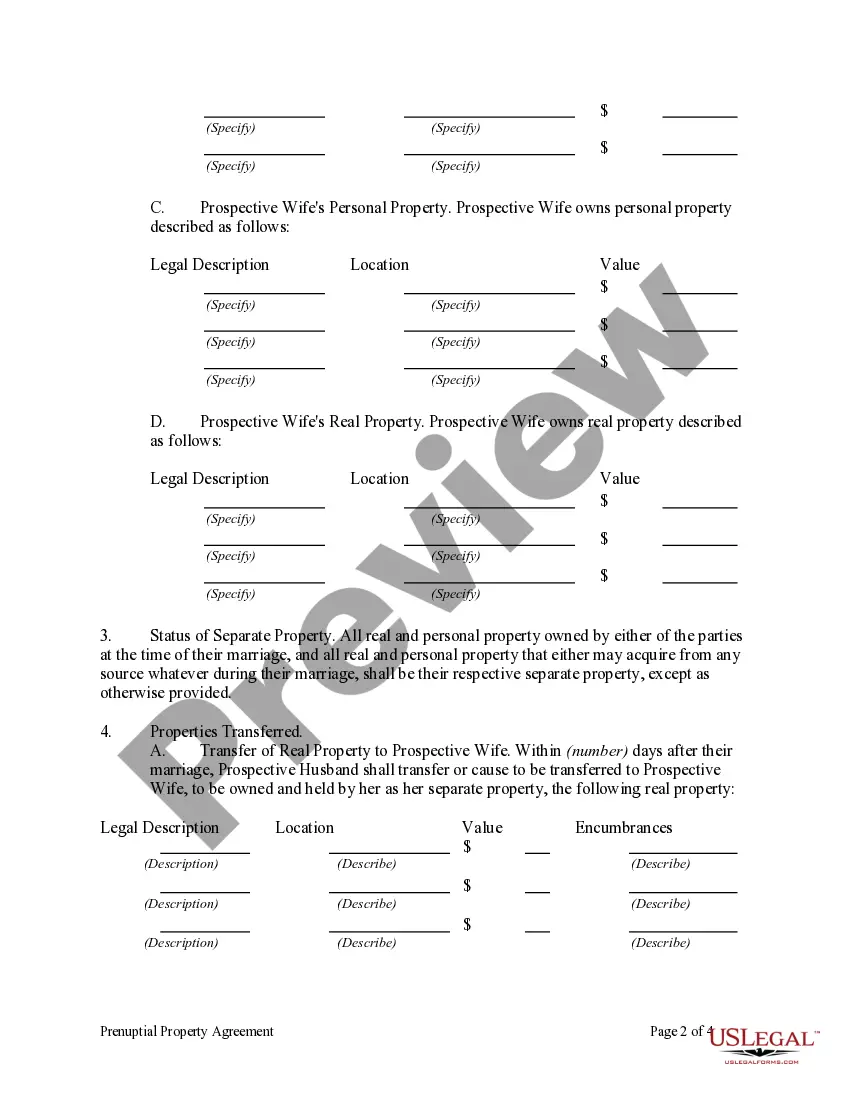

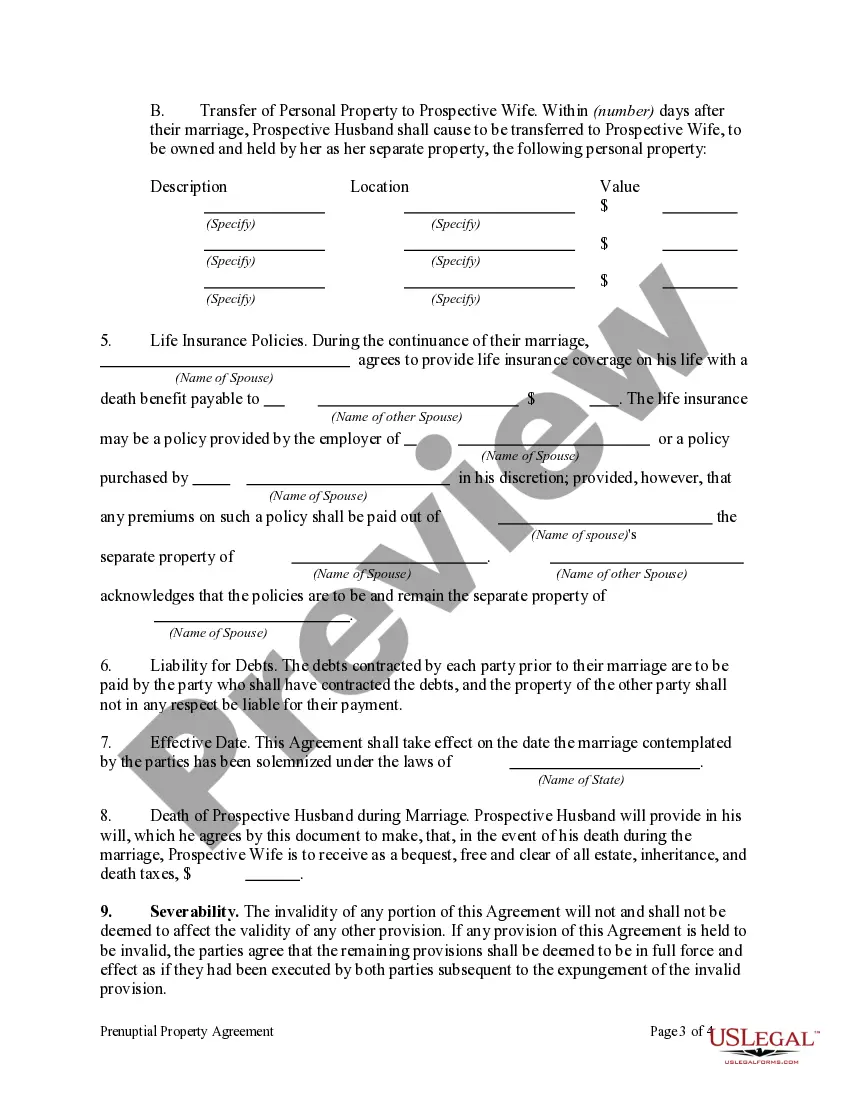

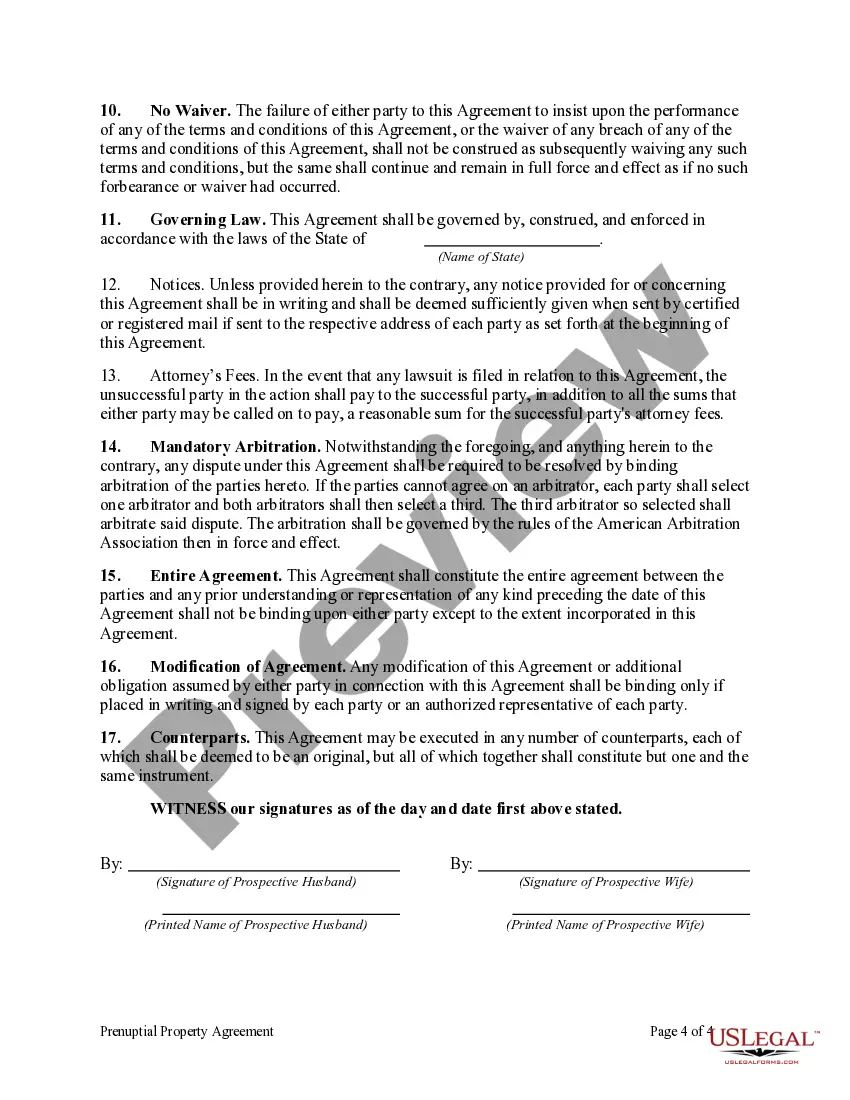

A New Hampshire Prenuptial Property Agreement is a legally binding contract that outlines how a couple's assets and liabilities will be divided in the event of a divorce or separation. This agreement, also known as a prenuptial agreement or a premarital agreement, is signed by both parties before they get married or enter into a civil union. The New Hampshire Prenuptial Property Agreement allows couples to protect their individual assets and clarify each party's rights and responsibilities regarding property division, spousal support, debts, and other financial matters. This document is especially beneficial if one or both partners have significant assets, own a business, have children from a previous relationship, or wish to safeguard certain personal belongings or investments. In New Hampshire, there are two main types of prenuptial property agreements: 1. Traditional Agreement: — This type of agreement is a comprehensive document that covers a wide range of financial matters, including property division, debt allocation, and alimony. — It outlines each spouse's property rights, including separate property (owned before marriage) and marital property (acquired during the marriage). — The agreement can also specify how assets would be divided in case of death, not just in a divorce scenario. 2. Limited Agreement: — This type of agreement focuses on specific financial aspects rather than a comprehensive overall plan. — It may address only certain properties, businesses, investments, or debts that the couple wants to protect. — Limited agreements are often considered when one partner has substantial wealth or assets they wish to safeguard. New Hampshire state laws govern the enforcement and validity of prenuptial agreements. To be considered legally binding, the agreement must be in writing, signed voluntarily by both parties, and without coercion or duress. It is highly recommended that each party consults with separate legal counsel to ensure their rights are protected and that the terms of the agreement align with their best interests. Overall, a New Hampshire Prenuptial Property Agreement is a valuable tool that enables couples to establish clear financial guidelines and protect their individual interests in the event of a divorce or separation. By addressing these matters proactively, couples can alleviate future uncertainties and potential conflicts, fostering a stronger foundation for their relationship.

New Hampshire Prenuptial Property Agreement

Description

How to fill out New Hampshire Prenuptial Property Agreement?

Are you currently inside a situation where you will need files for sometimes enterprise or individual functions nearly every time? There are tons of authorized record layouts available on the Internet, but locating versions you can rely on is not easy. US Legal Forms delivers 1000s of kind layouts, such as the New Hampshire Prenuptial Property Agreement, that are written to satisfy state and federal requirements.

If you are already informed about US Legal Forms website and have an account, simply log in. Next, it is possible to obtain the New Hampshire Prenuptial Property Agreement web template.

Should you not come with an bank account and need to start using US Legal Forms, follow these steps:

- Discover the kind you want and make sure it is for that appropriate city/state.

- Utilize the Review switch to analyze the shape.

- Read the outline to ensure that you have chosen the right kind.

- When the kind is not what you`re searching for, utilize the Search area to obtain the kind that meets your requirements and requirements.

- Whenever you get the appropriate kind, just click Get now.

- Choose the pricing strategy you desire, submit the specified details to produce your bank account, and purchase an order utilizing your PayPal or charge card.

- Choose a convenient file structure and obtain your version.

Get all of the record layouts you possess bought in the My Forms food selection. You can get a more version of New Hampshire Prenuptial Property Agreement any time, if possible. Just click the needed kind to obtain or printing the record web template.

Use US Legal Forms, one of the most comprehensive variety of authorized varieties, to conserve some time and stay away from mistakes. The service delivers skillfully produced authorized record layouts that you can use for a range of functions. Generate an account on US Legal Forms and commence generating your daily life a little easier.