In this form, the Buyer is assuming the indebtedness on a loan used to purchase a vehicle. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness

Description

How to fill out Conditional Sales Agreement Of Automobile Between Individuals And Assumption Of Outstanding Indebtedness?

If you need to sum up, obtain, or create sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Leverage the website's straightforward and user-friendly search function to locate the documents required. A variety of templates for corporate and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to find the New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to access the New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. You can also retrieve forms you have downloaded previously in the My documents tab of your account.

Each legal document template you acquire is your property indefinitely. You have access to every form you downloaded within your account. Click the My documents section and select a document to print or download again.

Act quickly and obtain, as well as print the New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness using US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

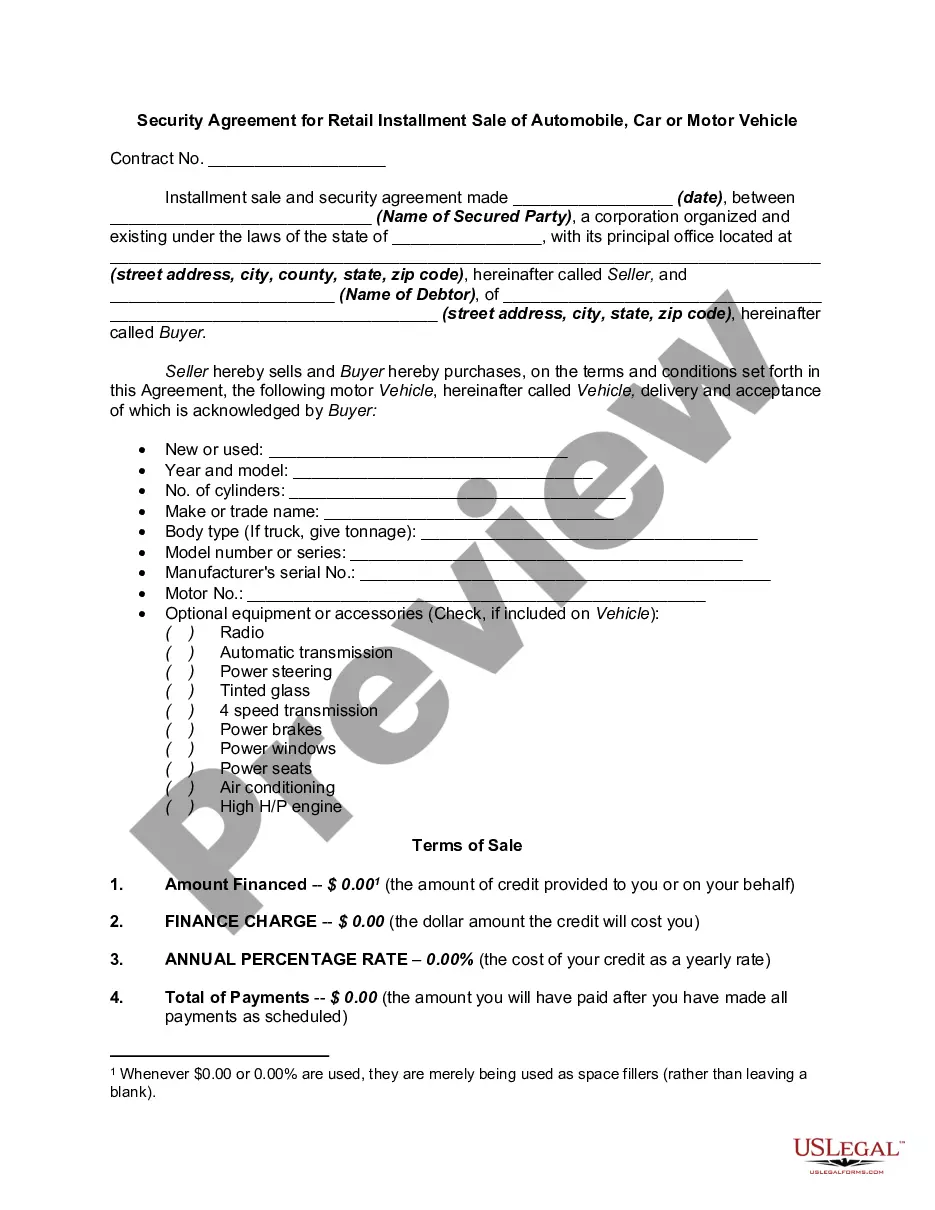

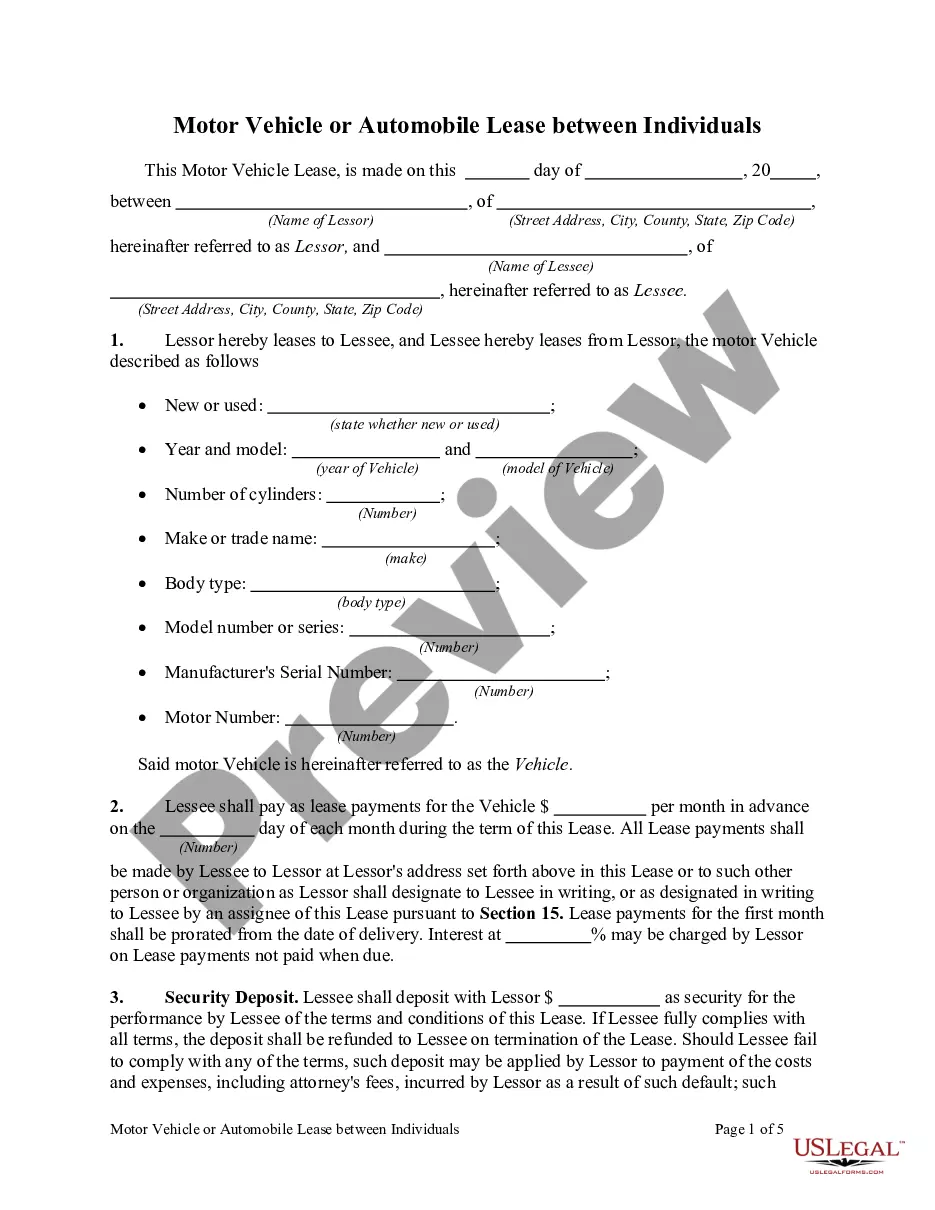

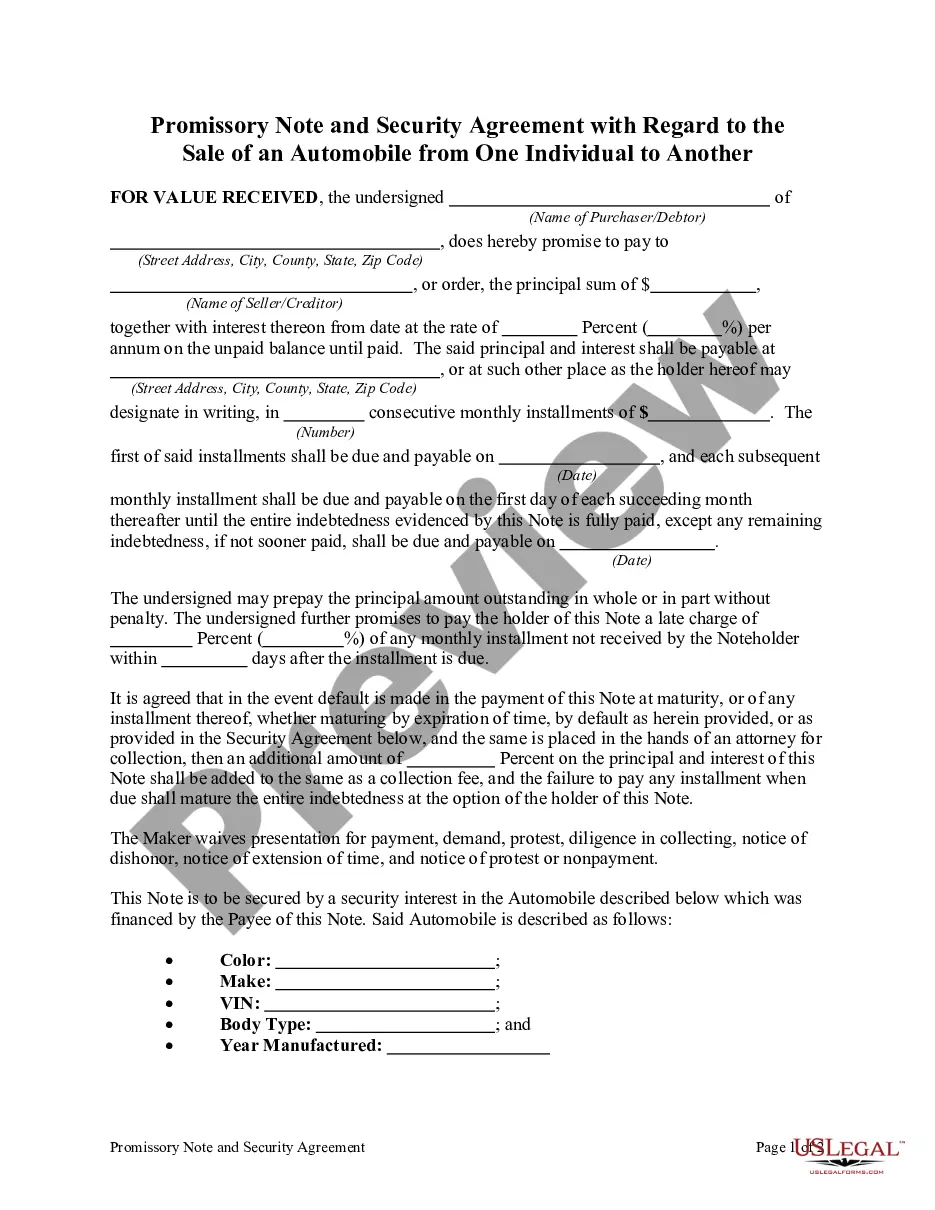

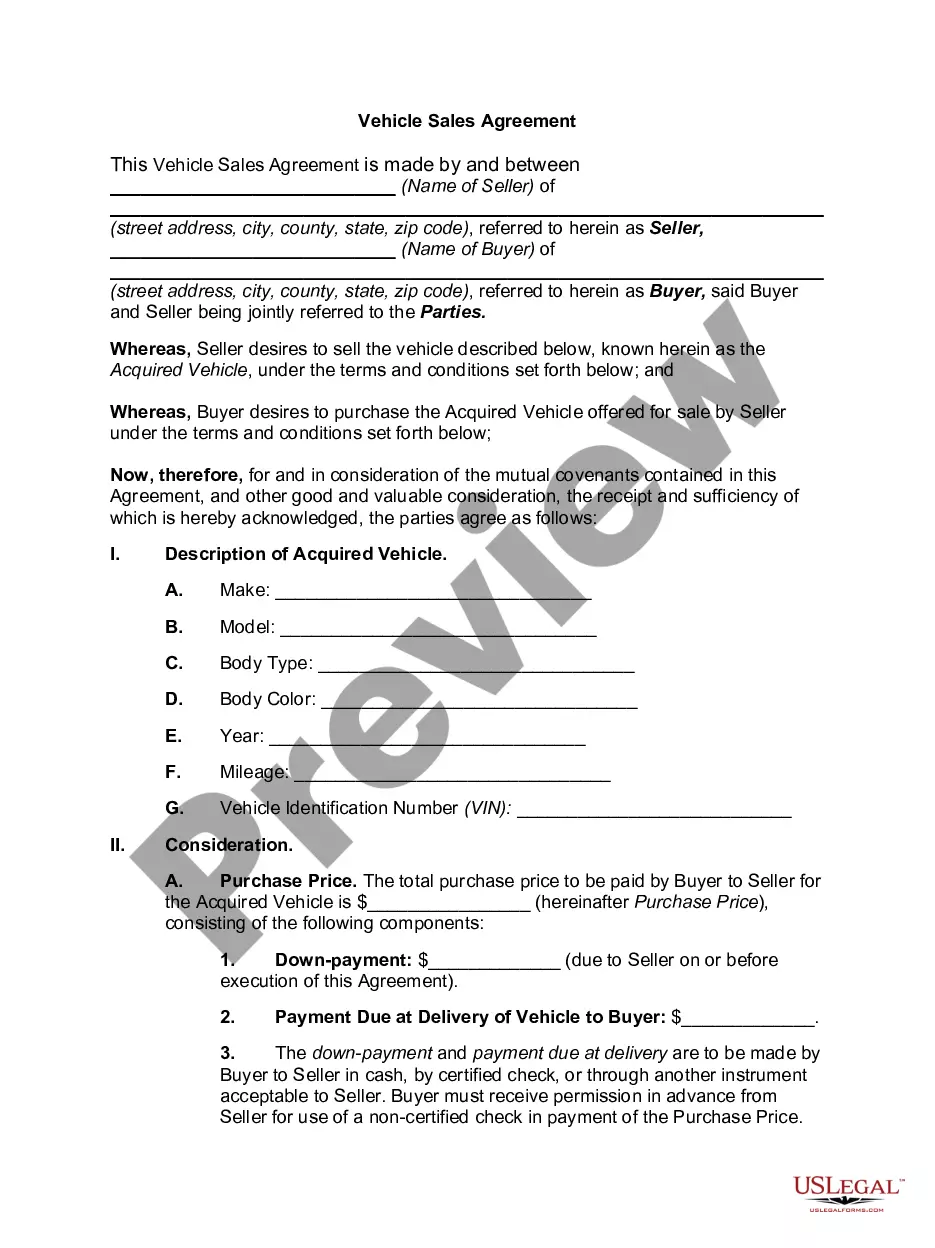

- Step 2. Utilize the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are unsatisfied with the document, use the Search field at the top of the screen to find other variations of the legal document.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness.

Form popularity

FAQ

To write a private car sale agreement, start by gathering essential information about both the buyer and seller, including names and contact details. Clearly describe the vehicle, including its make, model, year, and vehicle identification number (VIN). Incorporate terms, such as payment amount and schedule, referencing a New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness where necessary, to ensure all conditions are clearly defined and understood by both parties.

A conditional sale agreement is a contract between a seller and a buyer that stipulates ownership of an item remains with the seller until certain conditions are met. In the context of a New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, this means that the buyer makes payments over time, and ownership transfers only after the final payment. This arrangement helps protect the seller while providing the buyer an opportunity to own the vehicle.

A conditional bill of sale is a document that outlines the terms under which the buyer acquires an asset, such as an automobile, while a lien is retained by the seller until payment is completed. For instance, in a New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, the buyer may take possession of the car but must make specific payments to fully own it. Until all payments are made, the seller retains certain rights to the vehicle.

In New Hampshire, the vehicle title does not need to be notarized to transfer ownership. However, it is essential to ensure that all parties understand what the New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness entails, especially if it involves outstanding loans. This clarity can help mitigate future disputes related to the vehicle.

To sell your car privately in New Hampshire, you'll need a few key documents, including the vehicle title, a bill of sale, and any maintenance records. The New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness can be extremely helpful in detailing any agreements about unpaid debts. Additional paperwork, like a transfer of ownership form, may also be required to complete the sale.

In New Hampshire, a bill of sale does not require notarization to be valid; however, having it notarized can add a layer of assurance. The New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness can also guide you in drafting a document that meets legal standards without needing a notary. Nevertheless, if you wish to add credibility, notarization may benefit both buyer and seller.

You can write up a bill of sale for your vehicle, but for the process to be legally solid, you should consider using a New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. This method can offer more protection for both parties and ensure that any outstanding debts are clearly addressed. By using established templates, you can save time and avoid potential legal complications.

An example of a conditional contract is a rental agreement that specifies tenancy contingent on the payment of rent. In a New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, the contract stipulates that the buyer receives the vehicle as long as they adhere to payment terms. These contracts cater to various situations, providing clear guidelines for transactions.

While a conditional sales contract shares similarities with a financing lease, they are not the same. A New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness typically involves a transfer of ownership upon fulfillment of conditions, whereas financing leases often do not result in ownership transfer. It's essential to understand these distinctions when entering into such agreements to choose the right option for your needs.

A conditional sale is a transaction where the transfer of ownership is contingent on the buyer meeting certain conditions. This type of agreement is common in the New Hampshire Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. The buyer may take possession of the vehicle but does not receive full ownership until they complete all payment obligations. This structure benefits both parties by clearly defining responsibilities.