New Hampshire Checklist - Action to Improve Collection of Accounts

Description

How to fill out Checklist - Action To Improve Collection Of Accounts?

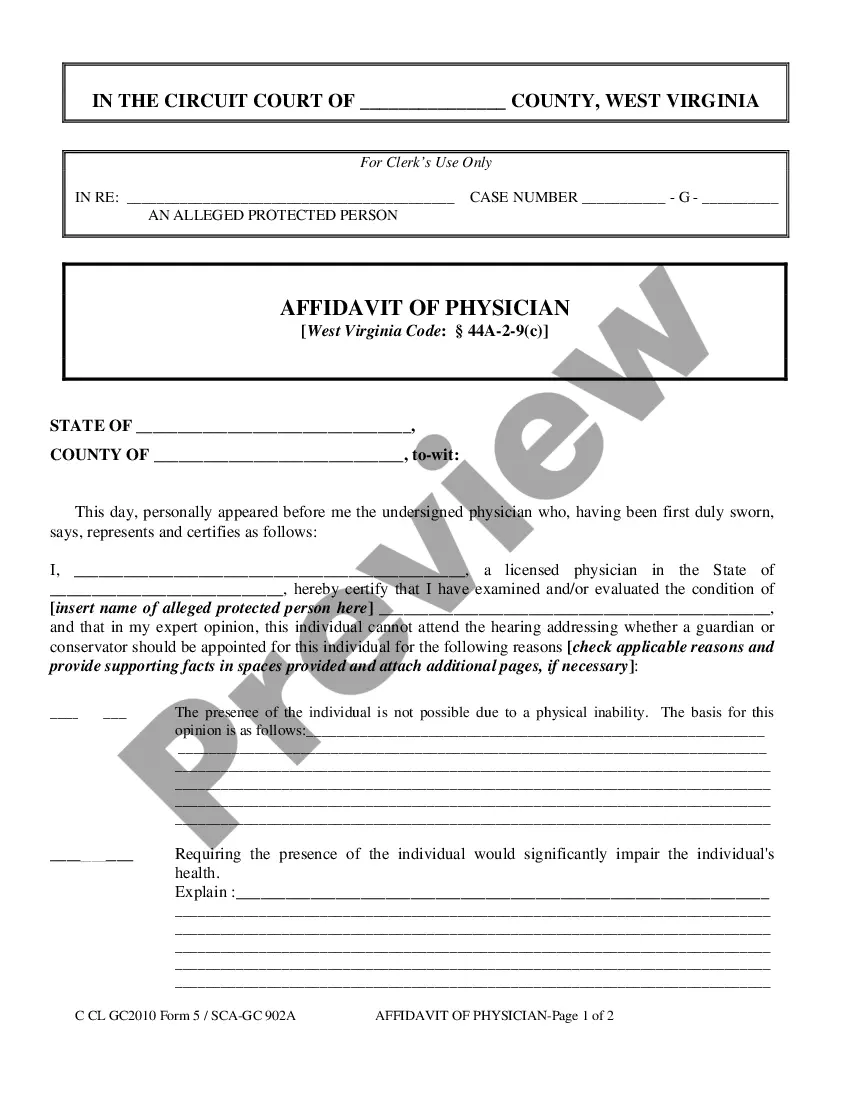

Finding the appropriate valid document template can be a challenge.

Certainly, there are numerous templates available online, but how can you locate the authentic type you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the New Hampshire Checklist - Action to Enhance Collection of Accounts, suitable for business and personal needs.

You can preview the form using the Preview button and review the form details to confirm it is suitable for you.

- All templates are vetted by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the New Hampshire Checklist - Action to Enhance Collection of Accounts.

- Leverage your account to review the legal documents you have purchased previously.

- Visit the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have chosen the correct form for your city/region.

Form popularity

FAQ

The NH 1120 must be filed by corporations operating in New Hampshire, including both domestic and foreign corporations. This form relates to the business profits tax, and timely filing is crucial for compliance. Adhering to your New Hampshire Checklist - Action to Improve Collection of Accounts includes understanding which forms to file, and using resources like uslegalforms can guide you through the process. This proactive approach supports better financial management.

The NH DP-10 must be filed by any New Hampshire business entity that has earned income during the tax year. This includes partnerships, corporations, and any entities subject to the business profits tax. By following your New Hampshire Checklist - Action to Improve Collection of Accounts, you ensure that you meet all filing requirements and maintain good standing with the state. Proper filing can enhance your business's financial health.

Rule 1.25 A in New Hampshire pertains to the assessment of penalties for late filing. It's critical to understand this rule as it impacts your financial responsibilities directly. Awareness and compliance with such regulations are vital when working from your New Hampshire Checklist - Action to Improve Collection of Accounts. Ensuring timely submissions can help prevent unnecessary penalties.

Yes, you can file NH DP-10 online through the New Hampshire Department of Revenue Administration's official website. Utilizing an online platform streamlines the process and minimizes delays in the collection of accounts. Incorporating this method is part of a comprehensive New Hampshire Checklist - Action to Improve Collection of Accounts. This approach not only saves time but also helps ensure accuracy in your filings.

To file for divorce in New Hampshire, at least one spouse must reside in the state for at least one year prior to filing. The state allows for both fault and no-fault divorce grounds, providing flexibility based on individual circumstances. Knowing the requirements can significantly affect the divorce process. For guidance throughout this process, consider our New Hampshire Checklist - Action to Improve Collection of Accounts.

In New Hampshire, a Class A misdemeanor is more serious than a Class B misdemeanor. Class A misdemeanors can result in a jail sentence of up to one year and fines of up to $2,000, whereas Class B misdemeanors typically lead to less severe penalties. Understanding these distinctions is vital for anyone navigating legal challenges. Use the New Hampshire Checklist - Action to Improve Collection of Accounts to stay informed about the legal landscape.

In New Hampshire, negligent driving can result in up to three points being added to your driving record. Accumulating too many points can lead to license suspensions and higher insurance rates. It's important to manage your driving behavior to avoid these penalties. Our New Hampshire Checklist - Action to Improve Collection of Accounts includes tips for responsible driving and account management.

'Administratively dissolved' refers to the status of a business that has failed to comply with state regulations, such as not filing required documents or fees. This status signifies that the business is no longer able to operate legally in New Hampshire. Understanding this status is crucial for business owners to take corrective actions. Keep track of your compliance using the New Hampshire Checklist - Action to Improve Collection of Accounts.

A beneficial ownership information report in New Hampshire is a document that discloses the individuals who ultimately own or control a business entity. This report enhances transparency in business operations and compliance with regulations. It plays a key role in ensuring financial accountability, making it essential for effective account management. The New Hampshire Checklist - Action to Improve Collection of Accounts can help you prepare relevant documentation.

Yes, New Hampshire does impose a one-week waiting period before unemployment benefits can be claimed. This means that after you file your initial claim, you must wait a week before benefits are payable. Understanding this wait week is crucial for managing your finances during unemployment. For more detailed assistance, refer to the New Hampshire Checklist - Action to Improve Collection of Accounts.