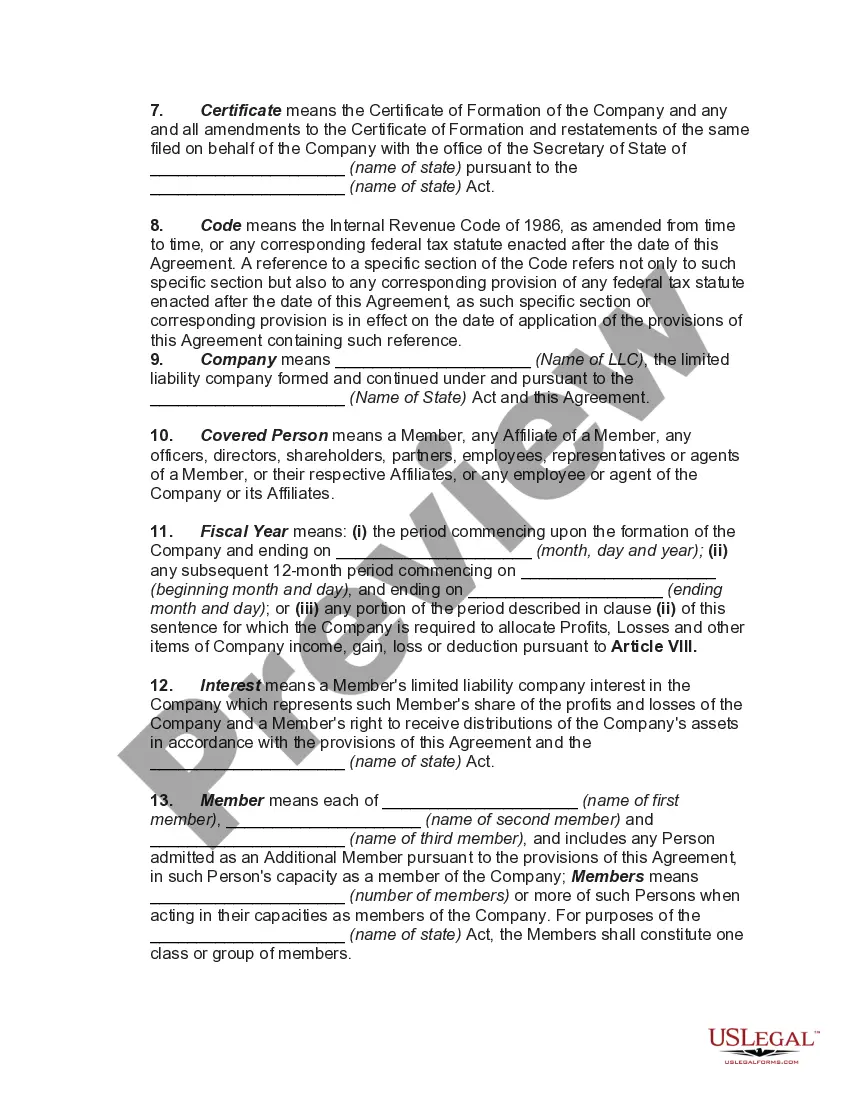

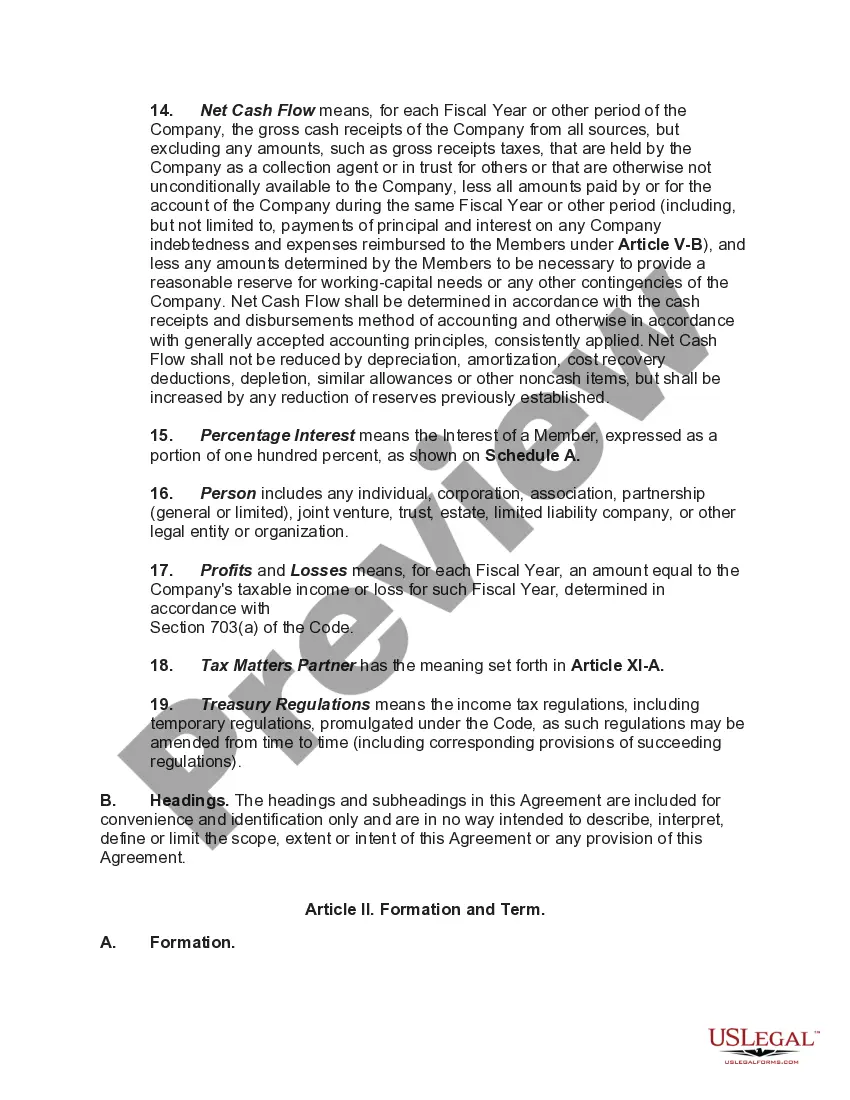

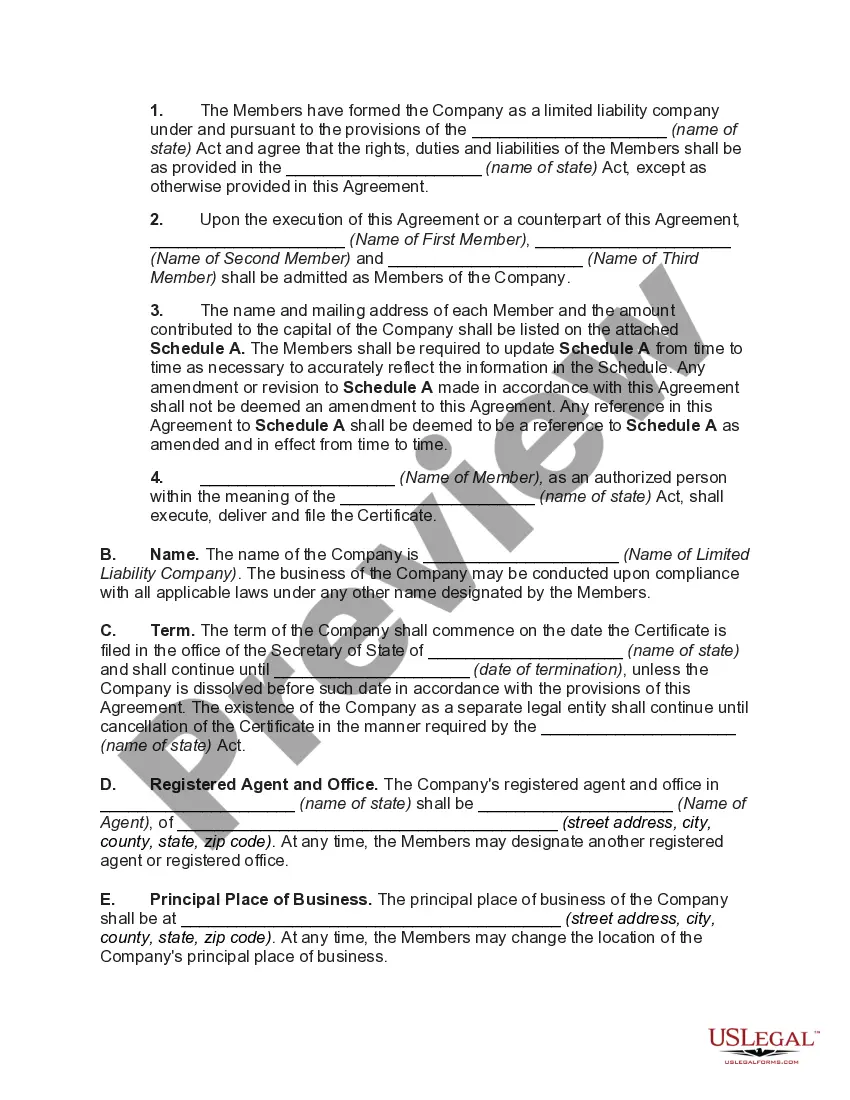

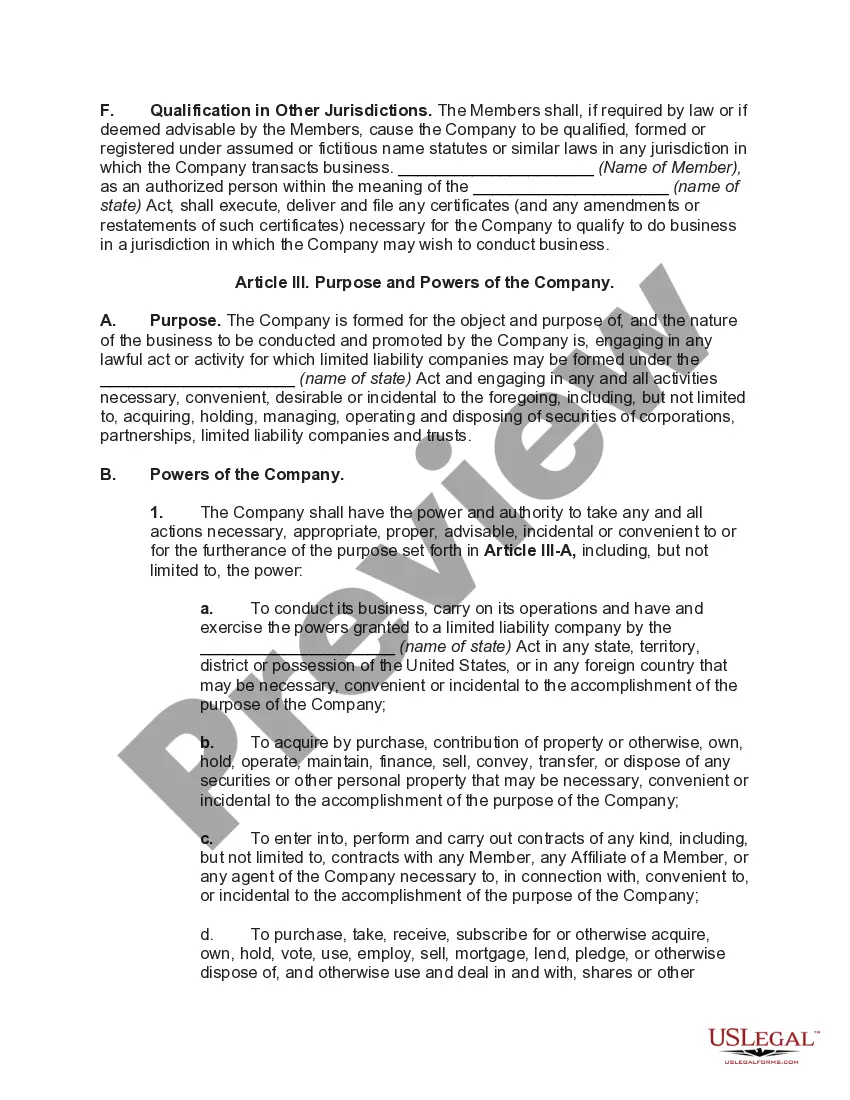

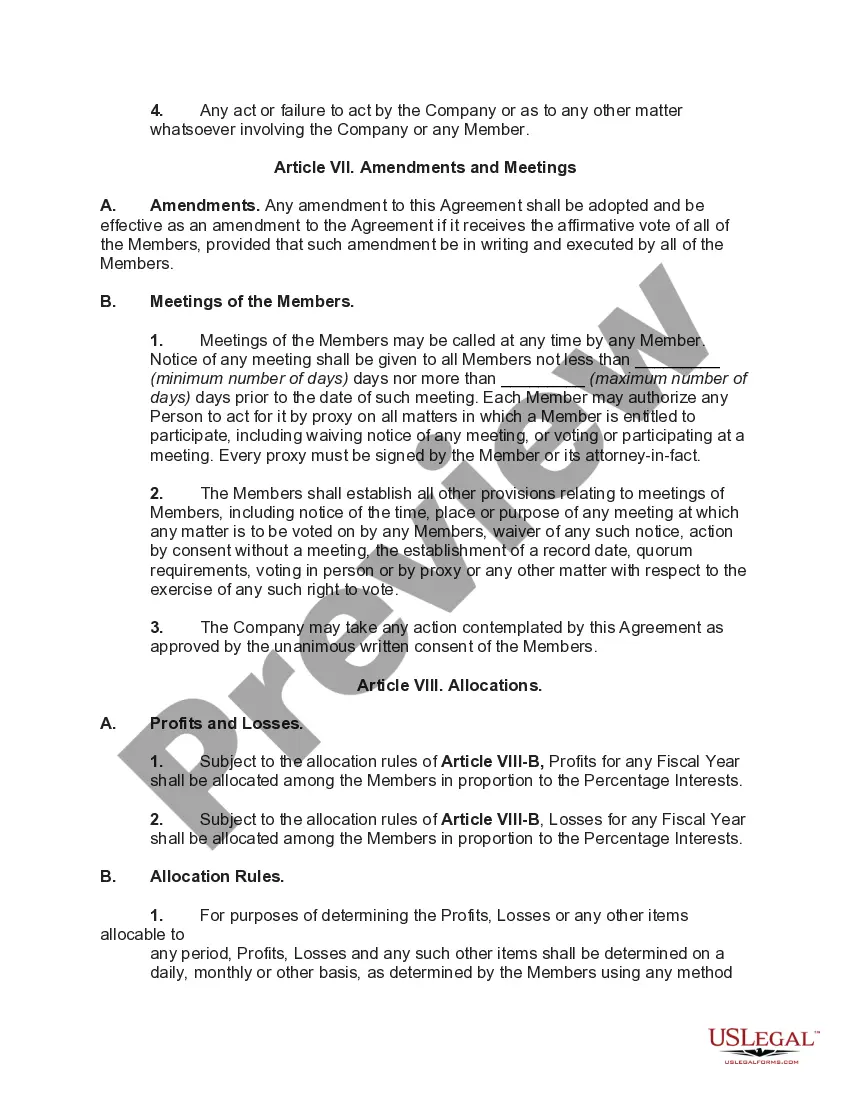

The New Hampshire Operating Agreement for Member Managed Limited Liability Company — Long Form is a legal document that outlines the internal workings and regulations of a member-managed LLC in the state of New Hampshire. This comprehensive agreement includes several key provisions and clauses ensuring smooth operations and defining the rights and responsibilities of the LLC members. Here is a detailed description of the document, highlighting its essence and important components: 1. Formation: The agreement commences by stating the name of the LLC and the date of its formation. It also identifies the business purpose of the company and specifies the principal place of business. 2. Membership: This section outlines the process for becoming a member, including conditions, admission, and transferability of membership interests. It further describes the rights and obligations of members, their liability limitations, and the procedure for resolving member disputes. 3. Management: The document specifies that the LLC will be managed collectively by its members. It defines their voting rights, decision-making processes, board meetings, and the authority granted to managers to execute the necessary functions of the company. 4. Capital Contributions: This section outlines the initial capital contributions made by each member and provides guidelines for subsequent contributions. It may include details regarding profit and loss allocation, distribution of assets, and methods for determining member ownership percentages. 5. Dissolution and Termination: The agreement outlines the conditions under which the LLC may be dissolved, such as bankruptcy, member consensus, or other triggering events. It also discusses the procedures for winding up the affairs of the company and distributing the remaining assets. 6. Arbitration and Governing Law: To address potential disputes, the agreement may include a provision for arbitration, specifying a particular method or organization for resolution. It also stipulates the governing law, which in this case would be the laws of the state of New Hampshire. Different types or variations of this agreement may include additional provisions based on specific needs or preferences of the members, such as: — Buy-Sell Agreement: This provision establishes guidelines for the sale or transfer of membership interests in the LLC. It outlines the process, valuation methods, and circumstances triggering the buy-sell agreement. — Non-Compete Agreement: In situations where the LLC engages in a competitive industry or has proprietary information, this provision restricts members from participating in similar activities that could harm the company's interests. — Tax Matters: This section may delve into the treatment of the LLC for tax purposes, including the election of specific tax classifications (such as pass-through taxation) and allocation of tax liabilities among members. Overall, the New Hampshire Operating Agreement for Member Managed Limited Liability Company — Long Form is a vital document that provides a comprehensive framework for managing and operating a member-managed LLC in New Hampshire, ensuring clarity and protection for the members' interests.

New Hampshire Operating Agreement for Member Managed Limited Liability Company - Long Form

Description

How to fill out New Hampshire Operating Agreement For Member Managed Limited Liability Company - Long Form?

If you wish to comprehensive, download, or produce lawful record themes, use US Legal Forms, the biggest selection of lawful forms, that can be found on the web. Use the site`s basic and convenient lookup to get the files you need. A variety of themes for company and specific purposes are sorted by groups and says, or search phrases. Use US Legal Forms to get the New Hampshire Operating Agreement for Member Managed Limited Liability Company - Long Form within a couple of click throughs.

Should you be already a US Legal Forms customer, log in to your profile and then click the Obtain option to obtain the New Hampshire Operating Agreement for Member Managed Limited Liability Company - Long Form. Also you can access forms you formerly acquired from the My Forms tab of your profile.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for the right city/region.

- Step 2. Make use of the Preview choice to look over the form`s content material. Don`t neglect to learn the information.

- Step 3. Should you be not satisfied with all the develop, use the Research area towards the top of the display screen to locate other models from the lawful develop web template.

- Step 4. After you have discovered the shape you need, go through the Purchase now option. Choose the rates prepare you choose and put your references to sign up to have an profile.

- Step 5. Method the deal. You can utilize your charge card or PayPal profile to complete the deal.

- Step 6. Select the structure from the lawful develop and download it in your system.

- Step 7. Total, revise and produce or indicator the New Hampshire Operating Agreement for Member Managed Limited Liability Company - Long Form.

Every single lawful record web template you buy is yours permanently. You might have acces to each develop you acquired inside your acccount. Go through the My Forms area and select a develop to produce or download again.

Remain competitive and download, and produce the New Hampshire Operating Agreement for Member Managed Limited Liability Company - Long Form with US Legal Forms. There are millions of professional and status-certain forms you can utilize for your company or specific requirements.