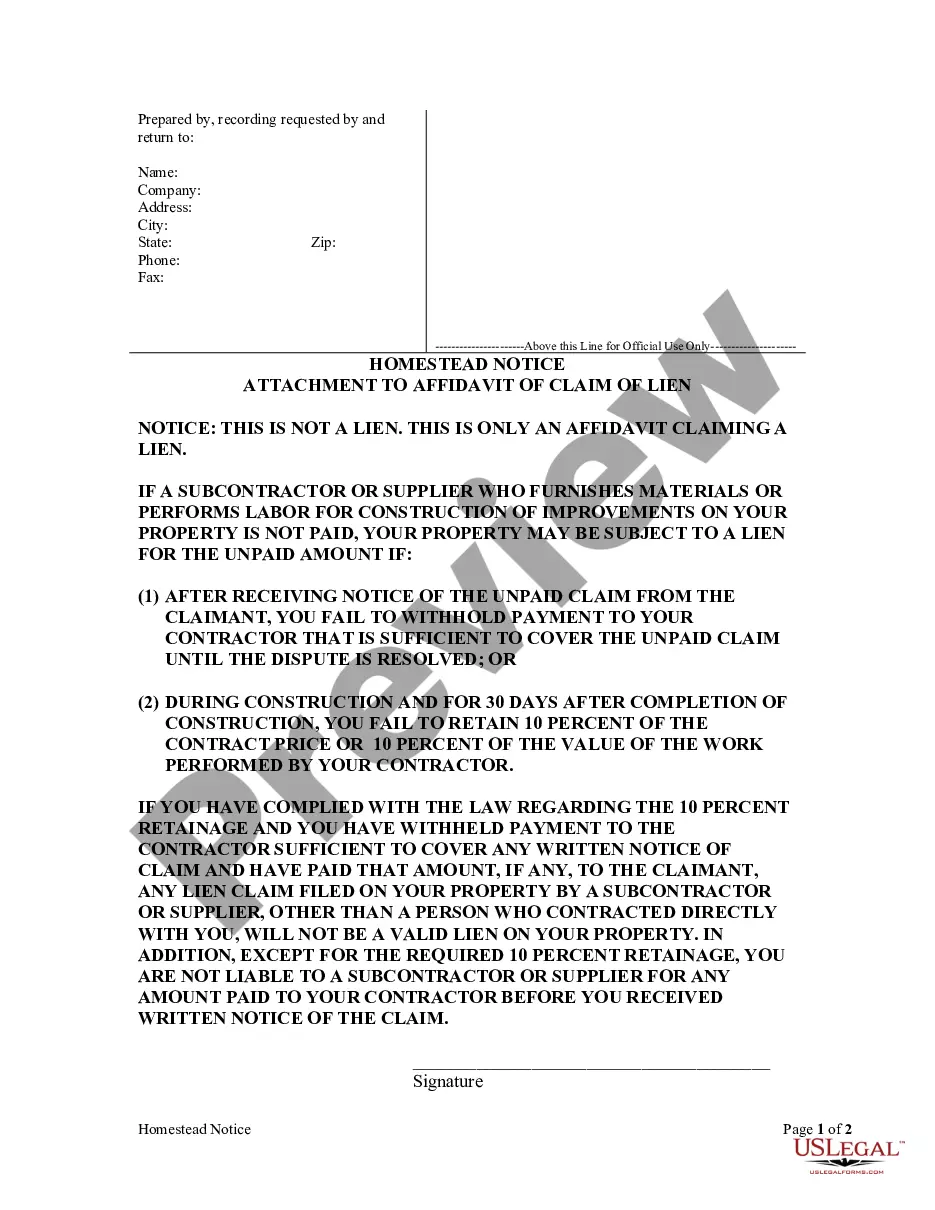

Where statutes specify the manner in which a homestead may be released or waived in a particular jurisdiction, such statutes must be strictly followed. In some jurisdictions, there can be no waiver except by deed. Other statutes require that the waiver be acknowledged or witnessed, recorded, or incorporated in an instrument that is independent of the agreement.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the New Hampshire Declaration of Abandonment of Homestead By Husband and Wife Keywords: New Hampshire, declaration of abandonment, homestead, husband and wife, property ownership, marital rights Introduction: The New Hampshire Declaration of Abandonment of Homestead By Husband and Wife refers to a legal document that allows married couples in New Hampshire to voluntarily abandon their homestead rights over a property. This declaration becomes relevant when spouses decide to relinquish their interests or protections associated with homestead rights and wish to waive them formally. It is important to note that there are no significant variations of this declaration in terms of types. Explanation: 1. Definition of Homestead Rights: Homestead rights signify the legal provisions that protect the principal residence of a homeowner from certain liens, creditors, and forced sale during bankruptcy or foreclosure. In the context of New Hampshire, the homestead rights are under the jurisdiction of RSA 480:1 and RSA 480:2. 2. Purpose of New Hampshire Declaration of Abandonment of Homestead By Husband and Wife: This declaration assures the intentional renouncement of homestead rights by both spouses involved. By signing this document, the husband and wife declare that they voluntarily waive and abandon their interests in the property-defined homestead exemptions. 3. Process and Elements of the Declaration: a) Consent and Agreement: Both spouses must agree to the abandonment of the property's homestead rights. This declaration cannot be completed by one spouse alone; it requires mutual consent. b) Legal Documentation: Appropriate legal documents must be obtained and completed accurately. Seek professional legal assistance to ensure all the necessary components are addressed. c) Declaration Contents: The declaration form includes essential details such as the names of husband and wife, property address, date of signing, a clear statement of waiver and abandonment of homestead rights, and signatures of both spouses. d) Notarization: While not mandatory, obtaining notarization for the declaration can add validity and make it more legally enforceable. 4. Implications and Advantages: a) Protection from Creditors: By abandoning their homestead rights, spouses may lose certain protections against creditors that are usually provided under homestead laws. b) Property Liabilities: Abandonment of homestead rights may expose the property to potential claims or legal actions. c) Flexibility for Future Transactions: The abandonment declaration creates flexibility for future transactions involving the property, such as refinancing, sale, or mortgage satisfaction, without any restrictions associated with homestead rights. Conclusion: The New Hampshire Declaration of Abandonment of Homestead By Husband and Wife allows for a formal renouncement of homestead rights by married couples. By signing this declaration, spouses voluntarily waive their interests and protections associated with homestead rights, enabling them to proceed with future transactions involving the property without hindrance. It is vital to consult with legal professionals to ensure that the abandonment declaration complies with all the necessary legal requirements in New Hampshire.