A bill of sale is a document that transfers ownership of an asset from a seller to the buyer. It can also serve as a basic agreement for sale of goods, and a sales receipt.

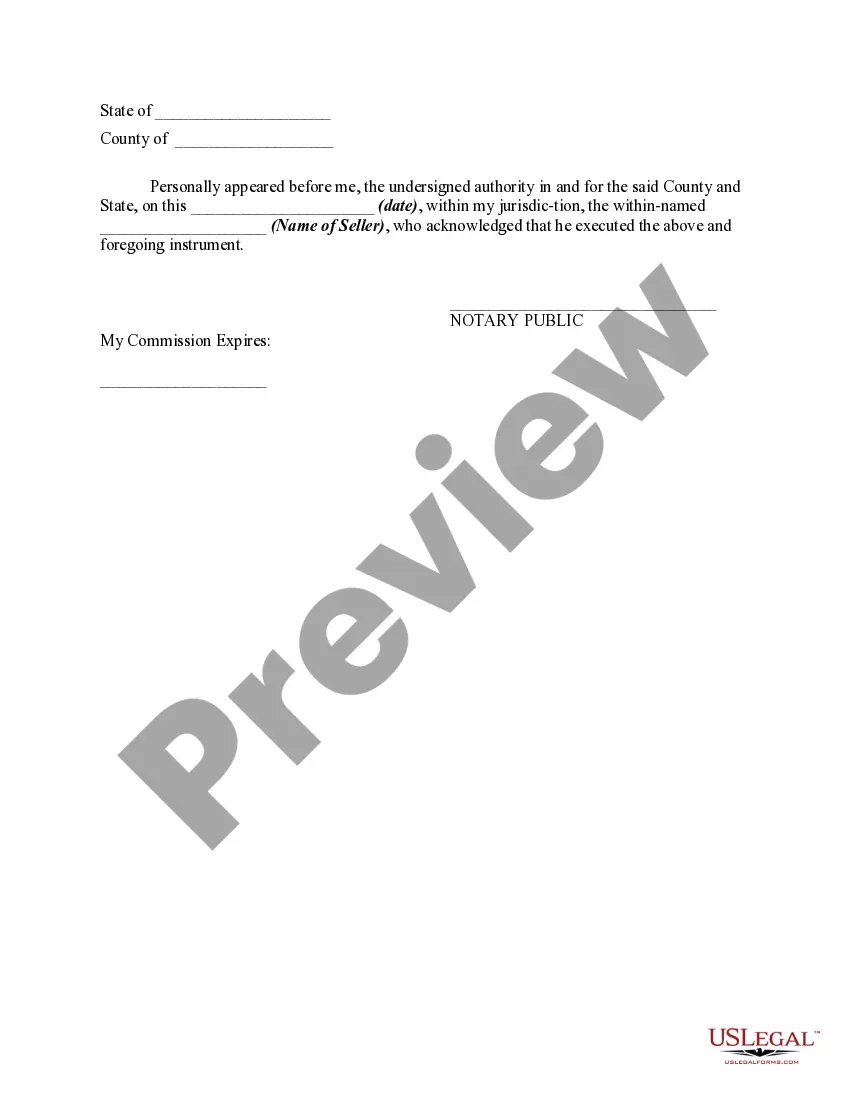

Title: Understanding the New Hampshire Bill of Sale for Goods or Personal Property Introduction: The New Hampshire Bill of Sale for Goods or Personal Property is a legal document used to facilitate the transfer of ownership rights from one party to another for various types of assets, including goods, vehicles, equipment, or personal possessions. This detailed description will outline the importance of the New Hampshire Bill of Sale, its key components, and highlight any specific types associated with it. 1. What is the New Hampshire Bill of Sale? The New Hampshire Bill of Sale refers to a legal contract that documents the sale/purchase of goods or personal property between a seller and a buyer. This written agreement acts as proof of the transaction and defines the terms and conditions agreed upon by both parties involved. 2. Key Components of the New Hampshire Bill of Sale: To ensure its legality and effectiveness, a New Hampshire Bill of Sale for Goods or Personal Property generally includes the following essential elements: a) Names and Contact Information: Identifies the seller (current owner) and the buyer (new owner), including their full legal names and contact details. b) Description of the Goods or Personal Property: Provides a comprehensive description of the asset being sold, including any specific identification numbers (such as serial or VIN numbers), brand names, model numbers, etc. c) Purchase Price: Specifies the agreed-upon purchase price for the goods or personal property being sold. d) Payment Terms: Outlines the payment method(s) and whether it will be a lump-sum or installment-based payment. e) Seller's Representations: States that the seller legally owns the goods or personal property and has the right to sell it. f) Buyer's Representations: Acknowledges that the buyer is aware of the asset's condition and purchases it "as-is" or with any disclosed defects. g) Signatures: Requires the signatures of both the seller and the buyer, along with the date of signing. 3. Types of New Hampshire Bills of Sale for Goods or Personal Property: Though the general structure remains consistent, there are specific types of New Hampshire Bills of Sale for different categories of goods or personal property. Some common types include: a) Vehicle Bill of Sale: Documents the transfer of ownership for motor vehicles, including cars, motorcycles, trucks, etc. b) Equipment Bill of Sale: Pertains to the sale of machinery, tools, appliances, or any other type of equipment. c) General Goods Bill of Sale: Covers the sale of general goods not falling under specific categories, such as furniture, electronics, artwork, etc. d) Livestock Bill of Sale: Specific to the sale and transfer of ownership of livestock, including cattle, horses, goats, etc. It is important to note that while these are common categorizations, a New Hampshire Bill of Sale can be tailored according to other asset types or specific requirements as well. Conclusion: The New Hampshire Bill of Sale for Goods or Personal Property is a crucial legal document that ensures smooth ownership transfer while protecting the rights and interests of both the seller and the buyer. By providing detailed information about the asset, purchase terms, and the agreement between parties, this document serves as evidence of the transaction's legality and helps prevent disputes in the future.