New Hampshire General Power of Attorney for Bank Account Operations

Description

How to fill out General Power Of Attorney For Bank Account Operations?

Selecting the optimal valid document format can be a challenge.

Undoubtedly, there are numerous templates accessible online, but how can you find the valid form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the New Hampshire General Power of Attorney for Bank Account Operations, that you can utilize for business and personal purposes.

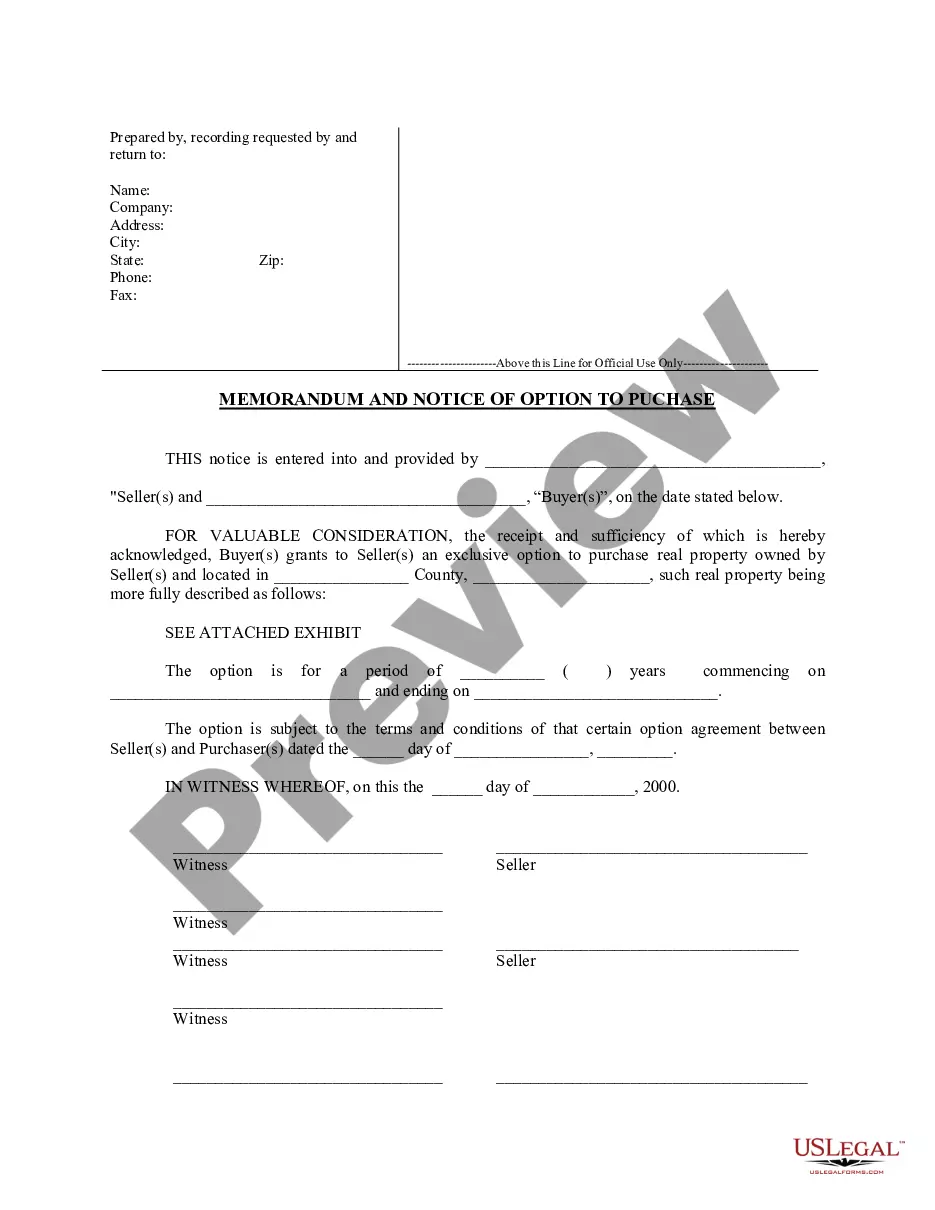

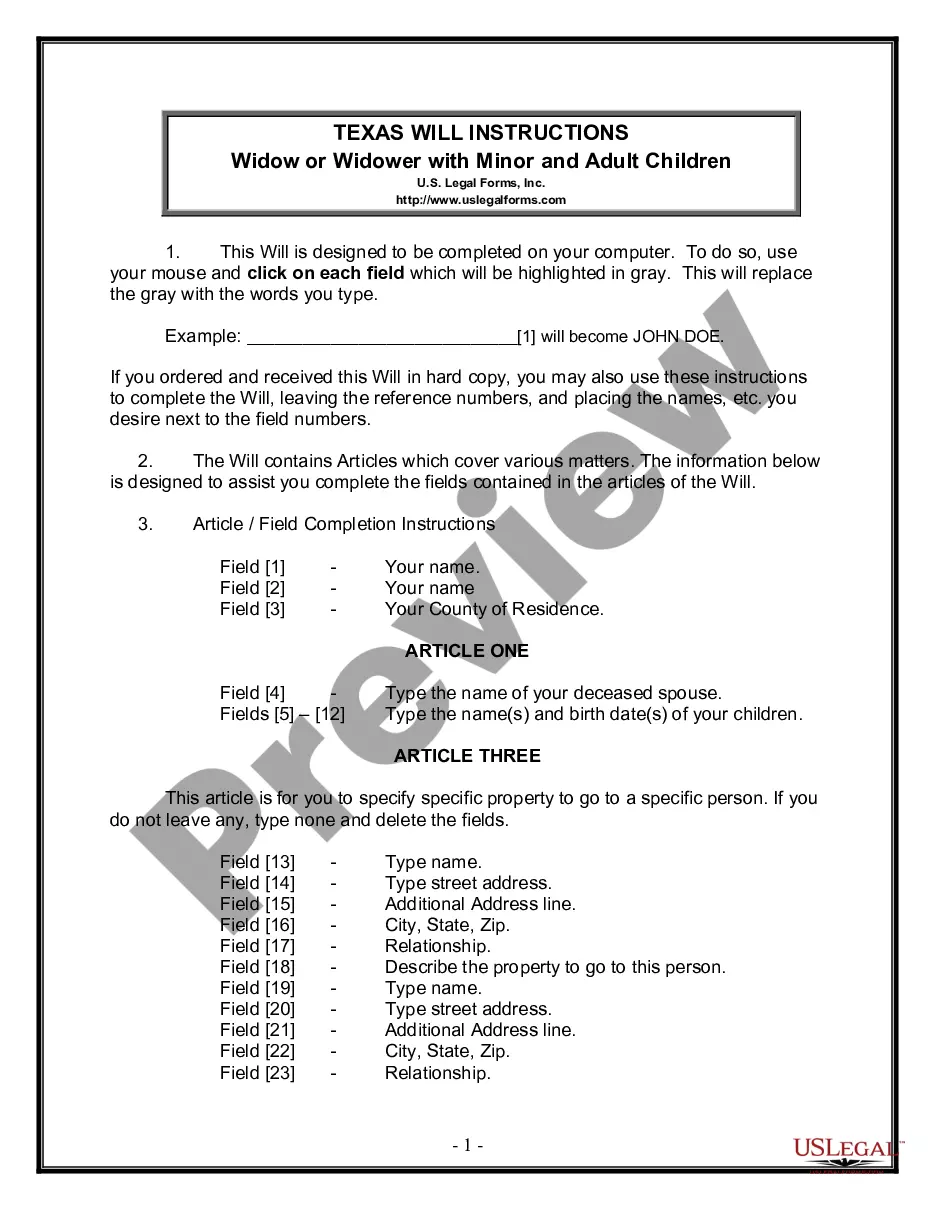

You can review the form using the Preview button and read the form description to confirm this is the correct one for you.

- All the forms are reviewed by experts and meet state and federal standards.

- If you are already registered, Log In to your account and click the Obtain button to access the New Hampshire General Power of Attorney for Bank Account Operations.

- Use your account to explore the valid forms you may have acquired previously.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the appropriate form for your city/region.

Form popularity

FAQ

A standard power of attorney becomes ineffective if the person who signed it becomes incapacitated. In contrast, a Durable Power of Attorney remains effective even in such situations. If you are creating a New Hampshire General Power of Attorney for Bank Account Operations, opting for a durable option offers greater security in managing your family’s financial needs.

If you're aged 18 or older and have the mental ability to make financial, property and medical decisions for yourself, you can arrange for someone else to make these decisions for you in the future. This legal authority is called "lasting power of attorney".

When it is to be registered it should be presented at the sub-registrar's office with jurisdiction over the immovable property referred to in the document. Notarising a power of attorney is as good as registration . Section 85 of the Indian Evidence Act applies to the documents authenticated by a notary.

If a person wants to authorise someone to act as a power of attorney on his behalf, it must be signed and notarised by a certified notary advocate, who is able to declare that you are competent at the time of signing the document to issue the said power of attorney.

Power of Attorney, or POA, is a legal document giving an attorney-in-charge or legal agent the authority to act on behalf of the principal. The attorney in charge possesses broad or limited authority to act on behalf of the principal.

To set up a power of attorney, the principal and agent must fill out and sign a power of attorney form. In New Hampshire, powers of attorney for financial matters must abide by Chapter 564-E of the New Hampshire Statutes, also known as the Uniform Power of Attorney Act.

Your attorney could be a family member, a friend, your spouse, partner or civil partner. Alternatively they could be a professional, such as a solicitor.

To complete the paperwork, the agent and the principal sign and date the durable power of attorney form. Don't forget that in New Hampshire, your form also needs to be notarized.

A POA must be signed by the principal or by another person in the principal's presence and at the principal's direction, and acknowledged by a notary public. The agent is also required to sign the POA to acknowledge that they have been appointed as agent and understand their role.

The Uniform Law applies to all public officials who perform notarial acts in New Hampshire, including notaries public, justices of the peace, commissioners, and all other persons authorized to perform any notarial acts.