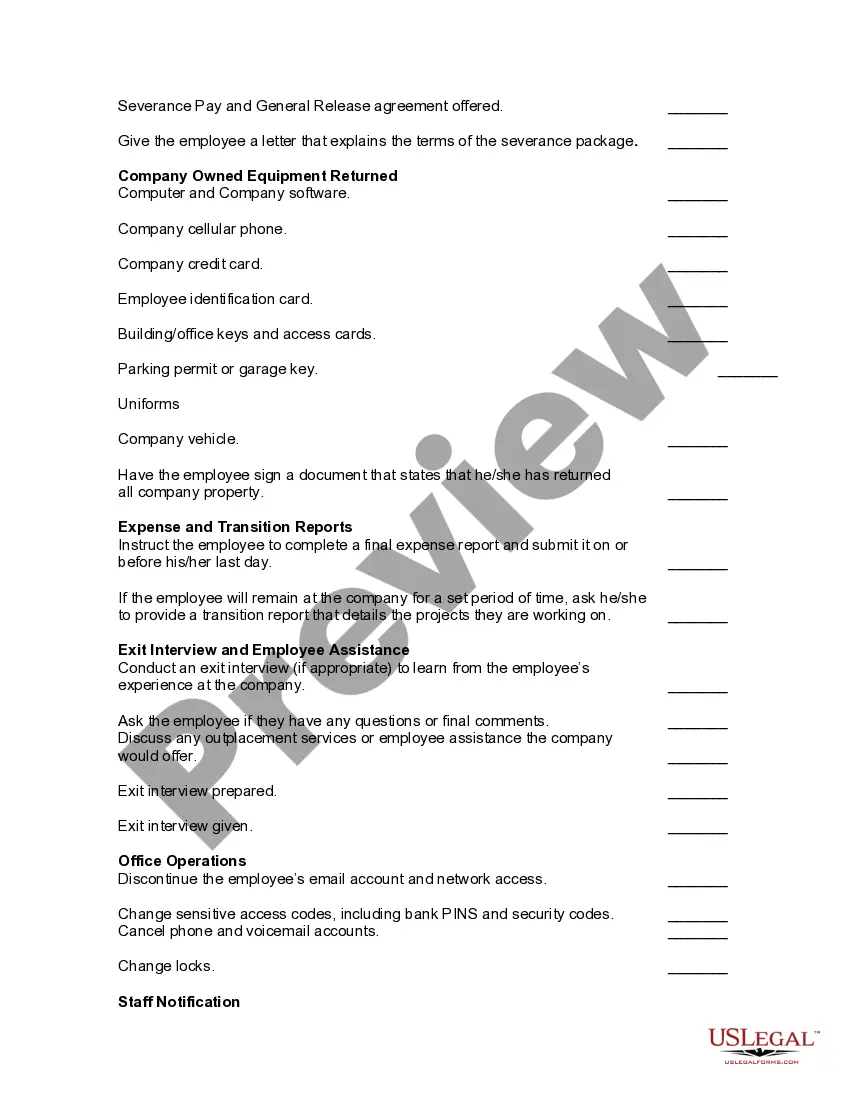

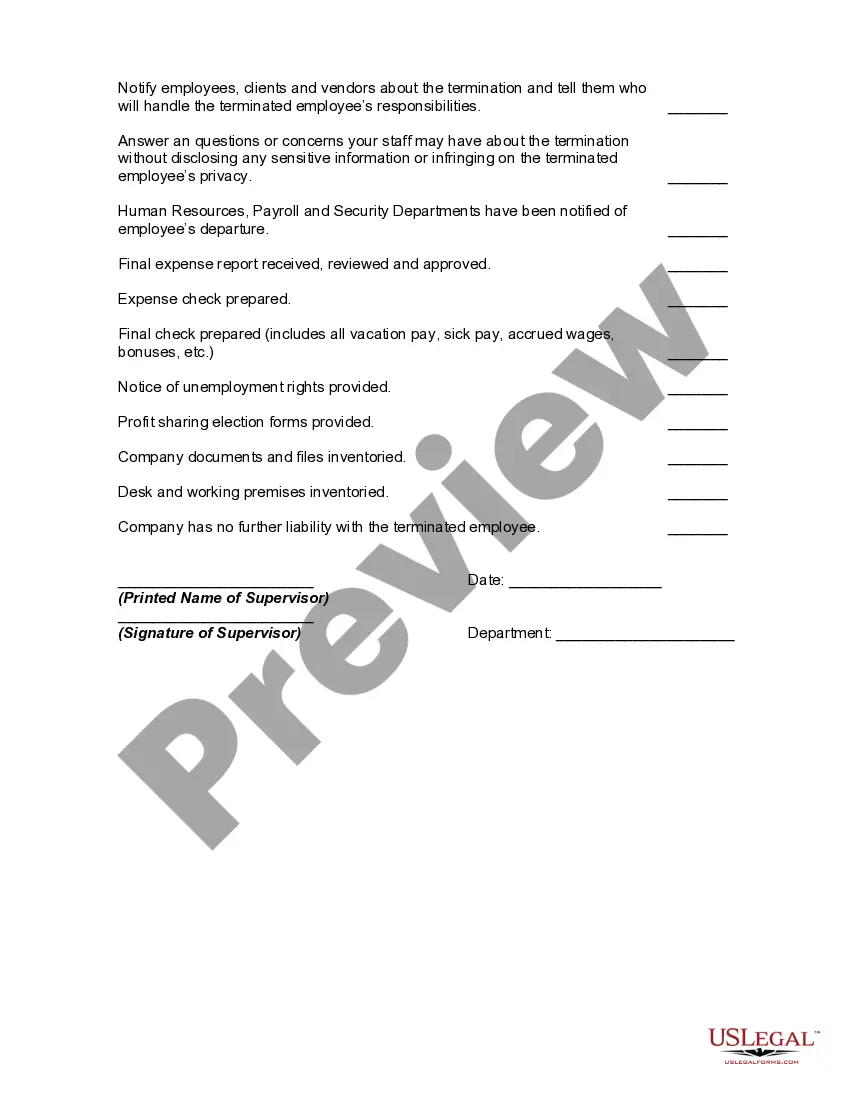

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

New Hampshire Worksheet — Termination of Employment is a comprehensive document designed to assist employers in adhering to the state's regulations and requirements when terminating an employee. This worksheet provides a step-by-step guide to ensure a smooth and legally compliant termination process. Keywords: New Hampshire, termination of employment, worksheet, employers, regulations, requirements, legally compliant, termination process. Types of New Hampshire Worksheet — Termination of Employment: 1. New Hampshire Employee Termination Checklist: This type of worksheet includes a checklist of essential steps that employers must follow when terminating an employee in accordance with New Hampshire labor laws. It ensures that all necessary tasks are completed, such as notifying the employee, conducting exit interviews, handling final payments, and addressing benefits. 2. New Hampshire Separation Agreement Worksheet: This worksheet focuses on the preparation and execution of a separation agreement between the employer and terminated employee. It outlines the essential terms and conditions to be included in the agreement, such as severance pay, release of claims, confidentiality clauses, and non-compete agreements. 3. New Hampshire Unemployment Benefits Worksheet: This type of worksheet provides employers with guidance on how to handle unemployment benefits for a terminated employee. It includes information on the unemployment insurance program in New Hampshire, eligibility requirements, documentation needed, and steps employers should take to support their former employees during the claims process. 4. New Hampshire Final Paycheck Worksheet: This worksheet helps employers calculate and distribute the final paycheck to a terminated employee in compliance with New Hampshire wage and hour laws. It includes information on unpaid wages, vacation pay, sick leave, commissions, and overtime, ensuring that employers fulfill their obligations regarding timely and accurate payment. 5. New Hampshire Termination Notice Worksheet: This worksheet assists employers in drafting and delivering a termination notice to an employee. It provides a template with relevant information to be included in the notice, such as the reason for termination, effective date, any requirements for return of company property, and contact details for further clarification. Employers in New Hampshire can utilize these various types of worksheets to navigate the complex process of terminating an employee while ensuring compliance with state laws, protecting both the rights of the employee and the legal interests of the organization.