New Hampshire Assignment of Deed of Trust

Description

How to fill out Assignment Of Deed Of Trust?

Discovering the right authorized document template could be a have difficulties. Obviously, there are tons of templates available on the Internet, but how will you get the authorized type you need? Make use of the US Legal Forms web site. The service delivers thousands of templates, for example the New Hampshire Assignment of Deed of Trust, which you can use for company and personal needs. Each of the varieties are checked out by pros and meet up with federal and state needs.

In case you are presently signed up, log in for your accounts and click on the Down load switch to have the New Hampshire Assignment of Deed of Trust. Make use of your accounts to check from the authorized varieties you possess ordered previously. Visit the My Forms tab of your respective accounts and have another version of the document you need.

In case you are a whole new end user of US Legal Forms, allow me to share basic recommendations so that you can follow:

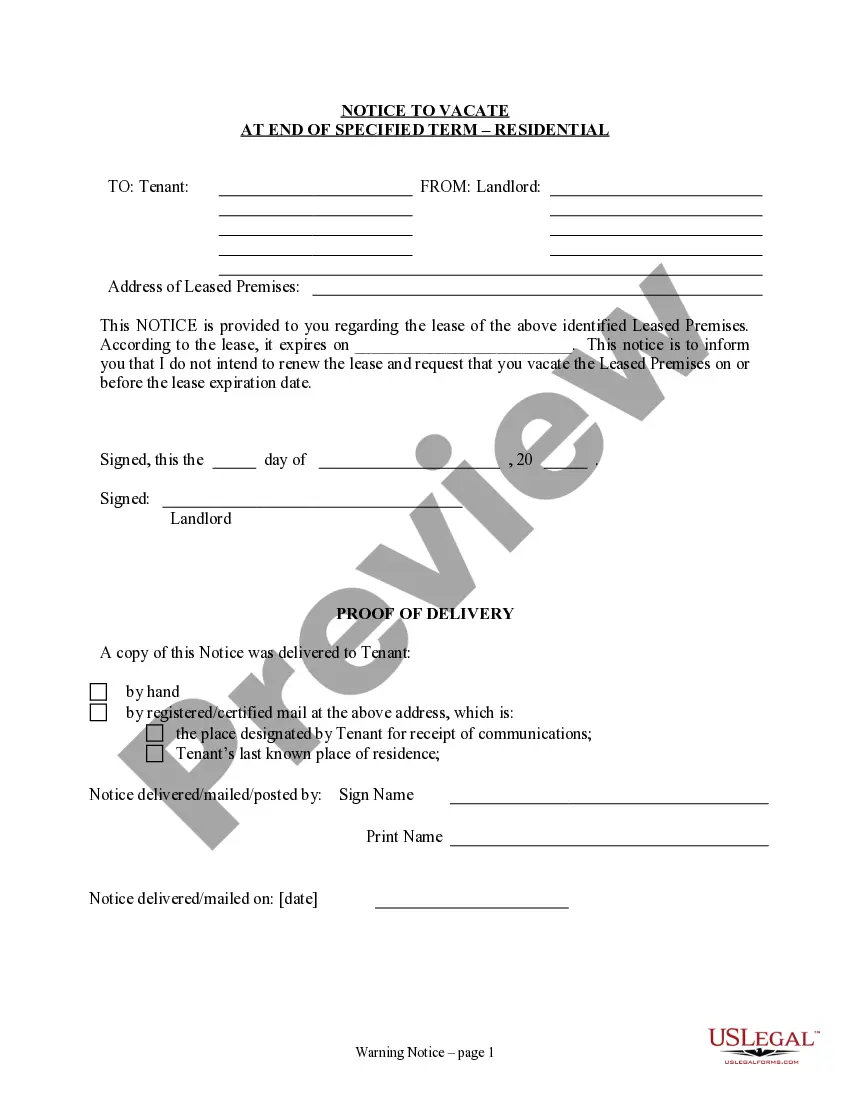

- Very first, ensure you have chosen the appropriate type to your area/region. You may look through the form using the Review switch and read the form information to ensure this is the best for you.

- In case the type is not going to meet up with your needs, take advantage of the Seach area to find the appropriate type.

- Once you are certain the form is acceptable, select the Get now switch to have the type.

- Opt for the prices strategy you need and type in the required details. Build your accounts and pay for your order with your PayPal accounts or charge card.

- Select the data file format and down load the authorized document template for your device.

- Total, change and produce and signal the attained New Hampshire Assignment of Deed of Trust.

US Legal Forms is definitely the most significant library of authorized varieties where you can discover different document templates. Make use of the service to down load skillfully-produced paperwork that follow express needs.