner's Interest, which are created to fulfill federal and state needs.

Should you be already familiar with US Legal Forms website and have a merchant account, basically log in. Following that, you are able to download the New Hampshire Sale of Deceased Partner's Interest design.

Unless you provide an bank account and need to begin to use US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for the proper area/county.

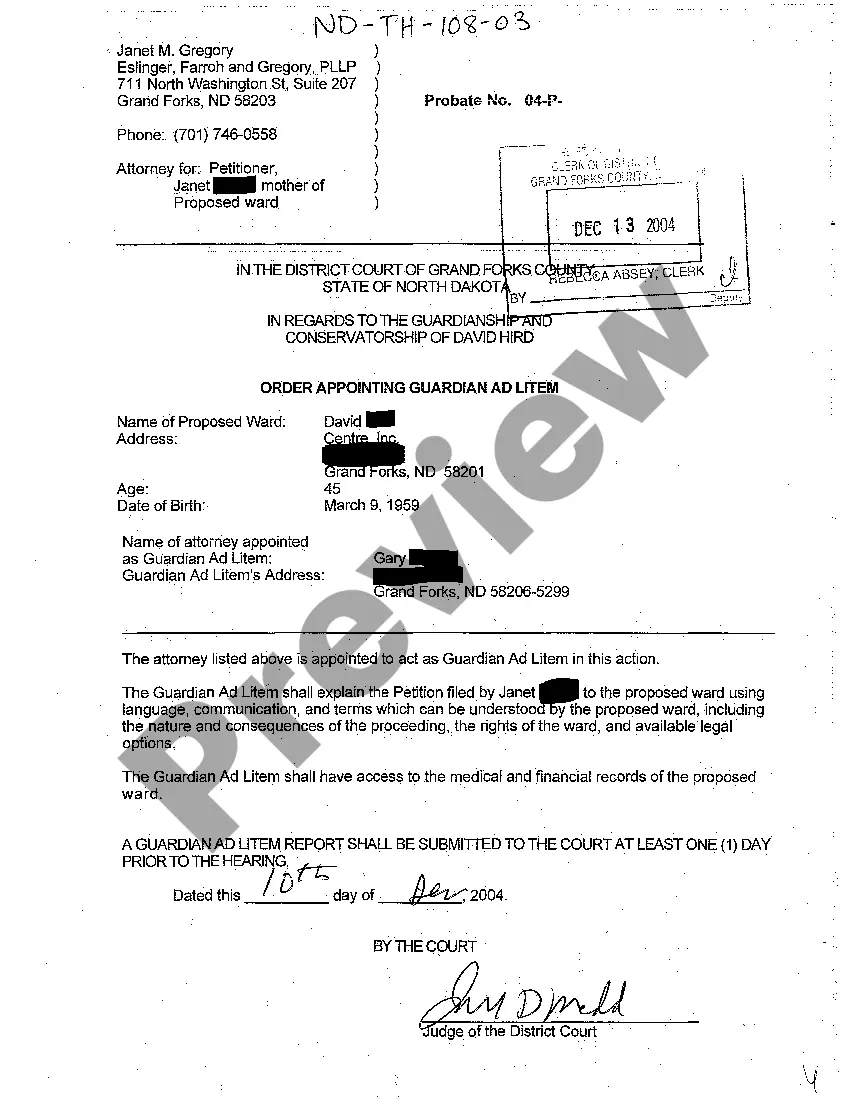

- Make use of the Review switch to analyze the shape.

- Browse the outline to ensure that you have chosen the right develop.

- When the develop is not what you are looking for, utilize the Search area to get the develop that meets your needs and needs.

- Whenever you obtain the proper develop, simply click Purchase now.

- Select the rates plan you want, complete the required info to make your account, and pay money for your order making use of your PayPal or charge card.

- Pick a convenient paper file format and download your duplicate.

Discover every one of the file layouts you may have purchased in the My Forms menu. You may get a more duplicate of New Hampshire Sale of Deceased Partner's Interest any time, if needed. Just click on the needed develop to download or printing the file design.

Use US Legal Forms, probably the most considerable variety of legitimate varieties, in order to save efforts and avoid errors. The service delivers professionally created legitimate file layouts which can be used for a variety of reasons. Produce a merchant account on US Legal Forms and commence making your daily life a little easier.