New Hampshire Sample Letter for Exemption of Ad Valorem Taxes

Description

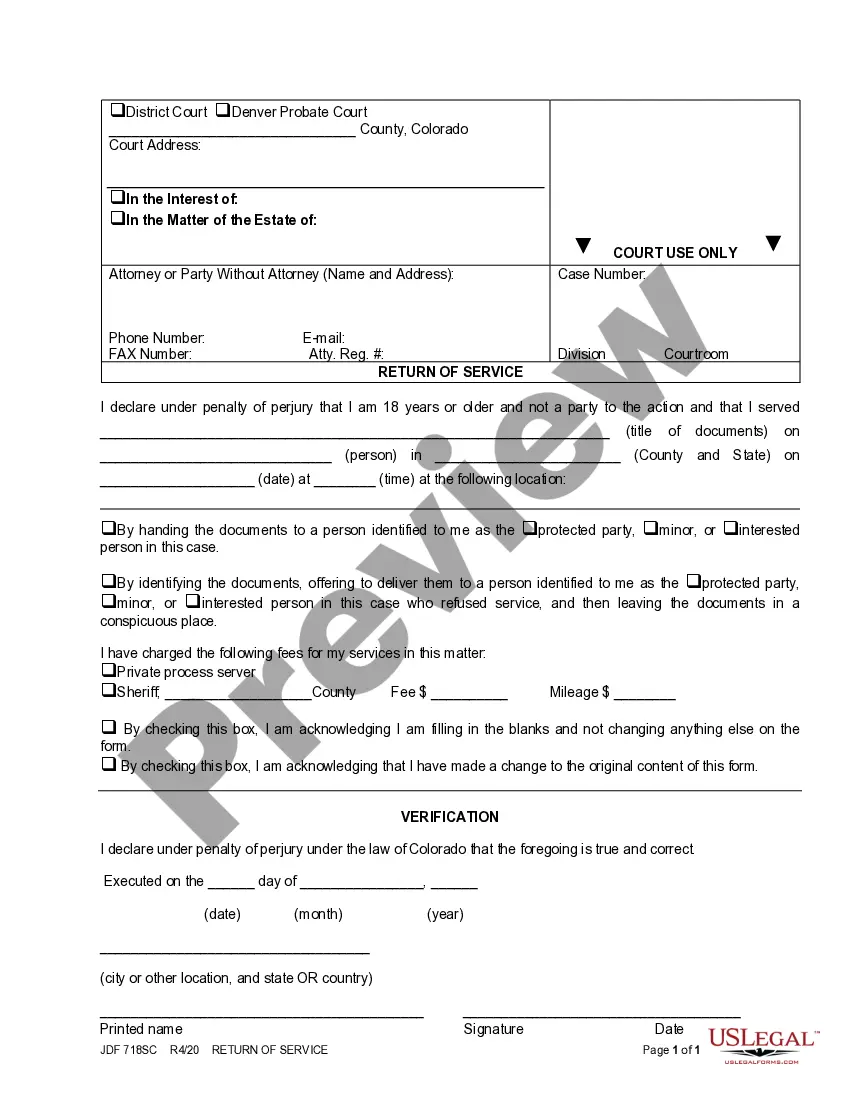

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

US Legal Forms - one of several largest libraries of lawful kinds in the USA - delivers an array of lawful document layouts you may obtain or print. Using the site, you will get a large number of kinds for organization and specific reasons, sorted by types, suggests, or key phrases.You will discover the latest types of kinds such as the New Hampshire Sample Letter for Exemption of Ad Valorem Taxes in seconds.

If you have a subscription, log in and obtain New Hampshire Sample Letter for Exemption of Ad Valorem Taxes from your US Legal Forms library. The Acquire switch can look on every type you see. You gain access to all earlier acquired kinds inside the My Forms tab of the account.

If you wish to use US Legal Forms initially, here are straightforward recommendations to help you get started off:

- Be sure you have picked out the correct type for your personal city/area. Click the Preview switch to examine the form`s information. Read the type description to ensure that you have selected the correct type.

- In the event the type does not match your demands, use the Look for discipline at the top of the display to find the one who does.

- If you are pleased with the form, validate your decision by clicking the Get now switch. Then, pick the prices prepare you like and supply your accreditations to sign up for an account.

- Method the deal. Make use of charge card or PayPal account to finish the deal.

- Pick the file format and obtain the form on the device.

- Make alterations. Load, change and print and sign the acquired New Hampshire Sample Letter for Exemption of Ad Valorem Taxes.

Every design you included with your bank account does not have an expiration particular date and is also yours for a long time. So, if you would like obtain or print yet another duplicate, just visit the My Forms portion and then click on the type you need.

Gain access to the New Hampshire Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms, one of the most comprehensive library of lawful document layouts. Use a large number of professional and condition-distinct layouts that meet up with your small business or specific requires and demands.

Form popularity

FAQ

Currently, the estate tax in New Hampshire in 2023 is 0%. As a result, when passing assets on, you won't owe New Hampshire estate taxes when passing assets on.

Elderly Exemption Program Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

New Hampshire does not charge an estate tax, but the federal government does. The federal estate tax may apply to you if your estate is valuable enough. The federal exemption is $12.06 million for 2022. It increases to $12.92 million for deaths in 2023.

If you qualify your exemption will be: 65-74 years of age are allowed $156,000 assessed value deducted from total assessed value. 75-79 years of age are allowed $210,000 assessed value deducted from total assessed value. 80+ years of age are allowed $280,000 assessed value deducted from total assessed value.

Is New Hampshire tax-friendly for retirees? New Hampshire has no personal income tax, which means Social Security retirement benefits are tax-free at the state level. Income from pensions and retirement accounts also go untaxed in New Hampshire. On top of that, there is no sales tax, estate tax or inheritance tax here.

New Hampshire's homestead exemption allows you to protect up to $120,000 of equity in your home, and twice that amount if you are a married couple filing jointly. In bankruptcy, a homestead exemption protects equity in your home. Here, you'll find specific information about the homestead exemption in New Hampshire.

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

If you qualify your exemption will be: 65-74 years of age are allowed $156,000 assessed value deducted from total assessed value. 75-79 years of age are allowed $210,000 assessed value deducted from total assessed value. 80+ years of age are allowed $280,000 assessed value deducted from total assessed value.