New Hampshire Withdrawal of Partner: A Detailed Description In the state of New Hampshire, the withdrawal of a partner refers to the process by which a partnership is dissolved or undergoes changes due to the departure of one of its partners. This legal procedure allows for the smooth transition and restructuring of a partnership, respecting the rights and responsibilities of all parties involved. A withdrawal of a partner can occur voluntarily or involuntarily, and it is essential to follow the proper legal steps to ensure a fair and legally binding process. There are several types of New Hampshire Withdrawal of Partner, each with specific conditions and consequences: 1. Voluntary Withdrawal: A partner may choose to withdraw from a partnership willingly for various reasons, such as retirement, personal circumstances, or pursuing new ventures. In a voluntary withdrawal, partners typically follow the procedure established in the partnership agreement or New Hampshire Revised Statutes (RSA) to initiate their departure. 2. Involuntary Withdrawal: An involuntary withdrawal of a partner can occur when a partner breaches the partnership agreement, violates fiduciary duties, displays misconduct, or becomes incapacitated. In such cases, the remaining partners may initiate the withdrawal process to safeguard the partnership's interests and continuity. 3. Dissolution of Partnership: While not strictly a form of withdrawal, dissolution refers to the complete termination of a partnership's existence. It can be initiated by the unanimous decision of all partners or due to events outlined in the partnership agreement or New Hampshire partnership laws. Dissolution can also lead to subsequent withdrawal of partners if they decide not to participate in winding up the partnership's affairs. The withdrawal process typically includes the following steps: 1. Reviewing the Partnership Agreement: Partners must begin by thoroughly examining the partnership agreement for specific provisions related to withdrawal, including notice periods, compensation, and distribution of assets and liabilities. 2. Notice of Withdrawal: The withdrawing partner must provide written notice to the partnership and other partners, clearly stating their intent to withdraw, effective date, and reasons for the withdrawal. 3. Valuation of Interests: Partnerships usually determine the value of the withdrawing partner's interest. This involves appraising the partner's capital account, including contributions made, undistributed profits, and any outstanding loans or debts. 4. Revising Partnership Agreement: As a result of the withdrawal, the partnership agreement may need to be amended accordingly to reflect the adjustments in partner shares, profit distribution, management structure, and other relevant clauses. 5. Settling Financial and Legal Obligations: The withdrawing partner's liabilities, outstanding debts, and obligations to partners, clients, creditors, and employees must be resolved. This involves paying off debts, transferring responsibilities, and redistributing assets equitably. 6. Public Notice and Filings: It may be necessary to file appropriate paperwork with the New Hampshire Secretary of State to update public records regarding the partnership's composition and status. The New Hampshire Withdrawal of Partner process aims to protect the interests of all parties and maintain transparency during partner departures. Seeking advice from a qualified attorney or legal professional experienced in partnership law is highly recommended ensuring compliance with New Hampshire state laws and regulations.

New Hampshire Withdrawal of Partner

Description

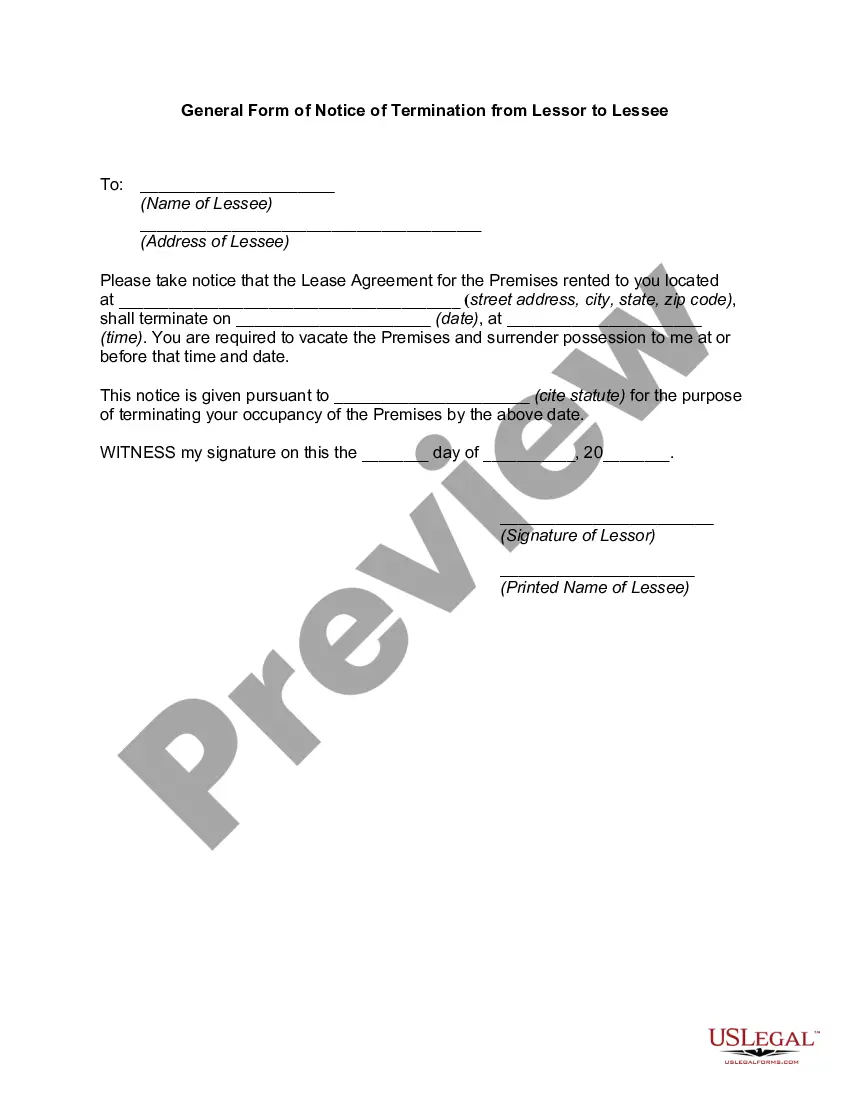

How to fill out New Hampshire Withdrawal Of Partner?

You can spend time on the web searching for the legal document format that meets the federal and state requirements you have. US Legal Forms provides numerous legal forms that have been reviewed by experts.

You can easily obtain or create the New Hampshire Withdrawal of Partner through our services.

If you already have a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the New Hampshire Withdrawal of Partner. Every legal document format you acquire is yours indefinitely. To obtain an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

Select the file format of the document and download it to your device. Make any necessary modifications to your document. You can complete, edit, sign, and print the New Hampshire Withdrawal of Partner. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or individual needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct format for the state/city of your choice. Review the document description to ensure you have chosen the right document.

- If available, use the Review button to examine the format as well.

- If you want to find another version of the form, utilize the Search field to locate the template that meets your needs and requirements.

- Once you have found the template you want, click on Buy now to proceed.

- Choose the pricing plan you desire, enter your credentials, and register for an account on US Legal Forms.

- Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal document.

Form popularity

FAQ

New Hampshire does offer the option of legal separation, allowing couples to delineate their financial responsibilities while remaining married. This can be particularly useful in circumstances where couples need time apart but wish to maintain their marital status for specific reasons. If you are undergoing a New Hampshire Withdrawal of Partner, understanding legal separation options can be beneficial. Uslegalforms provides resources to help you through this informed decision-making process.

Adultery can potentially affect divorce proceedings in New Hampshire, but it does not automatically lead to harsher consequences for either partner. The court primarily focuses on equitable distribution and child custody arrangements. However, in cases of a New Hampshire Withdrawal of Partner, evidence of infidelity may influence negotiations or settlements. Seeking professional legal counsel can help you navigate these complexities.

A partner withdrawal refers to the process of one partner removing themselves from a relationship, often through legal means. In New Hampshire, this can involve formalizing the withdrawal through court proceedings, especially in partnerships or marriages. Understanding the implications of a New Hampshire Withdrawal of Partner is essential for both parties, as it can affect financial obligations and custody arrangements. Connecting with legal experts can help clarify this process.

Yes, you can seek legal separation in New Hampshire. This process allows couples to live apart while still being legally married, providing security regarding financial and custody arrangements. If you are contemplating a New Hampshire Withdrawal of Partner, you may find that legal separation offers a structured way to navigate this period. Consulting with legal resources, such as uslegalforms, can provide you with valuable assistance.

New Hampshire does not strictly adhere to a 50/50 split of marital assets in a divorce. Instead, the state follows the principle of equitable distribution, meaning assets are divided fairly, but not necessarily equally. During the New Hampshire Withdrawal of Partner process, the court considers various factors, such as the length of the marriage and each partner's financial contributions. Understanding these nuances can be vital for a fair outcome.

Several states in the U.S. do not officially recognize legal separation. These states treat legal separation similarly to divorce, meaning they do not provide a separate legal status for couples who choose this option. In the context of New Hampshire Withdrawal of Partner, it is crucial to understand the legal framework in your state. If you are considering separation in New Hampshire, consulting with a legal professional can help clarify your options.

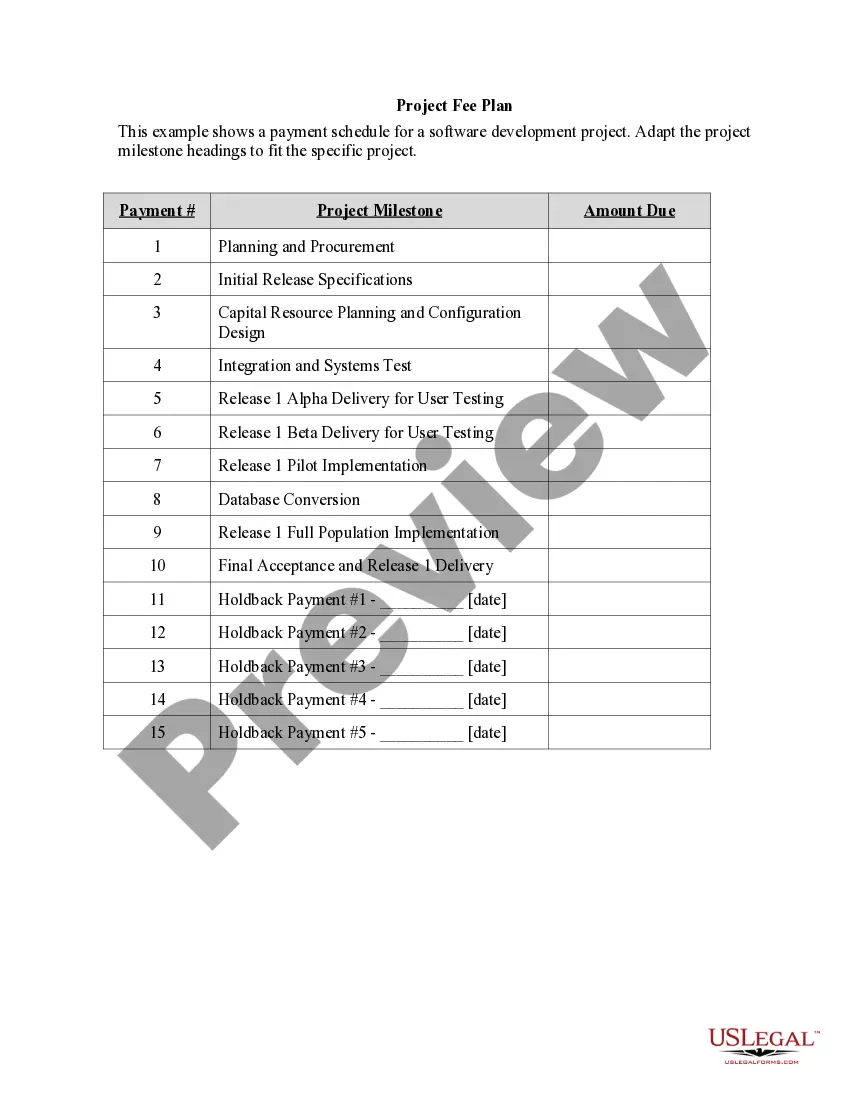

Distributions from partnerships in New Hampshire are typically subject to tax based on the nature of the income generated by the partnership. Each partner needs to report their share of income on their individual tax filings. As you navigate a New Hampshire withdrawal of partner, comprehending these tax rules is essential. US Legal Forms provides important resources to help you understand partnership taxation.

LLC partnership distributions in New Hampshire generally pass through to the members and are taxed at the individual level. Each member reports their portion of the distribution on their tax return, reflecting the income realized. Understanding this structure is crucial, especially during a New Hampshire withdrawal of partner to ensure compliance and timely processing. You can find assistance with these matters on the US Legal Forms platform.

New Hampshire does not impose a tax on wages or personal income, which distinguishes it from many other states. However, certain business earnings and revenue may still be taxed. When navigating a New Hampshire withdrawal of partner, it is important to be aware of what types of income are not taxed. US Legal Forms can provide you with answers and documentation regarding these tax regulations.

Yes, partnership distributions can be taxable in New Hampshire, depending on various factors. Generally, income allocated to partners from a partnership is subject to taxation. Therefore, understanding the tax implications is vital, particularly when analyzing the impact of a New Hampshire withdrawal of partner. Consider consulting resources from US Legal Forms for clarity on your obligations.