Until a conveyance, lease, or instrument executed for security purposes which may be recorded under ??? 44107(a)(1) or (2) has been filed with the FAA, it is valid only against the parties to the instrument and individuals and entities who have actual knowledge of the instrument. Therefore, the interests of the parties to a transaction, including purchasers, lessor, lessees and secured parties, are not perfected until the instruments creating those interests have been filed with the FAA.

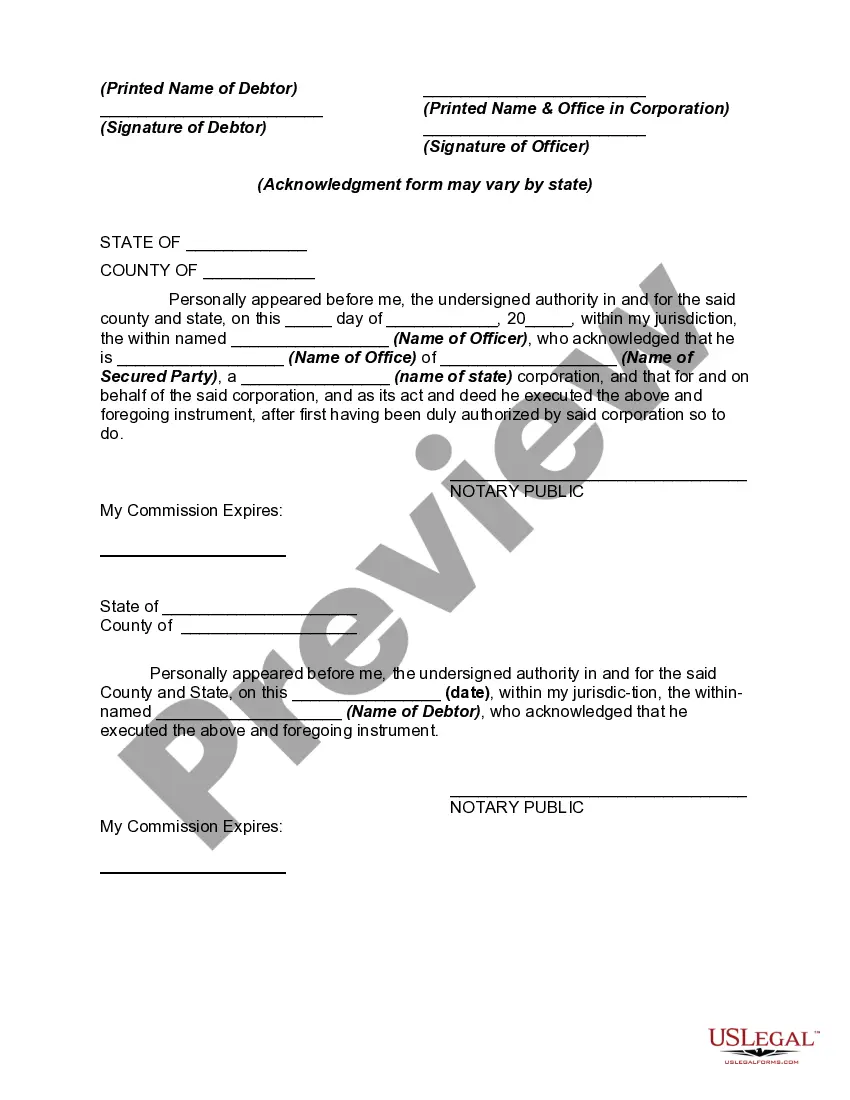

A New Hampshire Security Agreement Regarding Aircraft and Equipment refers to a legal document that is created to establish a security interest in aircraft and related equipment located in the state of New Hampshire. This agreement serves as a contractual arrangement between a debtor (usually an aircraft owner or operator) and a creditor (typically a lender or financial institution) to secure the repayment of a loan or debt. The New Hampshire Security Agreement Regarding Aircraft and Equipment is governed by the Uniform Commercial Code (UCC) under Article 9, which provides rules and regulations for securing interests in personal property, including aircraft. This agreement outlines the terms and conditions for the collateral being used to secure the debtor's obligation. It establishes the rights and responsibilities of both parties involved and the procedures to be followed in case of default or non-repayment. Keywords: New Hampshire, security agreement, aircraft, equipment, legal document, collateral, debtor, creditor, lender, financial institution, loan, Uniform Commercial Code, UCC, Article 9, personal property, rights, responsibilities, default, non-repayment. Types of New Hampshire Security Agreements Regarding Aircraft and Equipment: 1. Aircraft Financing Security Agreement: This type of agreement is specifically created when an individual or entity borrows money to purchase or refinance an aircraft. The lender, as the creditor, would hold a security interest in the aircraft and its related equipment until the loan is repaid. 2. Equipment Lease Security Agreement: In this type of agreement, an aircraft owner leases their equipment to a lessee. The lessee may secure their interest in the leased equipment, including the aircraft, by creating a security agreement. This gives the lessee certain rights and protections in case of default by the lessee. 3. Vendor's Security Agreement: When an entity sells aircraft or equipment on credit, they may require a security agreement as a way to secure their rights and interests in the sold items until the payment is made in full. This agreement allows the seller to repossess the aircraft or equipment in case of default or non-payment. 4. Cross-Collateralization Agreement: Sometimes, a creditor may require a security agreement that covers multiple aircraft and equipment to secure a larger loan or debt. This type of agreement enables the creditor to hold a security interest in all identified collateral, minimizing the risk of default. Keywords: aircraft financing, collateral, equipment lease, security interest, borrower, lessee, vendor, creditor, cross-collateralization, default, repayment.