Title: Exploring New Hampshire Miller Trust Forms for Assisted Living: A Comprehensive Guide Introduction: In New Hampshire, Miller Trust Forms for Assisted Living play a crucial role in ensuring the provision of care and financial support for individuals seeking assistance with their long-term care needs. This detailed description aims to shed light on these forms, their significance, and potential variations available within the state. 1. Understanding the Miller Trust: A Miller Trust, also known as a Qualified Income Trust (QIT), is a legal entity established to help individuals residing in assisted living facilities or nursing homes qualify for Medicaid benefits, particularly when their income exceeds the state's eligibility threshold. By redirecting excess income into this trust, individuals can meet the income requirements to receive financial assistance. 2. Purpose and Benefits of Miller Trust Forms: The primary purpose of Miller Trust Forms in New Hampshire is to provide financial relief for individuals requiring long-term care who would otherwise be deemed ineligible due to excessive income. The trust allows them to qualify for Medicaid, covering the costs of their assisted living services. Key benefits include: — Preserving eligibility for Medicaid benefits while using excess income to pay for necessary care. — Ensuring individuals have access to quality long-term care without financially burdening themselves or their families. — Providing a legal mechanism for managing income and optimizing Medicaid eligibility. 3. Different Types of New Hampshire Miller Trust Forms: While there are no specific variations of Miller Trust Forms based on assisted living in New Hampshire, the basic structure and guidelines remain the same. The main differentiating factor lies in the individual's income and the need for a Miller Trust to ensure Medicaid eligibility. However, it is crucial to consult with legal professionals who specialize in Medicaid planning to determine the most appropriate form based on individual circumstances. 4. Establishing a Miller Trust in New Hampshire: To establish a Miller Trust in New Hampshire for assisted living purposes, individuals must comply with the following steps: a) Seek guidance: Consult an attorney experienced in Medicaid planning to understand the requirements and process. b) Determine income limits: Calculate annual income to identify if it exceeds New Hampshire's Medicaid eligibility threshold. c) Create the trust: Establish the Miller Trust, ensuring it adheres to the state's guidelines and legal prerequisites. d) Redirect income: Direct the excess income into the trust account. e) Medicaid application: Work with a Medicaid specialist to complete the necessary application, including documentation related to the Miller Trust. f) Ongoing compliance: Maintain proper records and ensure the trust remains in compliance with New Hampshire's Medicaid regulations. Conclusion: New Hampshire Miller Trust Forms for Assisted Living serve as a vital tool in helping individuals bridge the financial gap between their income and Medicaid eligibility requirements. Understanding the purpose and benefits of these forms, along with the process involved in establishing and maintaining a Miller Trust, is crucial for those seeking long-term care assistance while residing in assisted living facilities in New Hampshire.

New Hampshire Miller Trust Forms for Assisted Living

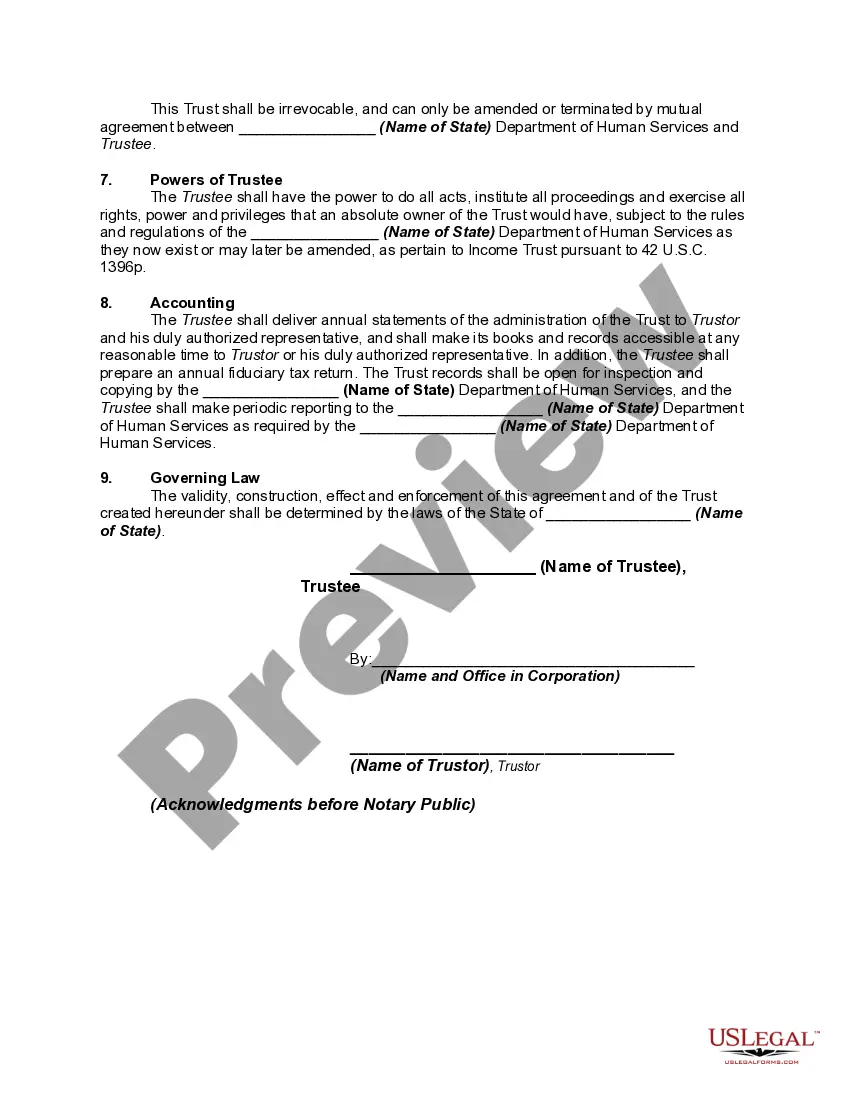

Description

How to fill out New Hampshire Miller Trust Forms For Assisted Living?

Finding the right lawful papers design can be quite a struggle. Needless to say, there are a lot of layouts available on the net, but how will you get the lawful develop you want? Use the US Legal Forms web site. The service offers thousands of layouts, such as the New Hampshire Miller Trust Forms for Assisted Living, that you can use for organization and private needs. Each of the varieties are inspected by pros and meet federal and state demands.

When you are previously signed up, log in for your profile and then click the Obtain key to find the New Hampshire Miller Trust Forms for Assisted Living. Utilize your profile to look from the lawful varieties you possess bought in the past. Check out the My Forms tab of your own profile and obtain yet another copy of the papers you want.

When you are a brand new customer of US Legal Forms, listed here are straightforward recommendations that you can comply with:

- Initial, make sure you have chosen the proper develop for your personal metropolis/state. You may examine the form making use of the Review key and study the form information to guarantee this is basically the best for you.

- When the develop does not meet your requirements, use the Seach industry to find the correct develop.

- When you are certain that the form is acceptable, click the Buy now key to find the develop.

- Opt for the rates strategy you would like and enter in the necessary information and facts. Build your profile and pay for the order making use of your PayPal profile or bank card.

- Pick the file formatting and down load the lawful papers design for your product.

- Complete, edit and print out and signal the attained New Hampshire Miller Trust Forms for Assisted Living.

US Legal Forms will be the most significant collection of lawful varieties in which you can see numerous papers layouts. Use the company to down load professionally-produced paperwork that comply with state demands.