New Hampshire Sample Letters for Deed of Trust and Promissory Note: A Comprehensive Guide In the state of New Hampshire, a Sample Letter for Deed of Trust and Promissory Note is an essential legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This comprehensive guide will provide you with an overview of what a Deed of Trust and Promissory Note entail, their importance, and different types of these documents used in New Hampshire. What is a Deed of Trust and Promissory Note? A Deed of Trust and Promissory Note is a legally binding contract between a borrower and a lender that establishes the terms of a loan. It outlines the specific details of the loan, including the loan amount, interest rate, repayment terms, and any other relevant clauses or conditions. The Deed of Trust secures the loan against the borrower's property, providing a legal mechanism for the lender to reclaim the property in case of default. Why is a Deed of Trust and Promissory Note important? Having a Deed of Trust and Promissory Note protects the interests of both the borrower and the lender in a loan transaction. It ensures that all parties involved are aware of their rights and responsibilities, preventing any potential misunderstandings or disputes in the future. The document serves as evidence of the loan agreement, offering legal protection in case of any legal actions or enforcement proceedings. Different types of New Hampshire Sample Letters for Deed of Trust and Promissory Note: 1. New Hampshire Residential Deed of Trust and Promissory Note: This type of Deed of Trust and Promissory Note is specifically designed for residential real estate transactions in New Hampshire. It includes provisions that cater to the unique requirements and regulations associated with residential properties. 2. New Hampshire Commercial Deed of Trust and Promissory Note: Geared towards commercial real estate loans, this document incorporates clauses and terms that are tailored for commercial properties. It addresses the distinct considerations and obligations associated with commercial transactions in New Hampshire. 3. New Hampshire Private Party Deed of Trust and Promissory Note: This type of document is used when the loan is made between two private individuals without the involvement of a financial institution. It outlines the terms and conditions of the loan and ensures legal protection for both parties involved. 4. New Hampshire Promissory Note Extension Agreement: In certain situations, borrowers may require additional time to comply with the original repayment terms. In such cases, a Promissory Note Extension Agreement can be used to modify the loan agreement and extend the repayment period. This agreement outlines the revised terms and conditions agreed upon by both parties. Conclusion: A New Hampshire Sample Letter for Deed of Trust and Promissory Note is crucial for protecting the interests of borrowers and lenders involved in loan transactions. It is important to choose the appropriate type of document based on the specific nature of the loan and the property involved. Consulting with legal professionals experienced in New Hampshire real estate law is recommended to ensure compliance with state regulations and to tailor the document to the unique needs of the parties involved in the loan transaction.

New Hampshire Sample Letter for Deed of Trust and Promissory Note

Description

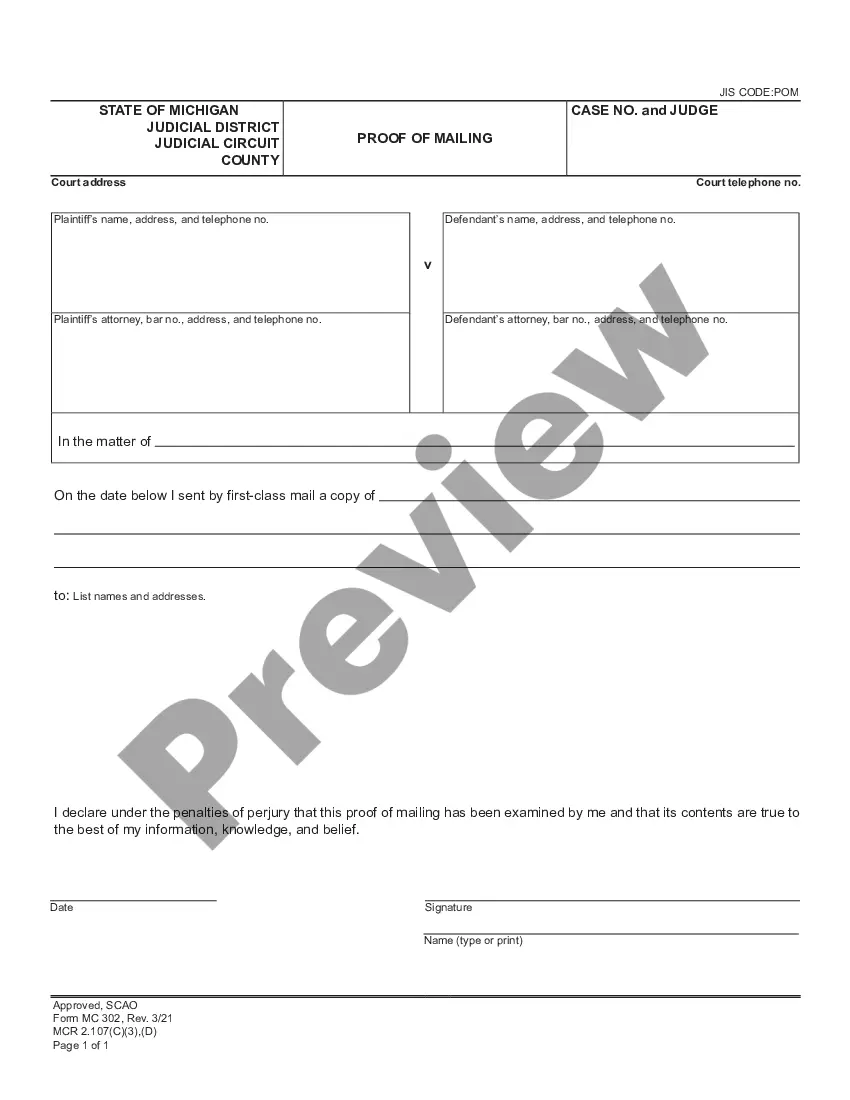

How to fill out New Hampshire Sample Letter For Deed Of Trust And Promissory Note?

Discovering the right authorized file design can be quite a battle. Needless to say, there are tons of templates available on the net, but how can you get the authorized form you will need? Use the US Legal Forms internet site. The assistance gives 1000s of templates, including the New Hampshire Sample Letter for Deed of Trust and Promissory Note, which you can use for organization and personal demands. Every one of the forms are inspected by pros and satisfy state and federal demands.

In case you are already listed, log in to the profile and click the Obtain switch to find the New Hampshire Sample Letter for Deed of Trust and Promissory Note. Utilize your profile to appear from the authorized forms you may have bought previously. Proceed to the My Forms tab of your respective profile and obtain an additional duplicate in the file you will need.

In case you are a brand new customer of US Legal Forms, listed here are straightforward recommendations so that you can stick to:

- First, make sure you have chosen the right form to your area/state. It is possible to check out the form using the Preview switch and browse the form outline to ensure this is the right one for you.

- In the event the form does not satisfy your needs, utilize the Seach field to find the correct form.

- Once you are certain the form would work, click on the Purchase now switch to find the form.

- Choose the prices plan you desire and enter the required information and facts. Design your profile and purchase the transaction making use of your PayPal profile or bank card.

- Opt for the file file format and obtain the authorized file design to the device.

- Total, revise and print and indicator the acquired New Hampshire Sample Letter for Deed of Trust and Promissory Note.

US Legal Forms may be the most significant collection of authorized forms for which you can find numerous file templates. Use the service to obtain skillfully-created files that stick to state demands.

Form popularity

FAQ

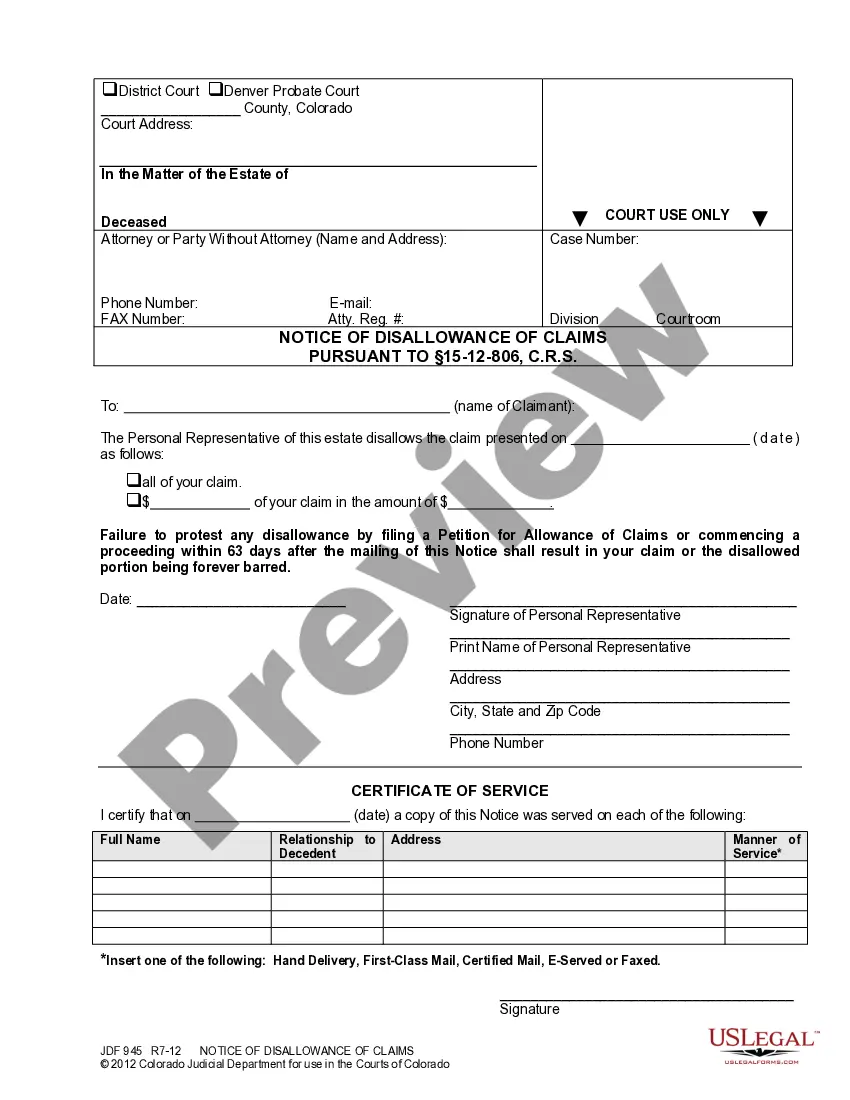

Over to the Trustees mentioned hereunder, is hereby acknowledged by the Trustees, who hereby accept the appointment as such Trustees of the said Trust, under the terms and conditions, set out hereunder for the fulfillment of the objects of the Trust, more fully and particularly described and set out hereunder.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

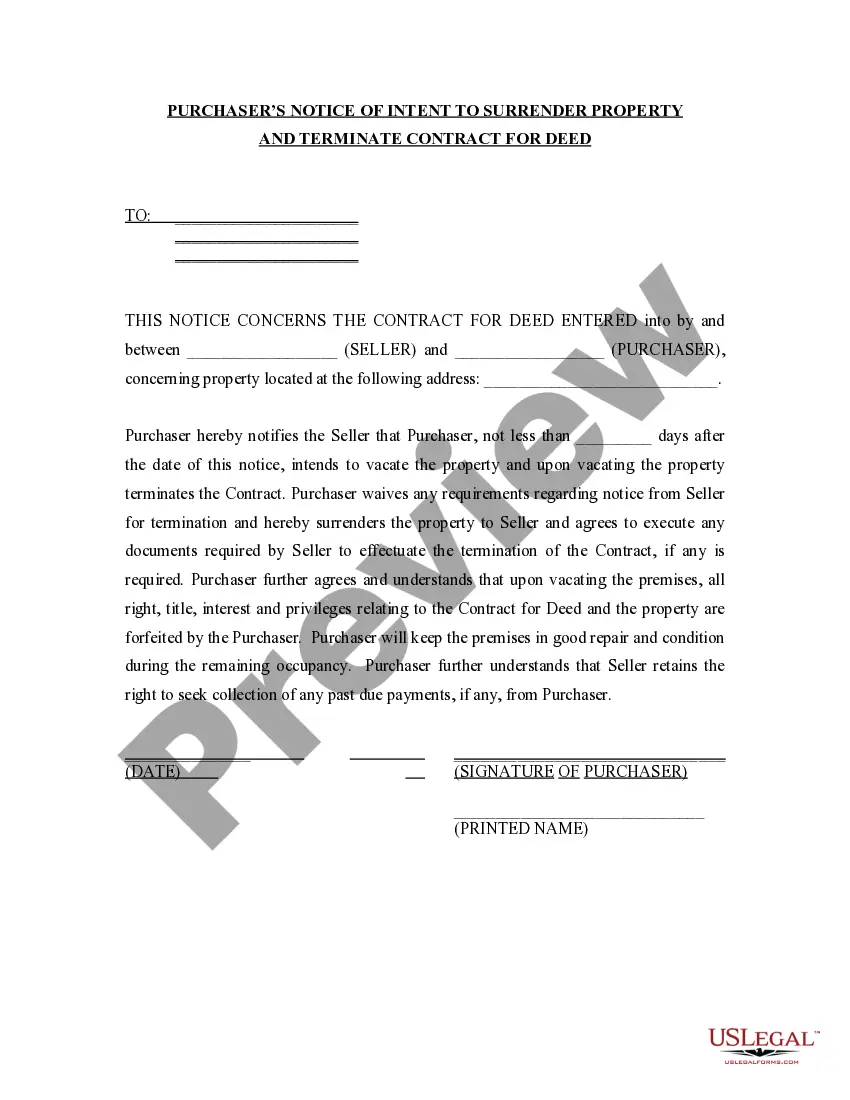

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

A deed of trust involves three parties: (1) the trustor, who is the person who received the loan, (2) the beneficiary, who is the person who loaned the money to the trustor, and (3) the trustee, who is the person that released the loan once it has been paid off.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.