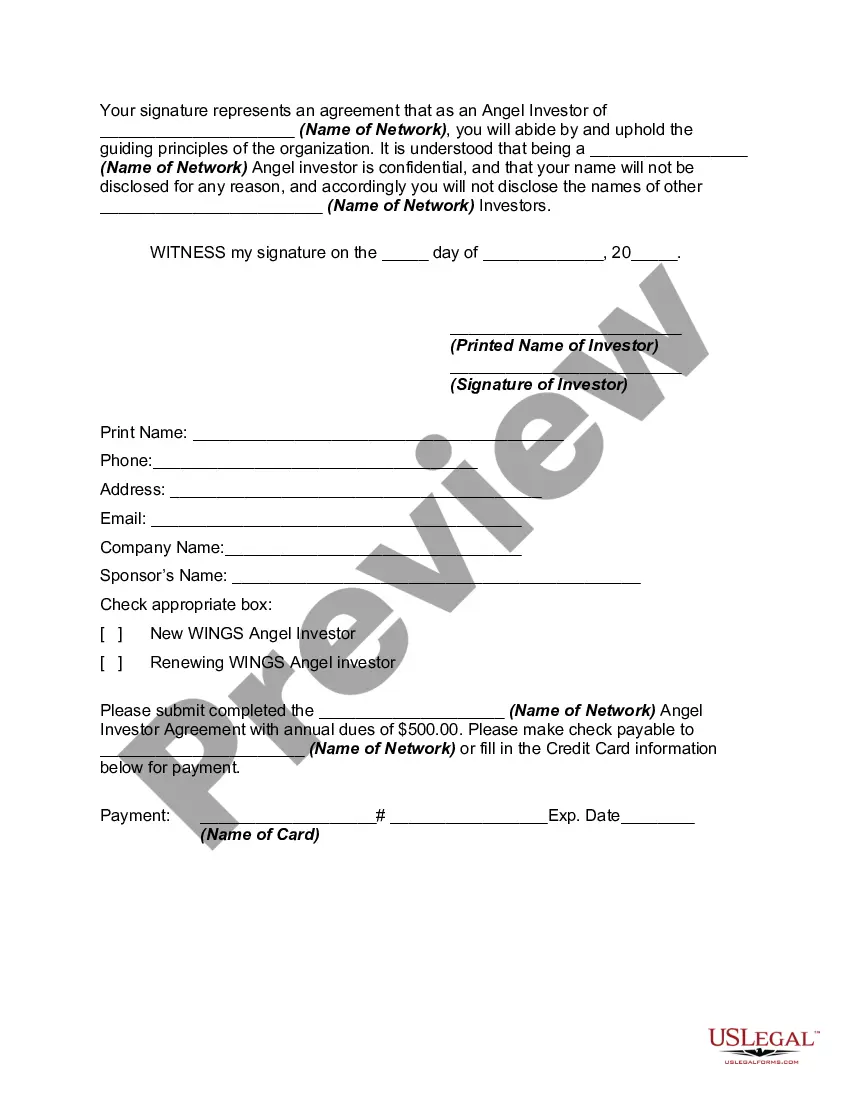

New Hampshire Angel Investor Agreement

Description

How to fill out Angel Investor Agreement?

You may spend multiple hours online searching for the legal template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast selection of legal documents that are evaluated by experts.

It is easy to download or print the New Hampshire Angel Investor Agreement from their service.

If available, use the Review option to view the document as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the New Hampshire Angel Investor Agreement.

- Every legal template you obtain is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct format for the region/city that you select.

- Review the form details to confirm that you have chosen the right document.

Form popularity

FAQ

An angel investor agreement is a contract between a startup and an angel investor, outlining the terms of the investment. This document details aspects such as equity share, payment schedules, and exit strategies. Utilizing a comprehensive New Hampshire Angel Investor Agreement can protect the interests of both the investor and the business owner.

The minimum amount for an angel investor can vary, but it usually starts at around $25,000. However, some investors may choose to invest less in early-stage startups. In the context of a New Hampshire Angel Investor Agreement, outlining the investment amount and conditions can help both parties navigate the process smoothly.

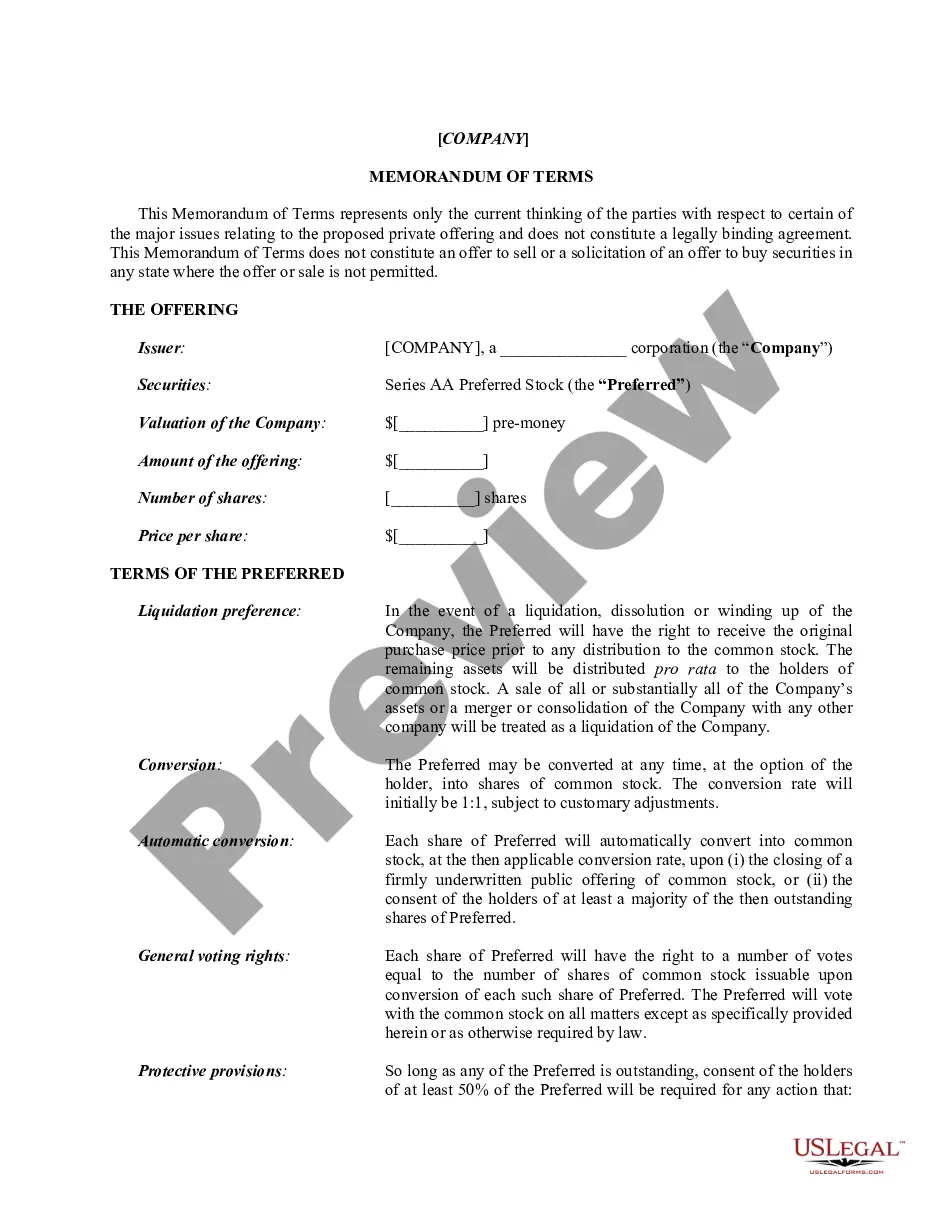

The typical angel investor deal often includes equity financing in exchange for capital. Investors may also negotiate terms that involve convertible notes or specific performance milestones. A well-defined New Hampshire Angel Investor Agreement lays out these conditions, ensuring transparency and mutual understanding.

A fair percentage for an angel investor typically falls between 15% and 25%. This range provides investors with a meaningful stake in the business while still allowing the founders to retain control. Crafting a precise New Hampshire Angel Investor Agreement ensures both parties feel valued and secure in the investment.

The typical equity for angel investors often ranges from 10% to 30% of the business. This percentage can vary based on the startup's valuation and the perceived risk. A well-structured New Hampshire Angel Investor Agreement will help clarify the terms and expectations on both sides.

When writing to an angel investor, be concise and articulate your business idea in a compelling way. Highlight the unique aspects of your business, including market potential and financial projections. Referencing a New Hampshire Angel Investor Agreement can assure them of your understanding of the investment process and commitment to a professional partnership.

The agreement between a business owner and an investor typically covers the terms of the investment, including equity shares and profit distribution. It also delineates the roles and expectations of each party. Creating a New Hampshire Angel Investor Agreement can help formalize this relationship and provide a framework for future cooperation and growth.

An investment agreement is a legal document that outlines the terms of an investment between an investor and a business. It specifies the amount invested, the equity stake, and the obligations of both parties. A solid New Hampshire Angel Investor Agreement can safeguard interests and provide a clear path for business growth and investor returns.

Structuring an investor deal requires a comprehensive understanding of what both parties want from the agreement. Focus on the amount of investment, expectations of returns, and exit strategy options. By clearly laying these elements out in a New Hampshire Angel Investor Agreement, you create a firm foundation for a mutually beneficial relationship.

Structuring an investor agreement involves outlining key elements such as the investment details, ownership percentages, and governance rules. Clear terms regarding control, decision-making authority, and profit distribution should also be included. A well-structured New Hampshire Angel Investor Agreement can significantly enhance clarity and reduce misunderstandings in the future.