New Hampshire Invoice Template for Aviator

Description

How to fill out Invoice Template For Aviator?

Are you located in a setting where you require documents for either business or personal purposes nearly all the time.

There are numerous official document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the New Hampshire Invoice Template for Aviator, designed to comply with federal and state regulations.

Once you locate the appropriate form, click Buy now.

Choose the pricing plan you prefer, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the New Hampshire Invoice Template for Aviator design.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/county.

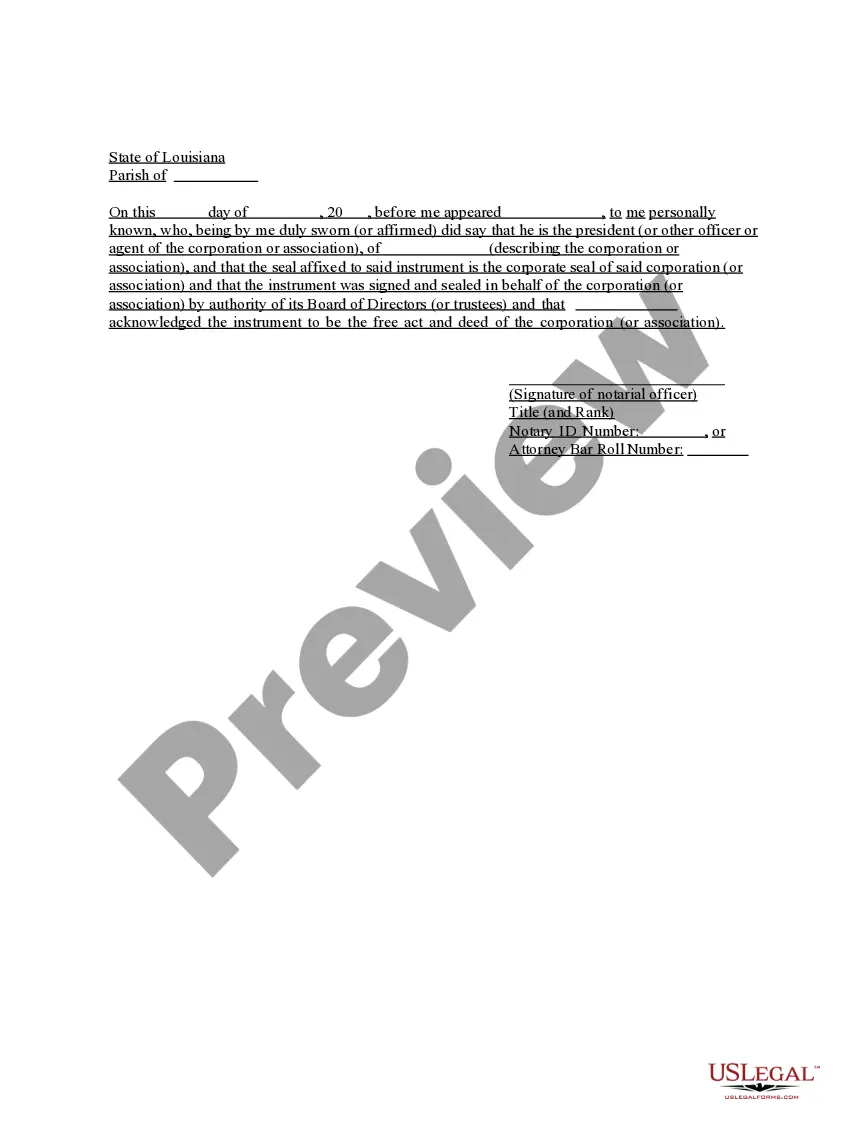

- Utilize the Preview button to view the form.

- Check the information to confirm that you have selected the right form.

- If the form is not what you seek, use the Research section to find the form that meets your needs and requirements.

Form popularity

FAQ

When writing an invoice for a payment example, start by stating your company name and contact information, followed by the client's details. Outline the services provided along with their costs and any applicable taxes, resulting in a clear total. A New Hampshire Invoice Template for Aviator can guide you in structuring this invoice effectively.

To fill out a simple invoice, begin with your business information at the top, followed by the client's details. Next, write a detailed list of the products or services provided, including unit prices and quantities. Finally, specify the total amount due and any payment terms, which can be easily achieved with a New Hampshire Invoice Template for Aviator.

To fill out an invoice for payment, start by entering your business details and the client's information. Then, list the services provided, including descriptions, quantities, and prices. Finally, ensure you add any applicable taxes and a total amount due with a due date. Implementing a New Hampshire Invoice Template for Aviator can make this process more efficient.

Filling out an invoice format requires you to include your name or business name, contact information, and the recipient's details. Next, list the products or services provided along with their individual costs and the total amount due. Using a New Hampshire Invoice Template for Aviator can streamline this process, ensuring all fields are correctly filled.

When detailing payment terms on an invoice, specify the payment due date and accepted payment methods. Clearly state if there are any late fees for overdue payments, as this encourages timely transactions. To simplify this process, consider using a New Hampshire Invoice Template for Aviator to ensure your terms are professional and clear.

To get a New Hampshire DOT number, you need to complete the application process via the New Hampshire Department of Transportation. This involves providing detailed information about your business and operational plans. For those managing multiple invoices and finances, a New Hampshire Invoice Template for Aviator could be a valuable tool, helping you track your expenses and income as you navigate through the registration process.

You can obtain New Hampshire tax forms from the New Hampshire Department of Revenue Administration’s website or local government offices. These forms cover various tax needs, including personal income tax and business-related taxes. Using a New Hampshire Invoice Template for Aviator can help you keep your finances orderly while you gather these forms to meet your tax obligations.

To obtain a Montana DOT number, fill out the application provided by the Montana Department of Transportation. You must provide information about your operating authority, type of vehicles, and insurance information. If you're managing invoices as part of your business operation, utilizing a New Hampshire Invoice Template for Aviator can help you stay organized while applying for your DOT number and managing expenses related to it.

The NH DOT (Department of Transportation) oversees the state’s transportation infrastructure, including highways, bridges, and public transit systems. It manages the registration and regulation of commercial vehicles, ensuring safety and compliance on the roads. If you’re handling invoices related to transportation services, a New Hampshire Invoice Template for Aviator can streamline your billing process and keep your finances in order.

The New Hampshire transfer tax form is used when you are transferring ownership of real estate in the state. This form, known as the Department of Revenue Administration’s Form RV-D, ensures that proper taxes are calculated and collected during the transfer process. Reporting your real estate transactions accurately is crucial, and utilizing a New Hampshire Invoice Template for Aviator can help maintain organized records for this purpose.