New Hampshire Business Start-up Checklist

Description

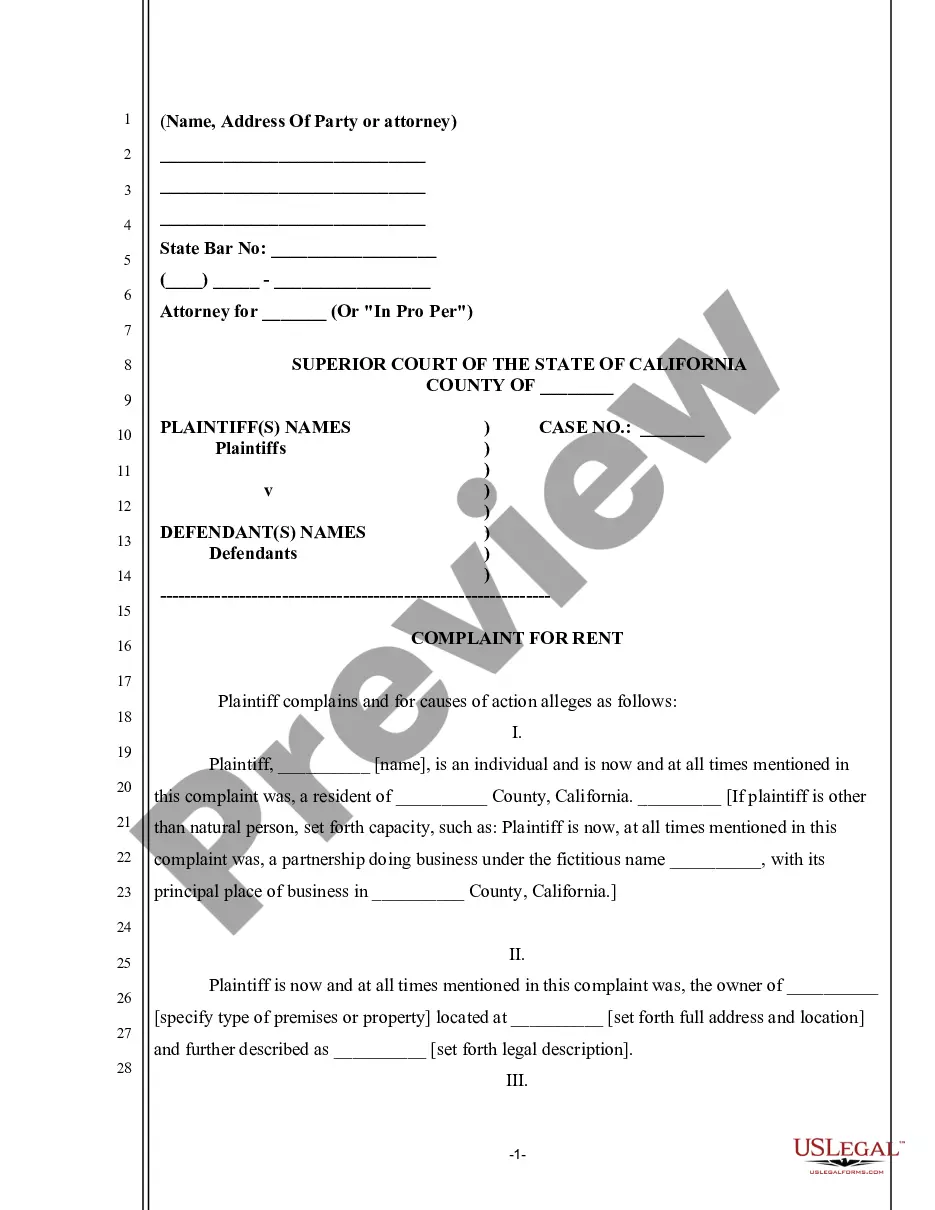

How to fill out Business Start-up Checklist?

Locating the correct legal document template can be challenging.

Naturally, there are numerous formats accessible online, but how can you get the legal document you need.

Make use of the US Legal Forms website.

If you are already a registered user, Log In to your account and click on the Download button to get the New Hampshire Business Start-up Checklist. Use your account to browse through the legal documents you may have purchased before. Visit the My documents section of your account to download another copy of the document you need.

- The service provides a plethora of templates, including the New Hampshire Business Start-up Checklist, suitable for both business and personal needs.

- All forms are reviewed by experts and meet federal and state requirements.

Form popularity

FAQ

While forming an LLC offers many benefits, such as limited liability, there are some downsides to consider. An LLC can involve higher startup costs and more complex tax requirements compared to a sole proprietorship. Additionally, your New Hampshire Business Start-up Checklist should include understanding these potential drawbacks, helping you make informed decisions. Uslegalforms can offer insights and resources to help you weigh the pros and cons effectively.

New Hampshire does not have a statewide general business license. Additionally, since there is no state sales tax, there is no New Hampshire seller's permit. However, businesses in certain professions are required to have specific licenses or permits.

N.H. Ranked 2018's 2nd Worst State to Start a BusinessAnd That's GOOD News! A new analysis by WalletHub ranks New Hampshire 49th on the list of Best States to Start A New Business. But the reason for the bad ranking is actually good news for New Hampshire.

How to start a business in 10 stepsEvaluate your business goals.Start writing your business plan.Conduct market research.Business structure and logistics.Get funding for your small business.Design prototypes and get feedback.Put together your leadership team.Develop your product.More items...?

If you plan to do business in the state of New Hampshire, but your company was not formed there, you will often need to obtain a New Hampshire Foreign Qualification. Typically, doing business is defined by activities such as maintaining a physical office or having employees in the state.

11 Steps to Start a BusinessFind a business idea.Write your business plan.Secure financing to fund your business.Choose a business structure.Get federal and state tax ID numbers.Obtain a business license and permits.Open a business bank account.Get business insurance.More items...?

In most states, forming an LLC doesn't require a business license, but you'll need to follow your state's procedures. An LLC requires registering with the state and filing the appropriate forms. But even though you don't need a business license to form an LLC, you probably need one to operate the LLC as a business.

12 Steps to Starting a Small BusinessStep 2: Write a business plan.Step 3: Fund your business.Step 4: Determine your business structure.Step 5: Choose and register a business name.Step 6: Create a marketing plan.Step 7: Get a Tax Identification Number.Step 8: Open a business bank account.Step 9: Figure out your taxes.More items...?

Business Plan. Almost every business needs a little funding to get started.Partnership Agreement.LLC Operating Agreement.Buy/Sell Agreement.Employment Agreement.Employee Handbook.Non-Disclosure Agreement.Non-Compete Agreement.More items...

New Hampshire Business Licenses. There is no statewide basic business license in New Hampshire. Most business entities are required to register and file annual business reports with the New Hampshire Secretary of State.