A New Hampshire Promissory Note with Payments Amortized for a Certain Number of Years is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of New Hampshire. This type of promissory note is used when the borrower agrees to make regular payments over a specific number of years until the loan is fully repaid. Keywords: New Hampshire, promissory note, payments, amortized, certain number of years, loan agreement There are several types of New Hampshire Promissory Notes with Payments Amortized for a Certain Number of Years, including: 1. Fixed-Term Promissory Note: This type of promissory note specifies a set repayment schedule where the borrower agrees to make equal monthly, quarterly, or annual payments over a predetermined number of years. The payments are calculated to fully amortize the loan within the specified time frame. 2. Balloon Payment Promissory Note: This variant of the promissory note allows the borrower to make smaller monthly payments over a certain number of years, with a large balloon payment due at the end of the term. This type of note is often used when the borrower expects a substantial influx of funds in the future. 3. Graduated Payment Promissory Note: This type of promissory note starts with lower monthly payments that gradually increase over time. The graduated payment structure allows the borrower to begin with manageable payments and adjust as their income potentially increases. 4. Interest-Only Promissory Note: In this type of promissory note, the borrower is only required to pay the interest accrued on the loan for a specified number of years. At the end of the term, a balloon payment or a separate repayment plan may be required to cover the principal amount. 5. Convertible Promissory Note: This variant of the promissory note allows for the debt to be converted into equity in the borrower's company, typically in the case of a startup or early-stage business. It is essential for both parties involved in a New Hampshire Promissory Note to clearly outline the terms, interest rates, payment amounts, due dates, and consequences for default. The note should also include provisions for late fees, prepayment penalties, and any specific circumstances that may impact the loan agreement. Disclaimer: This article is for informational purposes only and should not be considered legal advice. It is always recommended consulting with a qualified attorney for guidance on specific legal matters.

New Hampshire Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out New Hampshire Promissory Note With Payments Amortized For A Certain Number Of Years?

Have you been in the placement where you will need files for either enterprise or specific uses nearly every time? There are a lot of legitimate papers layouts available on the net, but locating ones you can rely on is not simple. US Legal Forms gives 1000s of type layouts, much like the New Hampshire Promissory Note with Payments Amortized for a Certain Number of Years, which are published to fulfill state and federal specifications.

In case you are currently knowledgeable about US Legal Forms site and get a free account, simply log in. Following that, you are able to obtain the New Hampshire Promissory Note with Payments Amortized for a Certain Number of Years template.

Should you not have an accounts and need to begin using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for that appropriate area/state.

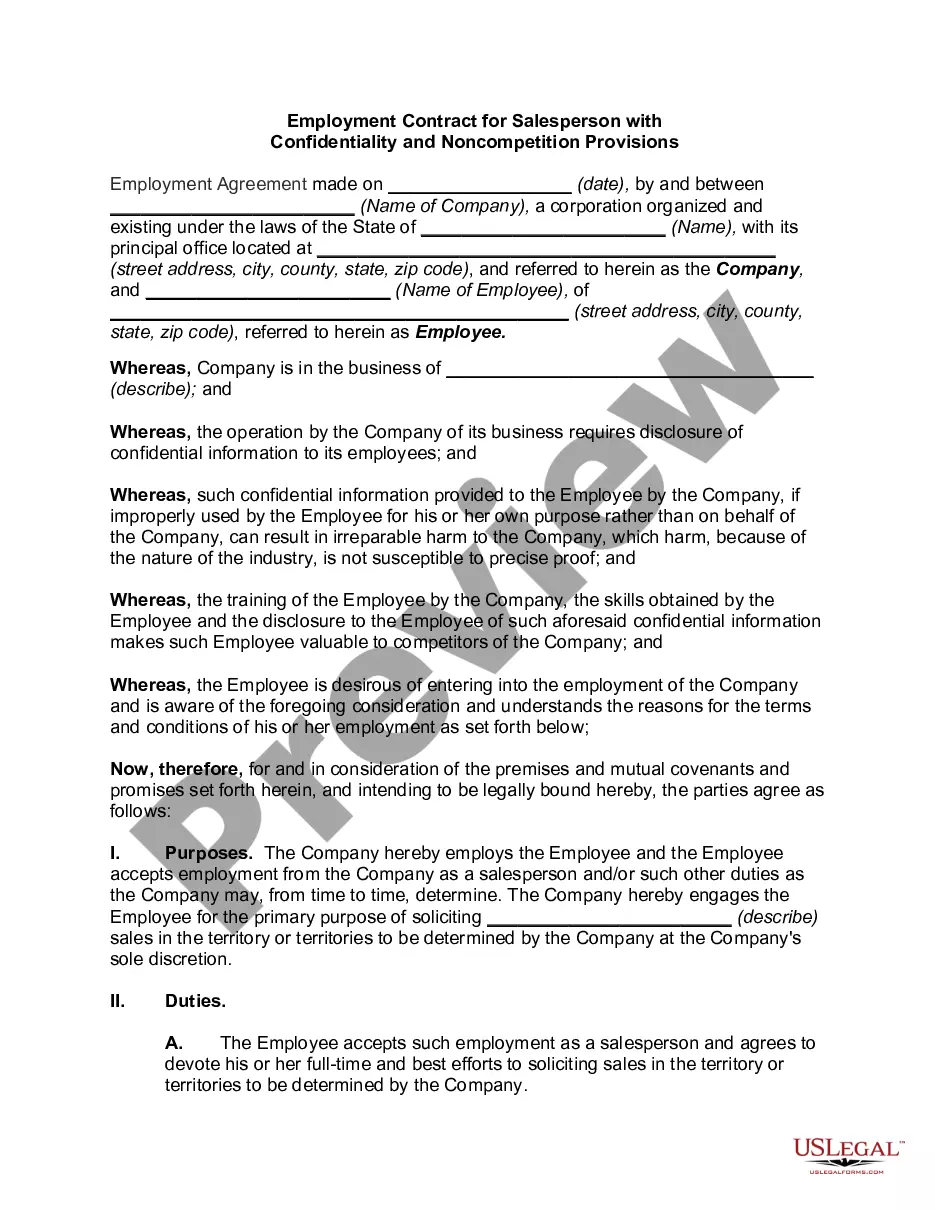

- Utilize the Preview option to examine the shape.

- Read the information to ensure that you have selected the appropriate type.

- If the type is not what you`re seeking, make use of the Lookup field to find the type that meets your needs and specifications.

- If you find the appropriate type, just click Get now.

- Choose the costs strategy you would like, complete the required details to create your account, and pay money for your order making use of your PayPal or charge card.

- Choose a practical paper formatting and obtain your duplicate.

Locate all of the papers layouts you might have purchased in the My Forms menu. You can get a further duplicate of New Hampshire Promissory Note with Payments Amortized for a Certain Number of Years anytime, if needed. Just click the required type to obtain or print the papers template.

Use US Legal Forms, probably the most extensive variety of legitimate kinds, in order to save some time and steer clear of blunders. The support gives expertly manufactured legitimate papers layouts that can be used for an array of uses. Make a free account on US Legal Forms and begin creating your daily life easier.