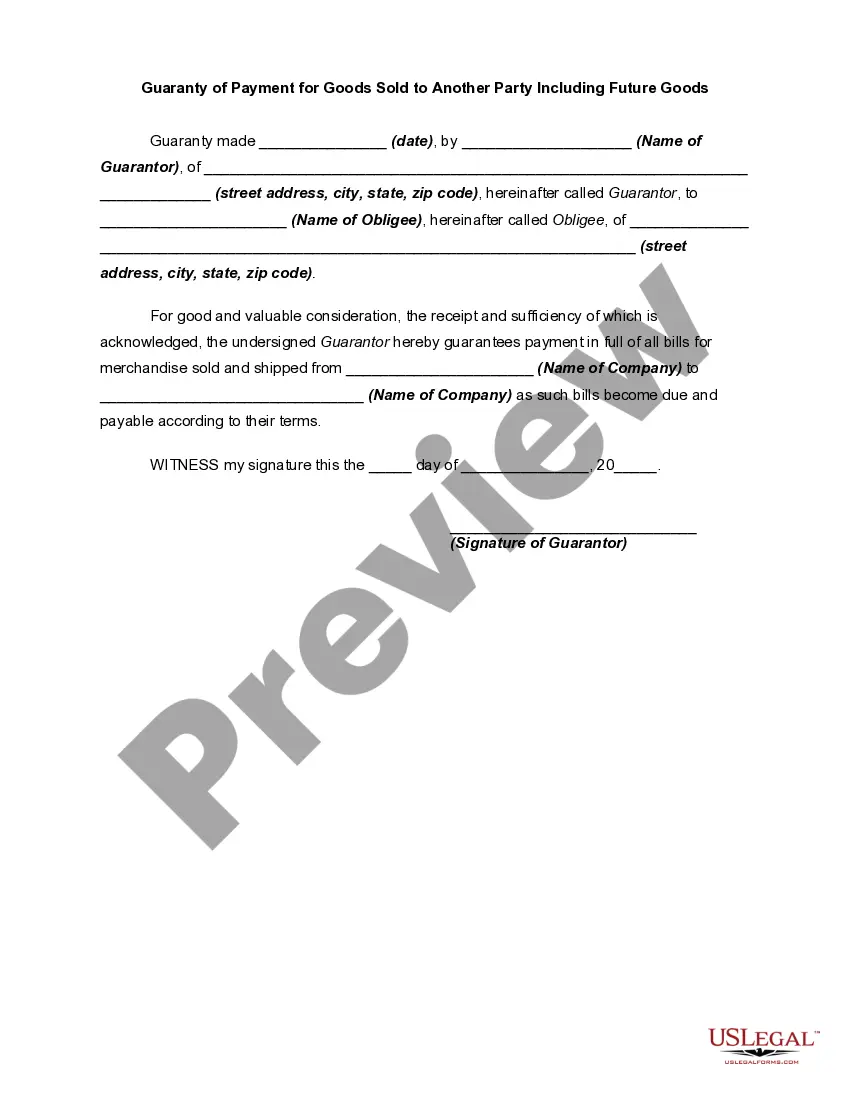

A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

New Hampshire Guaranty of Payment for Goods Sold to Another Party Including Future Goods is a legal document that ensures a seller's protection in the event of non-payment by the buyer. It serves as a guarantee that the buyer will compensate the seller for all goods sold, including future transactions. This guaranty establishes a legally binding agreement and ensures that the seller can recover their costs if the buyer fails to make payment. In New Hampshire, there are primarily two types of Guaranty of Payment for Goods Sold to Another Party Including Future Goods: 1. General Guaranty of Payment: This type of guaranty covers all existing and future transactions between the seller and the buyer. It safeguards the seller from any potential losses by ensuring that the buyer's obligations are met in terms of payment for goods. 2. Specific Guaranty of Payment: Unlike a general guaranty, a specific guaranty is limited to a particular transaction or series of transactions. It covers only the goods sold under the specified agreement and does not extend to future transactions. This type of guaranty is often used when parties want to secure a one-time or limited sale. The New Hampshire Guaranty of Payment for Goods Sold to Another Party Including Future Goods document typically includes the following key elements and clauses: 1. Parties involved: The guaranty document will identify and provide the names and addresses of parties involved, including the seller, buyer, and guarantor. 2. Goods and future transactions: It will outline the specific goods covered by the guaranty and clarify whether it extends to future transactions or is limited to a specific transaction. 3. Payment terms: The document will establish the payment terms and conditions, including due dates, interest rates if applicable, and methods of payment acceptable by the seller. 4. Guarantor's obligations: The guaranty will outline the guarantor's responsibilities, which include guaranteeing the payment of goods sold and any related costs or expenses. 5. Default and remedies: It will specify the actions the seller can take in the event of the buyer's default, such as the right to pursue legal actions, seek damages, or secure collateral. 6. Governing law: The document will state that it is governed by New Hampshire laws and any disputes arising from the guaranty will be resolved within the state's jurisdiction. It is critical for both the seller and guarantor to carefully review and understand the terms outlined in the Guaranty of Payment for Goods Sold to Another Party Including Future Goods. Seeking legal advice before entering into such an agreement is highly recommended ensuring compliance and protect one's interests.New Hampshire Guaranty of Payment for Goods Sold to Another Party Including Future Goods is a legal document that ensures a seller's protection in the event of non-payment by the buyer. It serves as a guarantee that the buyer will compensate the seller for all goods sold, including future transactions. This guaranty establishes a legally binding agreement and ensures that the seller can recover their costs if the buyer fails to make payment. In New Hampshire, there are primarily two types of Guaranty of Payment for Goods Sold to Another Party Including Future Goods: 1. General Guaranty of Payment: This type of guaranty covers all existing and future transactions between the seller and the buyer. It safeguards the seller from any potential losses by ensuring that the buyer's obligations are met in terms of payment for goods. 2. Specific Guaranty of Payment: Unlike a general guaranty, a specific guaranty is limited to a particular transaction or series of transactions. It covers only the goods sold under the specified agreement and does not extend to future transactions. This type of guaranty is often used when parties want to secure a one-time or limited sale. The New Hampshire Guaranty of Payment for Goods Sold to Another Party Including Future Goods document typically includes the following key elements and clauses: 1. Parties involved: The guaranty document will identify and provide the names and addresses of parties involved, including the seller, buyer, and guarantor. 2. Goods and future transactions: It will outline the specific goods covered by the guaranty and clarify whether it extends to future transactions or is limited to a specific transaction. 3. Payment terms: The document will establish the payment terms and conditions, including due dates, interest rates if applicable, and methods of payment acceptable by the seller. 4. Guarantor's obligations: The guaranty will outline the guarantor's responsibilities, which include guaranteeing the payment of goods sold and any related costs or expenses. 5. Default and remedies: It will specify the actions the seller can take in the event of the buyer's default, such as the right to pursue legal actions, seek damages, or secure collateral. 6. Governing law: The document will state that it is governed by New Hampshire laws and any disputes arising from the guaranty will be resolved within the state's jurisdiction. It is critical for both the seller and guarantor to carefully review and understand the terms outlined in the Guaranty of Payment for Goods Sold to Another Party Including Future Goods. Seeking legal advice before entering into such an agreement is highly recommended ensuring compliance and protect one's interests.