New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency

Description

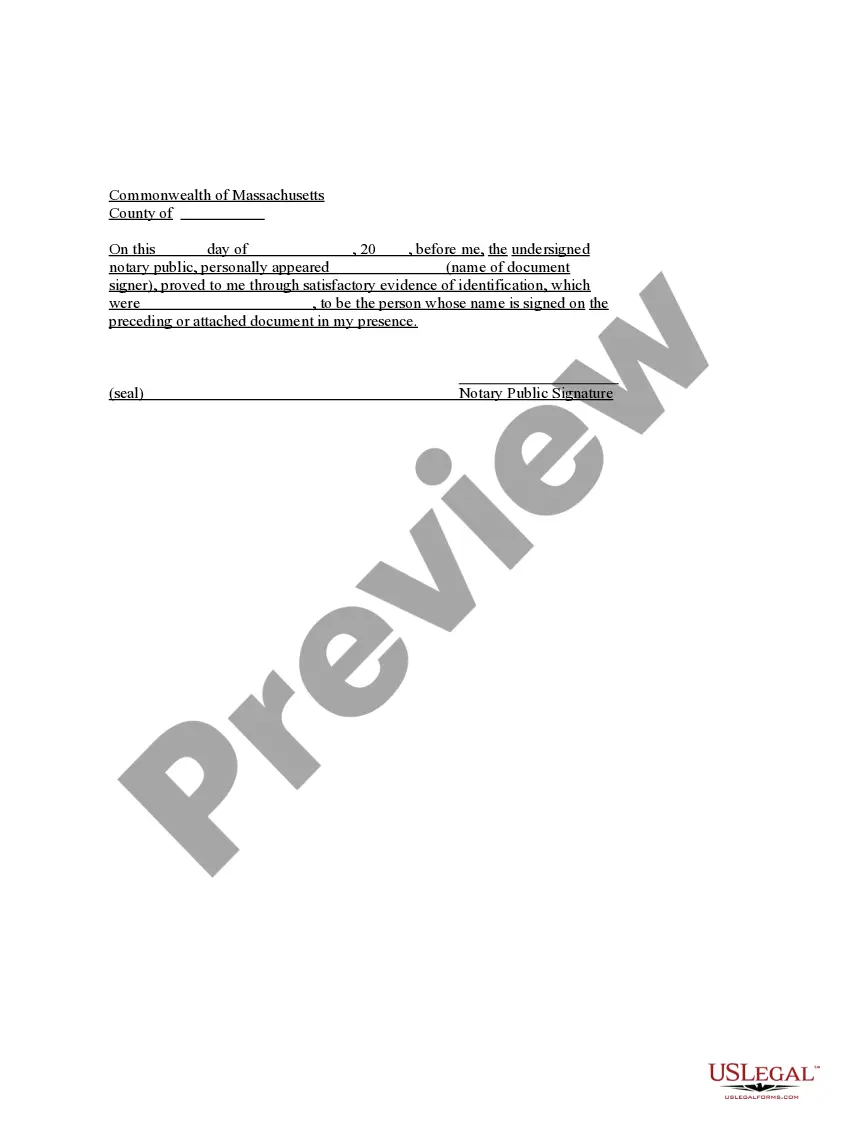

How to fill out Sample Letter For Collection - Referral Of Account To Collection Agency?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document categories that you can download or print.

By using the website, you can access numerous forms for business and personal use, organized by categories, states, or keywords. You can also find the latest versions of documents such as the New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency in moments.

If you are a subscriber, Log In to download the New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the file format and download the form onto your device. Edit it. Fill out, modify, print, and sign the downloaded New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency. Each format you added to your account does not expire and is permanently yours. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Gain access to the New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs.

- If you are using US Legal Forms for the first time, here are essential steps to help you get started.

- Ensure you have chosen the correct form for your location. Click on the Review button to examine the form's details.

- Check the form description to confirm that you have selected the correct form.

- If the form does not meet your requirements, utilize the Search area at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Order now button.

- Then, select the pricing plan of your choice and provide your information to register for an account.

Form popularity

FAQ

In a collection letter, you should express the outstanding balance and provide a concise account of what led to the debt. Additionally, offer payment options and include any relevant contact information. Using a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency will help you formulate your message accurately and professionally, making it easier for the recipient to understand and respond.

To write an effective collection letter, begin with a professional greeting and state the purpose clearly. Next, specify the debt amount, the services rendered, and any payment deadlines. It may be beneficial to reference a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency to structure your letter and ensure it addresses all essential aspects of collection.

An example of a collection letter includes a clear statement about the amount owed, a brief explanation of services provided, and any previous communications regarding the debt. You can also mention the next steps if payment is not made. For crafting such letters, consider a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency to ensure you cover all necessary points effectively.

To write a good collection email, start by addressing the recipient respectfully. Clearly state the purpose of your email, including details about the outstanding balance and the due date. Include a call to action, encouraging the recipient to settle the amount promptly. Utilizing a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency can provide you with a solid framework for your email.

A referral to a collection agency is similar to an assignment, whereby the original creditor outsources the debt recovery process to a specialized firm. This is commonly done when the creditor feels they cannot recover the debt on their own. Familiarizing yourself with a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency can equip you with the tools to manage your communications effectively.

When you are referred to debt collection, you may face multiple contacts from the agency seeking to recover the owed amount. This may also impact your credit score negatively. Using a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency can provide you with a clear format to address the situation and communicate effectively with the agency.

When an account is referred to collections, it means the original creditor has decided to hand over the responsibility of collecting the debt to a third-party agency. This typically follows numerous failed attempts to collect payment directly. Knowing how to respond with a well-structured New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency is crucial to managing your debt effectively.

A referral to a collections agency occurs when a creditor decides to outsource the collection of unpaid debts to a professional agency. This process often happens after the original creditor has made several attempts to collect the debt without success. Understanding a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency can help you navigate this situation more confidently.

To write a letter to a collection agency, start with your details and the agency’s information. Clearly state the purpose of your letter, whether you are disputing a debt or requesting more information. Using a New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency can guide you in creating a structured letter that conveys your concerns professionally.

A nice collection letter is a professional, respectful communication that encourages payment while maintaining a positive relationship. It should clearly state the amount owed and express understanding of any circumstances that may have led to the delay. A well-crafted New Hampshire Sample Letter for Collection - Referral of Account to Collection Agency can effectively prompt action without causing disrespect or resentment.