A New Hampshire Notice of Default on Promissory Note Installment is a legal document used to notify a borrower that they have failed to make one or more installment payments on their promissory note. This written notice is crucial in the loan default process as it informs the borrower about the specific breach and the consequences they may face if the default is not cured within a certain timeframe. There are primarily two types of New Hampshire Notices of Default on Promissory Note Installment: 1. New Hampshire Judicial Notice of Default on Promissory Note Installment: This type of notice is typically initiated by the lender or the creditor when the borrower defaults on their installment payments as agreed upon in the promissory note. The creditor can file a lawsuit against the borrower in a New Hampshire court to recover the outstanding amount owed, initiate foreclosure proceedings (if applicable), and pursue any other applicable legal remedies. 2. New Hampshire Non-judicial Notice of Default on Promissory Note Installment: In cases where the promissory note includes a power of sale clause, the lender or creditor can choose to forego the court process and instead follow the non-judicial foreclosure procedure. The lender must issue a written notice of default, specifying the breach of the installment payment terms, along with a statement of the amount due. This notice must be sent to the borrower and any other interested parties, giving them a certain period to cure the default (usually 30 days) before the lender proceeds with the foreclosure sale. Keywords: New Hampshire, Notice of Default, Promissory Note Installment, borrower, breach, lender, creditor, loan default process, cure, timeframe, judicial, non-judicial, foreclosure, lawsuit, installment payments, power of sale clause, court process, non-judicial foreclosure procedure, foreclosure sale.

New Hampshire Notice of Default on Promissory Note Installment

Description

How to fill out New Hampshire Notice Of Default On Promissory Note Installment?

Are you currently in a situation that you need to have papers for either business or specific purposes just about every time? There are tons of legitimate papers themes available online, but finding kinds you can rely on is not straightforward. US Legal Forms provides a large number of kind themes, just like the New Hampshire Notice of Default on Promissory Note Installment, that happen to be written to meet federal and state needs.

Should you be currently familiar with US Legal Forms website and possess an account, basically log in. Following that, you can acquire the New Hampshire Notice of Default on Promissory Note Installment design.

If you do not offer an bank account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for that right town/state.

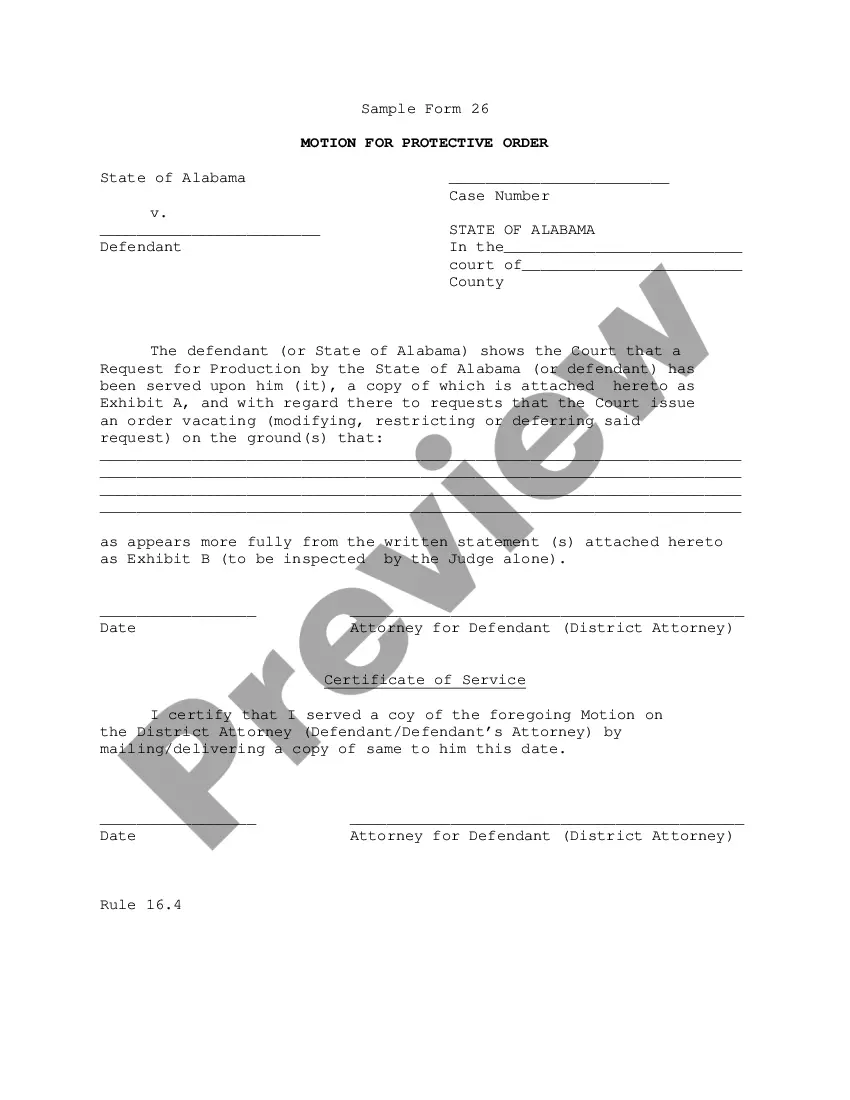

- Utilize the Review switch to examine the form.

- Browse the explanation to actually have selected the correct kind.

- In the event the kind is not what you are searching for, use the Lookup area to discover the kind that suits you and needs.

- If you discover the right kind, click Purchase now.

- Select the pricing prepare you need, complete the desired info to produce your account, and pay money for the order using your PayPal or charge card.

- Select a practical document structure and acquire your copy.

Locate all of the papers themes you have purchased in the My Forms food selection. You may get a extra copy of New Hampshire Notice of Default on Promissory Note Installment any time, if needed. Just select the essential kind to acquire or print the papers design.

Use US Legal Forms, probably the most comprehensive selection of legitimate varieties, in order to save some time and steer clear of mistakes. The support provides expertly created legitimate papers themes that you can use for an array of purposes. Generate an account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

What invalidates promissory notes?Incomplete signatures. Both parties must sign the promissory note.Missing payment amount or schedule.Missing interest rate.Lost original copy.Unclear clauses.Unreasonable terms.Past the statute of limitations.Changes made without a new agreement.

Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note. The promissory note itself should set out what constitutes default, so that both the lender and the borrower are clear on the terms.

Prepayment. Maker may prepay all or any part of the principal balance of this Promissory Note at any time without premium or penalty. Amounts prepaid may not be reborrowed.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

A default on a loan happens when the borrower fails to make the scheduled payments in full. Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

What happens when a promissory note is not paid? Promissory notes are legally binding contracts. That means when you don't pay back your loan, you could lose your collateral. If there's no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.