This form is a generic for filing an affidavit that is to be filed with a court. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities

Description

How to fill out Affidavit Or Proof Of Income And Property - Assets And Liabilities?

If you wish to collect, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

Various templates for professional and personal purposes are organized by categories and states or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other types of the legal form format.

Step 4. Once you have found the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your details to create an account.

- Leverage US Legal Forms to obtain the New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities in just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to retrieve the New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

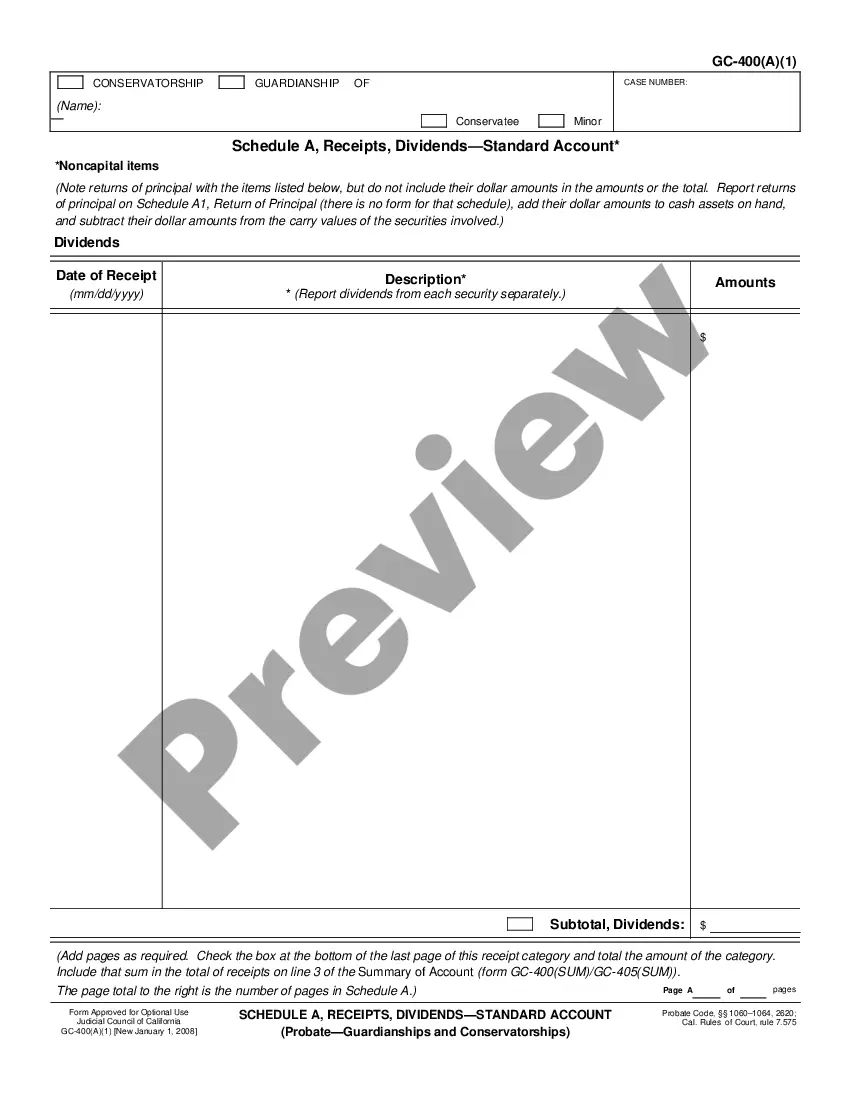

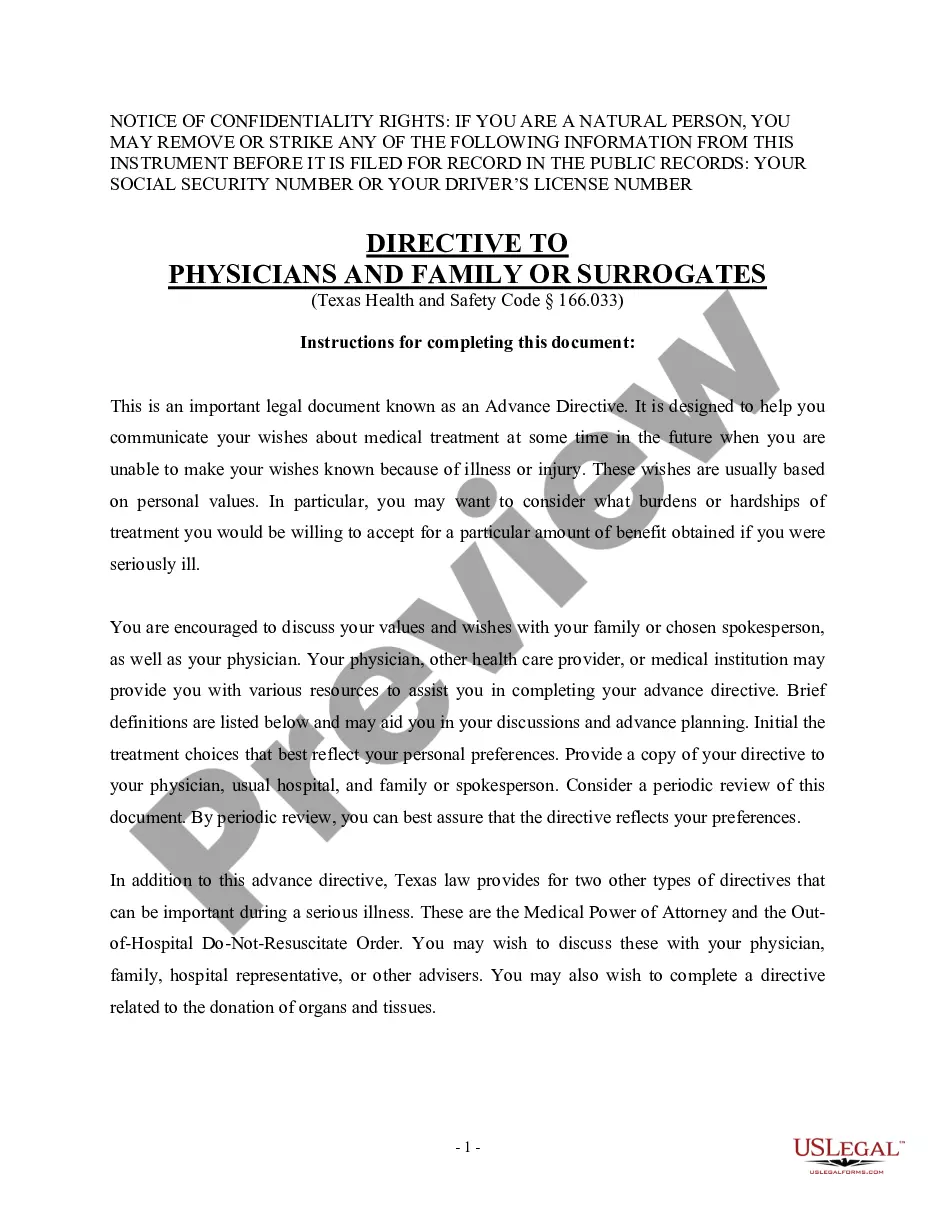

- Step 2. Utilize the Preview option to review the content of the form. Be sure to check the outline.

Form popularity

FAQ

To fill out a financial affidavit for divorce, start by compiling your financial records, including income statements, bank accounts, and debts. Clearly present your assets and liabilities to ensure full disclosure during the divorce process. Utilizing a resource like the New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities from uslegalforms will guide you in preparing a comprehensive and accurate affidavit, streamlining your divorce proceedings.

An affidavit example serves as a guide to help individuals understand how to format and present their financial information correctly. It illustrates the kind of information needed and offers a structure for your own affidavit. By using an example of a New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities, you can enhance your accuracy and professionalism in legal submissions.

A financial affidavit is used to disclose an individual’s economic situation in legal settings, such as court hearings or financial negotiations. It helps judges assess issues like alimony or child support by providing a comprehensive view of one's financial capacity. The New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities is essential in presenting your case clearly and accurately.

Filling out an affidavit of financial information involves gathering and organizing all relevant financial details. Start by listing your income sources, monthly expenses, assets, and liabilities accurately. Using a reliable template like the New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities from uslegalforms can simplify this process, ensuring you include all necessary information.

A financial affidavit is a document that outlines an individual's financial status, including income, expenses, assets, and liabilities. This affidavit is often required in legal proceedings, such as divorce or child support cases, to demonstrate financial capabilities. When submitting a New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities, it's vital to provide accurate information for fair legal decisions.

An affidavit in finance is a written statement confirmed by oath or affirmation, typically used in legal matters. It serves as a formal declaration of facts related to financial conditions, income, property, assets, and liabilities. For example, a New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities provides essential information to the court, helping in various financial evaluations.

Filling out a financial affidavit requires careful attention to detail. You should list your income, including wages, bonuses, and any rental income, and then itemize your monthly expenses, such as mortgage or rent, utilities, and insurance. It is essential to include your assets, such as savings accounts and real estate, as well as any liabilities, like loans and credit card debt. The New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities from US Legal Forms can provide you with structured forms and guidelines to ensure accuracy and compliance.

Completing a domestic relations financial affidavit in New Hampshire involves providing a comprehensive overview of your financial status. Start by detailing your monthly income from all sources, followed by expenses related to housing, utilities, and child support. Ensure you report all property and debts to create a clear picture of your financial health. Platforms like US Legal Forms offer resources and forms specifically for the New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities, making the process more straightforward.

To fill out an affidavit for child support in New Hampshire, you should start by gathering all necessary financial documents that detail your income, assets, and liabilities. You will typically need to provide information about your monthly income, expenses, and existing obligations. The New Hampshire Affidavit or Proof of Income and Property - Assets and Liabilities can guide you through the required sections, ensuring you include all pertinent numbers. Using a platform like US Legal Forms can simplify this process by providing templates and instructions tailored to your needs.

Filling out an affidavit of claim requires you to present clear and concise information regarding your claim. Begin by detailing your personal information, as well as specifics about the claim and relevant supporting documents. Using a structured template, like those available from uslegalforms, can help streamline the process and ensure all necessary components are included.