The New Hampshire Community Property Agreement, also known as CPA's, is a legal document that allows spouses to change their ownership of property from separate property to community property. By entering into this agreement, couples can convert their separate property into shared marital property, resulting in equal ownership and potential benefits in case of divorce, separation, or death. In New Hampshire, there are two types of Community Property Agreements available: the Uniform Marital Property Act (MPA) and the New Hampshire Community Property Agreements Act (CAA). Both types serve a similar purpose but have distinct characteristics. 1. Uniform Marital Property Act (MPA): Under MPA, spouses can create a Community Property Agreement by filing a declaration with the county clerk's office. This agreement establishes that all property, assets, and debts acquired during the marriage become community property, regardless of individual contributions. MPA ensures equitable division of property in case of divorce or separation. 2. New Hampshire Community Property Agreements Act (CAA): Similar to MPA, CAA enables spouses to convert their separate property into community property. However, CAA does not require formal documentation or public filing. Couples can create a Community Property Agreement by drafting a written contract signed by both parties. Although CAA does not provide as much legal protection as MPA, it offers flexibility and privacy. The New Hampshire Community Property Agreement grants numerous benefits to married couples. It promotes unity and shared responsibility within the marriage, as both spouses have an equal interest in the property acquired during the marriage. In the event of a divorce or separation, the agreement helps in determining fair asset division, thereby minimizing conflicts and providing a clearer framework for the distribution of community property. Additionally, a Community Property Agreement can simplify the estate planning process, allowing parties to pass on assets to their spouse more easily. It is essential to note that New Hampshire is not a community property state by default. Without a Community Property Agreement, the state follows an equitable distribution system during divorce proceedings, where property is divided based on factors like individual contributions, earning capacity, and economic circumstances. However, by entering into a New Hampshire Community Property Agreement, couples can override this default system and establish equitable joint ownership. In conclusion, the New Hampshire Community Property Agreement provides spouses with a legal instrument to establish shared ownership of property acquired during their marriage. By converting separate property into community property, couples can ensure equal division and potential benefits in the event of divorce, separation, or death. The two types of Community Property Agreements available in New Hampshire are the Uniform Marital Property Act (MPA) and the New Hampshire Community Property Agreements Act (CAA), each with its own set of regulations and advantages.

New Hampshire Community Property Agreement

Description

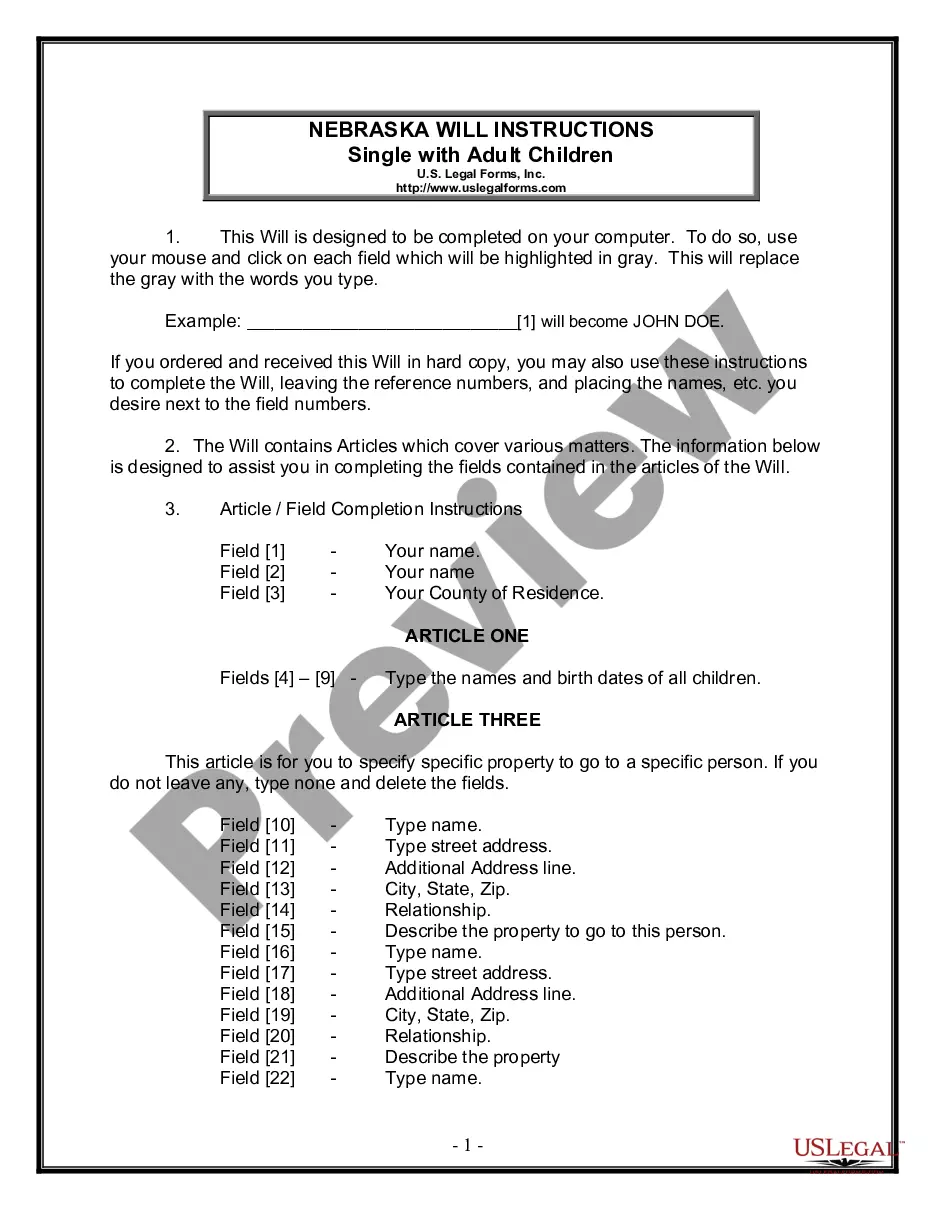

How to fill out New Hampshire Community Property Agreement?

If you need to total, obtain, or printing lawful record themes, use US Legal Forms, the greatest collection of lawful varieties, which can be found on the Internet. Use the site`s simple and easy handy look for to find the documents you require. Numerous themes for company and person functions are categorized by groups and says, or key phrases. Use US Legal Forms to find the New Hampshire Community Property Agreement in a handful of click throughs.

If you are previously a US Legal Forms consumer, log in to the bank account and click on the Obtain key to have the New Hampshire Community Property Agreement. You can also accessibility varieties you previously downloaded in the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have selected the form to the correct city/region.

- Step 2. Make use of the Review solution to check out the form`s content material. Never forget to learn the information.

- Step 3. If you are unhappy using the kind, make use of the Look for field at the top of the monitor to find other types of your lawful kind format.

- Step 4. Upon having found the form you require, click on the Purchase now key. Select the prices program you choose and include your references to register for the bank account.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the file format of your lawful kind and obtain it on your own gadget.

- Step 7. Total, edit and printing or indicator the New Hampshire Community Property Agreement.

Each and every lawful record format you purchase is your own forever. You may have acces to every single kind you downloaded inside your acccount. Select the My Forms area and choose a kind to printing or obtain yet again.

Remain competitive and obtain, and printing the New Hampshire Community Property Agreement with US Legal Forms. There are millions of specialist and state-specific varieties you can utilize for your company or person requirements.

Form popularity

FAQ

According to New Hampshire's property division laws for divorce, the courts see all property as marital property and divide them equally. This includes assets that individuals acquire before the marriage, as well as any gifts that either party receives, such as an inheritance, during the marriage.

New Hampshire recognizes the concept of marital and separate property, but its law makes both types of property subject to division in a divorce. In other words, any property the couple has at the time of divorce is on the table, regardless of where it came from or when a spouse acquired it.

New Hampshire is an "equitable distribution" state, which divides property based on a judge's determination of what's fair under the circumstances of each case. Community property states, on the other hand, allocate property between spouses as close to 50-50 as possible.

In New Hampshire all marital property is subject to division by the Court. Typically, all property, regardless of whose name the title to the property is held, is considered marital property and subject to division, subject to few exceptions.

New Hampshire is an "equitable distribution state, not a community property state. The judge decides what is fair, which doesn't mean a 50/50 split. The court has broad discretion to make a divorce order to fit the individual facts and particular circumstances of each case.

New Hampshire is NOT a community property state, which means that marital property is not automatically divided 50/50 between the spouses in a divorce case.

According to New Hampshire's property division laws for divorce, the courts see all property as marital property and divide them equally. This includes assets that individuals acquire before the marriage, as well as any gifts that either party receives, such as an inheritance, during the marriage.

New Hampshire is NOT a community property state, which means that marital property is not automatically divided 50/50 between the spouses in a divorce case.

More info

Net navicomedia.net Community Property Agreement: Introduction In Washington, any person can file a request for a community property agreement. The purpose of a community property agreement is to regulate and enforce a marriage or domestic partnership. It also provides guidelines to how property can pass between spouses. The community property agreement does not have to be registered with the courts or official records. When the two persons enter into a community property agreement, it is as if they have entered a contract and agreed to an arrangement of property ownership. For example, community property agreements can also include rules of usage such as when the property may be rented, or when tenants must vacate the property. A community property agreement can also require that a spouse or domestic partner give security for any marital or domestic partnership asset purchased while the partnership is active.