New Hampshire Receiving Order

Description

How to fill out Receiving Order?

If you wish to gather, obtain, or print legitimate document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Employ the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for commercial and personal purposes are organized by categories, states, or keywords.

Every legal document template you acquire is yours forever. You can access every form you have purchased within your account.

Select the My documents section and choose a form to print or download again. Be proactive and download, and print the New Hampshire Receiving Order with US Legal Forms. There are many professional and state-specific templates available for your business or personal requirements.

- Employ US Legal Forms to acquire the New Hampshire Receiving Order with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the New Hampshire Receiving Order.

- You can also access documents you previously obtained through the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct state/region.

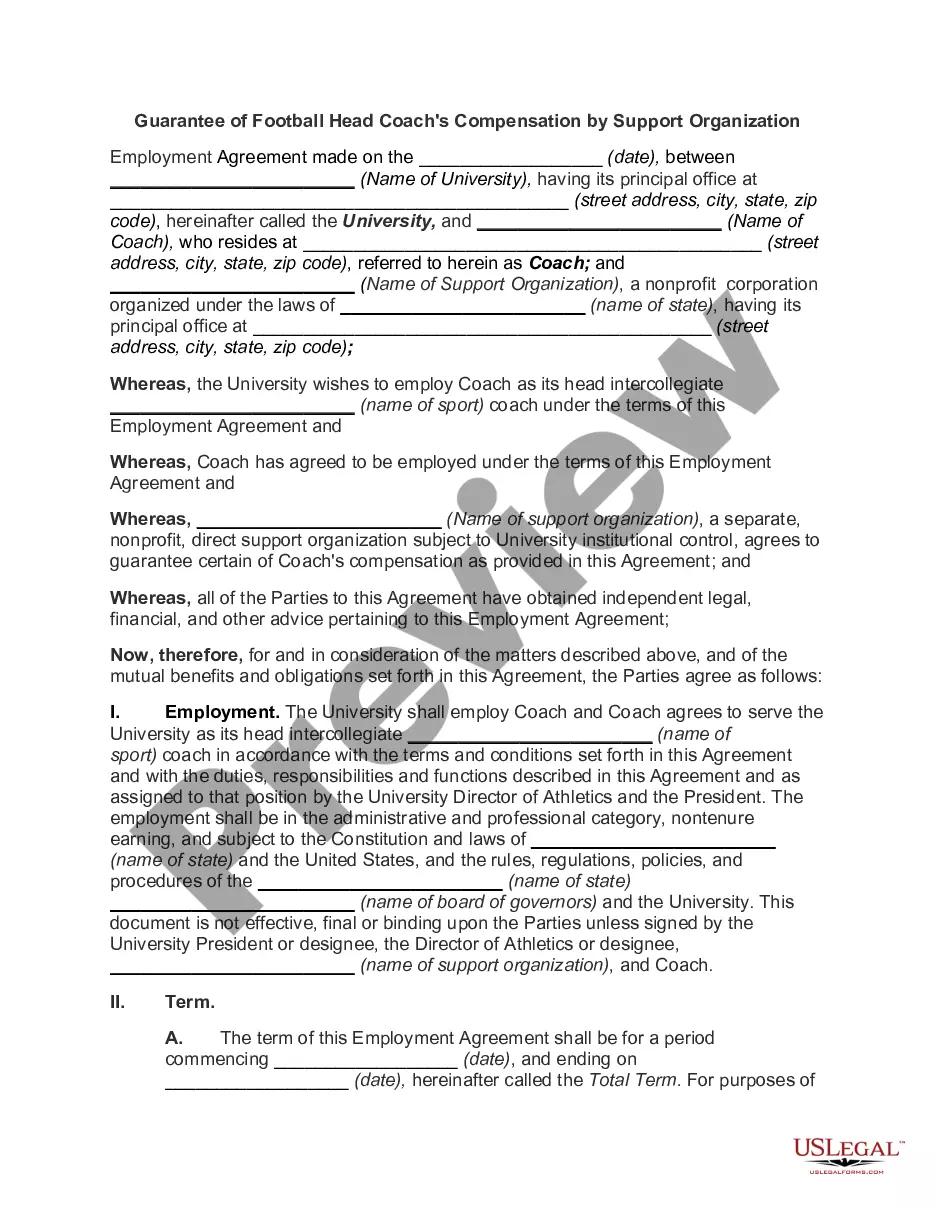

- Step 2. Use the Preview mode to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Get now button.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the New Hampshire Receiving Order.

Form popularity

FAQ

If you have income sourced from New Hampshire, you may need to file New Hampshire taxes. A New Hampshire Receiving Order can impact your tax responsibilities, especially if it involves income or property. It is advisable to keep track of any assets or income affected by the receiving order. For accurate guidance, consider consulting with a tax professional who understands your specific situation.

No, texting someone you have a restraining order against constitutes a breach of the order. It is essential to avoid all forms of communication, including text messages and calls. To maintain compliance, refer to the terms set forth in your New Hampshire Receiving Order, and consider reaching out to uslegalforms for guidance in such legal matters.

No, you should not contact someone against whom you have a restraining order. Doing so can lead to serious legal repercussions, including being charged with contempt of court. If you have questions about what to do next, consider exploring resources available through uslegalforms for navigating your New Hampshire Receiving Order.

Indirect contact refers to any communication with the restrained person that does not happen face to face. This can include messages through social media, emails, or even having a friend convey a message. Understanding the boundaries of your New Hampshire Receiving Order is crucial to staying compliant with the legal stipulations.

Yes, the individual against whom you file a restraining order will be notified about the order. This is a standard procedure intended to ensure that both parties are aware of their legal rights and responsibilities. If you require assistance with this process, using platforms like uslegalforms can streamline obtaining a New Hampshire Receiving Order.

New Hampshire became the ninth state in the United States on June 21, 1788. It played a significant role in early American history and the ratification of the Constitution. Understanding the state's background can provide context when discussing legal matters, including the New Hampshire Receiving Order.

If you contact someone with whom you have a protective order, you risk facing legal consequences. The court may view this as a violation of the New Hampshire Receiving Order. It is important to adhere strictly to the terms of the order to avoid further legal issues.

Yes, you can file your New Hampshire state taxes online, which is a convenient option for many residents. Various platforms, including the New Hampshire Department of Revenue Administration, offer online filing options. Embracing digital solutions makes tax filing easier and aligns with the straightforward experiences provided through resources like the New Hampshire Receiving Order process.

If neither party appears at the hearing for a restraining order in New Hampshire, the court may dismiss the case. It's important to understand that the absence of involved parties can result in lost opportunities for protection. Being well-informed about the New Hampshire Receiving Order process can help ensure that you attend your hearing and advocate for your rights.

Yes, you can file the NH DP 10 form online through the New Hampshire Department of Revenue Administration's website. This option provides a convenient way to submit your information without the need for physical paperwork. Utilizing this digital option aligns well with the streamlined processes found in New Hampshire Receiving Order applications.