Title: A Comprehensive Guide to New Hampshire Letter to Lender for Produce the Note Request Introduction: A New Hampshire Letter to Lender for Produce the Note Request is a legal document used by borrowers to request the original promissory note from their lender or loan service. This detailed guide aims to provide thorough information about this process, including its importance, key elements, and different types associated with it. 1. Understanding the Importance of the New Hampshire Letter to Lender for Produce the Note Request: — Guaranteeing legality: The New Hampshire law requires lenders to possess the original promissory note to enforce a foreclosure or prove loan ownership. — Ensuring accuracy: Borrowers verify if their lender or loan service has the legal right to collect mortgage payments or initiate foreclosure proceedings. 2. Key Elements of a New Hampshire Letter to Lender for Produce the Note Request: — Accurate borrower and lender information: The letter should include the borrower's name, address, contact details, and loan account number. Additionally, it should mention the lender's name, address, and contact details. — Request for the original promissory note: Clearly state that you are requesting the original promissory note, signed and executed by both parties. — Documentation and deadline: Request the lender to provide the note within a specific time frame and request a return receipt upon receiving the note. 3. Different Types of New Hampshire Letter to Lender for Produce the Note Request: — Foreclosure-related request: Borrowers facing foreclosure proceedings send this letter to lenders to ensure they possess the original promissory note to proceed legally. — Loan ownership verification request: Borrowers may request the note to verify if the current loan service or lender has the legal rights to collect mortgage payments. 4. Additional Considerations: — Keep a copy: Always make copies of the letter and any related correspondence for record purposes. — Certified mailing: It is recommended to send the letter via certified mail with return receipt requested to ensure proof of delivery. — Seek legal assistance: If you face difficulties obtaining the original promissory note or need guidance throughout the process, consulting a real estate attorney is advisable. Conclusion: A New Hampshire Letter to Lender for Produce the Note Request is a crucial document to establish the authenticity of a loan agreement and ensure legal compliance. By understanding its significance, key elements, and different types, borrowers can protect their rights and ensure proper loan ownership verification in New Hampshire.

New Hampshire Letter to Lender for Produce the Note Request

Description

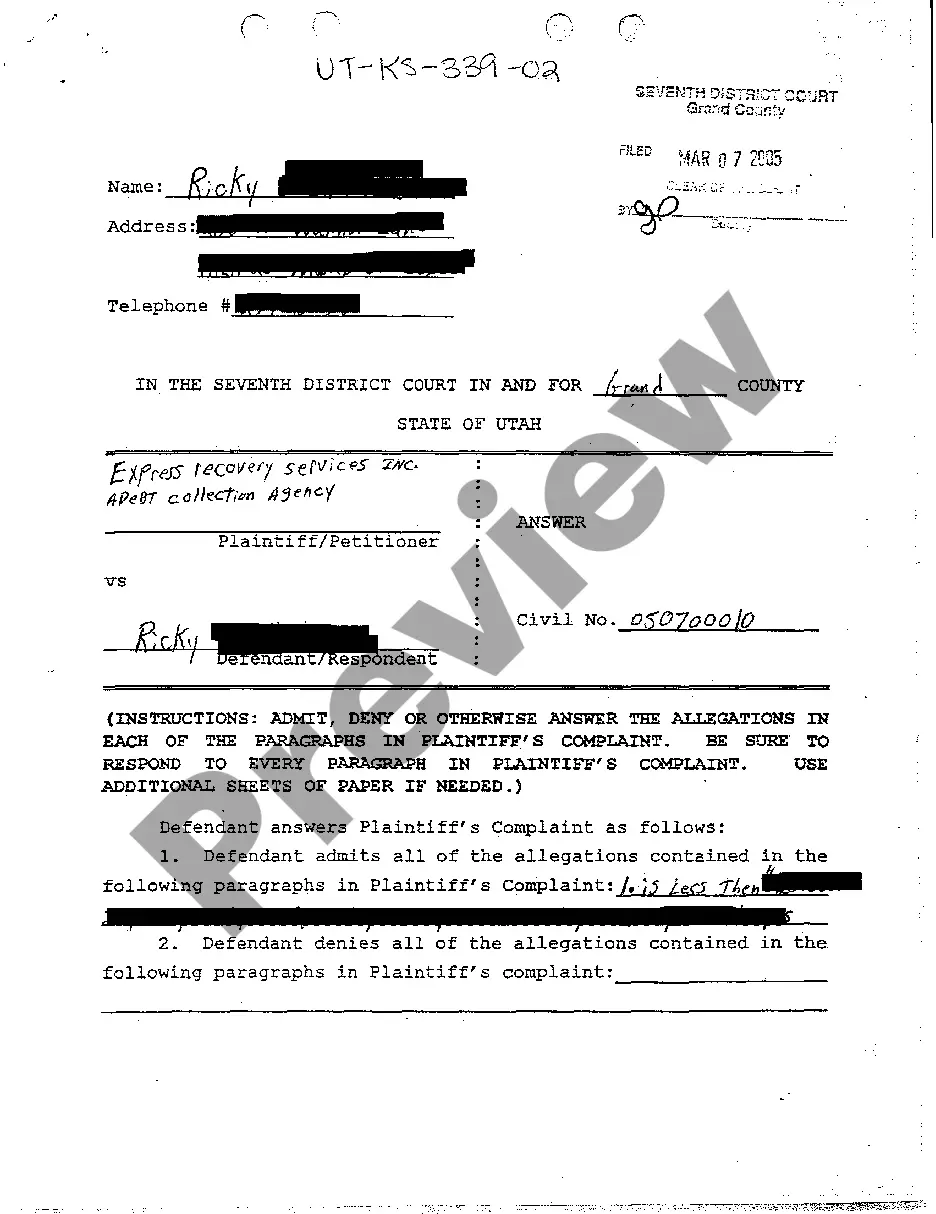

How to fill out New Hampshire Letter To Lender For Produce The Note Request?

If you need to obtain, download, or print authorized document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Make use of the website's simple and convenient search feature to find the documents you require.

A range of templates for business and personal purposes are categorized by industries and states, or by keywords.

Every legal document format you purchase is yours for a lifetime. You have access to each form you acquired in your account.

Complete and download, and print the New Hampshire Letter to Lender for Produce the Note Request using US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Employ US Legal Forms to acquire the New Hampshire Letter to Lender for Produce the Note Request with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and hit the Get button to retrieve the New Hampshire Letter to Lender for Produce the Note Request.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step1. Ensure that you have selected the form for the correct city/state.

- Step 2. Use the Preview function to review the form's contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form type.

- Step 4. Once you have found the form you need, click the Download now button. Choose your preferred pricing plan and input your information to register for an account.

- Step 5. Complete the transaction. You can use a credit card or PayPal account to finish the purchase.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the New Hampshire Letter to Lender for Produce the Note Request.

Form popularity

FAQ

Unlike a mortgage, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

1. Request loan paperwork from your lender. The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents.

When a lender cannot produce a note, then they are not able to prove when they took ownership or assignment of the note. A court may dismiss the case as a result.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

Search the county recorder's records. Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

More info

Search results for: 1) What Mortgage Note Rocket Mortgage Toggle navigation Related: Related: Home Mortgage Help “The problem with the bank and the whole banking system is that they are not a part of the economy anymore. They control everything.” — Thomas P. Friedman Mortgage Note Rocket is a web app created for Mac and iPhone.