The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

New Hampshire Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

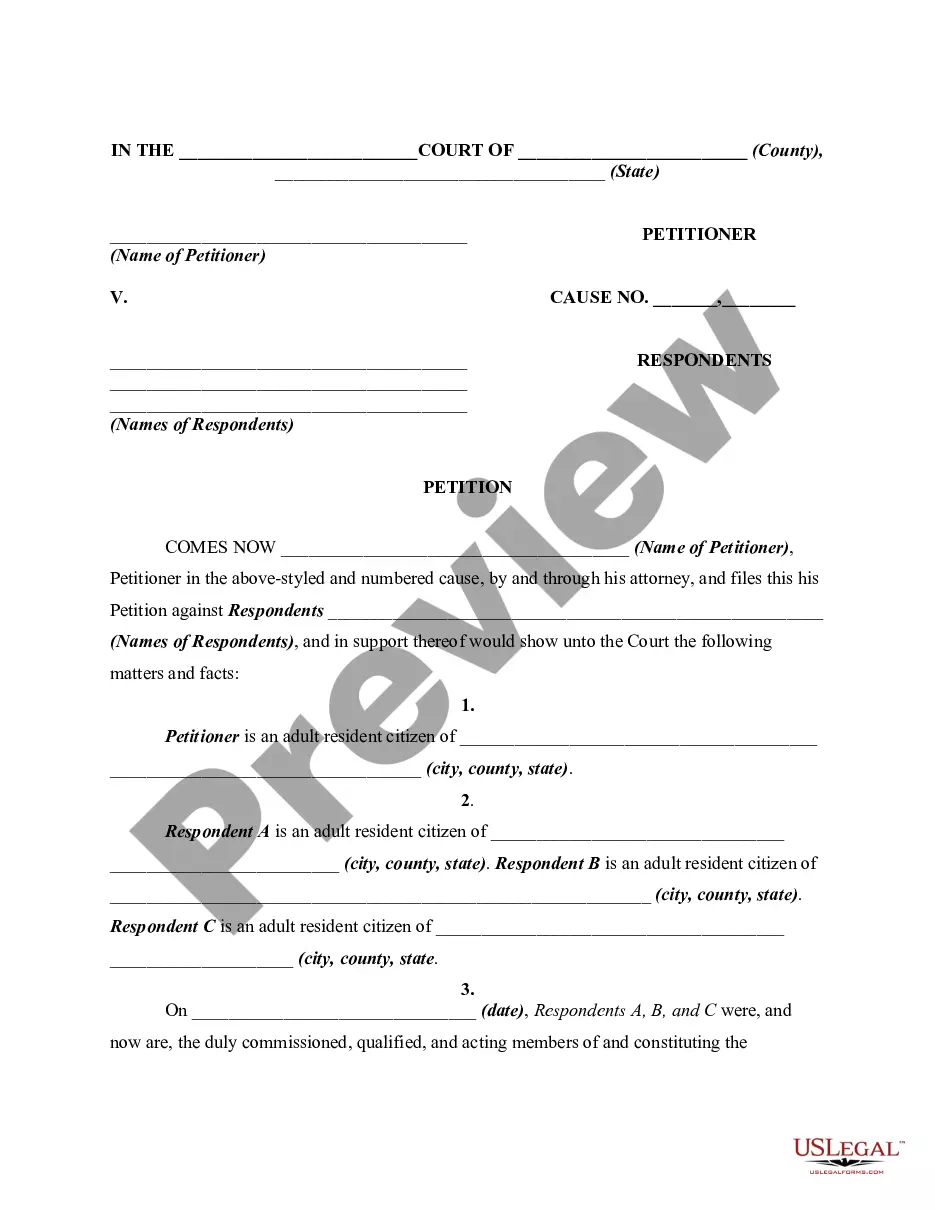

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms similar to the New Hampshire Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities in just a few seconds.

If you already hold a subscription, Log In and download the New Hampshire Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities from your US Legal Forms collection. The Obtain button will appear on each form you encounter. You can access all previously saved forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make changes. Fill out, modify and print, and sign the saved New Hampshire Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities. Every template added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print an additional copy, simply navigate to the My documents section and click on the form you need. Access the New Hampshire Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities with US Legal Forms, the most extensive library of legal document formats. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the appropriate form for the city/county.

- Click on the Review button to examine the content of the form.

- Check the description of the form to confirm that you've selected the correct one.

- If the form doesn't meet your requirements, use the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Next, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Chapter 11 bankruptcy is the formal process that allows debtors and creditors to resolve the problem of the debtor's financial shortcomings through a reorganization plan. Accordingly, the central goal of chapter 11 is to create a viable economic entity by reorganizing the debtor's debt structure.

Documents required to execute affidavit as below,Any of your government approved ID proof like aadhar, passport or driving license.Any of the specific supporting document for your intended purpose to execute affidavit like degree certificate, mark sheet, employment letter, marriage certificate, bank statement etcetera.More items...

Lying on a financial affidavit in Florida is a serious offense, and can lead to jail time, financial penalties, and verbal reprimands. In Florida, a financial affidavit consists of four key pieces of information: debts, assets, income, and expenses.

Chapter 11 can be done by almost any individual or business, with no specific debt-level limits and no required income. Chapter 13 is reserved for individuals with stable incomes, while also having specific debt limits.

The word bankrupt comes from the Latin banca rupta, which literally means broken bench, after the practice of moneylenders breaking the table they used when they were no longer in business.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time.

Under Florida Court Rule 12.285, the parties must make financial disclosures within 45 days of service of the divorce pleading. The so-called financial affidavit helps ensure that both spouses are aware of all the assets and debts that may be subject to Florida's equitable division law.

A financial affidavit is a statement of a party's income, expenses, assets, and liabilities.

Chapter 11 is a form of bankruptcy involving the reorganization of a business's debt and assets. The debtor business must create a repayment or, rather, reorganization plan, and if that plan is followed through, the remaining debt will likely be discharged. The terms of the plan, however, must be fulfilled.

This form acts as proof that you are financially capable of managing your stay in the United States. It is issued by the sponsor showing sponsorship for the visa applicant which shows that they have enough income or source of money to support the applicant while he/she is staying in the US.