The New Hampshire Agreement of Shareholders of a Close Corporation with Management by Shareholders is a legal document that outlines the rights, responsibilities, and duties of shareholders in a closely-held corporation. This agreement is specific to New Hampshire and aims to protect the interests of the shareholders while establishing guidelines for the management of the corporation. In a close corporation, the shareholders often have a proactive role in managing the company's affairs. The agreement helps define their roles and responsibilities regarding decision-making, voting rights, profit distribution, and more. With the inclusion of relevant keywords and phrases, let's delve into the detailed description of this agreement, covering its main components and possible types: 1. Shareholders' Rights and Obligations: The agreement clearly defines the rights of shareholders, including their ownership interests, voting rights, access to financial records, and involvement in decision-making processes. It also outlines their obligations, such as capital contributions, restrictions on share transfer, and compliance with the company's bylaws and state regulations. 2. Management Structure: The agreement sets forth the management structure where shareholders play an active role. It establishes how management decisions are made and the authority given to shareholders collectively or individually. It may mention specific positions like directors, officers, and other managerial roles, outlining their responsibilities and appointment procedures. 3. Decision-Making Processes: This agreement outlines the decision-making procedures within the close corporation. It may detail rules for shareholder meetings, quorum requirements, voting mechanisms (e.g., majority or super majority), and the handling of tied votes. By including dispute resolution clauses, it provides a framework for resolving conflicts or deadlock situations. 4. Profit Sharing and Distributions: To ensure fair distribution of profits, the agreement may specify how income and dividends are allocated among shareholders. It can establish different classes of shares, each with varying rights to dividends or liquidation proceeds. The agreement may also include guidelines for reinvestment, the use of retained earnings, and any special provisions for minority or controlling shareholders. 5. Share Transfer Restrictions: To maintain the close nature of the corporation, the agreement may include provisions that restrict the transfer of shares. This prevents shares from being sold to outside parties without the consent of existing shareholders. Rights of first refusal, buy-sell agreements, or stipulations on who can purchase shares may be incorporated. Types of New Hampshire Agreement of Shareholders of a Close Corporation with Management by Shareholders: 1. Standard Agreement: This is the most common type of shareholder agreement. It covers the basic provisions and outlines the rights and responsibilities of shareholders for managing the corporation. 2. Customized Agreement: Some close corporations have unique circumstances or specific requirements that necessitate tailored agreements. These agreements are personalized to address the distinct needs and concerns of the shareholders and the business itself. 3. Buy-Sell Agreement: This type of agreement focuses on the purchase and sale of shares among existing shareholders. It can include predetermined valuation methods, trigger events (such as death or disability of a shareholder), and terms for share buybacks or transfers. 4. Voting Agreement: A voting agreement is designed to ensure a unified voting block, allowing shareholders to collectively exert their influence over key decisions. It establishes voting commitments and may include provisions to vote as a group or pool shares to achieve specific objectives. In summary, the New Hampshire Agreement of Shareholders of a Close Corporation with Management by Shareholders is a comprehensive legal document tailored for closely-held corporations in New Hampshire. By utilizing the above keywords and providing an in-depth description, it clarifies the roles, rights, and obligations of shareholders, while facilitating effective management and decision-making within the corporation.

New Hampshire Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

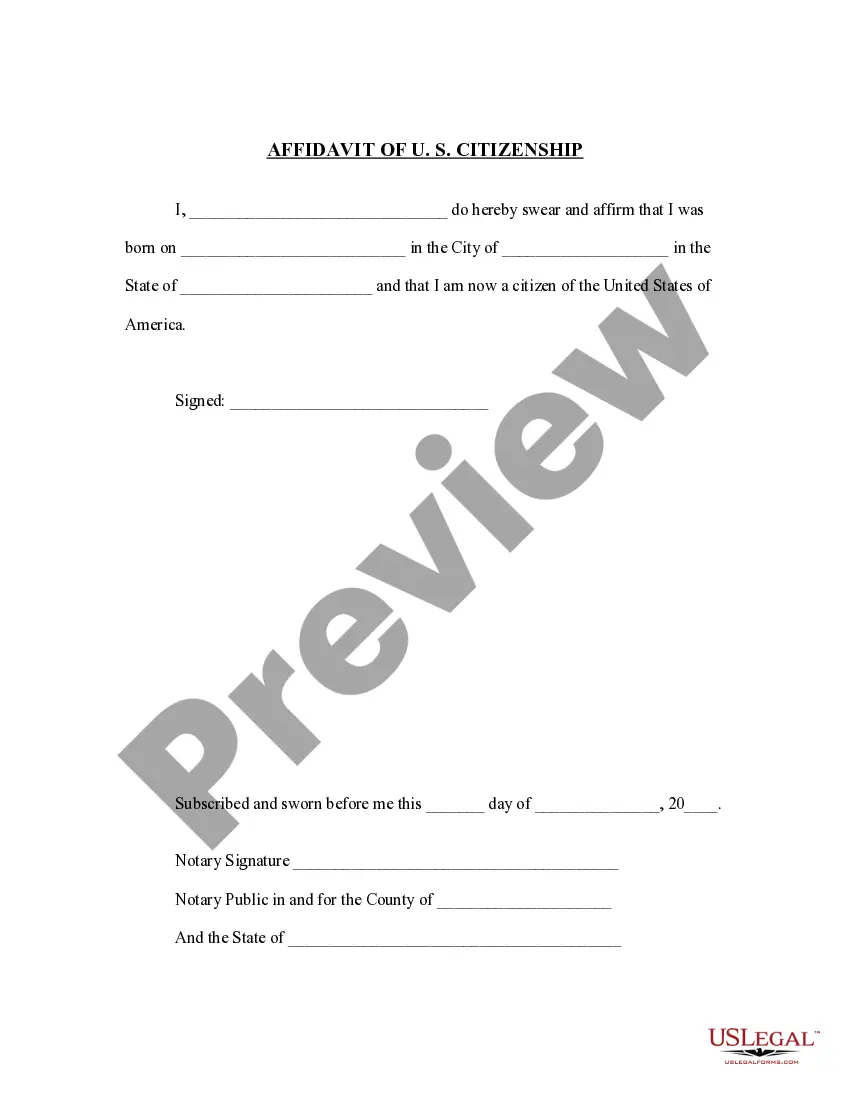

How to fill out New Hampshire Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

It is possible to invest several hours on-line searching for the legitimate record template that fits the state and federal demands you want. US Legal Forms gives a huge number of legitimate varieties which can be reviewed by pros. It is simple to download or produce the New Hampshire Agreement of Shareholders of a Close Corporation with Management by Shareholders from my support.

If you currently have a US Legal Forms bank account, you can log in and then click the Acquire button. After that, you can comprehensive, edit, produce, or sign the New Hampshire Agreement of Shareholders of a Close Corporation with Management by Shareholders. Every single legitimate record template you get is your own eternally. To obtain another version for any purchased develop, visit the My Forms tab and then click the corresponding button.

If you use the US Legal Forms internet site for the first time, keep to the easy instructions below:

- Very first, ensure that you have selected the best record template for the county/town of your choice. Browse the develop outline to make sure you have chosen the proper develop. If available, take advantage of the Review button to appear throughout the record template also.

- If you would like find another edition of your develop, take advantage of the Look for field to obtain the template that suits you and demands.

- When you have identified the template you want, just click Acquire now to continue.

- Find the pricing program you want, type in your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You may use your credit card or PayPal bank account to fund the legitimate develop.

- Find the formatting of your record and download it in your product.

- Make alterations in your record if necessary. It is possible to comprehensive, edit and sign and produce New Hampshire Agreement of Shareholders of a Close Corporation with Management by Shareholders.

Acquire and produce a huge number of record layouts while using US Legal Forms site, that offers the most important selection of legitimate varieties. Use skilled and state-specific layouts to handle your small business or person requirements.

Form popularity

FAQ

Generally, shareholders do not have control over the day to day running of the company simply by being shareholders. Shareholders do not have access to the majority of company's records. These sit with the directors.

If clear terms are available, it is possible to remove any shareholder. While a shareholder agreement cannot resolve an entrenched deadlock, it can be a valuable tool in helping to shift focus and resolve conflict.

Key Takeaways. By and large, shareholders have more rights than they do obligations. Their obligations are quite narrow in scope. Indeed, the most common obligation is their limited liability for their company's debts.

These fiduciary duties generally prohibit directors, officers, and controlling shareholders from competing with the corporation and using corporate resources or relationships for personal gain, among other things.

To dissolve a New Hampshire corporation, you need to file Articles of Dissolution. To dissolve a New Hampshire LLC, you need to request a Certificate of Dissolution from the Department of Revenue Administration. This certificate will state that the LLC has paid all its taxes due.

Yes. New Hampshire state law (Section 293-A:15.07) requires business entities to maintain a registered agent who resides in the state. If you do not appoint a New Hampshire registered agent, you cannot legally conduct business in the state.

Removal of Shareholder: Shareholders can choose to leave a company whenever they like. Maybe they want to cash in their shares and use the money to buy shares in a different company or to use it for personal use. Sometimes a shareholder will need to be removed due to their death. No matter what the [?]

The New Hampshire Secretary of State business entity search engine allows a query on the state's database of properly registered business entities that operate in New Hampshire. Users, armed with as little as a phrase, can engage this query and learn a New Hampshire entity's public information.